What Is Net Asset Value (NAV)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Is Net Asset Value?

Net asset value, or NAV, is the difference between an organization’s total assets and its total liabilities.

NAV is useful for evaluating the share price of open-ended funds[1], such as most mutual funds, unit investment trust funds (UITFs), hedge funds, and real estate investment trusts (REITs).

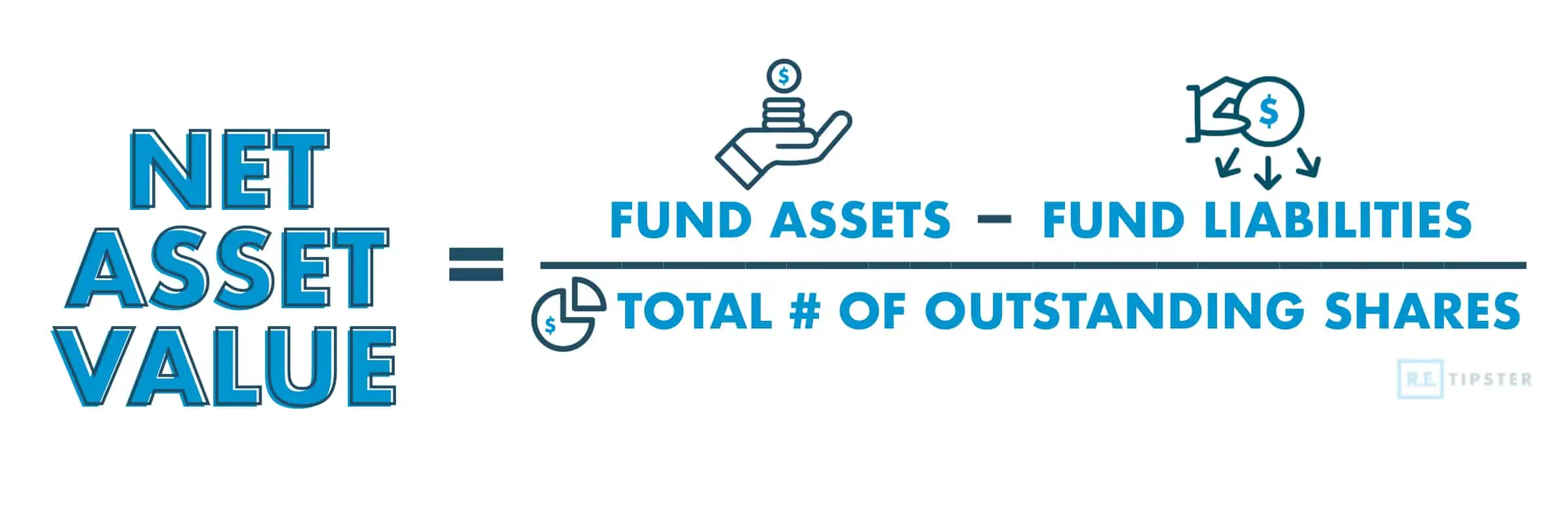

It is calculated by the formula:

NAV = total assets – total liabilities

NAV is also used to calculate the per-share market value of a particular stock by dividing the net asset value by the number of outstanding shares. Market value is determined by dividing a REIT asset’s operating income[2] by the capitalization rate[3].

Here is a more visual representation of calculating NAV per share:

Net asset value is usually recalculated daily, typically at the end of each trading/business day.

The frequency of net asset calculations depends on how often investment companies offer purchasable shares. Those with daily valuations have shares available for sale every day, while those with monthly valuations only have shares for sale every month.

Ultimately, NAV is only one of many indicators of how risky an investment is, so an investor should use net asset value in conjunction with other performance metrics.

Example of a NAV

To illustrate a fund valuation, consider a REIT with these figures:

- Total assets: $200 million

- Total liabilities: $50 million

- Outstanding shares: 2 million

Using the net asset value formula, the fund’s assets ($200 million) minus its liabilities ($50 million) show a NAV of $150 million.

On a per-share basis, divide the $150 million by the number of shares, which is 2 million, resulting in 75. The NAV per share is $75.

Stock Exchange Price vs. NAV-per-share

The stock price is the amount investors are willing to pay, whereas the fund’s NAV is usually closer to the fair market value of that stock.

If the value of a fund’s shares is much lower than the NAV, the asset may be undervalued. If the net asset value is lower, the investment is overvalued.

Why Is NAV Important?

NAV is important because it allows investors to calculate fund performance and manage the risks of investing in mutual funds or REITs[4].

Since book value and the price-to-book ratio[5] are not always accurate, NAV price paints a clearer picture of how much an investor should pay for a share of a certain investment firm. If the market price deviates substantially from its NAV, it may signal a buying or selling opportunity.

It’s worth noting that a fund’s NAV calculation relies on properly assessing the company’s market value. NAV accounts for the changes in the value of a company’s holdings; any change in its net assets and net income, as well as offering costs[6], can influence the final result.

Furthermore, NAV can help an investor make a more informed decision when others are driven by emotion. For example, misguided assumptions can drive the price of shares below or above the intrinsic value of the underlying assets.

Irrational market players are unpredictable. Without NAV, investors unnecessarily expose themselves to greater risk by trying to guess how new investors will influence fund performance.

In fact, noise theory[7] suggests that departures of stock prices from their NAV arise from shifts in investor sentiment.

Factors Affecting NAV

Several factors affect NAV.

In general, net asset value moves in tandem with changes in the value of a company’s tangible assets.

When the assets held by a company or investment firm underperform, NAV decreases, and vice versa. In real estate, where the market swings from hot to cold and back again much more quickly than other sectors, NAV figures can seem erratic.

For this reason, investors analyze the historical performance of a REIT and compare its NAVs on multiple dates.

Higher Net Asset Value vs. Lower Net Asset Value

Higher NAVs often indicate that the total intrinsic value of a REIT’s underlying assets is high, so it should inspire optimism among investors.

In general, high NAVs signify good investment performance. Conversely, if the NAV is low, the trust needs to do a better job driving up returns.

Whatever the case, NAV is a reliable metric to judge whether a mutual fund or REIT share sells at a discount or a premium.

Why Do Some REITs Trade at a Discount to NAV?

A REIT that trades at a discount to NAV typically does so when investor sentiment does not shift in its favor.

A REIT share in this position is a risky bet due to many reasons.

For Publicly Traded REITs

Publicly traded REITs are not immune to stock market fluctuations. When that happens[8], REIT share prices usually plummet due to capitulation[9], even though the fundamental value of the underlying assets is unchanged.

When fear rules the stock market, investors will typically sell shares of a company, even if the company remains profitable.

Some investors predict when the next stock market correction might occur based on historical data[10]. However, whether the forecast is accurate or not, if enough people believe it and expect it, it can become a self-fulfilling prophecy.

For Private REITs

Non-traded REITs’ share prices are less volatile since they are incredibly illiquid. With them, investors have no choice but to buy and hold their shares until the REIT goes public or liquidates its assets.

Although non-traded REIT share prices are less likely to fall below their net asset value, it may still happen when investors believe that the value of real estate held by the REIT will decline soon.

The selling pressure may come from the expectation of future drops, causing some investors to part ways with their shares at a discount to avoid greater losses[11].

Takeaways

- NAV is the resulting amount when an entity’s liabilities are subtracted from its assets and divided by the number of outstanding shares.

- NAV is useful for assessing the value of investment firms, such as those dealing in mutual funds and REITs.

- REITs may be traded at a discount to NAV when investors believe that they are risky to own even though the value of their holdings is solid.

Sources

- Hicks, C. & Likos, P. (2021, May 18.) What Are REITs and How to Invest in Them. U.S. News. Retrieved from https://money.usnews.com/investing/real-estate-investments/articles/the-ultimate-guide-to-reits

- How To Calculate Operating Income (Formula and Examples). (2020, February 5.) Indeed. Retrieved from https://www.indeed.com/career-advice/career-development/how-to-calculate-operating-income

- O’Connell, A. (2020, October 30.) Evaluating Cap Rate: Is That Residential Real Estate Investment Property Worth It? Nolo. Retrieved from https://www.nolo.com/legal-encyclopedia/is-that-residential-real-estate-investment-property-worth-it.html

- Risk Factors of Investing in REITs. (2022, October 24.) Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/wealth-management/risk-factors-of-investing-in-reits/

- Bromels, J. (2022, July 7.) Using the Price-to-Book Ratio to Analyze Stocks. The Motley Fool. Retrieved from https://www.fool.com/investing/how-to-invest/stocks/price-to-book-ratio/

- Suknanan, J. (2021, December 2.) 145 million Americans own REITs: 12 things to know about these stocks that make owning real estate easy. CNBC. Retrieved from https://www.cnbc.com/select/what-to-know-about-reits/

- Clayton, J. & MacKinnon, G. (n.d.) Explaining the Discount to NAV in REIT Pricing: Noise or Information? Real Estate Research Institute. Retrieved from https://reri.org/research/abstract_pdf/wp98.pdf

- Light, L. (2021, December 2.) Stock market pullback, correction, crash: How to tell the difference. Fortune. Retrieved from https://fortune.com/2021/12/01/stock-market-pullback-correction-crash-how-to-tell-the-difference/

- Wang, L. (2022, October 4.) Wall Street Capitulation Calls Get Ever Harder as Stocks Bounce. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2022-10-03/wall-street-capitulation-calls-get-ever-harder-as-stocks-bounce

- Jackson, A. (2021, October 20.) This Simple Chart Shows When to Expect the Next Stock Market Correction. Money. Retrieved from https://money.com/stock-market-correction-chart/

- Zuckerman, G. (2022, October 31.) Public REITs are down, nontraded REITs are Up. Which is right? Mint. Retrieved from https://www.livemint.com/market/stock-market-news/public-reits-are-down-nontraded-reits-are-up-which-is-right-11667218522287.html