What Is Residual Income?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Residual Income is the money generated after deducting all expenses and costs associated with the initial effort.

- Lenders look at a borrower’s residual income and debt-to-income ratio (DTI) to help them understand how much a borrower earns versus what they must pay.

- Borrowers with high residual income and low debt-to-income ratio present a lower risk to the lender.

- Passive income helps increase residual income as it’s money you make with little effort.

What Is Residual Income Used For?

The concept of residual income is based on the idea of building assets or income streams that can generate passive income, allowing individuals to earn money even when they are not actively working. It is often seen as a way to achieve financial freedom or create additional income streams beyond traditional employment.

Creditors and lenders often use a person’s residual income to estimate their creditworthiness[1]. Generally, the more residual income—the cash left after all financial duties like bills have been paid—the lower risk the borrower is because they’re less likely to miss or fall behind debt payments.

Many lenders use residual income alongside a financial ratio called the debt-to-income ratio[2]. This number paints a clearer picture of the borrower’s leftover monthly earnings once all unavoidable expenses are settled.

To calculate a borrower’s DTI, the lender simply divides the borrower’s total monthly debts by the borrower’s gross monthly income. For instance, if the borrower earns $12,000 monthly and pays $5,000 in debt payments, their DTI ratio is 42%.

In other words, 58% of the borrower’s income is left, which can be used for living costs and extra debt payments.

Most lenders approve loans for borrowers with DTI ratios no higher than 42%, like in this example, but this depends on the type of loan the borrower is applying for[3].

Moreover, some lenders check more detailed DTIs, known as the front-end and back-end DTI ratios[4]. The front-end ratio counts only the monthly housing payment, while the back-end ratio includes all monthly credit-related costs.

A borrower may need to meet both DTI limits to get a loan.

What Counts as Residual Income?

Residual income typically arises from activities such as rental properties, royalties from intellectual property, dividend payments from stocks, affiliate marketing, network marketing, and certain types of business ownership.

These sources of income often require an upfront investment of time, money, or effort to establish, but once established, they can generate income on a recurring basis with minimal ongoing effort or involvement.

Here are some examples:

- Social Security payments.

- Incomes not taxed by the Internal Revenue Service (such as healthcare benefits, welfare payments[5], and profits from renting out properties).

- Child support and alimony payments (subject to local laws and the lender’s policies)[6].

- Military service members’ allowances, provided they’re properly documented[7].

While mortgage lenders may not count realized capital gains because they’re not necessarily sustainable, some may accept dividends and investment interest.

What Affects Residual Income?

The balance between someone’s debt amount and total earnings ultimately determines their residual income size.

As a general rule, creditors don’t consider unverifiable debt and income. After all, pay stubs and receipts don’t show the whole story, leading to some borrowers having less residual income than the documents indicate.

One example is a payday loan[8]. Payday lenders don’t report information to credit bureaus, so their issued loans don’t factor into the DTI. As long as payday borrowers repay their debt as agreed, their accounts won’t be passed onto third-party collection agencies and won’t appear on their credit reports.

Similarly, money owed to friends or family members typically doesn’t have supporting documents (and thus can’t be verified on paper). Some people borrow credit from others by using other people’s credit cards[9]. The cardholder is ultimately accountable for the charges, but the person who used the card may still owe the card owner without penalties.

Note that these informal debts still have legal and ethical obligations. For example, using someone else’s credit card without authorization is illegal and can have legal consequences.

Passive vs. Residual Income

The terms “passive income” and “residual income” are often used interchangeably, but their connotations and usage can have subtle differences.

Passive income generally refers to income generated from activities in which an individual is not actively involved. It includes earnings from investments, rental properties, royalties, or interest from loans. The key characteristic of passive income is that it requires minimal ongoing effort once the initial setup or investment is made.

Residual income, on the other hand, typically represents a subset of passive income. It specifically refers to the income that continues to be earned on an ongoing basis after deducting expenses and costs associated with the initial effort. Residual income is often associated with income streams built and established upfront, such as network marketing, affiliate marketing, or revenue from intellectual property. It is income that persists even when the individual is not actively engaged in day-to-day operations.

In essence, residual income is a specific type of passive income that emphasizes the recurring nature of earnings derived from previous efforts or investments. While both terms encompass the idea of earning money without continuous active involvement, residual income emphasizes the concept of ongoing earnings generated from a specific source or venture.

It’s worth noting that there can be overlap between the two terms, and their precise definitions may vary depending on context and individual interpretations. Ultimately, both passive and residual income offer opportunities for individuals to generate income beyond traditional employment and establish financial stability.

How to Diversify Sources of Residual Income

Diversifying sources of residual income is important to mitigate risk and increase overall income potential. This can be achieved by investing in different asset classes, pursuing various business opportunities, or creating multiple streams within a single venture.

Sources of Passive Income

The most consistent method to increase passive income (and thus residual income) is to invest, whether that’s in stocks, bonds, real estate, or other investment vehicles.

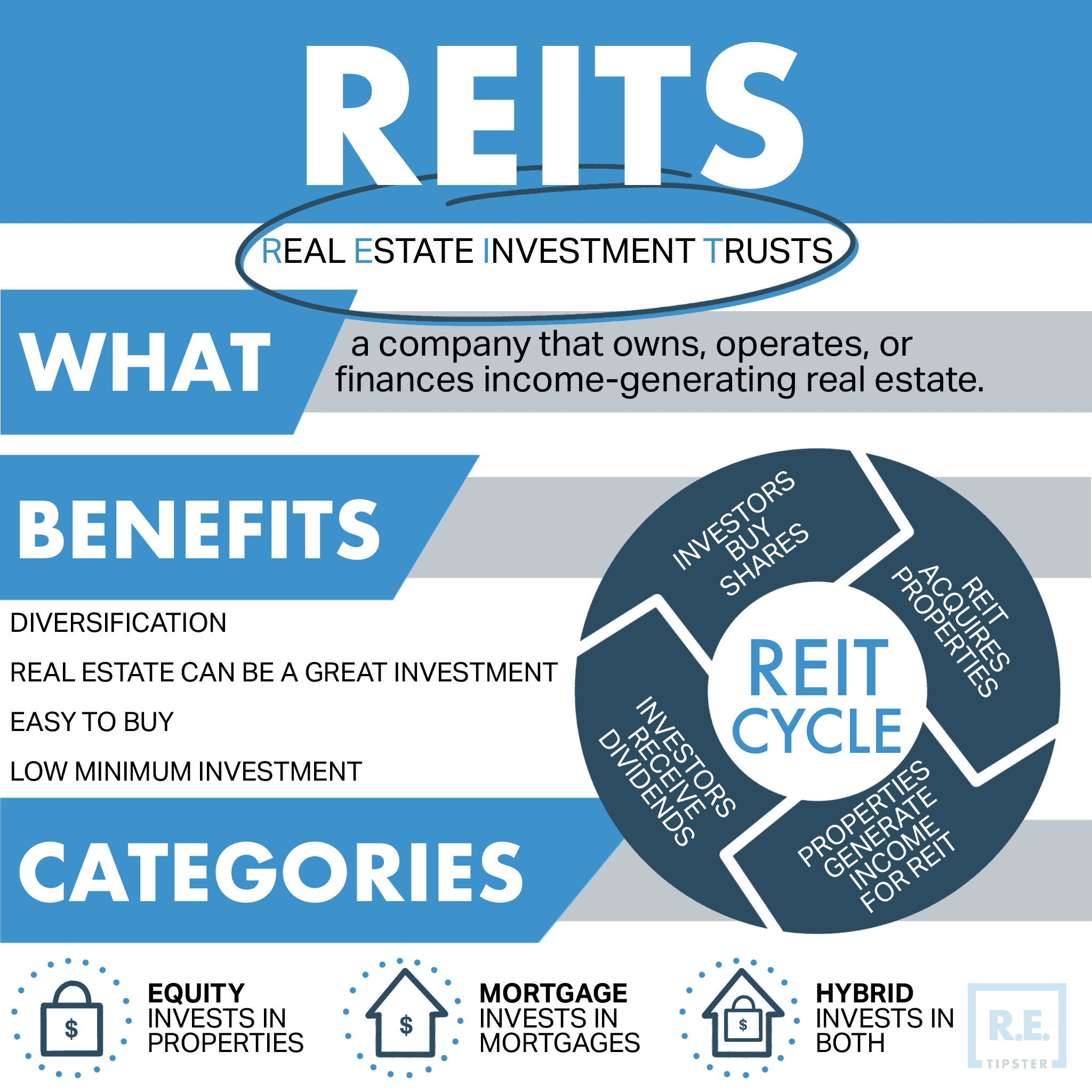

Real estate, in particular, can be a more secure option for casual investors who can’t access substantial capital. Many financial experts suggest investing cash in crowdfunded properties and real estate investment trusts (REITs)[10]. Neither needs substantial capital to get started, compared to other investment forms.

Similarly, renting out items like a property, a room, a house, a car, a parking spot, or household items such as power tools, tents, and coolers can be a great way to earn extra cash with minimal effort. For instance, rental properties can also provide a regular cash flow.

RELATED: 14 Surprising Ways to Earn an Income From Real Estate Without Leaving Home

Over the long term, other methods to generate passive income include creating digital products like online courses, e-books, photographs, apps, and video blogs (vlogs).

Creating these types of content can usually be done without a significant investment or material outlay.

That said, increasing your overall income actively or passively is useless without controlling spending.

BY THE NUMBERS: On average, REITs raise dividend payouts by 10%, which is nearly 3% higher than most of the S&P 500.

Source: Kiplinger

Sources

- The 4 Cs of Qualifying for a Mortgage. (2021, September 2.) My Home by Freddie Mac. Retrieved from https://myhome.freddiemac.com/blog/homeownership/20171204-4Cs-qualifying-mortgage

- What is a debt-to-income ratio? (2022, June 8.) What is a debt-to-income ratio? Consumer Financial Protection Bureau. Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

- What is debt to income ratio and why is it important? (n.d.) Chase. Retrieved from https://www.chase.com/personal/credit-cards/education/basics/what-is-debt-to-income-ratio-and-why-it-is-important

- Robertson, C. (2019, November 1.) Debt-to-Income Ratio (DTI): What It Is and How to Calculate It. Truth About Mortgage. Retrieved from https://www.thetruthaboutmortgage.com/dti-debt-to-income-ratio/

- Taxable Income vs. Nontaxable Income: What You Should Know. (2022, December 1.) TurboTax®. Retrieved from https://turbotax.intuit.com/tax-tips/irs-tax-return/taxable-income-vs-nontaxable-income-what-you-should-know/L0h4j5DZQ

- Grant, N. (2022, October 7.) Paying Alimony and Mortgage Qualification: How They Can Work Together. MoneyTips. Retrieved from https://moneytips.com/paying-alimony-mortgage-qualification/

- What Income Is Considered When Applying for a Mortgage? (2019, February 26.) Discover. Retrieved from https://www.discover.com/home-loans/articles/what-income-is-considered-when-applying-for-a-mortgage/

- Sandberg, E. (2019, May 17.) What Happens If I Stop Paying My Payday Loan? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/what-happens-if-i-stop-paying-my-payday-loan/

- Pritchard, J. (2022, June 29.) Can You Use Someone Else’s Bank Card or Lend Yours? The Balance. Retrieved from https://www.thebalancemoney.com/when-somebody-else-uses-a-credit-card-315827

- Royal, J. (2023, January 1.) 23 passive income ideas to help you make money in 2023. Bankrate. Retrieved from https://www.bankrate.com/investing/passive-income-ideas/