What Is Net Profit?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Net profit is the most important financial metric, representing the money a company has generated through its operations after paying all expenses.

- Net profit margin expresses net profit as a percentage of total revenue, indicating how efficiently a company is generating profits from its sales.

- Key factors affecting net profit include revenue, cost of goods sold, operating expenses, tax rates, and financing costs.

- Analyzing net profit trends over time provides valuable insights into a company’s financial performance.

- Other related metrics like gross profit, operating profit, and EBITDA provide additional insights into a company’s financial health and operations.

Understanding Net Profit

Net profit is the most important financial metric for a business. It represents the money a company has generated through its operations after paying all of its bills, taxes, and other expenses. This is the amount ultimately available to be distributed to the business owners or reinvested back into the company.

The formula for calculating net profit is:

Net Profit = Total Revenue – Total Expenses

Total revenue includes all the money the business has earned through selling its products or services. Total expenses include the cost of goods sold, operating expenses, interest, taxes, and any other costs incurred by the business.

By subtracting total expenses from total revenue, you arrive at the net profit figure. This number provides a clear picture of the company’s overall profitability and financial health.

Net Profit Margin

Net profit margin is a related metric that expresses net profit as a percentage of total revenue. It is calculated as:

The net profit margin shows how efficiently a company is generating profits from its sales. A higher net profit margin indicates a more profitable business model. For example, a net profit margin of 20% means the company is keeping 20 cents of every dollar in revenue as net profit.

Net profit margin is a valuable metric for comparing the profitability of different companies or industries. It allows you to see which businesses are most efficient at converting sales into actual profits.

Factors Affecting Net Profit

Several factors can influence a company’s net profit:

- Revenue: The amount of sales a business generates is the primary driver of net profit. Increasing revenue through higher sales volumes, raising prices, or launching new products/services can boost the bottom line.

- Cost of Goods Sold (COGS): The direct costs associated with producing the goods or services a business sells. Lowering COGS through improved efficiency, bulk purchasing, or renegotiating supplier contracts can increase net profit.

- Operating expenses: The indirect costs of running the business, such as rent, utilities, payroll, marketing, etc. Reducing operating expenses through cost-cutting measures can expand net profit.

- Tax rates: The income tax a business must pay on its profits. Minimizing tax liability through deductions, credits, or tax planning strategies can preserve more of the net profit.

- Financing costs: Interest paid on loans, lines of credit, or other forms of business debt. Reducing debt levels or refinancing at lower rates can lower financing costs and increase net profit.

RELATED: How to Use Debt to Buy Real Estate Properties and Make Money

Since the main drive of businesses is to maximize their net profit, anything that can trim or streamline these factors can cause net profit to increase. They can also make their inventory management more efficient by avoiding stockouts or excessive carrying costs, which is especially useful for businesses that sell physical products.

Finally, investing in training, technology, and process improvements can boost employee and operational productivity, ultimately enhancing a company’s net profit.

Analyzing Net Profit Trends

Tracking net profit over time provides valuable insights into a company’s financial performance. Key things to look for include:

- Year-Over-Year comparisons: How has net profit changed compared to the previous year or previous periods? Consistent year-over-year growth is a positive sign.

- Industry benchmarks: How does the company’s net profit margin compare to industry averages or competitors? Outperforming industry peers indicates a competitive advantage.

- Drivers of change: What specific factors, such as revenue gains, cost reductions, or tax savings, are contributing to changes in net profit? Understanding the drivers can inform future strategies.

- Seasonal patterns: Does net profit exhibit cyclical trends based on the company’s business model or industry? Recognizing seasonal fluctuations can help with forecasting and cash flow management.

- Volatility: Is net profit stable and predictable, or does it fluctuate significantly from period to period? Investors and lenders generally prefer consistent, reliable net profit.

Net Profit vs. Other Profitability Metrics

While net profit is the ultimate measure of a company’s profitability, there are several other related metrics that provide additional insights:

Gross Profit vs. Net Profit

Gross profit represents the revenue remaining after subtracting the cost of goods sold. This metric indicates the overall profitability of a company’s products or services before accounting for operating expenses. Gross profit gives a sense of the inherent profitability of a business‘s core offerings, whereas net profit factors in all the additional expenses required to run the company.

Operating Profit

Operating profit is the profit generated from a company’s core business operations before interest and taxes are accounted for. This metric provides insight into how efficiently a business is run, as it excludes the impacts of financial and tax-related decisions. Operating profit can be a useful barometer for comparing the operational performance of different companies or business units.

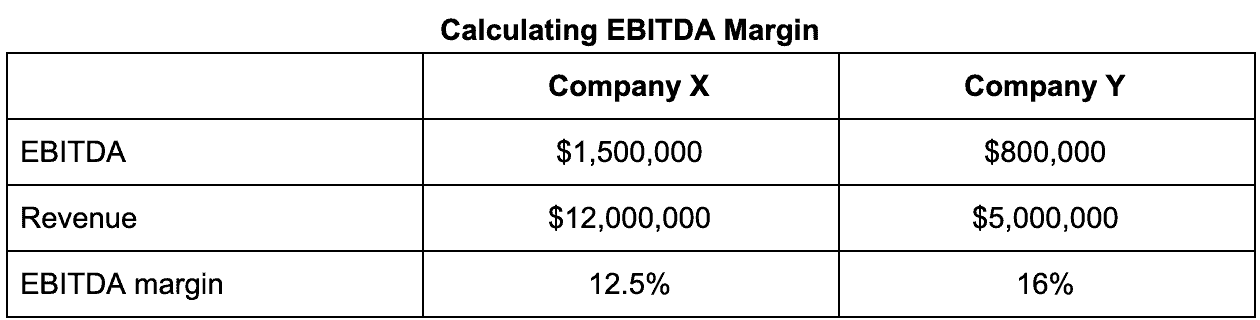

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

EBITDA is a measure of a company’s overall financial performance and cash flow potential, excluding the impact of financing and accounting decisions. By stripping out the effects of interest, taxes, depreciation, and amortization, EBITDA offers a clearer picture of a business’s underlying profitability and ability to generate cash. Investors and lenders frequently use this metric to assess a company’s financial health and future prospects.

Many investors use a derived figure called the EBITDA margin to measure a company’s operating profit, which they can get by dividing EBITDA by the total revenue. This number aims to show how much of its operating expenses comprise its total income, as shown in the table below.

Importance of the Net Profit Metric

Net profit is a crucial metric for several key stakeholders.

For the owners, net profit is the ultimate measure of a company’s success and the effectiveness of its strategies and operations. It guides important decisions about investment, growth, and resource allocation.

Meanwhile, potential and current investors refer to net profit to evaluate a company’s financial strength, assess its risk profile, and determine the appropriate valuation. Strong, consistent net profits are attractive to investors.

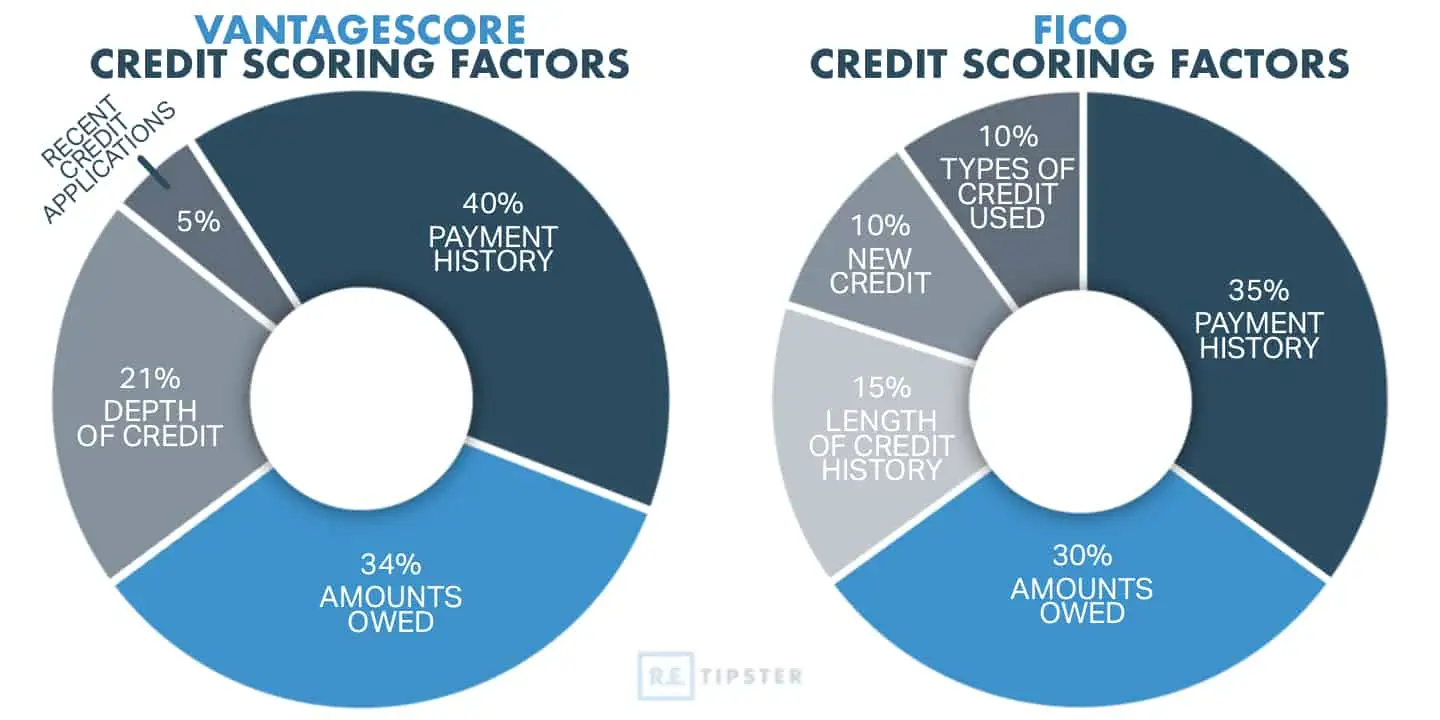

On the other hand, lenders (such as banks and credit unions) rely on net profit to gauge a company’s ability to service debt and meet financial obligations. Healthy net profits demonstrate creditworthiness.

In addition, government agencies use net profit data to ensure businesses are accurately reporting income and paying the appropriate taxes.

Finally, employees or prospective applicants look at a company’s net profit to see how much compensation they can ask for, how secure the job is, or if there are opportunities for career advancement and growth.

Frequently Asked Questions: Net Profit

What is the difference between net income and net profit?

Net income and net profit are generally used interchangeably to refer to the same metric—the bottom line figure that represents a company’s overall profitability after accounting for all expenses. They both represent the final amount of money a business has earned or retained after subtracting costs from revenue.

How do you calculate the net profit ratio?

The net profit ratio is calculated by dividing net profit by total revenue and expressing the result as a percentage. For example, if a company has $1 million in revenue and $200,000 in net profit, the net profit ratio would be 20% ($200,000 / $1,000,000 = 0.20 or 20%).

Is a higher net profit margin always better?

Not necessarily. While a higher net profit margin is generally desirable, it’s important to consider the broader context. Extremely high margins may indicate a lack of competition or an unsustainable business model. The optimal net profit margin varies by industry and depends on factors like capital requirements, market conditions, and growth strategies.