What Does It Mean to "Refinance" a Loan?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

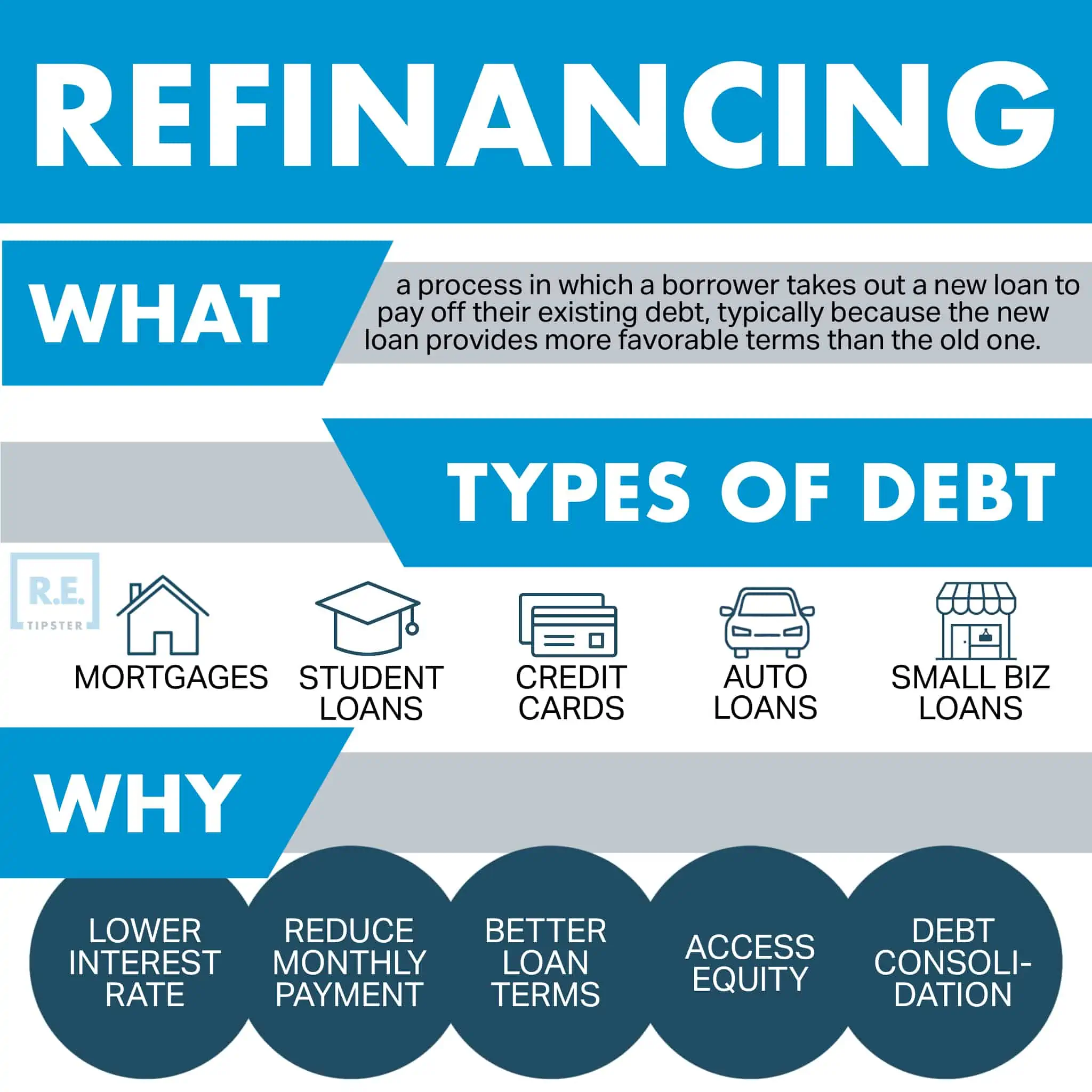

How a Refinance Works

Borrowers will typically refinance their existing debt because they are taking advantage of a lower interest rate, more optimal payment schedule, or other improvements to the terms of their original loan agreement. An applicant may also seek refinancing to consolidate several loans into one with an easier term or lower rate.

If the new lender (usually different from the original one) approves the application, the new loan will pay off the existing debt(s) in full. The borrower then has a new agreement with the new lender and will make payments to that lender until the new loan is paid off or until the borrower chooses to refinance the new loan again in the future.

Perhaps the most common reason to refinance a loan is to lower interest rates so the borrower can enjoy reduced payments over the life of the loan. Other reasons include changing the loan duration, changing an adjustable-rate mortgage (ARM) to a fixed-rate mortgage or vice versa[1], or even cashing out a portion of their home’s equity.

When a borrower successfully refinances a loan with a lower interest rate or a longer term, the outcome often favors the borrower’s monthly budget. The loan payments put less strain on the borrower’s cash flow and there is more money left for other expenses.

What Kind of Debt Can Be Refinanced?

Almost all types of debt can be refinanced. Here are examples of five common types of debt that borrowers usually refinance:

- Mortgages – Most people who refinance a mortgage want to lower their total monthly payments or shorten a 30-year mortgage. A low-downpayment FHA mortgage, for instance, requires an additional monthly payment for mortgage insurance premium, which is an added expense and strain on a borrower’s budget. Refinancing such a loan with a conventional mortgage can lower the insurance the borrower has to pay. Meanwhile, those who refinance to a mortgage with a 15-year amortization can pay off their loan much sooner and pay less in interest along the way.

- Auto Loans – Auto loan refinancing is a way to lower a car owner’s monthly payments. Most of the same reasons that borrowers refinance a mortgage can apply to refinancing an auto loan[2].

- Student Loans – Student loan refinancing can consolidate multiple loans into one, so the borrower only has to deal with a single loan and monthly payment. For example, an individual may have existing loans from unsubsidized federal loans, subsidized federal loans, and private loans, which may have different interest rates. The borrower can consolidate those loans so they do not have to pay each one separately. It is also possible to get a lower interest rate on their newly consolidated loan.

- Credit Cards – A credit card user might have to deal with rapidly accruing interests with credit card debt. By refinancing the debt with a personal loan, the borrower can enjoy a more manageable and affordable way to pay it off.

- Small Business Loans – Small business owners can improve their bottom line by refinancing their small business loans. They can also use refinancing to consolidate several debts into a single, more manageable loan.

Types of Refinancing

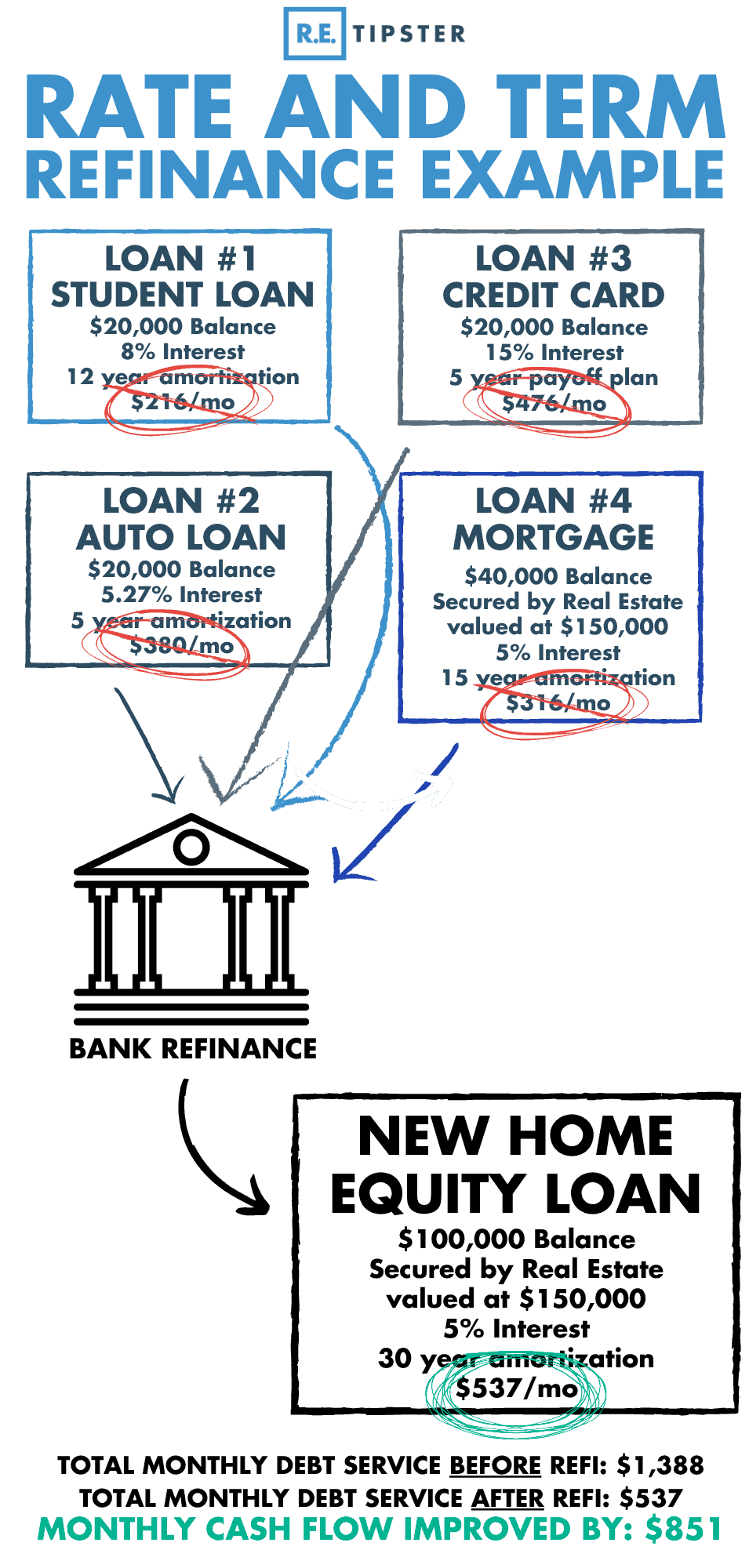

Generally, there are three major types of refinancing: cash-in, cash-out, and rate-and-term.

Cash-In Refinance

A homeowner can reduce the new mortgage balance through refinancing by bringing money to the table. The borrower may use a cash-in refinance to get rid of private mortgage insurance, lower their mortgage amount, or qualify for a more affordable interest rate. If the borrower has less than 20% equity on their home, the borrower can use this option[3] as most lenders would want applicants for refinancing to own at least 20% of their property.

Cash-Out Refinance

This type of loan means the borrower cashes out some of the home’s equity. This raises the loan’s principal loan amount[4] and the borrower has to absorb the rise in the monthly payment and interest rate that results from the higher principal loan balance. Because it eats into a portion of the borrower’s home equity, most borrowers use this time of loan after they have paid down a substantial amount of their original loan balance and/or their home’s value has risen[5].

Rate-and-Term Refinance

When a borrower refinances using a rate-and-term loan, they may be seeking to change either the interest rate or the term of the loan, or both. The borrower can also switch from an adjustable-rate to a fixed-rate loan or vice versa. This type of refinancing is also called a no cash-out refinancing, as it works similarly to a cash-out refinance without advancing any new money.

Pros and Cons of a Refinance

Refinancing can be a good measure for some borrowers, especially if they are having difficulties with their current debt. However, if a borrower is not careful, or if the refinancing landscape is not favorable at the moment of the refinance application, this can lead to more problems than solutions.

Pros

- Lower Interest – A borrower who has an improved credit score may qualify for refinancing to a lower interest loan. More favorable market conditions than when the borrower applied for the original loan can also lead to lower interest. Borrowers of large or long-term loans can benefit from refinancing by saving money over the life of the loan.

- Manageable Terms – A borrower can refinance a loan and extend its terms to reduce total monthly payments. Conversely, a borrower can increase total monthly payments but pay off the loan sooner.

- Consolidating Multiple Loans – A borrower can consolidate multiple loans by refinancing them. The lender will pay off the original loans so the borrower now only has to pay one monthly amount. A consolidated loan also makes it easier for the borrower to keep track of payments.

- Interest Rate Buffer – If interest rates are likely to rise, a borrower can apply to get a fixed-rate loan to replace a variable-rate loan. This is ideal while interest rates are still low and manageable to protect the borrower from a situation that could make the original loan difficult to pay.

- Lump Sum Payment – Some loans require a lump sum payment, also known as a “balloon” payment. If a borrower cannot make the balloon payment on the specified date, they could refinance the loan. The new loan will provide the funding needed to pay off the original lender, and the borrower can pay the new lender off via the monthly installments laid out in the new loan agreement.

Cons

- Costs – The borrower should expect to pay a percentage of the outstanding principal in fees involved in the refinance. Depending on what type of asset is being refinanced, these fees can include application, appraisal, origination, and inspection fees. Other closing costs may result in more fees as well. Sometimes, the total amount to be paid for refinancing eliminates any benefit a borrower might get from it.

- Higher Interest Expense – If a borrower is refinancing their loan to achieve a lower monthly payment, this typically is motivated by a lower interest rate and/or longer amortization. Even with a lower monthly payment, this move will often result in a higher total amount paid towards interest over the life of the loan.

- Reduced Borrower Protection – When a borrower refinances a loan, it may lose some useful features that favor the borrower. For instance, if the borrower refinances a federal student loan, various repayment plans and reprieve for borrowers who could not pay for a time will not be carried over to the refinance[6]. A career in public service might also lead to partial student loan forgiveness by the federal government, but this will no longer be possible once the loan is refinanced. In this case, the borrower would be better off paying down the original loan.

- Prepayment Penalties – Some types of financing may require pre-payment penalties if the loan is paid off early (this is common with SBA 504 loans, for example). If a borrower’s existing loan requires this type of penalty for an early payoff, it can hinder the overall benefit a borrower is seeking by refinancing their debt with another lender.

Takeaways

A refinance allows a borrower to pay off their existing debt by taking out a new loan. The new loan’s terms replace that of the old one. Borrowers refinance to access more favorable terms, lower interest rates, or consolidate debt that would not have been possible at the time when the original loan agreement was made. A borrower who experiences an improvement on their credit score or who would like to take advantage of a favorable market can apply for refinancing.

Refinancing is possible with many types of debt, such as mortgage loans, student loans, auto loans, small business loans, credit card debt, and others. However, refinancing has its pros and cons. The borrower should determine whether the advantages of the refinance loan outweigh the benefits of the original loan and factor in their credit score and the market situation before applying to refinance.

Sources

- Idaho Central Credit Union. (n.d.) Reasons to Refinance. Retrieved from https://www.iccu.com/blog/financial-education/reasons-to-refinance.

- Brady, S. (2020.) When should I refinance my auto loan? Credit Karma. Retrieved from https://www.creditkarma.com/auto/i/when-should-i-refinance-auto

- Tarpley, L.G. (2021.) How a cash-in refinance works. Insider. Retrieved from https://www.businessinsider.com/personal-finance/cash-in-refinance

- Pritchard, J. (2020.) What Is Refinancing? The Balance Small Business. Retrieved from https://www.thebalance.com/what-is-refinancing-315633

- Eppraisal. (n.d.) Why House Values Matter in a Home Refinance. Retrieved from https://www.eppraisal.com/why-house-values-matter-in-a-home-refinance/

- Andersen, E. (2019.) What Happens to Your Original Loan When You Refinance? College Raptor®. Retrieved from https://www.collegeraptor.com/paying-for-college/articles/student-loans/what-happens-to-your-original-loan-when-you-refinance/