What Is a Real Estate Investment Trust (REIT)?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

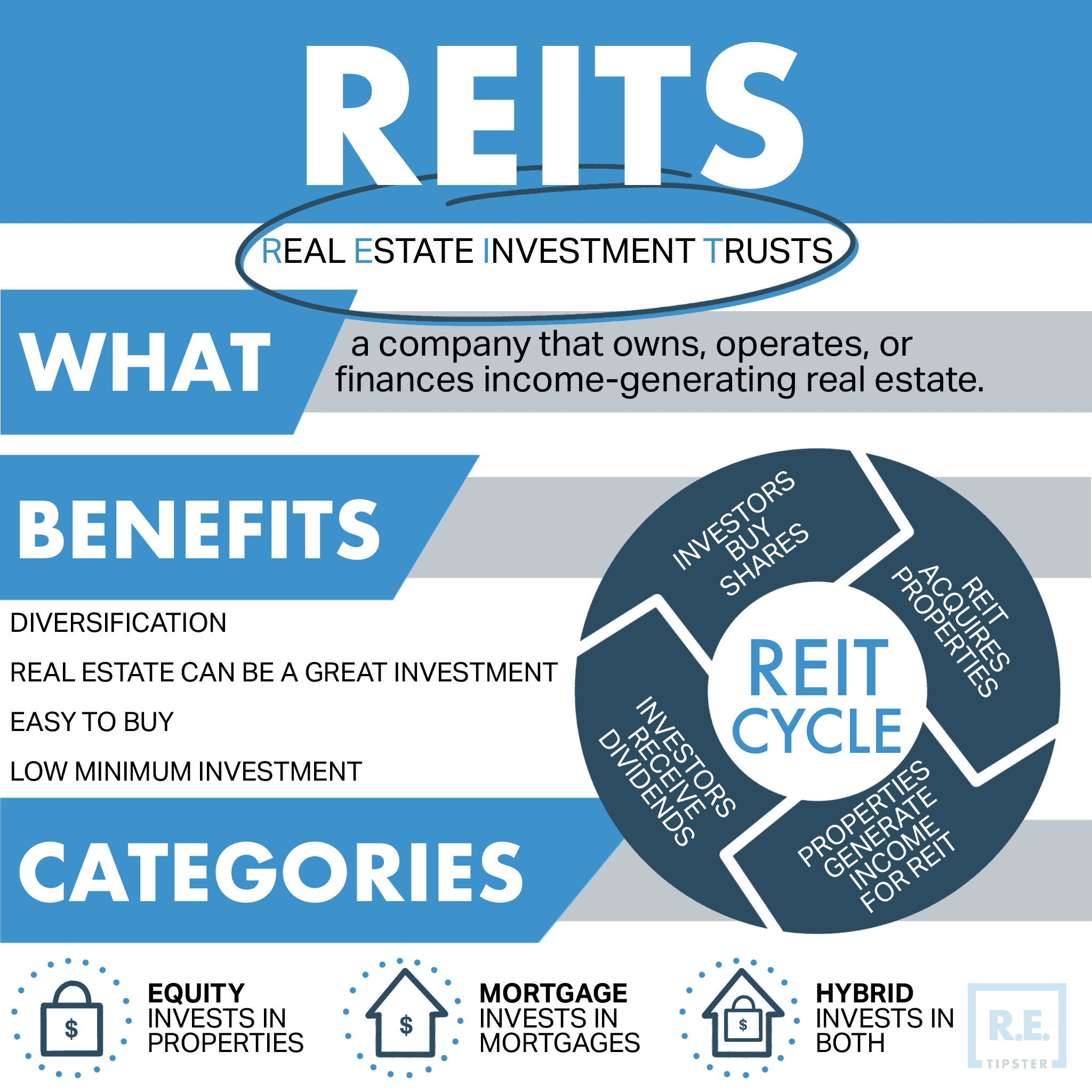

How Does a REIT Work?

When an individual invests in a REIT, they are buying a share of the REIT’s portfolio, which should consist primarily of real estate. In other words, investors do not own an equity share in the property itself but a portion of that portfolio’s value. The REIT then uses the pooled funds to make more real estate investments.

The Securities and Exchange Commission (SEC) requires that REITs return “at least 90 percent of its taxable income to shareholders annually in the form of dividends.” This makes REITs attractive to investors looking to see more significant returns. When a REIT fails to do so, the Internal Revenue Code mandates that the entity be taxed as a C corporation[1].

Most REITs, if not all, often set predefined criteria for investing. For instance, one REIT might only invest in hotels and apartment complexes in and around a particular city. This is why investors must first understand the company’s parameters before finalizing their plans.

However, REIT shares can be sold and purchased easily like traditional stocks. Therefore, a REIT share price can change day-to-day as trading occurs.

RELATED: What Is a C Corporation and How Does It Differ From an S Corporation?

How to Qualify as a REIT

REITs are typically structured to specialize in a specific type of real estate, from office buildings and retail shops to multi-housing complexes, parking spaces, and everything in between. All the shareholder needs to do is decide which type of property they want to invest in, review their brokerage account, and select a REIT specializing in that particular asset class.

To qualify as a REIT, a company must meet the following criteria[2]:

- At least 75% of its total assets must consist of real estate.

- Obtain at least 75% of its gross income from real estate, such as rental fees, interest on mortgages, or real estate sales.

- Pay shareholders at least 90% of their taxable income in the form of dividends annually.

- Be a taxable corporation overseen by a board of directors or trustees.

- Have at least 100 shareholders with no more than 50% of total shares being held by five or fewer.

Many real estate corporations find the 100-shareholder requirement challenging when trying to obtain REIT status. To overcome this, they will start out as management corporations before restructuring as REITs.

BY THE NUMBERS: Approximately 145 million U.S. citizens invest in REIT stocks through their investment funds, including their 401(k) funds.

Source: Nareit

Different Types of REITs

REITs are generally broken down into three groups:

1. Equity REITs

The most common type of REIT, equity REITs revolve around acquiring, managing, and developing investment assets. Their primary source of revenue is rental income from their properties, as REIT restrictions require that they own and develop properties over long periods.

This REIT type mostly invests in the following:

- Residential

- Office and industrial

- Hotels and resorts

- Retail

- Self-storage

- Lodging

- Data centers

2. Mortgage REITs

While not as well-known as equity REITs, mortgage REITs (or mREITs) make money via the interest from the mortgage they originate to real estate buyers. They can also invest in existing mortgage loans on properties instead of investing in the properties themselves.

3. Hybrid REITs

As their name suggests, hybrid REITs combine the qualities of equity and mortgage REITs. Hybrid REITs’ portfolios are highly diverse, shared between owning properties and funding loans to real estate investors. As such, they generate revenue from both rental and interest fees.

Publicly Traded vs. Non-Traded REITs

While most REITs are publicly traded, it is not necessary to become a REIT. There are three categories when it comes to how REITs accept investments:

- Publicly traded REITs are those registered with the SEC. They can be purchased and sold on the stock market through brokers, subjecting them to usual brokerage fees.

- Public non-traded REITs are different in that while they are also registered with the SEC, they do not trade on major stock exchanges. Investors must meet minimum net worth or liquidity requirements to maintain fund stability.

- Private REITs or private placement REITS are neither registered with the SEC nor listed on major exchanges. Only institutional investors and/or qualified investors (high-net-worth individuals or HNWI) can invest in these REITs[3].

All three types have their own pros and cons. Note that the latter two are not liquid investments, which means they can be challenging to sell or earn income from. Additionally, private REITs are not required to follow SEC regulations—which apply to only publicly traded and non-traded REITs—so lack of transparency can be a prominent issue.

Pros and Cons of Investing in REITs

A REIT investment may yield consistent and significant returns, depending on the state of the market and the type of REIT.

| PROS | CONS |

| Stable cash flow | No tangible control over properties |

| Less hassle | Subject to market volatility |

| Good liquidity | Some are more liquid than others |

| Low price entry | The share price is not guaranteed |

Since REITs return 90% of their annual income as dividends, they pay some of the highest yields in the stock market. In addition, REITs are usually more liquid than traditional real estate. For instance, putting up a publicly-traded REIT for sale is typically less involved than waiting for a real estate property sale to close. The struggles of being a landlord will not be a problem, usually because investors only have to buy and sell their REIT shares as they would typically do in stocks. Lastly, since REITs pool money from multiple shareholders, a sole investor does not need to raise as much capital to invest.

On the downside, REIT investors have no control over what happens in the properties they invest in, unlike real estate owners who have the final say on their assets. REIT investors can also be victims of market volatility, with factors such as property supply and demand and occupancy rates playing a huge part in shrinking investment values. Also, not all REITs have the same level of liquidity. For example, publicly-traded REIT investors might find their assets more liquid than those of untraded and private REITs.

Is It a Good Idea to Invest in REITs?

Investing in REITs can improve income and portfolio stability. Still, it is important to study a specific REIT’s assets to find out how much of their resources are invested in real estate and other allocations. Many well-known REITs hold diverse investments in their portfolios to cushion their funds from unexpected circumstances.

While REITs offer long-term benefits and steady earnings, many investment managers believe that REITs should comprise 5% to 15% of a healthy, diverse portfolio. After all, REITs behave like stocks, which means they are subject to market volatility[4].

BY THE NUMBERS: As much as 80% of registered investment advisors recommend REITs to their clients.

Source: Nareit

Getting Started

Getting started is as easy as opening a brokerage account. Publicly traded REITs, for instance, are listed in an exchange, making it easy for investors to purchase shares through a broker.

Generally, there are two approaches for investing in REITs:

- Investing in Individual REITs – As with individual stocks, single REITs can be tricky as investors will put all their money into just one investment. This means their entire financial future would depend on one company, putting them at high risk of completely losing their shares. Building a diversified portfolio, pick by pick, is one way to avoid potential failure.

- Investing Through a Mutual Fund – Another option is through a mutual fund or exchange-traded funds (ETF). This approach helps investors buy shares from multiple REITs at once, ensuring immediate diversification and lower risk. Essentially, it requires less legwork than looking into individual REITs for investment.

Takeaways

REITs give investors the unique opportunity to add real estate to their portfolios without buying real estate themselves. In essence, a REIT produces income for its shareholders, distributed via dividends, by collecting rental fees, mortgage interest, or even real estate sales. As required by the SEC, they return at least 90% of their taxable income annually to shareholders in the form of dividends.

If an investor might need the funds in a couple of years, their best option is to invest in an equity REIT due to its liquidity. If getting immediate returns is not part of the plan, then a hybrid REIT is the way to go. They are less liquid, but the earnings potential can be much greater.

Sources

- Nigliazzo, D. (2020.) What if Your REIT Doesn’t Meet Its Distribution Requirement? EisnerAmper. Retrieved from https://www.eisneramper.com/reit-distribution-requirement-0620/

- Nareit. (n.d.) How to Form a Real Estate Investment Trust (REIT). Retrieved from https://www.reit.com/what-reit/how-form-reit

- Corporate Finance Institute. (n.d.) What are Private REITs vs Publicly Traded REITs? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/finance/private-reits-vs-publicly-traded-reits/

- DiLallo, M. (2020.) Can an All-REIT Portfolio Be a Good Idea? MillionAcres. Retrieved from https://www.fool.com/millionacres/real-estate-investing/articles/can-an-all-reit-portfolio-be-a-good-idea/