What Are Tax Brackets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

What Are Tax Brackets For?

Tax brackets refer to a sliding scale of tax rate ranges taxpayers pay based on their income[1]. The United States employs a progressive tax system, which means people with higher incomes are placed in higher tax brackets with higher tax rates.

The IRS generally defines “income” (particularly taxable income) as any monetary return, whether in cash or in kind. Income may fall under any of these categories[2]:

- Salary Income. This is income gained from being compensated as an employee.

- Property Income. Any income produced by real property.

- Business or Profession Income. Profits from practicing a profession or operating a business.

- Capital Gains. Returns generated by selling an asset at a higher price than its original purchase cost.

- Other Income. Any income that does not fall under the above four, such as interest from a bank account or income from dividends.

The IRS determines how much their income is taxable by subtracting all tax deductions that apply to all taxpayer’s income [3].

Different amounts of income are taxed at different rates. When the taxable income reaches a different bracket, that part of the income is taxed at a new rate. For example, a taxpayer with a $40,000 taxable income falls under the 12% bracket. The first $10,275 of that person’s income will be taxed at 10%. The rest of the income will be taxed at the 12% rate.

The IRS adjusts tax brackets every year because of inflation[4]. For instance, the tax bracket rate for this year may be higher or lower than the following year. That means even if a person’s income remains the same, their taxable income may end up in a different tax bracket (and therefore at another rate) from one year to the next.

BY THE NUMBERS: The top 1% of taxpayers pay a greater share of individual taxes—about 39%—than the bottom 90% combined.

Source: Taxfoundation.org

How to Determine the Tax Bracket

One’s tax bracket depends on their taxable income and filing status. Filing statuses include[5]:

- Single – Individual taxpayers file as single if they are unmarried, divorced, and not claimed as a dependent on another person’s tax return.

- Married, filing jointly – Married couples can agree to combine income and file a joint tax return.

- Married, filing separately – A married couple can choose to file individual or separate tax returns to lower the tax burden.

- Head of household – A person qualifies as head of household if unmarried or divorced, has paid more than half the cost of keeping up a home for the year, and has a qualifying child or dependent living with them in their home for more than half the year.

Calculating Taxes Using the Tax Bracket

The marginal and effective tax rates are crucial to understanding tax brackets. The marginal tax rate refers to what a person pays on the last dollar of their taxable income[6]. The effective tax rate, meanwhile, is the total tax paid as a percentage of the total income taxed[7].

For example, a person is single and has a taxable income of $55,000. This taxable income falls under the 22% bracket. But that does not mean the taxpayer will have to pay 22% on all earnings; instead, the taxable income will be taxed at three different rates, shown below.

- The first $10,275 is taxed at 10%, or $1,027.50 in taxes.

- The amount between $10,275 and $41,775, or the next $31,500, is taxed at 12%. This results in $3,780 in income taxes.

- The amount between $41,775 and $55,000, or the last $13,225, is taxed at 22%, equivalent to $2,909.50 in taxes.

Add the taxable amounts for each segment to get the total tax amount for the $55,000 income.

$1,027.50 + $3,780 + $2,909.50 = $7,717.

The person will pay $7,717 in tax returns for that year.

To get the effective tax rate, divide the total tax paid by the taxable income. Then, multiply the result by 100 to get the percentage.

($7,717 / $55,000) x 100 = 14%

In this example, the person’s marginal tax rate—or the rate that they pay in the top bracket—is 22%. The person’s effective tax rate—or the total tax liability—is 14% of the taxable income and is lower than the marginal tax rate.

How to Get Into a Lower Tax Bracket

Individuals have a couple of ways to get into a lower tax bracket and effectively reduce how much they pay on tax[8].

Tax Credits

These refer to reductions in the income tax bill on a dollar-for-dollar basis. For example, a $3,500 tax bill can drop to $2,500 if a taxpayer is eligible for $1,000 in tax credits.

Child tax credit, education tax credit, and dependent care tax credit are some of the most common examples of tax credits. In real estate investment and development, an LIHTC (low-income housing tax credit) is also an example of a tax credit.

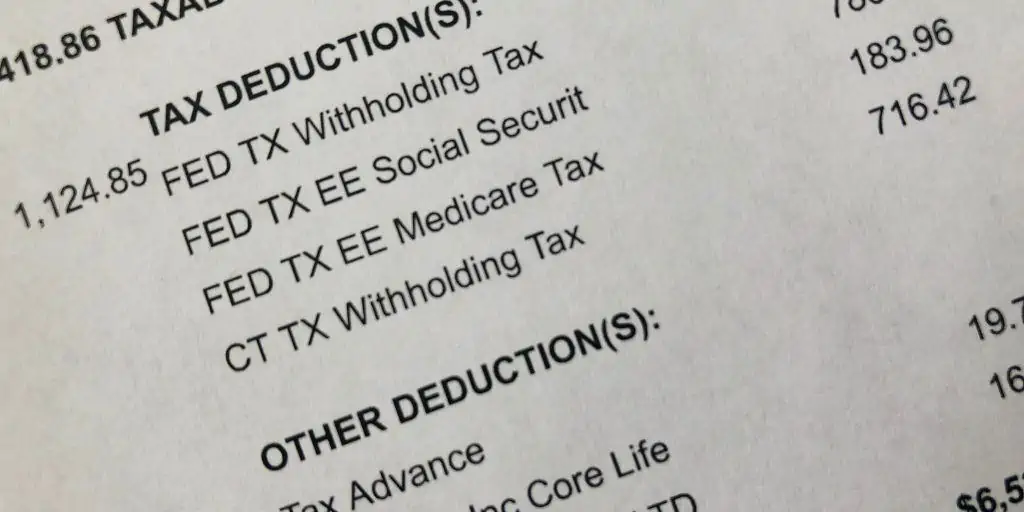

Tax Deductions

These deductions reduce the total amount of taxable income. Therefore, taxpayers who take all the tax deductions they can claim can reduce their taxable income and get into a lower tax bracket.

Common tax deductions include charitable donations, medical expenses, mortgage interest, and educator expenses.

What Is Capital Gains Tax?

A capital gain occurs when selling assets at a price higher than their original purchase price. That means if a person acquires a property and sells it for more than what they paid, then the profits from the sale of a property are subject to tax[9].

The rate at which the capital gains will be taxed depends on factors that include[10]:

- The owner’s filing status.

- The owner’s income tax bracket.

- The cost of owning the property, including all fees paid to date.

- The length of time the property was owned.

Takeaways

- Tax brackets show the range of a taxpayer’s income that can be taxed at a specific rate. The higher the income, the higher the tax rate.

- The IRS defines “income” as any form of monetary return, whether in cash or in kind.

- One’s tax bracket depends on some factors, such as whether they are married or not.

- There are ways to be taxed into a lower tax bracket using tax credits, tax deductions, or both.

- Kagan, J. (2022, July 31). Tax Bracket. Investopedia. Retrieved from https://www.investopedia.com/terms/t/taxbracket.asp

- Income. (n.d.) Tax2Win | Tax Dictionary – Know the meaning of tax jargons. Retrieved from https://tax2win.in/tax-glossary/income

- Berry-Johnson, J. (2021, November 22). What Is Taxable Income And How Does It Work? Forbes. Retrieved from https://www.forbes.com/advisor/taxes/what-is-taxable-income/

- Bischoff, B. (2022, July 7). How inflation could affect 2023 tax brackets: You may get an unexpected ‘tax cut,’ in a way. Market Watch. Retrieved from https://www.marketwatch.com/story/what-will-inflation-do-to-next-years-tax-brackets-and-why-should-i-care-11657129883

- Loudenback, T. (2022, March 21). What is my filing status? It helps determine how much income tax you pay. Insider. https://www.businessinsider.com/personal-finance/what-is-my-filing-status-for-taxes

- LaRock, H. (2021, October 4). Marginal vs. effective tax rate: What’s the difference? Bankrate. Retrieved from https://www.bankrate.com/taxes/marginal-vs-effective-tax-rate/

- Kerr, E. (2022, January 27). How to Calculate Your Effective Tax Rate. U.S.News. Retrieved from https://money.usnews.com/money/blogs/my-money/articles/how-to-calculate-your-effective-tax-rate

- Waugh, E. (2022, March 10). Tax Credit vs. Tax Deduction: What’s the Difference? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/tax-credit-vs-tax-deduction-whats-the-difference/

- Araj, V. (2022, August 22). Capital Gains Tax On Real Estate And Home Sales. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/capital-gains-home-sale

- Amadeo, K. (2022, May 17). What Is the Capital Gains Tax? The Balance. Retrieved from https://www.thebalance.com/what-is-the-capital-gains-tax-3305824