What is the SBA?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Does the SBA Do?

The SBA describes its mission in four parts:

The SBA describes its mission in four parts:

- Access to capital. The agency has several well-known loan programs[2], including the SBA 7(a) loan and the SBA 504 loan, and grant programs focusing on research and development, trade expansion, and economic development. The agency also licenses Small Business Investment Companies (SBIC) to provide venture capital for new businesses[3].

- Advocacy. The SBA represents the voice of small business with Congress and the federal government. It also conducts hearings and appeals on behalf of small business owners who disagree with the administration’s decisions. Finally, the SBA ombudsman works on behalf of small business owners targeted for federal regulatory enforcement actions.

- Government Contracting. The SBA is responsible for ensuring that 23% of federal contract dollars are awarded to small businesses, with a percentage of those funds reserved for women-owned businesses and businesses owned by disabled veterans.

- Entrepreneur Development. The agency provides free counseling and guidance for small business owners in all aspects of business development. There are free courses for everything, from finding financing and investors to implementing a social media marketing strategy.

While the SBA is widely known for its loan programs, its services extend beyond financing and act as an important source of assistance for small businesses around the United States.

SBA Loan Programs

While the SBA focuses first and foremost on developing small businesses, some of their loan programs may help real estate investors finance new acquisitions. However, the rules and restrictions limit their use to specific types of real estate transactions.

SBA 504 Loans

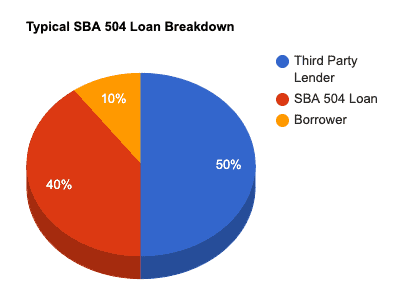

SBA 504 loans[4] are specifically designed to assist in financing major fixed assets such as land, buildings, and equipment. While there is no maximum project size for an SBA 504 loan, the maximum SBA portion of the total project amount (debenture) is $5 million, and in some cases, small manufacturers or specific types of energy projects (as described in the energy project section) may qualify for a $5.5 million debenture [5].

An SBA-approved certified development company (CDC) co-funds the loan with an approved bank. The borrower must put down at least 10% of the total project cost, and in the case of a new business or a special purpose building, the borrower may be required to put down an additional 5% in each scenario, bringing the total borrower contribution to 15% or 20% of the total project cost.

Because there are two loans in place, the third party lender will have a first lien mortgage position and/or security interest in the real estate or equipment being financed, and the SBA will be in the second position, giving the third party lender a very well protected 50% loan to value on the financed assets.

With this added security from the SBA 504 loan program, it encourages many banks and conventional lenders to participate in financing borrowers they otherwise would not pursue without the assistance of the SBA 504 loan program.

SBA 504 financing can be used to:

- Purchase land.

- Purchase existing buildings.

- Improve or expand existing buildings.

- Construct new buildings.

- Purchase equipment.

- Refinance existing debt as part of an expansion or renovation project.

- Pay for various professional fees involved in the acquisition of real estate or equipment (appraisal, environmental, etc.)

There are many eligibility requirements for SBA 504 loans. Some relate to the borrower’s individual net worth, net income, and personal cash flow, and most notably, the financed real estate must be at least 51% owner-occupied for existing buildings and 60% owner-occupied for new construction (with the expectation of occupying up to 80% of the building within 10 years of ownership[6]).

The SBA also has an interest in financing projects that create new jobs, so even though job creation isn’t an absolute requirement for every 504 loan, job creation is also given special consideration in the approval process for an SBA 504 loan.

SBA 7(a) Loans

SBA 7(a) loans are general purpose loans fully guaranteed by the SBA. They can be used for working capital, equipment purchases, or real estate financing. There is no loan minimum, but the maximum is $5 million. Most lenders shy away from smaller loans because of the additional qualification and underwriting work required for SBA approval. The average loan amount in 2019 was about $450,000[7]. The maximum repayment term is 25 years.

A real estate investor can use the standard SBA 7(a) loan to:

- Purchase an existing commercial building.

- Expand or renovate commercial real estate.

- Construct new commercial property.

Another unique and attractive aspect that 7(a) loans attractive is that they can be used for working capital to cover cash flow issues while the property is being built, improved, or stabilized.

There are several different types of 7(a) loans.

- Standard 7(a)

- 7(a) Small Loan

- SBA Express

- Export Express

- Export Working Capital

- International Trade

- Preferred Lenders

- Veterans Advantage

- CAPLines

Unlike the SBA 504 loan, an SBA 7(a) program offers a guarantee to the bank, which can cover the lender in the event of a borrower default. Rather than SBA extending an actual loan to the borrower, the bank provides 100% of the loan proceeds, but in doing so, also receives a certain percentage guaranteed by SBA. The percentage of the guarantee can vary depending on the project and the type of 7(a) loan. For example:

- Standard 7(a) loans are backed by a guarantee of up to 85% for loans up to $150,000 and 75% for loans greater than $150,000.

- SBA Express loans are backed by an SBA guarantee of 50% and can be as high as $350,000. This type of 7(a) loan is easier and faster for lenders to provide small business loans because the lender can use its own application and documentation forms and the lender has unilateral credit approval authority as in the PLP Program.

- International Trade loans are backed by an SBA guarantee of up to 90%, with SBA generally providing a loan guarantee to the lender (if approved) within 5 – 10 days of their request.

SBA real estate loans are usually asset-based, but the lender and the SBA will review the borrower’s credit history, debt-to-income ratio, net worth, and real estate experience.

Drawbacks of SBA Loans

While SBA loans may seem like a simple type of financing arrangement on the surface, there can be some unforeseen obstacles and drawbacks involved in the underwriting and approval process and when getting the loan closed and funded (in the case of an SBA 504 loan).

SBA takes a hard stance on all underwriting approval and closing requirements, and while most of the requirements are reasonable, if effectively means requires the borrower and participating lender has to navigate through the loan approval process twice.

The additional fees are also one of the main drawbacks of SBA loans. With a second lending institution involved with each loan, the guarantee fee runs between 2% and 3.5%, which is on top of lender fees and closing costs.

Because of the additional hurdles involved with getting SBA loans approved and funded, many lenders look at the SBA as a “last resort” financing option. When the borrower poses a significant credit risk and the bank (third party lender) will not approve the borrower unless they have the additional security that comes from the SBA’s guarantee or takeout financing.

Takeaways

The Small Business Administration is a helpful resource for all types of business owners. Between free classes, business guides, and mentorship programs, small business owners can access the knowledge and advice they need to successfully start and grow a business.

The SBA also offers loans, grants, and venture capital programs that may benefit commercial real estate investors. While the agency and its lending partners will also consider the borrower’s credit, net worth, and professional experience in their lending decisions, loans are primarily asset-based, which can be advantageous for real estate investors.

Sources

- U.S. Small Business Administration. (n.d.) Agency Financial Report. Retrieved from https://www.sba.gov/document/report-agency-financial-report

- U.S. Small Business Administration. (n.d.) Loans. Retrieved from https://www.sba.gov/funding-programs/loans

- U.S. Small Business Administration. (n.d.) Investment Capital. Retrieved from https://www.sba.gov/funding-programs/investment-capital

- Office of Financial Assistance. (n.d.) What is the 504 Loan Program? U.S. Small Business Administration. Retrieved from https://www.sba.gov/offices/headquarters/ofa/resources/4049

- U.S. Small Business Administration. (n.d.) Maximum Loan Amount (Debenture). Retrieved from https://www.sba.gov/offices/headquarters/ofa/resources/

- SBA 504 Q&A: 504 Loan Occupancy Requirements: Florida First Capital Finance Corporation (FFCFC). Retrieved from https://ffcfc.com/2018/01/23/sba-504-qa-504-loan-occupancy-requirements/

- Congressional Research Service. (2019.) Small Business Administration 7(a) Loan Guaranty Program. Retrieved from https://fas.org/sgp/crs/misc/R41146.pdf