What Is a Deficiency Judgment?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- A deficiency is a loss the lender incurs when the sale of the collateral does not cover the outstanding loan balance.

- A deficiency judgment empowers the lender to collect what’s still owed on a foreclosed home sold at fair market value.

- A lender can only seek a deficiency judgment in states where a defaulting borrower can be held personally liable for a loan.

- Deficiency judgments are calculated based on professional appraisals and comparable listings to prevent the financially distressed borrower from being unfairly billed.

- A deficiency judgment stays on a credit report for seven years, but paying bills on time and using credit moderately can help mitigate the impact.

When Is a Deficiency Judgment Called?

A deficiency judgment is called when the home loan is a recourse debt in a U.S. state without an anti-deficiency law[1].

In these jurisdictions, the real estate lender can hold the defaulting borrower personally liable for the mortgage debt. The lender may claim funds from the financially distressed borrower to make up for the deficiency, but only when the foreclosed home is worth less than the remaining mortgage balance.

Note that the lender’s rights and restrictions can vary by state, and some states may have specific laws that allow or prohibit certain actions by lenders. In general, however, lenders cannot intentionally sell a foreclosed property below its fair market value and then pursue the borrower for additional funds.

What Is Deficiency in Real Estate?

Deficiency in real estate is the loss that a mortgage lender may incur when selling a foreclosed home[2].

After taking ownership of a foreclosed property, the lender may attempt to sell it to recover the outstanding mortgage debt. The difference between the sale proceeds and the mortgage balance, if any, is known as the deficiency.

Let’s say John took out a mortgage of $200,000 to purchase a property that was worth $250,000 at the time. After a few years, John fell behind on his mortgage payments and eventually defaulted on the loan. The lender foreclosed on the property and sold it at a foreclosure auction for $150,000.

In this scenario, the deficiency is $50,000, which is the difference between the outstanding mortgage balance of $150,000 and the sale proceeds of $150,000. Assuming the property is in a state with no anti-deficiency laws, the lender could then pursue a deficiency judgment against John to collect this amount.

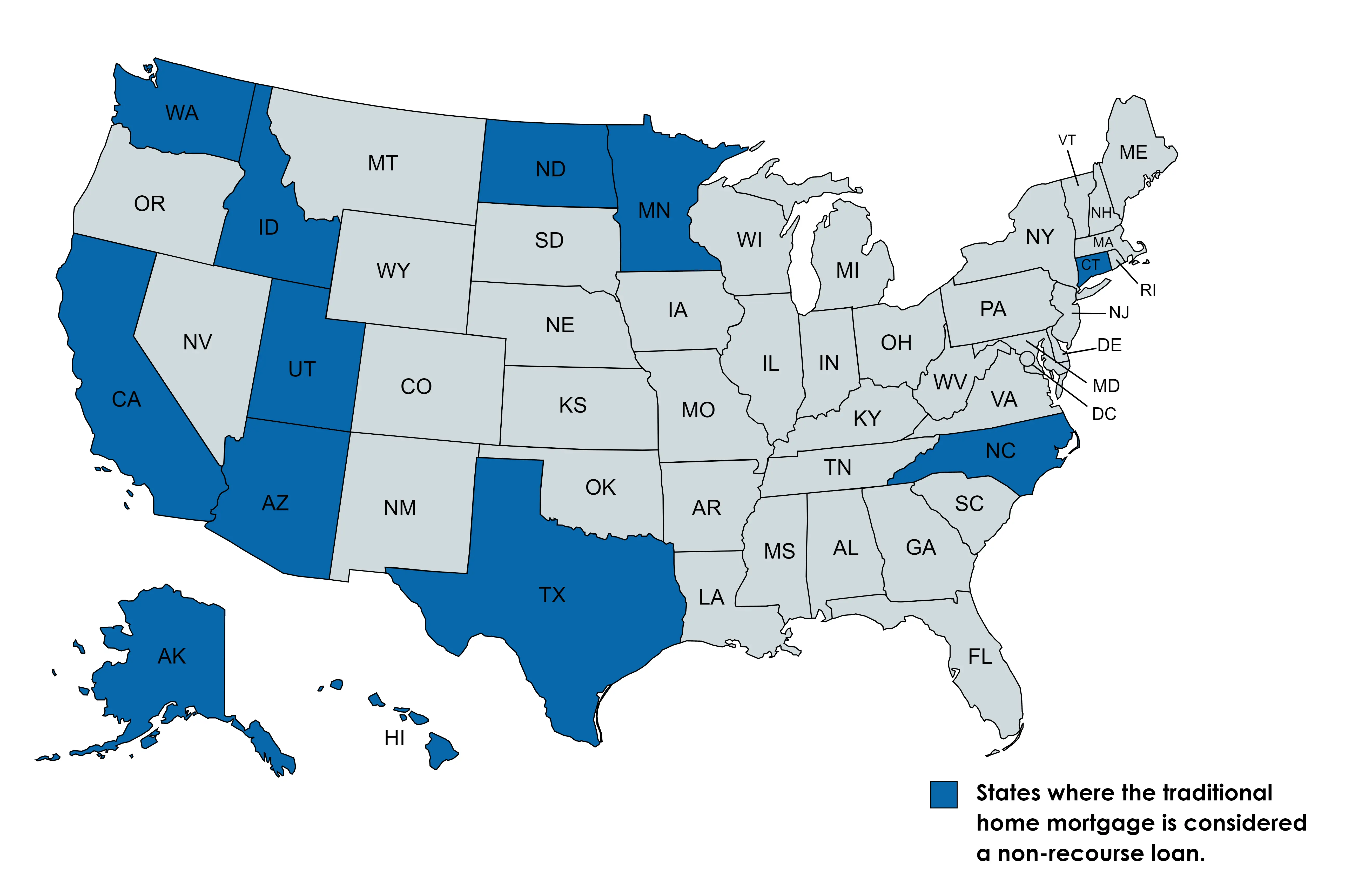

In other words, if John’s property is located in the states in gray on the map below, the lender may demand additional payment from John.

Ideally, lenders should only lend up to the property’s appraised value [3] to avoid the risk of a deficiency. Borrowers should also make adequate down payment to avoid negative equity[4], which occurs when the outstanding mortgage balance exceeds the property’s value. In reality, though, borrowers (even lenders) might not have fully understood the risks when taking out the loan[5].

Calculating Deficiency

To prevent this right from being abused, the lender must commission a professional appraisal and come up with comparable listings[6].

This way, the lender can justify that the amount accepted from the foreclosed home was fair and any attempts to collect the uncovered portion of the mortgage debt are reasonable and done in good faith.

BY THE NUMBERS: Only 12 states have anti-deficiency or non-recourse laws, so most of the U.S. does not prohibit mortgage lenders from legally chasing debtors to avoid losses.

Source: MoneyTips

How Does a Deficiency Judgment Work?

A deficiency judgment is a court order that allows a lender to collect the difference between the outstanding mortgage balance and the sale proceeds of a foreclosed property. To obtain a deficiency judgment, the lender must take legal action against the homeowner and obtain a court order.

If the sale proceeds are less than the outstanding mortgage balance, the lender may put a lien on the borrower’s personal assets, garnish their wages, or use a third-party debt collector to collect the deficiency. The lender has a limited amount of time, typically years[7], to obligate the borrower to pay the deficiency, depending on state law.

While this lack of immediate pressure on the borrower can be beneficial, it also puts them in an uncertain position, particularly when the lender decides to collect. Keep in mind that borrowers who file for bankruptcy may be able to nullify the deficiency judgment and avoid paying the deficiency.

Deficiency judgments are only allowed in U.S. states without anti-deficiency laws. In states with such laws in place, the lender is generally prohibited from pursuing the borrower for the deficiency.

RELATED: The Full List of All Judicial and Non-Judicial Foreclosure States in the U.S.

How Long Does a Deficiency Judgment Stay on a Credit Record?

A deficiency judgment stays on a borrower’s credit record for up to seven years.

The presence of a deficiency judgment on a credit report may not necessarily lower the credit score, but it can affect a creditor’s decision when considering a future loan application. As a result, it can make borrowing more expensive in the form of higher interest[8].

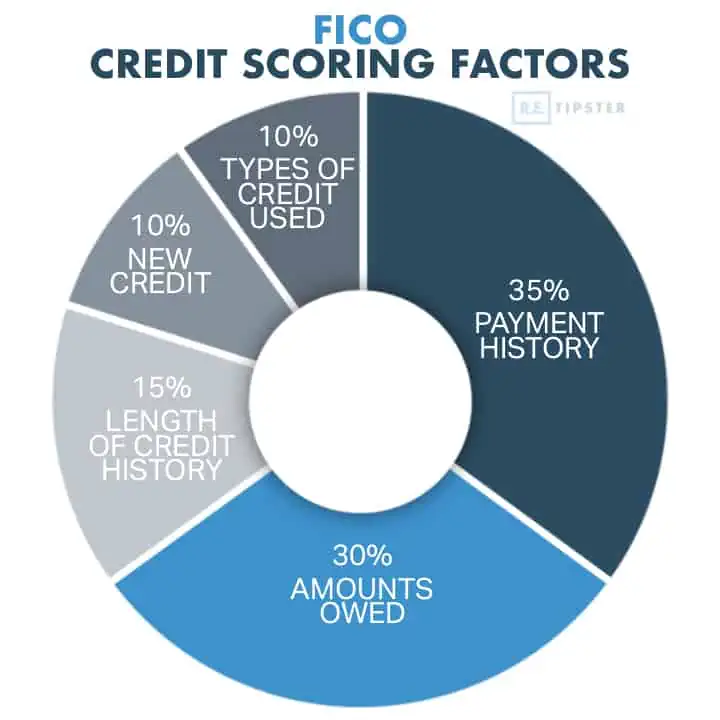

However, clearing the deficiency judgment is not a requirement for rebuilding credit. Maintaining a history of on-time payments and using credit responsibly[9] are key factors in improving overall creditworthiness.

In fact, consistent payment history and responsible credit usage can help offset the negative impact of a deficiency judgment.

BY THE NUMBERS: If a person’s credit was in good standing before foreclosure, fully recovering from the event might only take three years.

Sources

- Recourse vs. Nonrecourse Debt. (n.d.) Internal Revenue Service. Retrieved from https://apps.irs.gov/app/vita/content/36/36_02_020.jsp

- Loftsgordon, A. (2022, December 5.) What Is the Foreclosure Process? Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/what-is-the-foreclosure-process.html

- Everything you should know about a home appraisal. (2021, October 19.) Chase. Retrieved from https://www.chase.com/personal/mortgage/education/finding-a-home/everything-about-a-home-appraisal

- Pettinger, T. (2022, April 15.) Factors that affect the housing market. Economics Help. Retrieved from https://www.economicshelp.org/blog/377/housing/factors-that-affect-the-housing-market/

- Lambert, L. (2022, November 2.) This interactive map shows the home price shift in America’s biggest housing markets. Fortune. Retrieved from https://fortune.com/2022/11/02/housing-market-home-prices-correction-crash-updated-map/

- Lewis, M. (2018, January 5.) Do Your Own ‘Comps’ to Gauge Home Value. NerdWallet. Retrieved from https://www.nerdwallet.com/article/mortgages/find-your-homes-value-do-your-own-comps-in-4-steps

- Rafter, D. (2022, November 24.) Deficiency Judgment: What Is It And How Does It Work? Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/deficiency-judgment

- Balfour, B. & Matthews II, K. (2022, July 29.) How Bad Credit Affects You. LendingTree. Retrieved from https://www.lendingtree.com/credit-repair/how-bad-credit-affects-you/

- What’s in my FICO® Scores? (2022, February 23.) myFICO. Retrieved from https://www.myfico.com/credit-education/whats-in-your-credit-score