What is Land Speculation?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

The Basics of Land Speculation

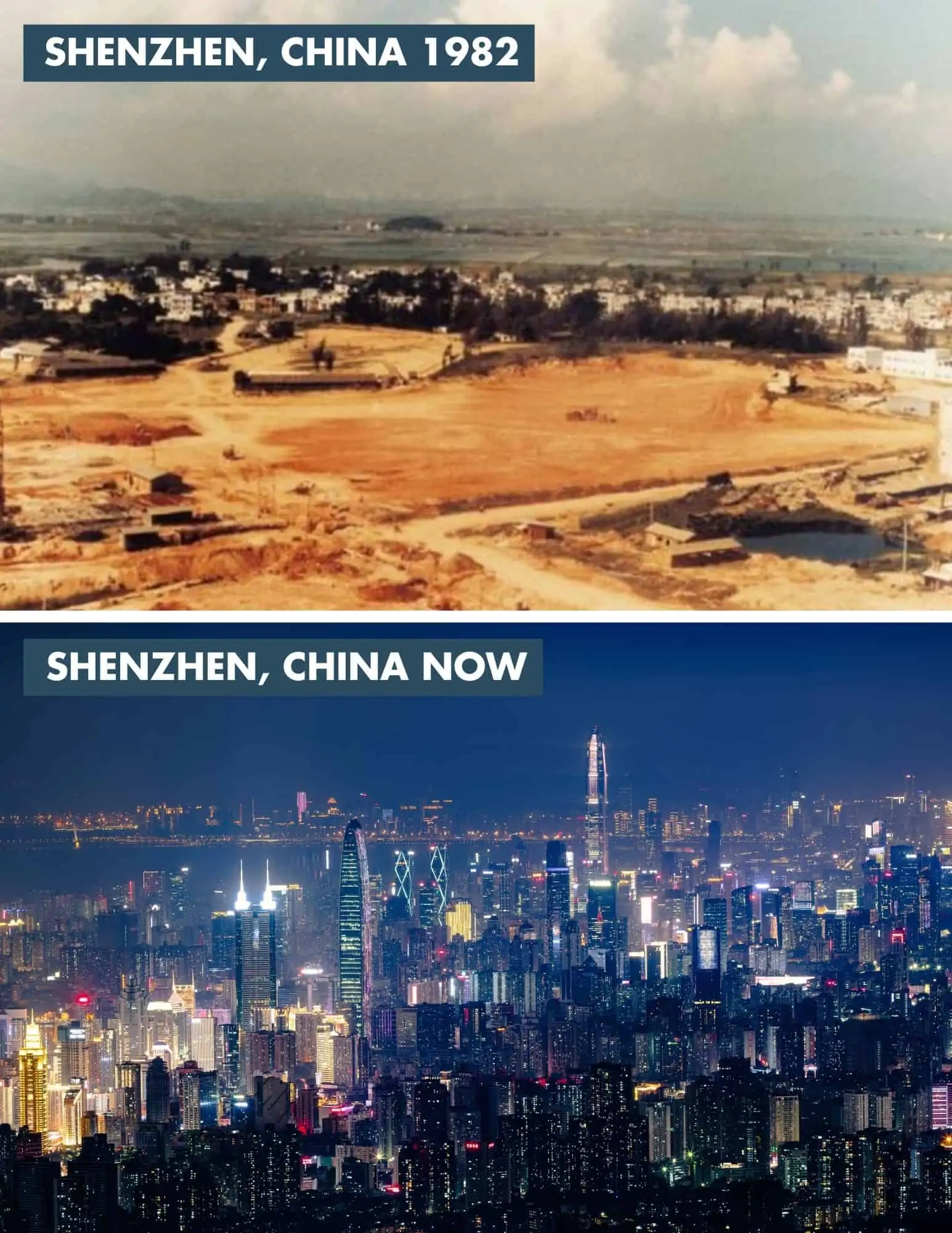

New York City wasn’t always filled with bustling streets and high-rise apartment buildings as far as the eye can see. The Big Apple took roughly a hundred years to develop into the metropolis it is today. In that time, the city’s land was bought, sold, and transformed into one of the most expensive real estate markets in the world. Those who were able to capitalize on the land developments mastered the art of land speculation.

Land speculation (sometimes referred to as “land banking”) is characterized by buying vacant land and holding it until development interest increases in an area. Speculating on land is one real estate investing strategy that people have implemented for centuries. One of the best examples was when Walt Disney began buying up central Florida farmland on the sly in the mid-’60s.

Still, there are more than a few misconceptions about the practice, which is why it’s important to understand the good and bad that come with land speculation. Here’s an overview of what it is, how to succeed at it, and things to consider before jumping in.

Land Speculation Explained

If you are coming to the idea of land speculation for the first time, you probably have one question: what is it? And closely followed by, “should I invest in it?”

One reason—which we’ll explain in detail shortly—is that there are potentially huge gains to be made, although these should also be balanced against large levels of risk. A good return, in itself, is not a good reason to use a particular investment strategy, after all. Instead, look at land speculation as just one form of investment in your broader strategy, with its own peculiarities and opportunities.

For most investors, land speculation will be one of the riskier forms of investment within your portfolio, albeit also one with the highest potential returns. However, speculating on land is essentially taking a bet that an area of the earth will be more desirable in the future, which is an uncertain prediction at best.

Because of these factors, land speculation should form only a part (and a relatively small part) of a much broader real estate investment strategy for most investors. Nonetheless, it poses a unique potential vs. risk profile, so let’s look at it more closely.

The Good: Benefits of Land Speculation

Owning vacant land requires relatively low holding costs and comes with excellent benefits compared to other forms of real estate investment. Land speculation can result in significant multiples on initial investments when bought at the right location and the right price.

One major perk of land speculation is the cost of entry. Untapped, vacant land is generally the cheapest type of real estate to be found. It’s not until expansion and development occurs that a property begins to increase in value.

Also, since land purchased for speculation is vacant, holding costs are generally low. Holding costs, expenses associated with owning a piece of real estate, include mortgage payments, insurance, utilities, property tax, and more. The nature of land speculation’s low costs in this area provides more wiggle room for investors if the property must be held longer than expected.

The Bad: Pitfalls of Land Speculation

Land speculation has the word “speculate” in its name for a reason. Due diligence can help turn pure speculation into an educated guess, but there’s no guarantee that future economic activity in and around the land you purchase will actually occur.

First of all, keep in mind that the quality of your research has much to do with how informed it is. While the internet is a great place to start, it shouldn’t be the sole source as it presents conflicting information, misinterpreted business models, and data that is often flat-out wrong. Consult multiple sources and read reviews before making a decision.

Second, be extremely careful when it comes to who you share your personal information with. Identity theft has been a real issue in recent years and is sometimes instigated when a criminal elicits personal information as part of a land or property deal.

Third, unlike other forms of real estate, taking out a loan for vacant land can also lead to potential problems. For one, land generally has a much lower loan-to-value ratio, which is used to calculate risk. And since land speculation is inherently risky (because it’s undeveloped land that might stay that way forever), the risk is higher than most other real estate investments.

Consequently, a riskier investment means interest rates tend to be higher. Banks might require you to pay higher interest on a loan due to this uncertainty.

Is Land Speculation Worth It?

The concept behind land speculation is that a future economic event will dramatically increase its value, allowing it to be sold for a profit. The most successful land speculators essentially “guesstimate” the prospect of future economic growth in a particular area. As developers begin to nose around for projects, prime landholders stand to cash out with bags of money.

Obviously, not every land speculation investment returns profits as New York City or central Florida. It’s difficult to predict where the next region, bubbling under the surface and set to explode with profits, will be. You can use several ways to aid your prediction, however.

First, land speculation is like any real estate investment in that success relies on due diligence. You need to understand aspects like the local economy, the probability of urban expansion, housing development, and major employers and/or industries planning to move into the area.

Note also that entitlements add value to land. Your land must have the right entitlements like proper zoning, the ability for builders to acquire proper permits, and other development-ready permissions.

Another thing to consider is the amount of the investment. Investing in real estate doesn’t always require a fortune, but it’s important to identify how much you’re willing to invest and the profits you hope to make. It’s crucial to weigh the pros and cons that come with land investment before committing to it.

Takeaways

Land speculation takes time and patience and isn’t for the investor looking to make a quick dollar but rather for those with long-term vision and patience.

Proper due diligence and a sound strategy are two ways to increase your chances at investing in a property that pays dividends in the future. It’s essential to understand the good and the bad that come along with land speculation before you decide it’s right for you.