What Is a Security Agreement?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- A security agreement is a legal contract that grants the lender certain rights over specific collateral if the borrower defaults on their loan.

- It identifies the collateral being pledged, such as the property address for real estate loans.

- The agreement outlines what constitutes default, giving the lender remedies like foreclosure if the borrower misses payments or violates other terms.

- After default, common lender rights include accelerating the loan, foreclosing on the collateral, repossessing assets, and pursuing deficiency judgments.

- A security agreement creates a security interest, while a security instrument perfects an interest in real estate collateral through public records.

Understanding a Security Agreement

A security agreement is a legal document that pledges specific property (collateral) to the lender as security for loan repayment. The collateral protects the lender if the borrower does not repay the loan as agreed. If the borrower defaults, the lender has the right to take ownership of the collateral and sell it to recover their losses.

In real estate investing, the purchased property usually acts as collateral for the loan. For example, if an investor takes out a loan to buy a rental property, that property becomes collateral. If the investor stops making payments, the lender can foreclose on the property to recoup their money.

Other types of collateral besides real estate can include vehicles, equipment, inventory, accounts receivable, securities, or cash. The security agreement spells out exactly what assets are being used as collateral for the loan, unless the parties agree to a general security agreement (GSA).

What Is a General Security Agreement?

A general security agreement is more comprehensive type of security agreement, covering all personal property or assets, including future acquisitions. GSAs are particularly versatile, enabling cross-collateralization of various business assets like inventory, equipment, accounts receivable, and intangible properties to support multiple loans.

However, it’s worth noting that GSAs typically do not cover real property (land and buildings), as these are often subject to separate mortgage agreements due to distinct legal requirements.

Key Elements of a Security Agreement

While security agreements vary depending on the lender and type of loan, most contain several standard elements:

- Description of Collateral: This clearly identifies the specific property being pledged as collateral. For real estate loans, this would include the property address and legal description. You can easily do this with various tools and online references. For example, if you’re a real estate investor using seller financing, you can use a tool like DataTree to find the property’s legal description easily, as described in the video below.

- Grant of Security Interest: This is language stating that the borrower is granting the lender a security interest in the described collateral. This gives the lender certain legal rights over the collateral.

- Default Clause: Outlines what constitutes a default on the loan terms, such as missing a payment. This triggers the lender’s right to seize the collateral.

- Rights of the Lender: This section specifies actions the lender can take if default occurs, such as repossessing and selling the collateral to satisfy the debt.

- Responsibilities of the Borrower: Obligations of the borrower, such as maintaining property insurance on the collateral and paying taxes.

- Signature Block: Space for all parties to sign, date, and notarize the agreement.

The security agreement remains in effect until the borrower pays the loan off or the lender releases the collateral. It ensures the lender has legal recourse if the borrower does not fulfill their obligations.

How Does a Security Agreement Define Default?

One of the most important aspects of a security agreement is defining what constitutes a default.

For a real estate loan, consistently missing mortgage payments over a certain timeframe is typically considered default. However, the agreement may allow for some flexibility, such as a grace period before default is triggered.

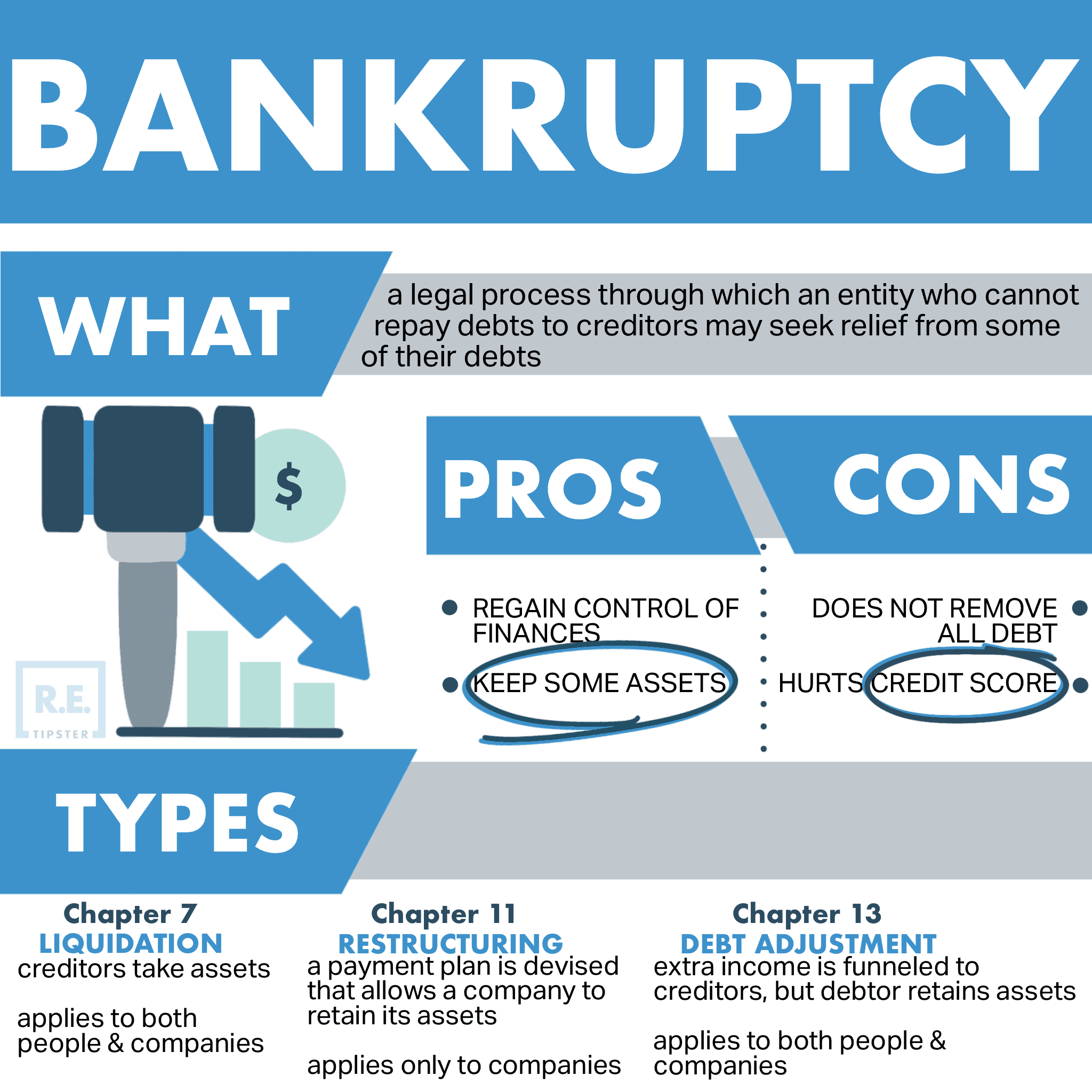

Other events that could cause default include:

- Failing to pay property taxes or insurance.

- Allowing significant damage or waste to occur on the property.

- Filing for bankruptcy.

- Selling or transferring ownership of the collateral without permission.

- Falsifying information on the loan application.

If any of these default conditions occur, the lender has the right to take action against the collateral, such as foreclosure on a mortgage. It’s critical for borrowers to avoid default at all costs by carefully adhering to the loan terms.

Lender Rights After Default

Once a default is established, the security agreement grants the lender certain remedies they can pursue to recover their investment.

Under the security agreement, they have significant power to pursue the collateral through foreclosure or repossession. They may also call for acceleration, which calls for the entire outstanding loan balance to be immediately due and payable, or sue the borrower for a deficiency judgment for any remaining unpaid portion of the loan after selling the collateral.

In any case, lenders may also charge administrative fees for expenses incurred in the default and repossession process.

Borrower Responsibilities

While default rights favor the lender, the security agreement also outlines responsibilities for borrowers:

- Loan Repayment: Making timely payments of principal and interest as scheduled.

- Insurance: Maintaining adequate property/casualty insurance on any collateral.

- Taxes: Paying all property taxes and assessments when due.

- Upkeep: Properly maintaining and preventing damage or waste to collateral.

- No Transfer: Not selling or encumbering collateral without permission.

- Records: Providing financial records to lenders upon request.

- Notifications: Informing the lender immediately of any default events.

Fulfilling these obligations is critical to avoiding default. Borrowers must carefully manage collateral assets and honor all loan repayment terms. Failing to do so can result in serious legal and financial consequences.

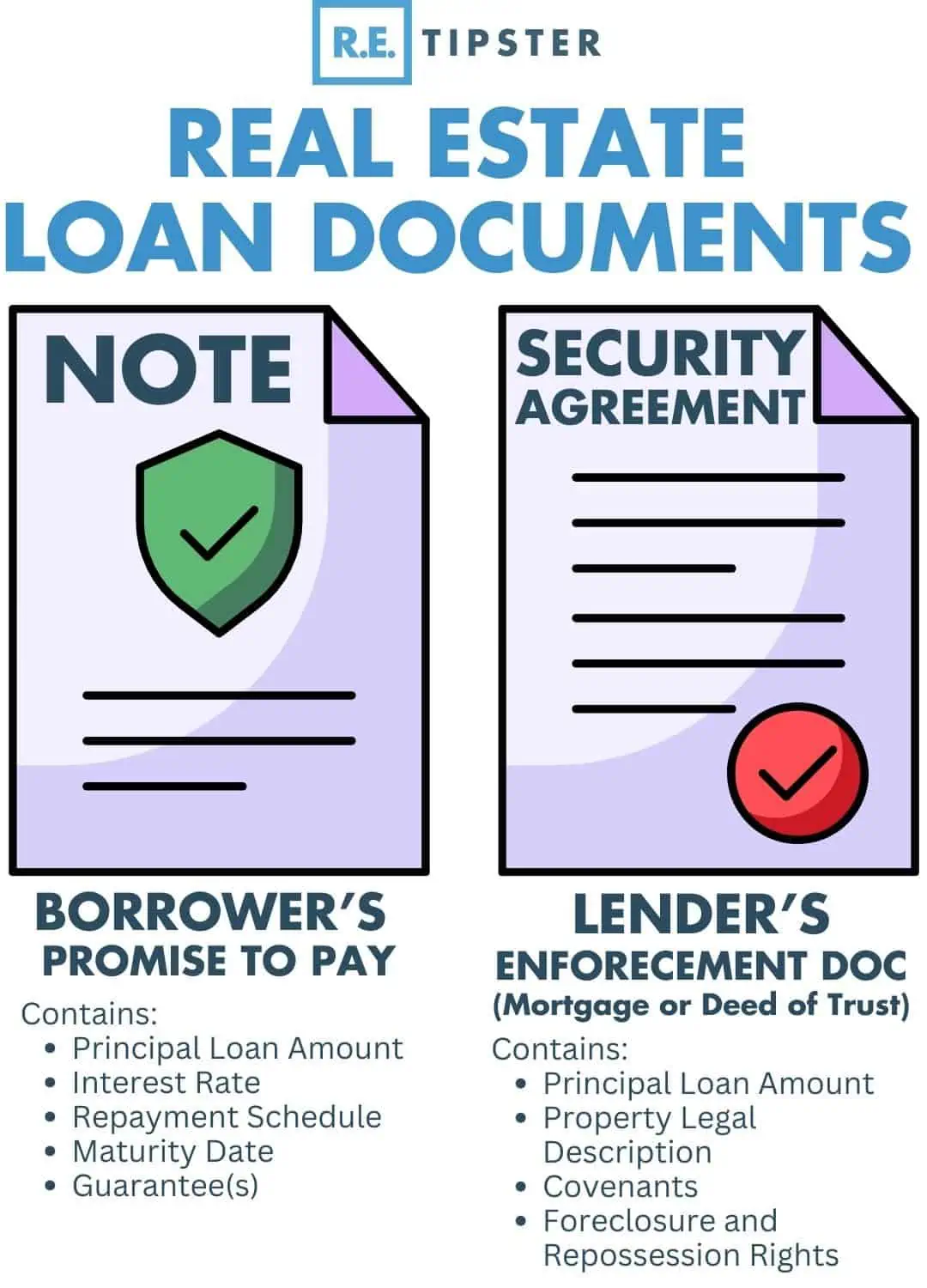

Security Agreement vs. Security Interest and Security Instrument

While security agreement, security interest, and security instrument are sometimes used interchangeably, there are important differences between these terms:

Security Agreement

A security agreement is a written contract that creates or provides for a security interest. It includes granting language and outlines the collateral, obligations, and rights of the borrower and lender.

Security Interest

A security interest is the “stake” a lender has in the borrower’s collateral. A security agreement establishes this interest and grants the lender certain legal rights over the collateral.

Security Instrument

The security instrument is a legal document, such as a mortgage or deed of trust, that perfects the security interest in real property collateral. It must be properly recorded with the local land records office.

Key Distinctions

- A security agreement is a contract that establishes the security interest between parties.

- A security interest is the actual property rights the lender receives over the collateral through the security agreement.

- A security instrument is used specifically for real estate collateral to officially record the security interest with the local government.

In a nutshell, a security agreement creates the security interest, while a security instrument legally perfects and documents that interest for real property collateral on public record. The security interest itself refers to the legal rights and power the lender obtains over pledged assets.

Frequently Asked Questions: Security Agreement

What happens if the collateral declines in value?

Declining collateral value alone doesn’t trigger default as long as payments are kept current. However, the lender assumes some risk that collateral may depreciate over the loan term.

However, borrowers remain responsible for any deficiency if the collateral is later sold for less than the outstanding loan balance.

Can collateral be substituted?

Yes, collateral in a security agreement can be substituted, but this process involves specific conditions and formalities.

For instance, in a practical setting, when customers wish to substitute collateral (like swapping one vehicle for another of equal or greater value as collateral for the same loan), it’s recommended not to allow such substitutions directly due to potential complications during repossession.

Instead, the existing loan should be closed out, and a new loan should be created for the new item to ensure clarity and avoid legal or operational issues. This approach helps maintain clear records and avoids confusion over the collateral securing the loan.

What other documents are involved?

Related documents typically include the security agreement, loan agreement, promissory note, and mortgage (if real estate is used as collateral). Title insurance may also be required to protect the lender’s interest in the collateral property. Borrowers should obtain and understand all applicable loan documents.