What Is Long-Term Capital Gains Tax?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Long-term capital gains tax applies to profits from assets held over a year, taxed at lower rates than short-term gains.

- Federal rates for long-term gains range from 0% to 20% based on the taxpayer’s income bracket.

- Income thresholds determine the tax rate for long-term gains, with specific brackets for 0%, 15%, and 20% rates.

- Special rules allow for a step-up in basis on inherited property and a gain exclusion on primary residences, under certain conditions.

- Capital losses can offset gains, with the ability to deduct up to $3,000 against other income annually and carry forward excess losses.

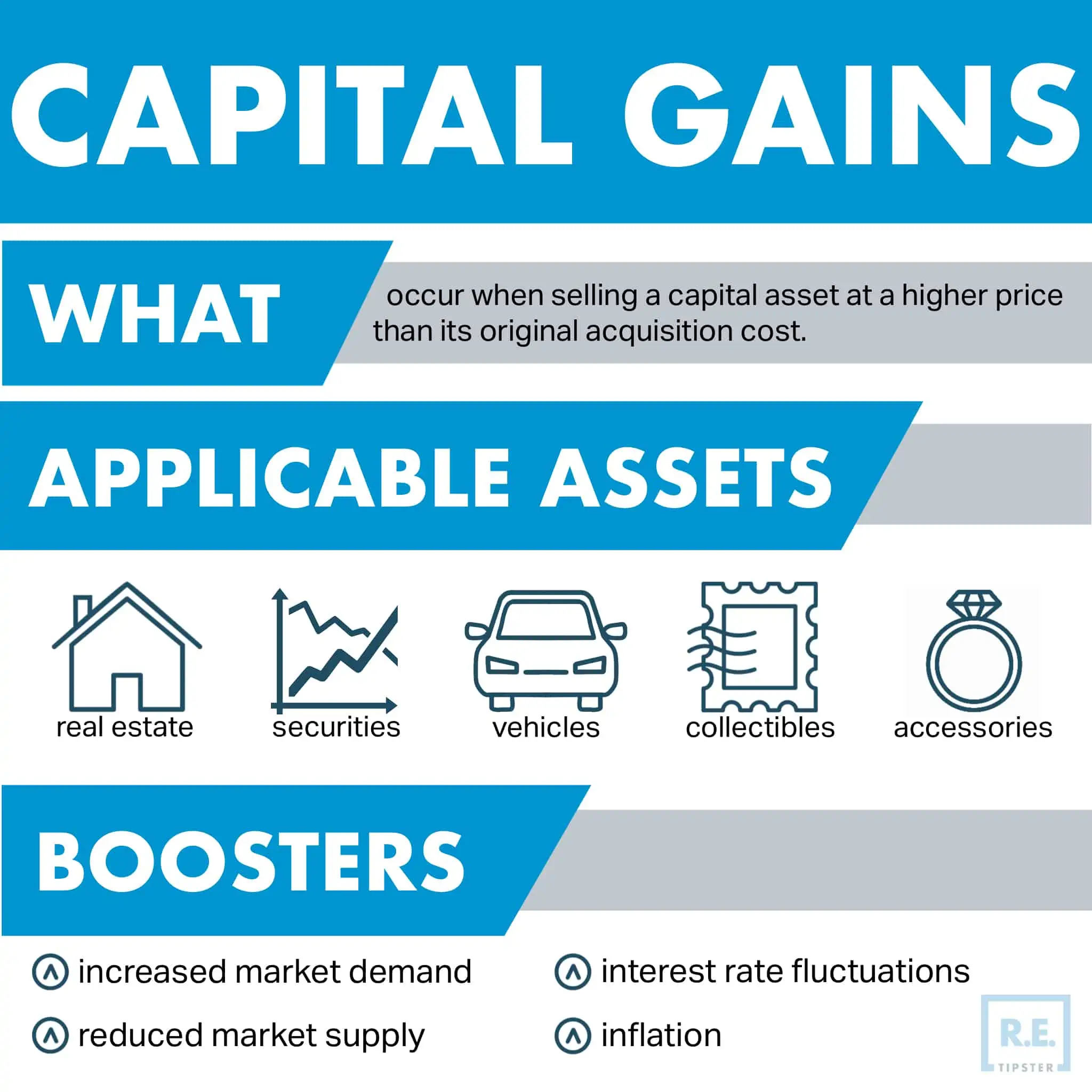

Understanding Capital Gains Tax

A capital gain occurs when you sell an asset, like a stock or property, for more than what you paid for it. The difference between what you paid (your cost basis) and what you received when you sold it (proceeds) is considered a capital gain.

For example, say you bought a rental property for $200,000 and later sold it for $300,000. Your capital gain would be $100,000, which is $300,000 (proceeds) minus $200,000 (cost basis). This $100,000 gain would be subject to capital gains tax.

For tax purposes, gains are classified as either short-term or long-term, depending on how long the asset was held before being sold.

Short-Term vs. Long-Term Capital Gains Tax

If an asset is held for one year or less before being sold, the gain is considered short-term and taxed as ordinary income. On the other hand, if an asset is held for over one year before being sold, the gain is considered long-term and usually taxed at lower capital gains tax rates.

So, in the example above, if the rental property was held for two years before being sold, the $100,000 gain would be considered a long-term capital gain since it was held for over one year.

Discerning the difference between short-term and long-term capital gains tax rates is even more important when you’re in the real estate business, in which you’re either a real estate dealer or an investor. Generally speaking, a dealer is subject to higher taxes, while an investor enjoys lower rates.

State-Level Taxes

Most states also impose a tax on capital gains. Some states may fully conform to the federal treatment, while others have unique rates, brackets, and exemptions. The states with no additional state tax on capital gains are Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Rates and rules vary by location, so research your state’s specific guidance.

Unless otherwise noted, this article discusses federal capital gains taxes.

Long-Term Capital Gains Tax Rates

The tax rates for long-term capital gains are generally lower than the rates for short-term capital gains (taxed as ordinary income). Here are the current federal long-term capital gains tax rates:

- 0% for individuals in the 10% and 12% ordinary income tax brackets.

- 15% for individuals in the 22% to 35% ordinary income tax brackets and married filing jointly for those in the 22% to 37% brackets.

- 20% for individuals in the 39.6% ordinary income tax bracket.

These rates may change from year to year, so it is essential to stay informed about the current tax rates.

Tax Thresholds and Taxable Income

In addition, capital gains tax rates have income thresholds based on tax brackets:

0% Tax Rate

The 0% rate applies to long-term gains from assets held for over a year up to the top of the 10% or 12% tax bracket thresholds. Currently, the thresholds are $44,675 for single filers and $89,350 for married couples filing jointly.

For example, if you’re single and have $40,000 in taxable income plus $5,000 in long-term capital gains, the gains would be taxed at 0% since your total income is under $44,675.

15% Tax Rate

On the other hand, the 15% rate applies to gains for those in higher income tax brackets. And the 20% rate applies to gains for those in the highest 39.6% tax bracket.

Again, these brackets and thresholds may change, so it is advisable to consult your tax advisor for the most updated figures.

How Do You Calculate Basis?

To determine your capital gain or loss, you need to calculate your cost basis in the asset. “Basis” generally refers to what you paid for the asset, including any purchase prices, commissions, improvements, and other related expenses.

For real estate, your cost basis includes:

- Purchase price of the property.

- Closing costs such as taxes, fees, commissions, surveys, inspections, etc.

- Capital improvements like additions, renovations, and repairs that prolong the property’s life.

- Selling expenses like commissions, legal fees, inspections, transfer taxes, etc.

Any costs that improve or prolong the life of the property, like a new roof or remodeling a kitchen, can increase your cost basis. Keep good records of these expenses to accurately calculate your basis when you sell the property later.

Special Rules for Ownership Periods

While long-term gains are typically taxed at lower rates than short-term gains, there are some special rules around ownership periods.

For instance:

- Heirs receive a step-up in basis on inherited property equal to the fair market value on the date of death. This can eliminate capital gains tax liability if the heir sells right away.

- Property transferred between spouses doesn’t trigger capital gains tax, but the recipient spouse takes the transferor’s original cost basis.

- Selling your primary residence may qualify for a $250,000 capital gain exclusion for single filers or $500,000 for married filing jointly if you meet ownership and use tests.

These special rules are important to understand if you plan to pass down investment properties, buy or sell with a spouse, or sell a former primary residence that has greatly appreciated. If in doubt, consult a tax professional.

Using Capital Losses to Offset Capital Gains

If you have capital losses from selling other investments at a loss, you can use up to $3,000 per year of net capital losses to offset other income like wages or interest. Any additional capital losses above $3,000 can be carried forward to future years to offset future capital gains.

Let’s say you made two investments in a given tax year:

- Investment A: You bought shares for $10,000 and sold them for $15,000, realizing a capital gain of $5,000.

- Investment B: You bought shares for $8,000 and sold them for $5,000, realizing a capital loss of $3,000.

You can then subtract your total capital losses from your total capital gains to calculate your net capital gain or loss for the year. In this scenario, the net total is $2,000.

Therefore, the $3,000 loss from Investment B reduces the taxable amount of the capital gain from Investment A. Instead of paying taxes on the full $5,000 gain, you would only pay taxes on the net gain of $2,000.

In other words, if the net result is a gain, you will owe taxes on this amount; if it’s a loss, you may use up to $3,000 of net capital losses a year to offset ordinary income (for individuals). If your net capital loss exceeds $3,000, you can carry over the loss to future years.

This capital loss offset can provide valuable tax relief if you have losses to offset gains in the current or future years. Just be aware of the wash sale rule, which disallows losses if you buy a “substantially identical” asset 30 days before or after the sale. The rule applies to stocks, bonds, mutual funds, exchange-traded funds (ETFs), and options, among other investments.

Recordkeeping Tips

Good records are crucial for calculating capital gains and losses accurately years later when filing taxes. Keep records of:

- Purchase settlement statements, receipts, and paperwork for cost basis.

- Improvements, repairs, and upgrades made to increase basis.

- Sale settlement statements and final sale price proceeds.

- Any other related expenses like commissions, legal fees, inspections, etc.

Scan or digitize important documents and store them electronically in an organized way for easy access later on. This can save headaches and disputes with the IRS down the road.

Frequently Asked Questions: Long-Term Capital Gains Tax

How are investment properties I rent out taxed?

If you sell a property that was used strictly for rental income, any capital gain would be subject to the long-term capital gains tax rates.

However, keep in mind that depreciation taken on the property over the years as a rental property may cause some or all of the gain to be taxed as ordinary income instead of the lower capital gains rates.

What if I have collectibles like artwork or antiques?

Gains from the sale of collectibles like artwork, antiques, metals (gold, silver, or platinum bullion), gems, stamps, or coins held longer than one year are still taxed at a maximum 28% rate rather than the typical long-term capital gains rate. This higher rate applies regardless of your income.

What is the difference between capital losses and income losses in terms of tax treatment?

Capital losses refer to losses incurred from the sale of assets, while income losses refer to losses incurred from the sale of goods or services.

Capital losses can be used to offset capital gains, but there are limits to how much can be deducted in a single year (i.e., $3,000).

On the other hand, income losses can’t be used to offset capital gains directly. Instead, they are deducted from the taxpayer’s other income sources. For example, if a taxpayer has a business that incurs a loss, that loss can be deducted from their other income sources, such as salary or investment income, to reduce their overall tax liability.

Keep in mind that capital losses can only be used to offset capital gains, while income losses can be used to offset any type of income. Additionally, capital losses can be carried forward to future years, unlike income losses.