What Is Keynesian Economics?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Keynesian economics (named after John Maynard Keynes) is a macroeconomic theory that proposes government intervention during a recession, such as by increasing spending and lowering taxes to stimulate economic growth.

- The Keynesian Theory of Economics asserts that increasing spending, relaxing fiscal policies, and allowing a higher money supply can pull an economy out of recession.

- Under the Keynesian economic model, governments must monitor three main economic indicators: interest rates, tax rates, and social programs.

Keynesian economics directly challenges classical economic theories, particularly laissez-faire policies that promote a free market with minimal government intervention.

What Is the Keynesian Theory of Economics?

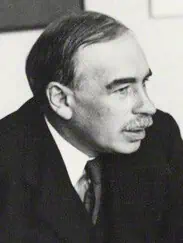

British economist John Maynard Keynes developed what would be known as the Keynesian Theory of Economics in the 1930s[1].

by Unknown photographer, bromide print, 1933

In his book The General Theory of Employment, Interest and Money[2], Keynes asserted that in economic downturns, the government must stimulate the demand for goods and services to boost growth. The government can accomplish this by raising spending, which leads to increased employment, private consumption, and investment. These factors are crucial to reviving the economy.

Supporters of the Keynesian Theory of Economics are called Keynesians.

Understanding Keynesian Economics

The theory is based on the belief that aggregate demand—measured as the aggregated spending by households, businesses, and the government—is the main driving force in the economy.

Demand is directly related to consumer spending, which is directly related to the overall health of an economy. Therefore, a significant drop in consumer spending results in a sluggish economy and eventually a recession since, without demand, production also declines, worsening the situation.

To counter this, Keynesian economists advocate for expansionary monetary policy by the government. In other words, Keynesians believe in spending more and increasing the money supply in the economy. In theory, this fiscal policy will spur economic activity because if people had more money to spend, demand would ultimately pick up and grow again, stimulating production and employment.

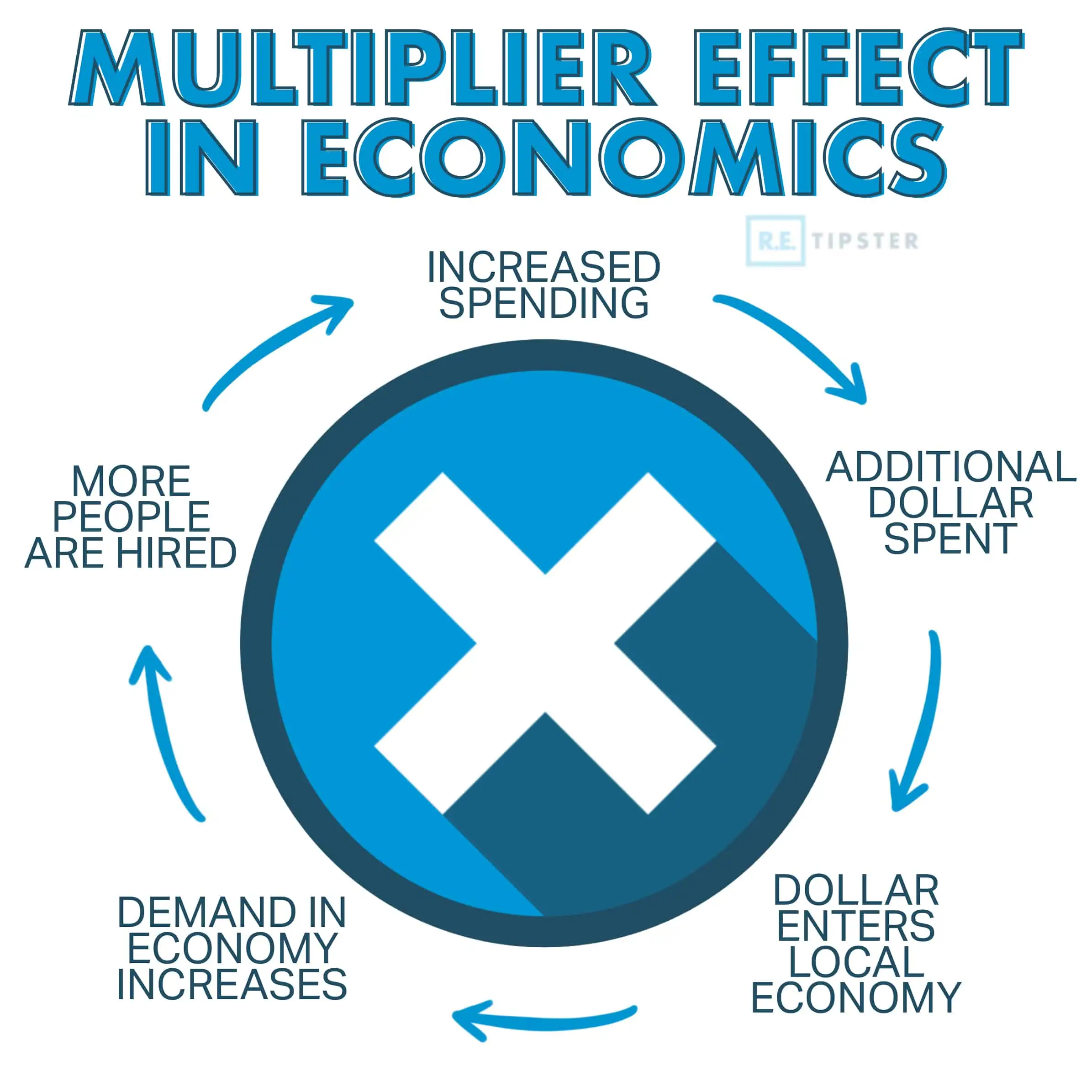

Multiplier Effect

The Keynesian economic model is predicated on the idea that increased government spending in the economy and more money in circulation leads to more spending. Economists call this the multiplier effect.

The multiplier effect posits that when the government spends money, it becomes someone’s income. Then, from that income, one spends some and saves the rest. The money that they spend becomes someone else’s income, and so on.

For instance, if a tenant pays rent, that money becomes the landlord’s income. The landlord then saves and spends some of their income, which becomes another person’s income. If the landlord spends money dining out, it becomes the restaurant’s income. When the restaurant owner buys clothes, the business cycle continues.

This spending repeatedly happens, creating a ripple effect on aggregate consumer spending. The more people spend, the more profound the impact of the multiplier effect, ultimately reinvigorating key economic factors, such as production, employment, and education.

On the other hand, the multiplier effect is one of the main reasons behind recessions. If people are generally pessimistic about the economy, they are likely to decrease spending and instead try to save more of their income. This results in a multiplier effect that will likely see companies losing sales, which results in these organizations laying off some workers, ultimately leading to even less spending until a recession sets in.

This is why Keynesians believe that governments must ramp up spending during recessions. The multiplier effect will mean more consumer spending and, hopefully, more growth.

Challenging Classical Economics

Keynes published his book in the middle of the Great Depression[3], focusing on proposing a solution to getting a country out of an economic recession. At the time, the primary school of economic thought was the laissez-faire policy under classical economics theory.

A laissez-faire economy promotes a free market self-regulated by the laws of demand and supply. Laissez-faire economists believe in zero government intervention in the economy unless it is to protect the people’s inalienable rights. By maintaining a balanced budget, capitalism will thrive and create a productive market on its own where employment (and therefore income) is automatically guaranteed.

Classical economists also believe that aggregate supply is the key driver of economic activity. Simply put, products will be bought as long as there is production. This assertion has merit in certain situations. For example, in terms of food products, people must eat. Therefore, as long as food products are available for sale, people will surely buy even if prices go up.

Former U.S. President Herbert Hoover was one of the staunchest supporters of laissez-faire policies. He believed that an economy based on a free market would self-correct. He was committed to limited government intervention and a balanced budget[4] even during the stock market crash of 1929, which eventually spiraled into the Great Depression.

Government Intervention Under Keynesian Economics

The General Theory of Employment, Interest and Money challenged classical theory, particularly regarding government intervention.

In contrast to a laissez-faire approach, Keynes argued that the government should not sit around and wait for the economy to self-correct. Instead, it should take active steps to stimulate the economy.

According to the Keynesian economic model, the government should focus on these three main areas:

- Interest Rates — The Keynesian economic theory proposes that interest rates should be raised during times of prosperity to control the magnitude of the economic boom. Conversely, interest rates should be lowered during a recession to encourage borrowing and investments.

- Tax Rates — Because tax rates directly affect disposable income, Keynesians argue that taxes should be increased during times of prosperity so the government can participate in economic activity. On the other hand, tax rates should be lowered during economic slowdowns to increase disposable income and spur aggregate demand.

- Social Programs — During periods of economic growth, Keynes contends that the government should decrease its spending on social programs since additional investments into a thriving labor force are not necessarily needed. When the economy cools, government spending on social programs should increase to stimulate an increased supply of skilled labor.

Here is a summary:

| Economic Growth | Economic Slowdown | |

| Interest rates | Raise | Lower |

| Tax | Raise | Lower |

| Social programs | Decrease | Increase |

Real-World Applications of Keynesian Economics In the United States

From 1993 to 2001, President Bill Clinton introduced expansionary fiscal policies modeled on Keynesian economics. These policies ushered in several years of economic prosperity and a drastic reduction in unemployment, resulting in a significant drop in poverty[5].

President Obama signs the American Recovery and Reinvestment Act as Vice President Biden watches in Denver, Colo. on Feb. 17, 2009. (White House photo by Pete Souza)

Another example of the Keynesian model in action was during the term of President Barack Obama. He proposed expansionary fiscal and monetary measures to stimulate the economy to combat the gnawing effects of the Great Recession of 2007[6].

In 2009, he signed the American Recovery and Reinvestment Act (ARRA)[7], effectively ending the recession by allocating $787 billion to tackle unemployment and improve access to healthcare.

Some critics argue[8] that the U.S. government’s economic stimulus response to the COVID pandemic was based on the Keynesian economic model. This is because it involved expanding fiscal policy and printing more money to give to people so they could afford basic living expenses in the face of grounded economic activities[9].

Criticisms of Keynesian Economics

Economists of contrasting schools of thought have presented various criticisms against Keynesian economics.

Supply-side economists claim that increased business growth, not consumer demand, is the key to boosting the economy. While they agree that government intervention may be necessary for stimulating economic growth, fiscal policies should target job creators, not consumers.

Trickle-down economists share a similar belief. They maintain that if fiscal policies favor business owners, the benefits can trickle down to the consumers through more jobs and products for sale.

However, outside of these conflicting views, one of the biggest problems with Keynesian economics is the long-term effects of expansionary fiscal policy. Even if the government increases spending, it will likely need to take on more debt to raise the money.

Another problem is that calculating the multiplier effect in real life is complicated. There is no way of knowing exactly how much people will spend after the government has increased spending and eased the money supply into the economy.

At the end of the day, the Keynesian economic model, like all models, has a trade-off. It is effective in certain scenarios but cannot be a one-size-fits-all solution. Many other variables at play need to be accounted for if a Keynesian response is to be effective.

Sources

- Henderson, R. (n.d.) John Maynard Keynes Bio. Econlib. Retrieved from https://www.econlib.org/library/Enc/bios/Keynes.html

- Keynes, J. (1935.) The General Theory of Employment, Interest and Money. Marxists.org. Retrieved from https://www.marxists.org/reference/subject/economics/keynes/general-theory/

- Federal Reserve History. (n.d.) The Great Depression. Retrieved from https://www.federalreservehistory.org/essays/great-depression

- Hoover, H. (1952) THE MEMOIRS OF Herbert Hoover. The Great Depression 1929-1941. Macmillan Company, New York. Retrieved from https://hoover.archives.gov/sites/default/files/research/ebooks/b1v3_full.pdf

- The Clinton White House Archives. (n.d.) The Clinton Presidency: Historic Economic Growth. Retrieved from https://clintonwhitehouse5.archives.gov/WH/Accomplishments/eightyears-03.html

- Federal Reserve History. (n.d.) The Great Recession. Retrieved from https://www.federalreservehistory.org/essays/great-recession-of-200709

- H.R.1 – American Recovery and Reinvestment Act of 2009. U.S. Congress. Retrieved from https://www.congress.gov/bill/111th-congress/house-bill/1/text

- Rugy, V. (2021.) COVID, and Stimuli, and Keynes, oh my! Econlib. Retrieved from https://www.econlib.org/covid-and-stimuli-and-keynes-oh-my/

- Schwartz, E. (2020). What Would John Maynard Keynes Have Said About Stimulus Spending? econlife®. Retrieved from https://econlife.com/2020/03/the-keynesian-side-of-coronavirus-stimulus-spending/