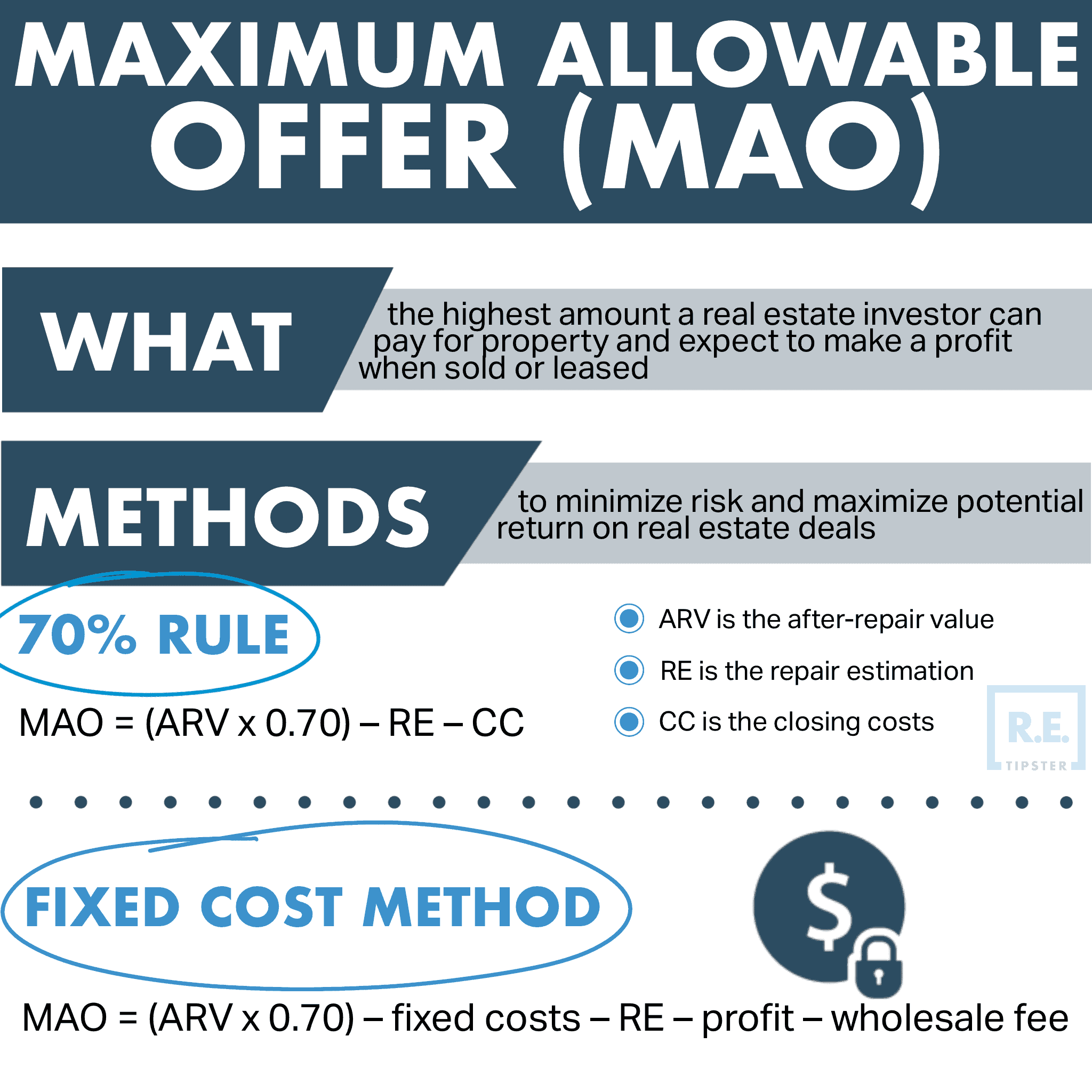

What Is a Maximum Allowable Offer?

How to Calculate the Maximum Allowable Offer

Real estate investors and wholesalers who can accurately determine the maximum allowable offer for a property stand a better chance of minimizing their risk while maximizing their potential returns on real estate deals.

There are many different variations on what constitutes a real estate investor’s MAO. The formula for calculating the maximum allowable offer depends entirely on the specific strategy, property type, risk tolerance, and other factors.

One of the more common MAO calculations is known as the 70% rule.

The 70% rule says that an investor should pay no more than 70% of a property’s after-repair value (ARV) minus the cost of repairs.

For properties with a high ARV—typically $250,000 or more—investors may tighten the rule to 75%. They may also use the 75% figure in highly competitive markets.

For properties with a significantly lower market value commonly seen in the land investing business, investors may drastically decrease the rule to as low as 10% – 30%.

RELATED: How Much Should You Offer For That Property?

One example of the MAO formula using the 70% rule might looks like this:

MAO = (ARV x 0.70) – RE – CC

Where:

- ARV is the after-repair value

- RE is the repair estimation

- CC is the closing costs

Example: Cora finds a property she plans to rehab and rent. The after repair value is $155,000, the repair estimation is $25,000 and the closing costs are $2,000.

Her maximum allowable offer using the 70% rule would be $81,500 ([$155,000 x 0.70] – $25,000 – $2,000).

Obviously, any MAO calculation is only as accurate as the values the investor applies, so it’s important to be thorough in the preliminary work of determining a property’s after-repair value, repair estimation, and closing costs.

Want to run the calculations yourself? Try our easy 70% rule calculator below!

Calculating After Repair Value (ARV)

The ARV is what the property will be worth after all repairs and improvements are complete.

ARV is usually based on comparable sales. Most real estate professionals look at 4 to 6 comps within the last six months and use the average as a starting point for ARV.

Some prefer a more precise estimate and calculate the price per square foot from the comps. They then multiply the square foot price by the square footage of the property to arrive at ARV.

If the price per square foot from the comps is $100, for example, and the property is 1,400 square feet in size, the ARV would be $140,000.

Calculating Repair Estimation

This figure is more complex to determine. Some investors and wholesalers partner with contractors and have a good idea of what various repairs and renovations will cost. Others use a rule-of-thumb price per square foot based on the type of work required.

For example, an investor may know from experience that a total gut rehab for a flip will cost roughly $75 per square foot in their market, while a cosmetic rehab for a rental property runs $25 per square foot.

Whatever method is used to calculate the repair estimation, an investor should remember to include any potential finance costs for the work.

Fixed Cost Method of Calculating MAO

While many investors use some variation of the 70% rule, some prefer the more detailed approach used in the fixed cost method.

This method may also be useful for wholesalers who need to factor in another layer of profit when determining their MAO.

The formula using the fixed cost method is as follows:

MAO = (ARV x 0.70) – fixed costs – RE – investor’s profit – wholesaling fee

Using this method, the investor determines the ARV and RE as they would for the 70% method, but then itemizes the fixed costs.

Although specific costs may vary from project to project, most include the following expenses:

- Lender and financing fees

- Closing costs

- Inspections

- Taxes and insurance

- Home warranty

- Advertising and MLS fees

- Commissions

The profit figure also varies from project to project, but the investor should have a figure in mind for each deal. Wholesalers who deal with fix-and-flip properties need to factor in the investor’s profit as well as their own wholesaler fee to arrive at the final maximum allowable offer.

Example: George is a wholesaler who discovers a suitable property for a fix-and-flip. Based on comps and square footage, the ARV of the property is $180,000, the RE is $45,000, fixed costs are $15,000, and the investor expects to make a profit of $25,000 on the project. George wants to pocket $10,000 for his wholesaling fee.

Thus, his maximum allowable offer using the fixed cost method would be:

($180,000 ARV x 0.70) – $15,000 (fixed costs) – $45,000 (RE) – $25,000 (profit) – $10,000 (fee) = $31,000 MAO

RELATED: Wholesaling Made Simple! A Comprehensive Guide to Assigning Contracts

Maximum Allowable Offer (MAO) vs. Lowest Allowable Offer (LAO)

While the Maximum Allowable Offer (MAO) and the Lowest Allowable Offer (LAO) are important concepts in real estate transactions, they represent opposite ends of the negotiation spectrum and serve different purposes for buyers and sellers.

Maximum Allowable Offer (MAO)

- Represents the highest price a buyer (typically an investor) can pay for a property while still expecting to make a profit.

- Is calculated by the buyer based on factors like the After Repair Value (ARV), repair costs, and desired profit margin.

- Helps buyers avoid overpaying for properties and ensures potential profitability.

- Often uses formulas like the 70% rule or fixed cost method to determine the maximum offer.

Lowest Allowable Offer (LAO)

- Represents the lowest price a seller is willing to accept for their property.

- The seller determines the price based on factors such as market conditions, their financial situation, and the property’s perceived value.

- Helps sellers ensure they don’t undersell their property.

- LAO is influenced by comparable sales, the seller’s motivations, and property characteristics.

Key Differences

- Perspective: MAO is a buyer-focused concept, while LAO is seller-focused.

- Calculation: MAO is typically calculated using specific formulas, while LAO is more subjective and based on various factors influencing the seller.

- Purpose: MAO aims to maximize potential profit for buyers, while LAO aims to protect the seller’s interests and ensure a minimum acceptable sale price.

- Negotiation strategy: Buyers use MAO as a ceiling for their offers, while sellers use LAO as a floor for accepting offers.

Understanding MAO and LAO can lead to more effective negotiations in real estate transactions. Buyers should be aware that their calculated MAO might be lower than a seller’s LAO, potentially leading to failed negotiations if the gap is too wide. Conversely, sellers should recognize that a buyer’s MAO might be lower than their asking price, necessitating negotiation flexibility to close a deal.

RELATED: The Complete Guide to Land Seller Negotiation and Deal Closing w/ Ajay Sharma