What Is Inflation?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Inflation Explained

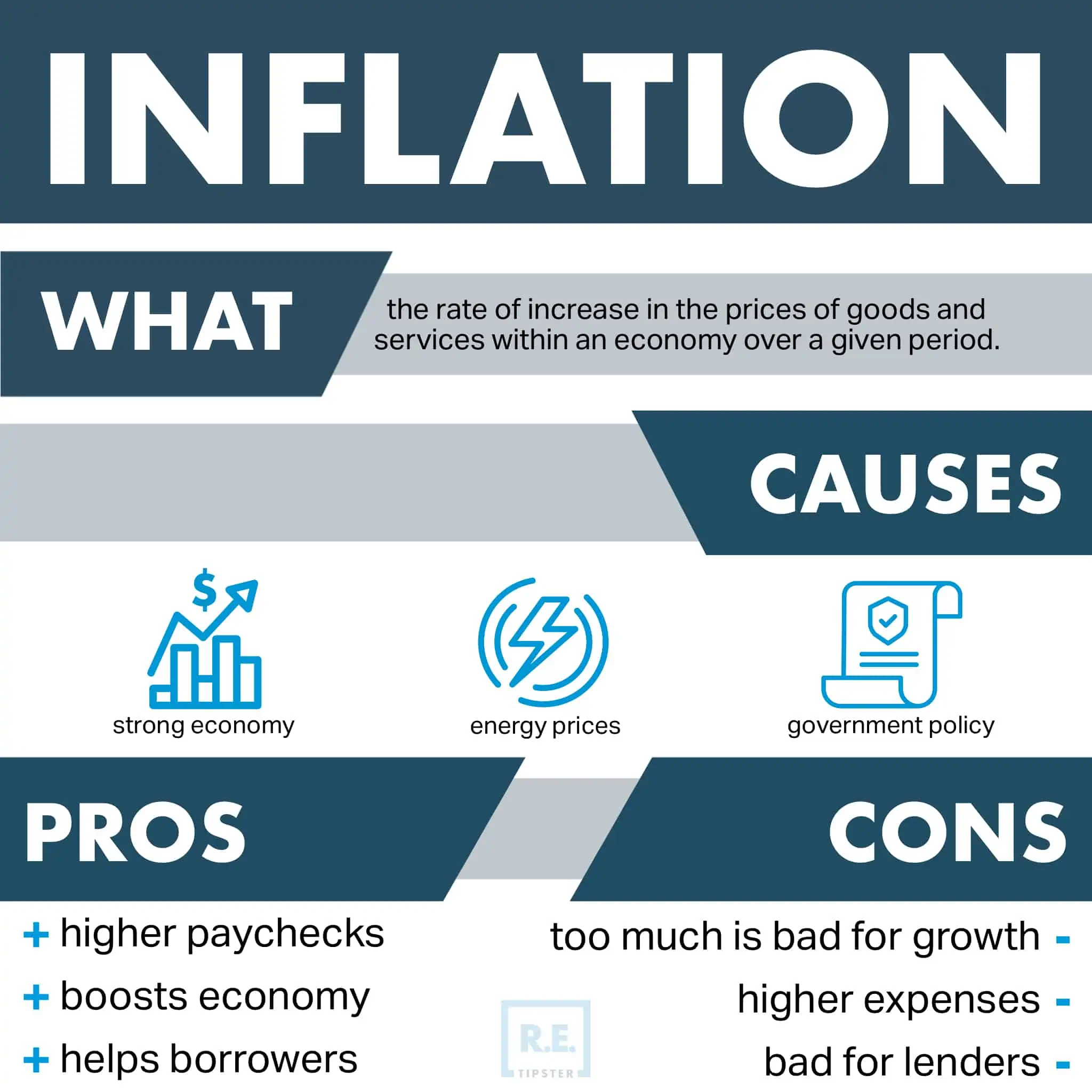

Inflation is the rate at which prices of goods and services increase over a period of time[1].

Consequently, inflation also causes a decline in the purchasing power of currency during that time.

Inflation is often expressed as a percentage[2], which compares how expensive certain commodities are today compared to how expensive they were in a previous period. Economists calculate inflation in reference to the Consumer Price Index, which uses a predetermined combination of goods and services and how their prices change over time.

Inflation impacts everything in an economy, including the prices of essential goods and services, such as housing, food, utilities, and medical care. Inflation also impacts non-essentials like luxury apparel, cosmetics, and jewelry.

The higher price of a good or service means more currency is required to buy the same good or service than it did before. As a result, the value of money in an inflationary period decreases, and the buying power of that currency is reduced.

Runaway inflation in an economy is a big concern for businesses and consumers alike. Since inflation erodes the ability of consumers to spend[3], it can eventually lead to slower business growth and it could have a negative impact on investments.

One way to see how the value of U.S. currency has changed over time is to try the Inflation Calculator from the U.S. Bureau of Labor Statistics, which shows how much the value of money has changed in the world’s largest economy.

What Causes Inflation?

Inflation affects every type of currency around the world, but the causes and effects don’t impact every currency at the same time and in the same way. That’s because a big factor that affects inflation is the supply of currency, and governments play a big role (but not the only role) in how much currency is available in the economy.

While there are many factors that can bring about inflation, they usually revolve around a pair of causes, namely[4]:

- Demand-Pull Inflation. When there is a rise in demand and/or a decline in supply for certain goods and services, it leads to a rise in the price of those goods and services, which brings balance back to the aggregate supply and demand. Sometimes this rise in demand is from consumers and sometimes it is caused by the government, as it chooses to spend more in certain sectors of the economy.

- Cost-Push Inflation. When goods and services start costing more to produce, usually because of rising fuel costs, raw materials, or wages, manufacturers and service providers will have to raise prices and pass the higher cost on to the consumer in order to preserve their profit margins.

Fiscal and monetary policies of the government can also have a major impact on inflation[5]. The Federal Reserve in the United States, for instance, can adopt an expansionary monetary policy by making money available at lower rates, which effectively makes it less expensive for consumers to borrow money. When money is available to borrowers at a lower price, it encourages consumers to spend more, which stimulates economic growth but also has a wider impact on the economy through demand-pull inflation.

This policy encourages business expansion and job generation. The rising employment, in turn, opens the possibility of an increase in demand for goods and services, which may lead to inflation. Higher wages and their boost on consumers’ purchasing power can also significantly increase the money supply, which devalues the existing cash in circulation.

Exchange rate fluctuations constitute another factor that can influence inflation[6]. For example, a decline in the dollar’s forex rate can lead to more expensive importation fees, both for finished products and raw materials. The resulting higher production costs raise prices, thus contributing to inflationary pressure.

BY THE NUMBERS: Over 65 countries have their currencies pegged to the U.S. dollar. The dollar is also legal tender in five U.S. territories and seven sovereign countries.

Source: Investopedia

Effects of Inflation on the Real Estate Market

Inflation directly affects the housing market, primarily through the cost of borrowing.

When inflation rises, the Federal Reserve can increase interest rates to act as a “brake”[7] on the overheating economy. People are more inclined to save their money in a high-interest rate environment due to a higher return on savings. As a result, the demand for goods and services declines, and dampens inflation.

However, higher interest rates due to inflation will also raise the interest rates on mortgages. Interestingly, higher mortgage rates can create a buyer’s market because fewer people are willing to take on debt when it’s more expensive to borrow. As a result, home values often fall when mortgage rates increase.

Is Real Estate a Hedge Against Inflation?

A Stanford University study[8] has concluded that real estate, particularly residential, can be considered a safe haven in inflationary periods. There are three main reasons for this:

- Rent prices often rise with inflation, which creates bigger cash flows for landlords.

- Properties appreciate faster.

- Inflation devalues fixed-rate loans because borrowers tend to pay lenders money worth less when they originally took out the loan[9].

However, real estate investors should keep in mind that they increase rent commensurate with inflation. Therefore, landlords often increase rent at least by the rate of inflation to keep up with the increase in prices of other goods.

Types of Inflation

Inflation can rise or fall from a number of different causes.

- Demand-pull inflation. This happens when prices rise because of low market supply but high consumer demand.

- Cost-push inflation. This type of inflation occurs when production cost rises because of costlier raw materials. It can also happen due to increased taxes that can prompt price hikes.

- Wage inflation. This combines the characteristics of demand-pull and cost-push inflation. Increasing wages raises production costs, eventually leading to higher consumer prices. Rising wages also boost consumers’ disposable incomes, further spurring higher demand.

- Imported inflation. Depreciation of local currency results in more expensive imports. Imported finished products and raw materials are priced higher, triggering a chain reaction down the supply line. Foreign exchange depreciation can also lead to more competitive exports, thus stimulating higher wages, and finally driving domestic demand and price increases.

Rates of Inflation

The rate of inflation aims to measure the pace of inflation over time.

- Creeping inflation (1–4%). Low-velocity inflation may not be noticeable right away. However, if it persists progressively, this can be a concern.

- Walking inflation (2–10%). Also called moderate inflation, walking inflation is concerning, but manageable.

- Running inflation (10–20%). Inflation of this type accelerates at a significant pace. It imposes substantial economic costs and could easily shift to even higher levels.

- Galloping inflation (20–1000%). At this rapid velocity, inflation is already serious and challenging to control.

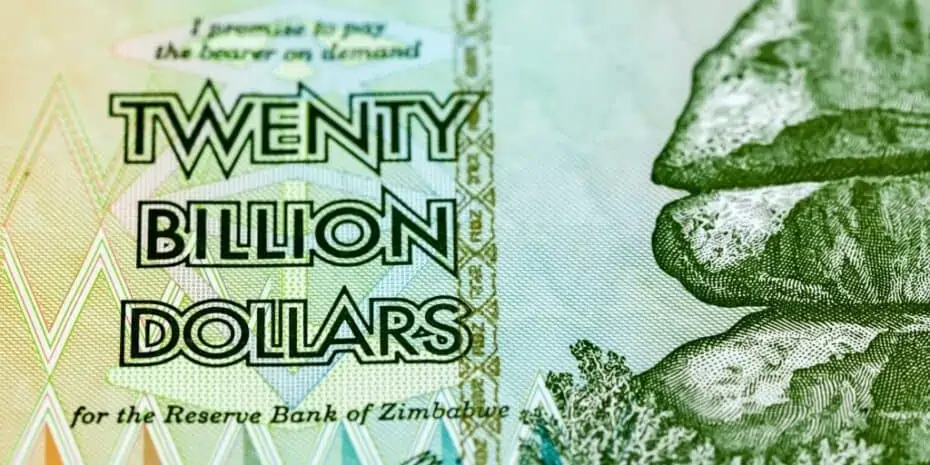

- Hyperinflation (>1000%). This extreme form of inflation typically manifests in the daily escalation of prices and the rapid decline in a country’s currency value.

The meme-famous Zimbabwean dollar, an example of extreme hyperinflation. In 2008, it took 2 billion Zimbabwean dollars for one U.S. dollar. However, less than a month later, this exchange rate accelerated to 1 trillion Zimbabwean dollars for 1 U.S. dollar.

Concepts Related to Inflation

The dynamics of market prices within an economy also gave rise to several terminologies related to inflation. These include the following:

- Disinflation. This means a decline in the inflation rate where price increases are slower.

- Deflation. It refers to a negative inflation rate resulting from a decline in prices.

- Shrinkflation. It describes prices at steady levels, but manufacturers reduce their products’ size—a price increase in effect.

- Stagflation[11]. A wordplay on stagnation and inflation, stagflation describes slow economic growth, high unemployment, and rising inflation.

How Inflation Is Measured: CPI and PCE

There are two most frequently used indexes[12] calculating U.S. inflation. One is the Consumer Price Index (CPI) of the Bureau of Labor Statistics (BLS) and the other is the Personal Consumption Expenditures (PCE) Price Index of the Bureau of Economic Analysis (BEA). Both indexes use a predetermined basket of goods to measure inflation.

Calculating the CPI is based on the data from its survey on consumers’ spending for a basket of goods and services. The BLS takes the average weighted cost of this basket. Then, it divides this cost by the weighted average of the previous month to calculate CPI inflation.

The PCE is also a widely used inflation gauge. BEA’s PCE calculation is similar to the BLS’s. However, unlike the CPI that bases its report on consumer surveys, the PCE tracks the prices that businesses report on the goods and services they sell. This way, the PCE can better track expenses that consumers indirectly pay, like employer-paid medical care.

Compared with CPI’s, PCE’s consumer basket is also more flexible in its components. It can account for consumer substitution when certain goods or services become more expensive.

BY THE NUMBERS: The BLS records the prices of about 80,000 items in its basket of goods and services monthly to calculate CPI inflation.

Source: BLS

Takeaways

- Inflation indicates the pace of increases in the prices of goods and services within a certain period. It can be triggered by higher demand and low supply, rising production costs, or both.

- Inflation impacts essential and non-essential goods and services, thus creating a far-reaching effect on an economy. Higher inflation also means a lower purchasing power of each unit of currency.

- There are two main ways to measure inflation: the CPI and the PCE. These two indexes give economists and policymakers an idea of how much prices are changing, the direction of the market, and some fiscal policies they can use to control inflation.

Reviewed by Jay Wu, the founder of Money Knock, an online hub for remote workers and finance nerds.

Sources

- Oner, C. (n.d.) Inflation: Prices on the Rise. International Monetary Fund. Retrieved from https://www.imf.org/external/pubs/ft/fandd/basics/30-inflation.htm

- Flynn, J. (2021.) How to Calculate the Inflation Rate (with Examples). Zippia. Retrieved from https://www.zippia.com/advice/how-to-calculate-inflation-rate/

- Investopedia. (2021.) What Causes Inflation and Who Profits from It? Retrieved from https://www.investopedia.com/ask/answers/111314/what-causes-inflation-and-does-anyone-gain-it.asp

- Simon, J. (2021.) What Are the Causes of Inflation? Smart Asset. Retrieved from https://smartasset.com/investing/what-causes-inflation

- The Federal Reserve. (n.d.) How does the Federal Reserve affect inflation and employment? Retrieved from https://www.federalreserve.gov/faqs/money_12856.htm

- Chaluvadi, S. (2021.) Inflation Meaning. Scripbox. Retrieved from https://scripbox.com/pf/inflation/

- Reinicke, C. (2022.) Inflation is at its highest in 40 years. Here’s how raising interest rates could help. CNBC. Retrieved from https://www.cnbc.com/2022/02/15/why-the-fed-raises-interest-rates-to-combat-inflation.html

- Leombroni, M., Piazzesi, M., et al. (2020.) Inflation and the Price of Real Assets. Department of Economics, Stanford University. Retrieved from https://web.stanford.edu/~piazzesi/inflationAP.pdf

- Wolfe, M. (n.d.) How Is Debt Handled With Currency Devaluation? Sapling. Retrieved from https://www.sapling.com/8117368/debt-handled-currency-devaluation

- Pettinger, T. (2021) Different Types of Inflation. Economics Help. Retrieved from https://www.economicshelp.org/blog/2656/inflation/different-types-of-inflation/

- Folger J. (2021.) What Is Stagflation? The Economic Phenomenon That Stifled Growth through the 1970s. Business Insider. Retrieved from https://www.businessinsider.com/stagflation

- Lavie, D., Curry, B. (2021). How to Measure Inflation: PCE & CPI. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/investing/how-to-calculate-inflation/