What Is a Security Instrument?

Shortcuts

- A security instrument secures a loan’s promissory note, giving its holder the legal claim to the collateral when the borrower fails to repay the loan.

- In real estate, a security instrument can be a mortgage or a deed of trust signed by the borrower and lender.

- Security instruments aren’t as negotiable as promissory notes, but, in some cases, the terms can be adjusted to include a third party who can step in when the borrower can no longer make payments.

- Although a security instrument and a promissory note are separate documents, they should coexist to make a loan secured.

- Every mortgage gives its holder a security interest in the property backing the loan, while every security interest comes from a security instrument.

How Security Instruments Are Used in Real Estate

A security instrument is used in real estate to give a lender a security interest in a particular property.

An example of a security instrument in real estate is a mortgage (or, in some states, a deed of trust), which a borrower uses to finance the purchase of a home. The lender holds the mortgage, giving them a security interest in the property that serves as collateral. It entitles the lender to seize the house and resell it to recoup its investment when the initial buyer fails to fulfill their obligations under the loan terms.

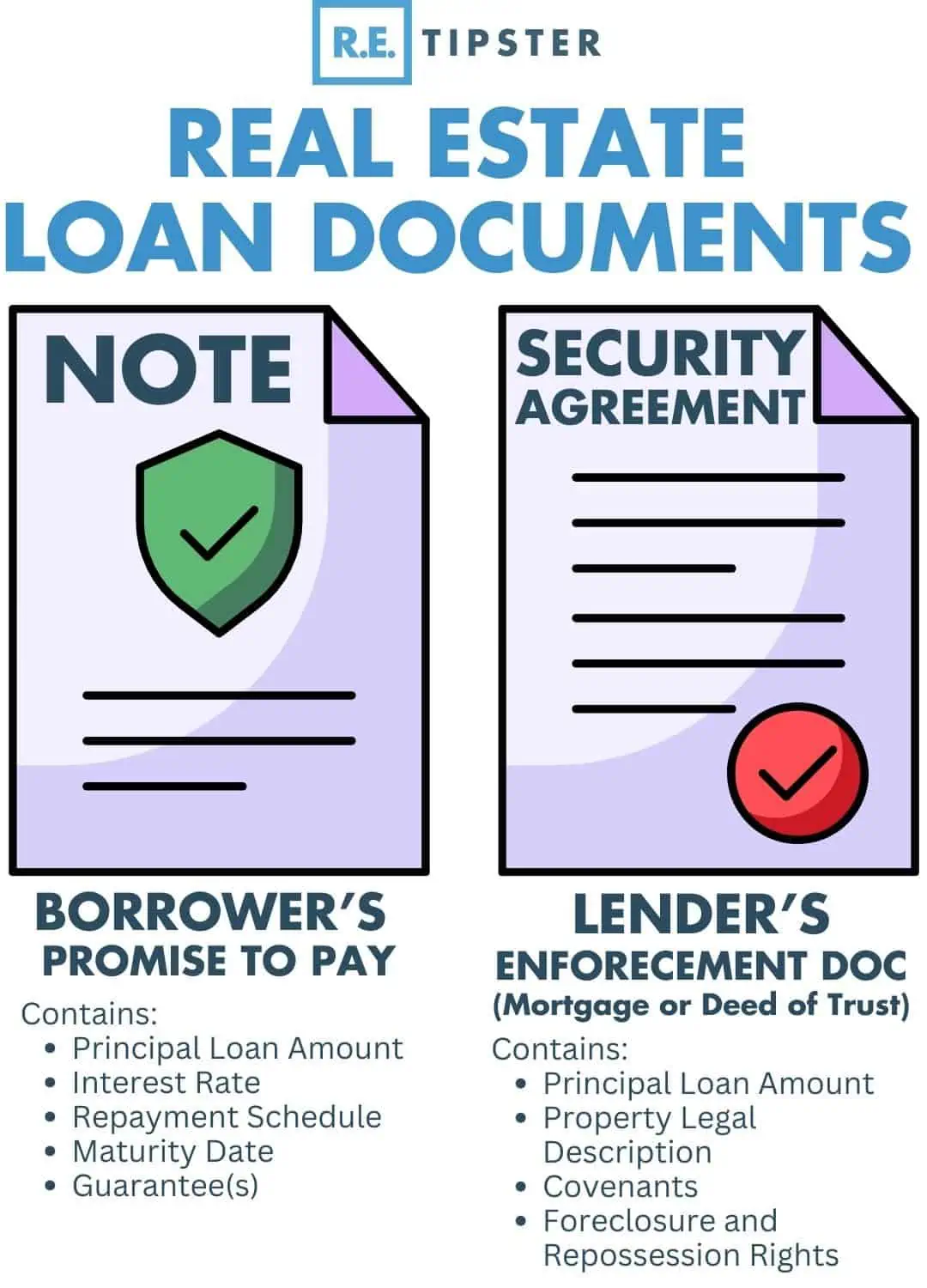

In a typical home loan, the lender issues two documents: the mortgage and the promissory note. These loan documents work together to lay out the specifics of the home loan. The former spells out the home loan terms, such as the amount and interest rate. But, more importantly, it puts the unconditional promise to pay what is owed within a certain period in writing.

Although this written commitment to repay is legally binding, the collection process becomes more complicated when such agreements have no accompanying security instrument.

If a lender only holds a promissory note and the borrower defaults, the bank needs to sue said borrower and go after their assets until the losses are recouped. But if the assets’ value isn’t enough to satisfy the loan balance, the lender has no choice but to charge it to experience[1].

A security instrument (in this case, the mortgage) is thus important because it secures the note. It creates a lien on the property, giving the lender a legal claim. If the creditor has a security interest in the home, they can foreclose on the property in accordance with state law[2] to get paid.

Every mortgage creates a security interest, but not every security interest comes from a mortgage since not every security instrument is a mortgage. They can originate from any secured loan like auto financing or car title lending.

Mortgage vs. Deed of Trust

As mentioned, mortgages and deeds of trust are the best security instruments. These legal documents apply to home loans, although they’re not always available for lenders everywhere. Some states prefer one or the other, while some jurisdictions accept both[3].

A mortgage transaction involves only two parties: a homebuyer and a home loan lender. A mortgage without a power of sale clause requires the creditor to seek judicial supervision to foreclose on the home[4]. Conversely, a mortgage with power of sale written on it permits the lender to take possession of the property with no judicial order and proceed to the sale immediately.

On the other hand, a deed of trust includes an impartial third party: the trustee. The role of a trustee in a home loan is to hold the legal title[5] to the property until the debt is paid off. The equitable title to the house stays with the homebuyer, but they only become the legal, unencumbered owner when the financial obligation is fulfilled to its end.

A deed of trust comes with a power of sale, which allows the trustee to put the property on sale when the borrower defaults. The lender notifies the borrower of the sale of property, which the borrower can then challenge in court should they find the grounds to do so[6].

Who Signs the Security Instrument?

In general, the borrower and lender may sign the security instrument.

When one borrows money to buy something and uses credit information to qualify for a loan, that person has to put their signature on this document and the promissory note.

Likewise, the name of the lender will appear on the security instrument, so the lender usually signs it as well. However, they don’t need to sign the note, just the security instrument.

Moreover, using a third party like a co-signer[7] or guarantor to beef up loan qualifications doesn’t require them to sign the security instrument. The document doesn’t even need to mention the third party at all.

Is a Security Instrument Negotiable?

A security instrument is negotiable because one may bargain with a creditor to use a third party to reduce the risk everyone has to take. After all, a co-signer or a guarantor is a form of security too.

However, borrowers can’t expect a lender to pass up security when borrowing an amount that usually merits a secured loan. Unless the homebuyer has extraordinary credentials, they won’t usually find a lender to help finance a big purchase without a security instrument.

What can be negotiated are the contents of a promissory note. Borrowers can negotiate a better deal when applying for, renewing, or refinancing a loan.

Depending on creditworthiness and the prevailing market conditions, one can snag a lower interest rate[8], extend or shorten a repayment term, decrease the down payment requirement, or eliminate some closing costs[9].

Security Instrument: Similar Terms Compared

Some similar terms may confuse people, as described below.

Security Instrument vs. Loan Agreement

A loan agreement isn’t a security instrument. A loan agreement is another term used to refer to a promissory note. It may also go by other names, such as a credit agreement, a loan contract, or a financing agreement.

Security Instrument vs. Note

The difference between a security instrument and a note is that a note is short for a promissory note.

The security instrument and promissory note are separate legal documents a person has to sign when taking out a secured loan.

The holder of a loan’s note gets to receive the monthly payments. If a lender sells it to someone else like an investor, the interest earnings it generates will go to its new owner[10].

Since the note and security instrument are paired with each other, the legal rights to the underlying collateral backing the loan go to whoever owns the debt. So when a secured note changes hands, its corresponding security instrument follows suit.

Security Instrument vs. Security Interest

A security instrument is a legal document that creates or provides evidence of security interest, while security interest is a legal right or claim a lender has over a borrower’s property.

In other words, a security instrument is a document that validates or proves a lender’s security interest in an asset or property.

Sources

- Haman, E. (2023, February 1.) Secured promissory note vs. unsecured promissory note. LegalZoom. Retrieved from https://www.legalzoom.com/articles/secured-promissory-note-vs-unsecured-promissory-note

- Foreclosure Laws and Procedures: 50-State Survey. (2022, November 29.) Justia. Retrieved from https://www.justia.com/foreclosure/foreclosure-laws-and-procedures-50-state-survey/

- Sherman, F. (2010, June 25.) Mortgage State vs. Deed State. SF Gate. Retrieved from https://homeguides.sfgate.com/mortgage-state-vs-deed-state-1362.html

- Harding, C. (2021, October 30.) Judicial Foreclosure: An Overview. Upsolve. Retrieved from https://upsolve.org/learn/judicial-foreclosure/

- Legal Title vs. Equitable Title. (2022, June 13.) Study.com. Retrieved from https://study.com/learn/lesson/legal-vs-equitable-title-overview-differences-applications.html

- Do procedural defects in the assignment of a trust deed allow a foreclosed owner to challenge its assignment? (2016, March 28.) firsttuesday Journal. Retrieved from https://journal.firsttuesday.us/do-procedural-defects-in-the-assignment-of-a-trust-deed-allow-a-foreclosed-owner-to-challenge-its-assignment/51524/

- What is a co-signer? (2021, June 23.) Consumer Financial Protection Bureau. Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-a-co-signer-en-745/

- Calonia, J. (2022, August 25.) How to Negotiate Lower Interest Rates on Your Credit Cards, Student Loans, and Mortgage. FinanceBuzz. Retrieved from https://financebuzz.com/how-to-negotiate-lower-interest-rates

- Zinn, D. (2022, July 20.) How to negotiate your mortgage closing costs. Bankrate. Retrieved from https://www.bankrate.com/mortgages/how-to-negotiate-closing-costs/

- Passive Income from Investing in Notes, Be The Bank. (2018, April 17.) Passive Income MD. Retrieved from https://passiveincomemd.com/passive-income-from-investing-in-notes-be-the-bank/