What Is Short-Term Capital Gains Tax?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Short-term capital gains tax applies to profits from assets held for less than a year and doesn’t benefit from any special tax rate.

- It’s usually taxed at the same rate as your ordinary income: 10%, 12%, 22%, 24%, 32%, 35%, or 37%, depending on your income tax bracket.

- Capital losses can offset gains; you can deduct up to $3,000 against other income annually and carry forward excess losses.

- Other than capital loss offsetting, there are various ways to minimize short-term capital gains tax, including taking advantage of tax credits and deferring losses or gains to the following year/s.

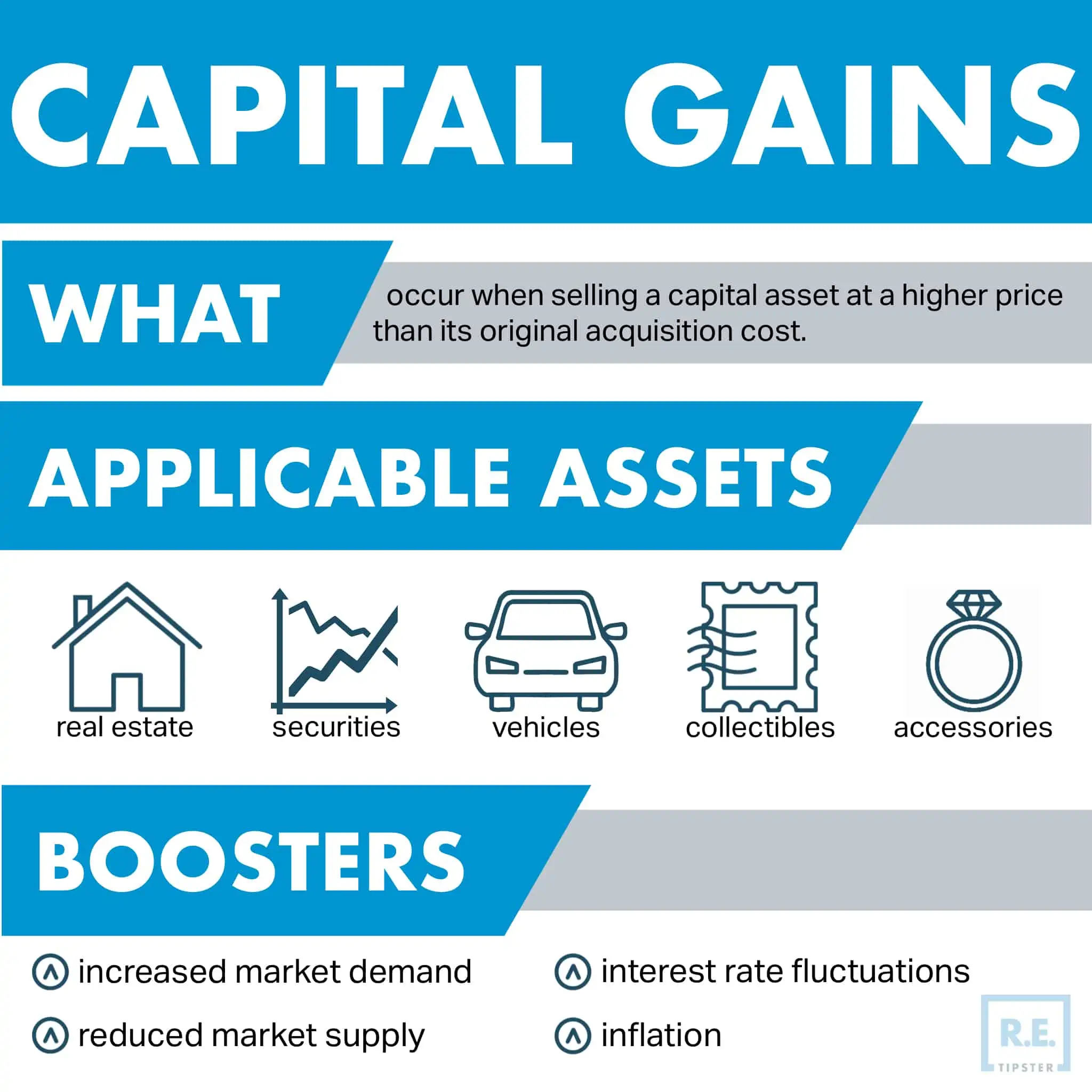

Understanding Capital Gains Tax

When you purchase an investment asset like a rental property or a stock and later sell it for more than you paid, the profit is considered a capital gain. In other words, capital gains are the difference between what you paid (your cost basis) and what you received when you sold it (proceeds).

Capital gains are taxed differently than ordinary income from things like wages, salaries, commissions, and business income. Say you bought a rental property for $200,000 and later sold it for $300,000. Your capital gain would be $100,000, which is the profit made from the sale. This $100,000 gain would be subject to capital gains tax.

For tax purposes, gains are classified as either short-term or long-term, depending on how long the asset was held before being sold.

Short-Term vs. Long-Term Capital Gains Tax

The main difference between short-term and long-term capital gains is based on how long you hold the asset before selling. If you sell an asset that you’ve held for one year or less, the profit is considered a short-term capital gain. If you hold the asset for more than one year before selling, the profit is a long-term capital gain.

Short-term capital gains are taxed at the same rate as your ordinary income, such as from a W-2. Long-term capital gains, on the other hand, are typically taxed at lower tax rates than ordinary income. So it’s usually better from a tax perspective to hold your investments for at least a year and a day to qualify for the lower long-term capital gains tax rates.

So, in the example above, if you sell the rental property a few months after you acquire it, the $100,000 profit is a short-term capital gain and, therefore, taxed at short-term capital gains tax rates.

State-Level Taxes

Most states follow the federal treatment of capital gains for tax purposes. So, if your state has an income tax, short-term capital gains will typically be added to your taxable income and taxed at your ordinary state income tax rate as well.

The states with no additional state tax on capital gains are Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Unless otherwise noted, this article discusses federal capital gains taxes.

Short-Term Capital Gains Tax Rates

The tax rates applied to short-term capital gains are the same as those for ordinary income. So, depending on your total taxable income and filing status, your short-term capital gains will be taxed at 10%, 12%, 22%, 24%, 32%, 35%, or 37%.

These rates can increase slightly if you are subject to the Net Investment Income Tax (NIIT). The NIIT adds an extra 3.8% tax to investment income over certain income thresholds.

Some key things to note about the short-term capital gains tax rates:

- Your capital gains are added to your other taxable income like wages to determine your total taxable income and tax bracket.

- Your filing status (e.g., single, married filing jointly, head of household, etc.) determines which tax bracket thresholds apply.

- Short-term capital gains are not eligible for the lower long-term capital gains tax rates of 0%, 15%, or 20%.

These rates may change from year to year, so it is essential to stay informed about the current tax rates.

How Do You Calculate Cost Basis?

To determine your capital gain or loss, you need to calculate your cost basis in the asset. Basis is generally what you paid for the asset, including any purchase prices, commissions, improvements, and other related expenses.

For real estate, your cost basis includes:

- Purchase price of the property.

- Closing costs such as taxes, fees, commissions, surveys, inspections, etc.

- Capital improvements like additions, renovations, and repairs that prolong the property’s life.

- Selling expenses like commissions, legal fees, inspections, transfer taxes, etc.

Any costs that improve or prolong the life of the property, like a new roof or remodeling a kitchen, can increase your cost basis. Keep good records of these expenses to accurately calculate your basis when you sell the property later.

RELATED: 30 Roof Types and Styles (Examples and Illustrations Included)

Real Estate and Short-Term Capital Gains

For real estate investors, short-term capital gains usually arise in flipping situations where you buy a property, renovate it, and quickly resell it for a profit within a year. Real estate investors aim to hold properties long-term as rental properties to qualify for long-term capital gains treatment when they eventually sell.

However, there are situations where you may need to sell a rental property within a year for various reasons, such as:

- You buy a property with plans to fix and flip it but the renovation takes longer than expected.

- You buy a rental property but then have unexpected family or job changes that require you to move.

- You inherit an investment property but need to sell it within a year of the previous owner’s death.

- You buy a property that has unforeseen issues that make it difficult or unprofitable to hold long-term.

In these cases, any profit from the short-term sale of the property within a year would be subject to the higher short-term capital gains tax rates rather than the lower long-term rates.

Discerning the difference between short-term and long-term capital gains tax rates is even more important when you’re in the real estate business, in which you’re either a real estate dealer or an investor. Generally speaking, a dealer is subject to higher taxes, while an investor enjoys lower rates.

Rules for Capital Gains Ownership Period

There are a few important rules regarding the minimum time period an asset must be held to qualify for preferential capital gains tax treatment. Understanding these nuances can help real estate investors optimize their tax situation when selling investment properties.

12 Months and 1 Day Rule for Long-Term Capital Gains

For real estate investors, one of the most important rules regarding capital gains tax treatment is the 12 months and 1 day holding period required to qualify for long-term capital gains rates. If an investment property is sold before reaching this threshold, any profit will be subject to higher short-term capital gains rates instead of the preferential long-term rates.

To qualify for long-term capital gains treatment, real estate investors must hold an investment property for more than 12 months, meaning at least one day past the 12-month anniversary of the purchase date. The day of purchase counts as day one, so month 13 is the first month the property can be sold and still qualify for long-term treatment.

18 Months for Primary Residence Exclusion

One exception to the 12-month rule is for selling your primary residence. Taxpayers can exclude up to $250,000 ($500,000 for married couples) of capital gains from the sale of their main home.

However, to qualify for this exclusion, the home must have been owned and used as the primary residence for at least 2 of the last 5 years, meaning an 18-month minimum holding period.

This longer ownership period for the primary residence exclusion provides more flexibility if homeowners need to sell within a few years of purchasing for job changes or family reasons. Just be sure not to rent out the home or use it as an investment property to maintain the exemption.

Using Capital Losses to Offset Capital Gains

When you sell an investment asset like real property, you may realize both capital gains and capital losses. In such cases, the losses can be used to offset the gains, thereby reducing the overall tax liability. This is known as capital loss offsetting.

If you have capital losses from selling other investments at a loss, you can use up to $3,000 per year of net capital losses to offset other income like wages or interest. Any additional capital losses above $3,000 can be carried forward to future years to offset future capital gains.

Let’s say you made two investments in a given tax year:

- Investment A: You bought shares for $10,000 and sold them for $15,000, realizing a capital gain of $5,000.

- Investment B: You bought shares for $8,000 and sold them for $5,000, realizing a capital loss of $3,000.

To offset the loss, subtract your total capital losses from your total capital gains to calculate your net capital gain or loss for the year. In this scenario, the net total is $2,000.

Therefore, the $3,000 loss from Investment B reduces the taxable amount of the capital gain from Investment A. Instead of paying taxes on the full $5,000 gain, you would only pay taxes on the net gain of $2,000.

In other words, if the net result is a gain, you will owe taxes on this amount; if it’s a loss, you may use up to $3,000 of net capital losses a year to offset ordinary income (for individuals). If your net capital loss exceeds $3,000, you can carry over the loss to future years.

This capital loss offset can provide valuable tax relief if you have losses to offset gains in the current or future years. Just be aware of the wash sale rule, which disallows losses if you buy a “substantially identical” asset 30 days before or after the sale. The rule applies to stocks, bonds, mutual funds, exchange-traded funds (ETFs), and options, among other investments.

Minimizing Short-Term Capital Gains Tax

While you can’t avoid the tax entirely if you have a short-term capital gain, you can use some strategies to minimize the tax impact.

A common way to minimize short-term capital gains tax is to offset gains with capital losses, as described above. Others include:

Defer Gains to Future Years

Consider doing an installment sale over multiple years if possible to defer some of the gain and taxes to future years. You’ll still owe the tax eventually, but you can spread it out.

Take Advantage of Tax Credits

Look for tax credits you may qualify for based on the type of investment property, such as the residential energy-efficient property credit. This credit applies to solar electric property, solar water heating property, fuel cell property, small wind energy property, geothermal heat pump property, and biomass fuel property.

To claim this credit, taxpayers must file Form 5695, Residential Energy Credits Part II, with their tax return for the tax year when the property is installed.

Carefully Time the Sale

Sell just after the one-year mark if possible to qualify for the lower long-term capital gains rates instead of the higher short-term rates.

Consult a Tax Professional

Work with a qualified tax advisor who understands your full financial situation and can advise you on the best strategies. They may have additional suggestions tailored to your specific circumstances.

Frequently Asked Questions: Long-Term Capital Gains Tax

Can I use capital losses to offset my capital gains?

Yes, capital losses can offset capital gains for tax purposes. If your capital losses for the year exceed your capital gains, you can deduct up to $3,000 of the net losses from your ordinary income. Any additional net losses can be carried forward to future tax years indefinitely until they are used up.

If you have both capital gains and capital losses in the same tax year, you can use your losses to offset your gains. Any capital losses exceeding the amount of your capital gains can be deducted from your ordinary income, up to $3,000 per year. Any remaining unused capital losses can be carried forward to future years until they are fully used up. This allows your losses to reduce the amount of capital gains tax you owe.

Do I need to pay self-employment tax on short-term capital gains?

No, short-term capital gains are not subject to self-employment tax. Self-employment tax (SE tax) only applies to net earnings from self-employment, which does not include capital gains or losses from investment property. SE tax funds Social Security and Medicare.

What records do I need to keep for capital gains and losses?

The IRS requires taxpayers to keep detailed records of capital gain and loss transactions. You need to maintain records of cost basis, purchase and sale dates, expenses, incidental costs associated with acquiring the asset, any valuation or sale details, and 1099-B forms from brokerages for at least 3 years after filing your tax return.

Keep good records in case the IRS ever wants to verify capital gains or losses you reported, at least a year after January 31 following the tax year after property disposition.