What Is a Qualified Intermediary (QI)?

Shortcuts

- A qualified intermediary (QI) is a third-party entity or individual that facilitates and guides a 1031 exchange transaction.

- A QI allows an investor to comply with IRS regulations regarding the tax deferral of a 1031 exchange.

- Other than holding the proceeds of the sale, a QI also prepares documentation, assists the investor in identifying the replacement properties, coordinates with closing, and reports to the IRS.

- Qualified intermediaries are not regulated, licensed, or overseen by the IRS, but the IRS advises looking at a QI’s reputation, experience, and financial security measures before committing to one.

Understanding 1031 Exchanges

A 1031 exchange, also known as a like-kind exchange, is a provision in the Internal Revenue Code (specifically Section 1031)[1] that allows real estate investors to defer capital gains taxes on the sale of investment properties.

In other words, this provision allows investors to sell a property and reinvest the proceeds into a new property of equal or greater value without triggering an immediate tax liability. These properties are said to be of “like-kind,” i.e., of similar nature, even if they differ in quality or grade[2].

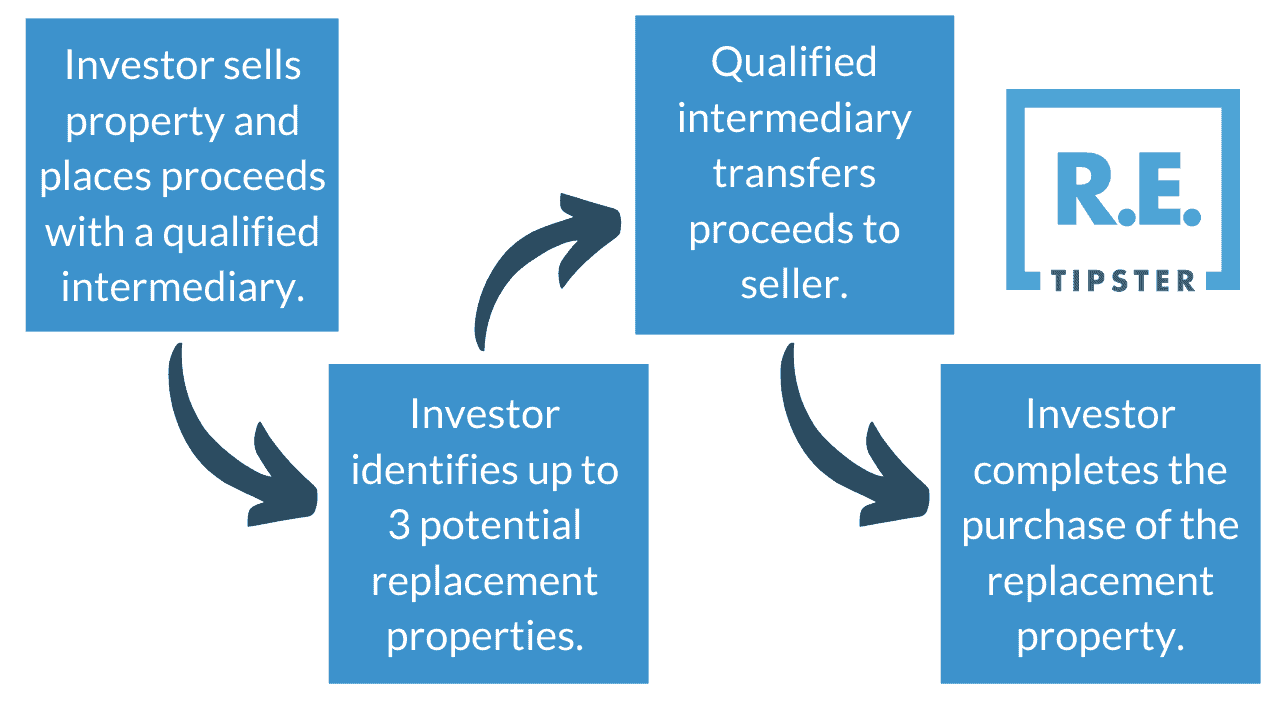

The graphic below illustrates the typical process of a 1031 exchange:

One crucial aspect of a 1031 exchange is the involvement of a qualified intermediary (QI), who guides the investor along the process, ensuring a smooth transaction.

The Role of a Qualified Intermediary

A qualified intermediary is an individual or entity that assists in the execution of a 1031 exchange. A QI’s role is to facilitate the purchase of the replacement property, ensuring that the transaction meets the requirements for a legal and legitimate 1031 exchange[3].

Note that an investor (the taxpayer who wants to defer the capital gains tax from a 1031 exchange) should engage a qualified intermediary before the 1031 exchange takes place[4]. Otherwise, the transaction may not comply with IRS requirements for Section 1031 and thus be taxed accordingly.

The primary responsibilities of a qualified intermediary include:

- Safekeeping of funds: The QI holds the proceeds from the sale of the relinquished property in a segregated escrow account or trust until the funds are needed to purchase the replacement property.

- Preparation of necessary documents: The QI prepares the documentation required, such as the exchange agreement and assignment documents, to ensure compliance with IRS regulations.

- Facilitation of the exchange: The QI coordinates with all parties involved, including the buyer, seller, and closing agents, to ensure a straightforward and timely transaction. They also work with the closing agents of both the relinquished and replacement properties to ensure the proper transfer of funds and title.

- Identification of replacement properties: The QI assists the investor in identifying suitable replacement properties within a 45-day identification period[5] required by the IRS.

- Reporting to the IRS: The QI provides the necessary documentation to the IRS, such as Form 8824[6], to report the 1031 exchange and ensure compliance with tax regulations.

A qualified intermediary may also fulfill the role of an Exchange Accommodation Titleholder (EAT) in a reverse 1031 exchange.

Choosing a Qualified Intermediary

Individuals or entities must meet certain criteria to be considered qualified intermediaries:

- No disqualifying relationship: The QI cannot be a person who has had a business or family relationship with the taxpayer within the two years before the exchange[7]. This ensures that the QI remains independent and impartial throughout the exchange process.

- Experience and knowledge: The QI must possess the necessary expertise and experience in facilitating 1031 exchanges, including a deep understanding of applicable IRS regulations and requirements.

- Financial security: The QI must demonstrate financial security, typically through fidelity bonds or other forms of insurance, to protect the funds held during the exchange.

When choosing a qualified intermediary, it’s best to look for these:

- Reputation and experience: When selecting a qualified intermediary, look for QIs with a proven track record of successfully facilitating 1031 exchanges and a solid understanding of IRS regulations. It can be helpful to seek recommendations from trusted professionals, such as real estate agents or attorneys, who may have previously worked with QIs.

- Security of funds: Since a qualified intermediary holds the funds from the relinquished property’s sale, they should have appropriate measures to safeguard those funds. Inquire about the QI’s fidelity bond or insurance coverage[8], which can protect the funds in case of fraud or misappropriation.

- Communication and responsiveness: Effective communication and responsiveness are critical to a successful exchange process. Choose a qualified intermediary who’s proactive and accessible and can promptly address your concerns or questions.

Frequently Asked Questions: Qualified Intermediary

Are qualified intermediaries required for a 1031 exchange?

Yes, qualified intermediaries are required for a 1031 exchange[9].

According to IRS regulations, a property owner cannot directly receive the proceeds from the sale of their relinquished property and use those funds to purchase a replacement property without triggering capital gains taxes. Instead, the funds must be held by a qualified intermediary during the exchange process.

Are qualified intermediaries regulated?

The IRS doesn’t mandate regulation, certification, or licensing for individuals or companies to qualify as intermediaries.

However, it is advisable to choose an experienced and reputable qualified intermediary. Untested or unverified QIs may run into problems they won’t be able to handle, including bankruptcy, while an exchange occurs.

To avoid this, work with a qualified intermediary who offers an escrow-like arrangement or utilizes a separate eligible trust account to hold the funds during the exchange. This provides an additional layer of protection in the event of a qualified intermediary’s financial difficulties.

How much does a qualified intermediary cost?

The fees associated with using a qualified intermediary can vary depending on the specific provider and the complexity of the transaction. Qualified intermediary charges depend on whether they’re institutional (i.e., affiliated with a bank, title company, or similar organization) or non-institutional (i.e., private entities).

Institutional qualified intermediaries often charge higher than their non-institutional counterparts[11], with some exceptions.

Keep in mind that involving a qualified intermediary is typically cheaper than paying taxes from an outright property swap or trade, which is a taxable event.

Sources

- Like-Kind Exchanges Under IRC Section 1031. (2008, February.) Internal Revenue Service. Retrieved from https://www.irs.gov/pub/irs-news/fs-08-18.pdf

- Chen, J. (2022, April 18.) Like-Kind Property: Definition and IRS 1031 Exchange Rules. Investopedia. Retrieved from https://www.investopedia.com/terms/l/like-kindproperty.asp

- Qualified Intermediary (QI). (n.d.) 1031 Corp. Retrieved from https://www.1031corp.com/1031-exchange-basics/role-of-qi

- Must I Hire a Qualified Intermediary for a 1031 Exchange? (n.d.) Retrieved from https://www.security1stexchange.com/news-item/must-i-hire-a-qualified-intermediary-for-a-1031-exchange

- How to Identify Replacement Property. (n.d.) Legal1031. Retrieved from https://legal1031.com/1031-exchange-resources/how-to-identify-replacement-property/

- What is IRS Form 8824: Like-Kind Exchange. (2023, June 2.) TurboTax. Retrieved from https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-irs-form-8824-like-kind-exchange/L6UsQp15n

- Ray, R., Lynch, N. (2016, October.) Selecting a Qualified Intermediary for a Like-Kind Exchange. The CPA Journal. Retrieved from https://www.cpajournal.com/2016/10/01/selecting-a-qualified-intermediary-for-a-like-kind-exchange/

- Simple Guide to Choosing a 1031 Qualified Intermediary. (2023, February 1.) Realized1031. Retrieved from https://www.realized1031.com/blog/simple-guide-to-choosing-a-1031-qualified-intermediary

- 1031 Exchange Qualified Intermediary. (2023, January 7.) Point Acquisitions. Retrieved from https://pointacquisitions.com/commercial-real-estate/insights/1031-exchange/qualified-intermediary/

- The Role of the Qualified Intermediary. (n.d.) Exeter 1031 Exchange Services. Retrieved from https://www.exeterco.com/Role_of_Qualified_Intermediary

- How Much Does a 1031 Exchange Cost? (2022, August 1.) First National Realty Partners. Retrieved from https://fnrpusa.com/blog/1031-exchange-cost/