What Is a Mortgage?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Mortgage Loan Calculator

Once calculated, click “View Amortization Schedule” to see the results!

Mortgage Basics Explained

Although people commonly use “mortgage” and “loan” synonymously, the two are distinctly different.

A mortgage is a security agreement that allows the lender to collateralize the subject property. In other words, all mortgages are connected to a loan, but not all loans are connected to a mortgage.

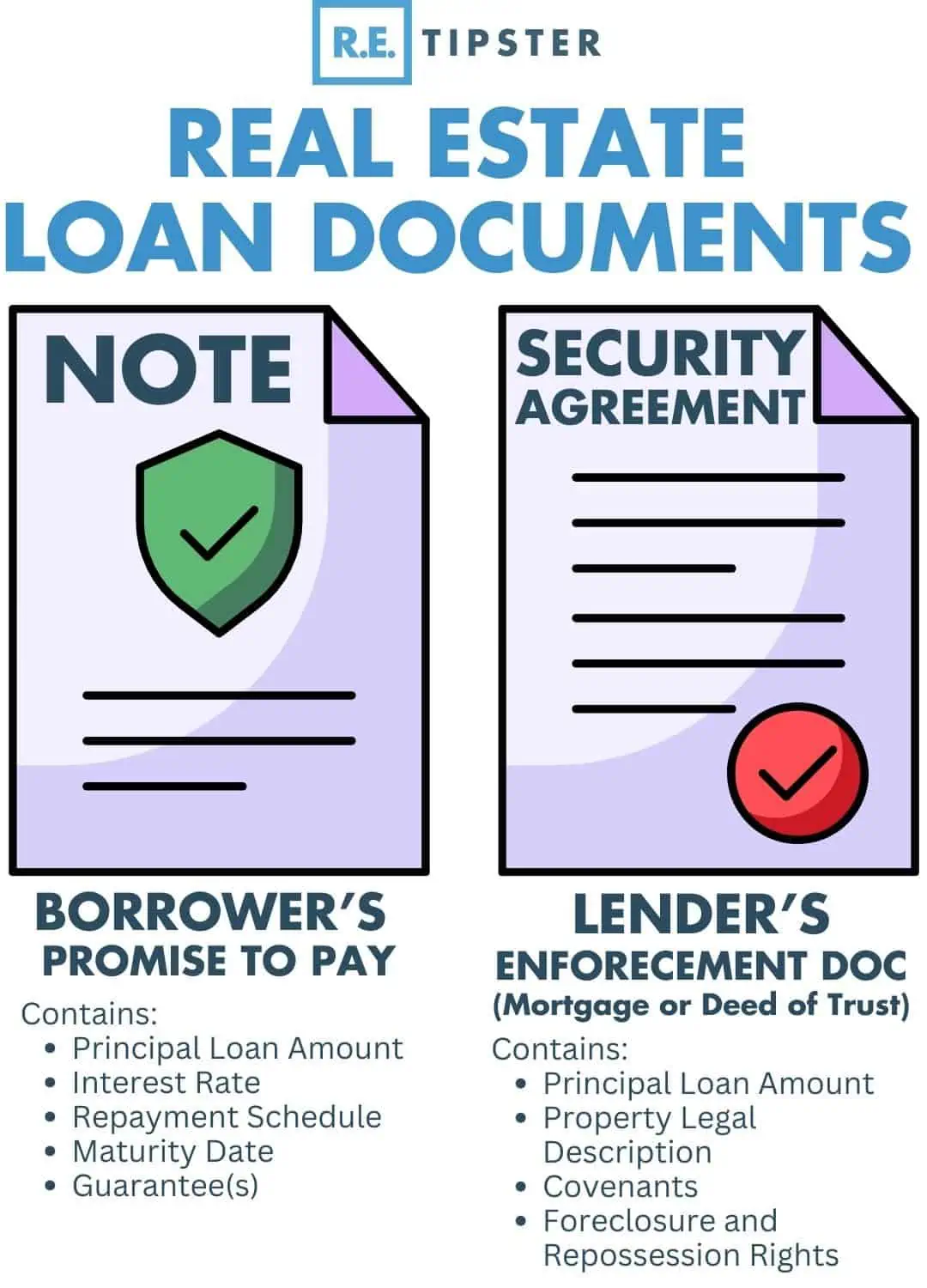

Mortgage loans are a common way to finance the purchase of real property. There are two parts to a mortgage:

- Promissory Note: A financial instrument specifying that the borrower will pay the lender a specified sum of money on demand or at a predetermined future date.

- Mortgage: A deed of trust recorded with the appropriate government agency (usually the county recorder) as a lien or claim against the property.

The word mortgage comes from Latin mortuus (dead) and Old French gage (pledge)[1]. The first known usage of this term was in the Middle Ages. It refers to an obligation that ends only by the debt’s fulfillment or the collateral’s repossession.

In common usage, however, “paying off a mortgage” typically refers to the loan, not the document.

Different Types of Mortgages

Mortgage loans can vary in many different ways.

One type of mortgage is a government-backed mortgage, which means it is guaranteed or insured by an agency such as the Veterans Administration, FHA, or the USDA[2]. Government-backed mortgages generally have more lending requirements that the mortgage originator and borrower must adhere to.

Another type of mortgage is a conventional mortgage, which does not have the same benefits as a government-backed mortgage.

A mortgage can also be conforming or nonconforming. A conforming loan meets the funding criteria for Fannie Mae and Freddie Mac, which means it is within the local lending limits set by the Federal Housing Finance Authority (FHFA). If a loan is conforming, the lender can sell it to Fannie Mae or Freddie Mac instead of servicing it in-house.

Beyond that, mortgage loans can be divided into several different types:

- Fixed-Rate Mortgage: A fixed-rate mortgage is one with a fixed interest rate for the duration of the loan. The most common terms for fixed-rate mortgages are 15 years and 30 years, although some lenders offer 10-, 20-, and even 40-year mortgage loans.

- Adjustable-Rate Mortgage: An adjustable-rate mortgage (ARM) is a type of loan where the interest rate varies over its lifespan. ARMs are usually expressed with two numbers, such as 3/1, 5/1, or 5/5. The first number is the period in which the introductory interest rate is fixed, while the second number describes how often the interest rate is adjusted.

- Interest-Only Mortgage: This is a type of mortgage in which the borrower only pays the interest due on the loan for a certain number of years. The borrower has two options thereafter: paying the principal in a lump sum (a balloon payment) or converting it into a standard amortization schedule where they perform monthly payments of the combined principal and interest. It is not uncommon for an adjustable-rate mortgage to offer an introductory period in which payments are interest-only.

- Jumbo Mortgage: Jumbo mortgages are non-conforming mortgages that exceed the loan limits set by the FHFA. Borrowers usually need a higher credit score, a more substantial down payment, and higher cash reserves to qualify for a jumbo mortgage.

- Reverse Mortgage: A reverse mortgage is a type of loan in which the homeowner withdraws a portion of his home equity each month. The loan is repaid when the homeowner leaves the home. To qualify, borrowers must be age 62 or over, and either owns their homes outright or have significant equity.

- Home Equity Loan (HELOC): HELOC loans are also mortgage loans because a lien secures them against the property. The difference between a mortgage and a HELOC is that a mortgage loan is used to purchase a property, while a home equity loan allows the borrower to leverage the equity they have built up in the property without having to sell it.

RELATED: How a Mortgage Closing Works (Seller Financing Tutorial)

Types of Mortgage Lenders

There is no shortage of banks, credit unions, online lenders, and other entities that make mortgage loans. To get the best deal, borrowers should know what different lenders offer and how they fit their financing needs.

These are the main types of mortgage lenders a borrower might work with:

- Retail Lenders: These are banks and credit unions that offer a range of financial products to consumers, including mortgage loans. They fund mortgages with their own money and tend to have the strictest underwriting guidelines compared to other types of mortgage lenders.

- Direct Lenders: These lenders specialize in mortgage loans. They originate their own loans either with their own money or borrowed funds. They have more flexible underwriting guidelines and may be more accommodating to borrowers with complex financial situations. Most direct lenders operate online and do not have brick-and-mortar branches.

- Portfolio Lenders: These lenders make loans with their own funds. As a result, they can set their underwriting guidelines without input from outside investors and organizations. Real estate investors and others who need creative or nonconforming financing often turn to these lenders because of their flexibility.

- Wholesale Lenders: Wholesale lenders offer mortgage loans through a third party such as a mortgage broker. They do not work directly with borrowers, and while they occasionally service their own loans, they typically sell them on the secondary market. Many mortgage banks operate both retail and wholesale mortgage lending divisions.

- Hard Money Lenders: Hard money lenders are private companies with vast capital reserves. They usually offer short-term mortgages with terms of just a few years. Hard money lenders charge high-interest rates (10% to 20%) and loan origination fees, and they usually require a substantial down payment. However, they can close loans very quickly. These are lenders of last resort for investors who cannot qualify with portfolio lenders or those who plan to fix and flip a property.

RELATED: Hard Money 101: Everything You Need to Know About Getting Started With Hard Money Loans

Glossary of Common Mortgage Terms

When borrowers begin the process of financing real estate, they are likely to encounter several jargon terms. These are a few of the most common mortgage terms a borrower may need to know.

Amortization: This is the payment schedule that shows which portion of each payment goes to principal and interest.

Escrow: An escrow account is a legal arrangement in which a third party holds the money until a condition is met. When a buyer makes an offer with earnest money, it is usually held in an escrow account. Many lenders also require escrow accounts to hold money for property taxes and insurance. The lender withholds a portion of each payment in an escrow account and pays the taxes and insurance premiums when they are due.

Loan Servicer: The loan servicer is responsible for sending statements, collecting payments, managing the escrow account, and handling any customer service issues. In some cases, lenders service their own loans, but others sell the servicing rights to a third party, such as Fannie Mae or Freddie Mac[3]. The borrower has no control over who services the loan.

Mortgage Broker: A mortgage broker acts as an intermediary between the borrower and the lender. A broker collects information to prequalify the borrower and submits the package to lenders. When the borrower chooses a loan offer, the broker is the point of contact between the two parties until the loan is closed. A broker does not fund or close the mortgage; the loan is made in the lender’s name, and the lender pays the broker a fee once the loan closes.

PITI: This is an acronym for principal, interest, taxes, and insurance. Most mortgage payments include these four parts. Most online mortgage calculators only include principal and interest, so borrowers need to add in estimates for property taxes and homeowner’s insurance to get a more accurate idea of their monthly mortgage payment.

Private Mortgage Insurance (PMI): Lenders generally require private mortgage insurance on loans with a loan-to-value ratio of at least 80%. If the borrower does not put down at least 20%, the lender will collect a premium, typically between 0.5% and 1% of the loan amount annually, to protect itself in case the borrower defaults. This premium is generally included in the loan payment.

Term: The mortgage term refers to the length of time between when funds were drawn from the lender and when the money must be paid in full[4]. Standard residential mortgage terms are 15 years and 30 years.

Takeaways

A mortgage is a legal document giving the lender the right to take control of a property if the borrower defaults on the loan. When someone borrows money to purchase real property, they sign both a promissory note and a mortgage deed of trust, which is recorded as a lien against the property.

There are many different types of mortgage loan products and mortgage loan providers. The borrower’s credit profile, property type, and loan amount all factor into the choice of mortgage program. Borrowers who cannot qualify for traditional mortgage loans may be able to obtain financing from direct or portfolio lenders.

Sources

- Business Insider. (n.d.) The origins of the word ‘mortgage’ will make you think twice about buying a house. Retrieved from https://www.businessinsider.com/mortgage-means-death-pledge-2016-3

- Rocket Mortgage. (n.d.) FHA Loans: Requirements, Loan Limits, And Rates. Retrieved from https://www.rocketmortgage.com/learn/fha-loans

- Fannie Mae. (n.d.) Originating & Underwriting. Retrieved from https://singlefamily.fanniemae.com/originating-underwriting

- Consumer Financial Protection Bureau. (n.d.) Understand loan options. Retrieved from https://www.consumerfinance.gov/owning-a-home/loan-options/