REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Whether you’re a borrower or a lender — and many real estate investors are both — the issue of bankruptcy may eventually impact you and your loan agreement.

But did you know that there are six different types of bankruptcy? They're all designed for different situations and each one changes debt agreements in different ways.

If you’re considering filing for bankruptcy, or you're concerned that your borrower will, here’s what you need to know about each one.

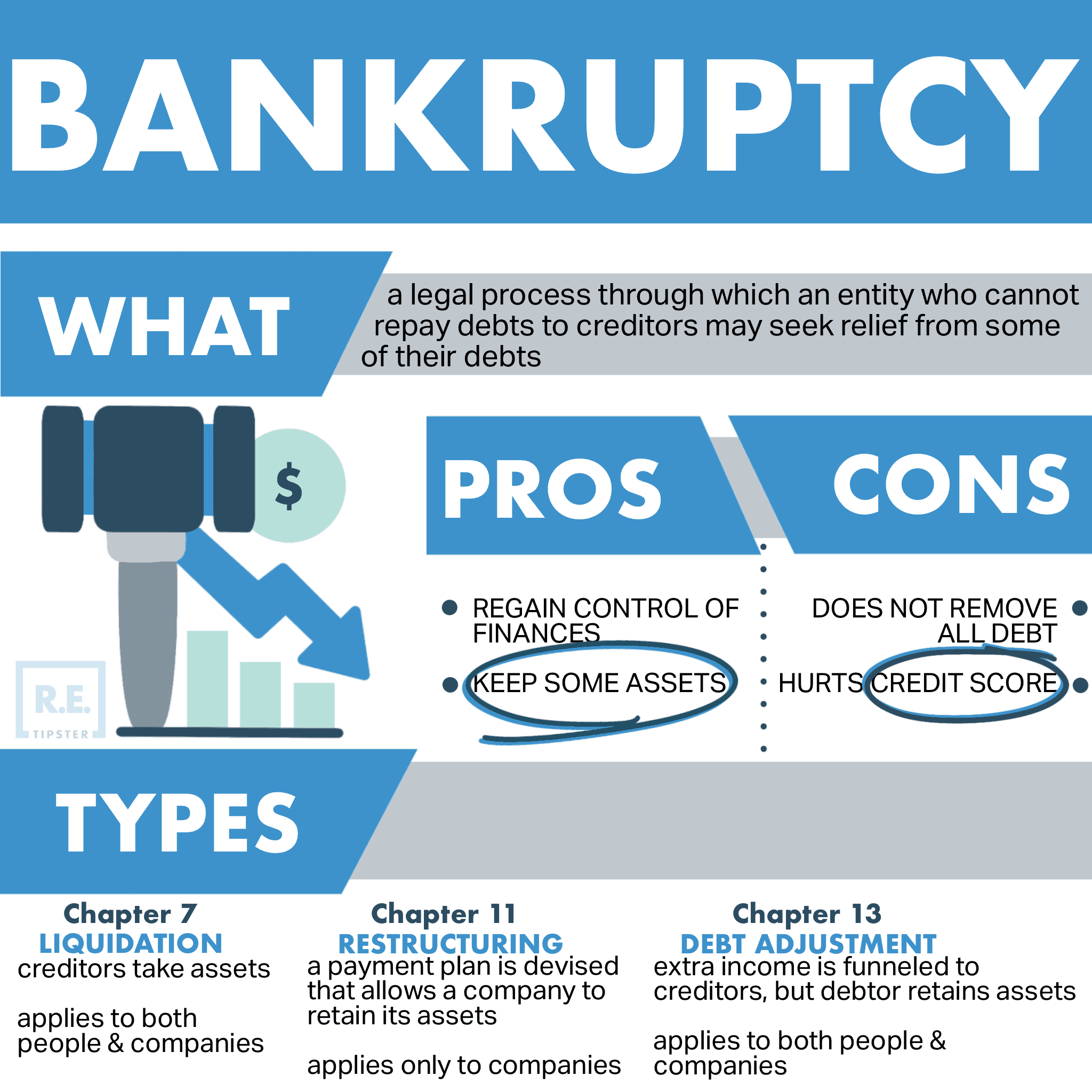

Overview of Bankruptcy

When a borrower can no longer afford to pay their debts, our legal system offers a set of rules that all parties must follow.

It starts when the borrower files a petition in bankruptcy court to declare a specific type of bankruptcy, usually with the help of an attorney. From there, the borrower must reveal all their remaining assets and income to the court (or more often their appointed trustee) and their creditors. Depending on the type of bankruptcy and those assets, income, and debts, the court can cancel some debts, reduce others, and create payment plans for repaying others.

Not all debts are eligible for being expunged through bankruptcy, however. Student loans, tax debts and other government debts, child support and alimony, and reaffirmed debts (those you agree to continue paying) all survive bankruptcy.

Bankruptcy follows you for many years to come, so don’t enter it lightly. Exactly how long it will follow you depends on the type of bankruptcy, but it remains on your credit report and affects your ability to borrow money for at least seven years. For real estate investors looking to use leverage and invest with other people’s money, bankruptcy can devastate your ability to borrow money and invest in the future.

Common Types of Bankruptcy & How They Impact You

Different types of bankruptcies apply to different people and legal entities. For consumers, Chapter 7 and Chapter 13 are the most well-known types of bankruptcy. For businesses that go bankrupt but want to continue operating, they will typically file for Chapter 11 bankruptcy, but there are a few other niche types of bankruptcy that we’ll touch on as well.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is commonly known as “liquidation bankruptcy” because, as the name implies, it will liquidate your assets to pay off as much of your debt as possible. For example, if you own rental properties and can’t pay the mortgages, the court typically orders you to sell the properties and pay the proceeds to your lenders.

After you sell off all your assets, the court generally discharges any remaining debts. Unsecured debts, such as personal loans or medical debts, typically disappear after a Chapter 7 bankruptcy.

Borrowers may keep several exempt assets, even when filing a Chapter 7 bankruptcy. In most cases, the borrower can keep their primary residence and basic furniture, their car, their professional tools (if applicable), their retirement accounts such as a 401(k) and IRA, and a small amount of cash. However, the rules vary by state, so check your state’s bankruptcy laws.

That said, you must be able to continue making payments on your home and car loans if you are to keep them. A Chapter 7 bankruptcy doesn’t erase those debts — if you want to keep them, you must reaffirm them and your ability to pay them.

Borrowers must appear before their creditors, who can ask them questions about their assets, income, and other debts. The court-appointed trustee has ultimate decision-making power over what the borrower must sell, who they must repay, and the terms of any modified loans.

Ultimately, borrowers declare a Chapter 7 bankruptcy when they have far fewer assets than liabilities, so lenders tend to see only a fraction of the money they’re owed if anything. A Chapter 7 bankruptcy will remain on the borrowers’ credit reports for ten years, and they cannot file another Chapter 7 bankruptcy for at least eight years.

Chapter 13 Bankruptcy

With Chapter 13 bankruptcy (often referred to as “wage earner’s bankruptcy”), the idea is to restructure the borrower’s debts to make them more affordable rather than sell off all assets and wipe their debts clean.

As in Chapter 7, borrowers must disclose all their assets, income, and liabilities to the trustee. The trustee and creditors then sit down and reorganize the debts so the borrower can repay them.

This usually includes a payment plan to get the borrower caught up on back payments. It could mean extending the loan term to reduce monthly payments.

Borrowers can’t declare a Chapter 13 bankruptcy if their unsecured debts exceed $419,275, or their secured debt exceeds $1,257,850. They must also have all their tax returns filed and their taxes paid to date.

In Chapter 13 bankruptcy, borrowers usually keep both their assets and their debts in place; they simply adjust the payment schedule. They can’t file it again for at least two years, and it stays on their credit report for seven years.

Chapter 11 Bankruptcy

While Chapter 7 and Chapter 13 bankruptcies are designed for consumers, Chapter 11 bankruptcies are designed for businesses.

Known as a “reorganization bankruptcy,” Chapter 11 works similarly to Chapter 13 for businesses. The goal is to restructure debts — and possibly business operations — so the business can continue paying its obligations without going under. Businesses may even borrow additional money with court approval.

Affected creditors meet with the trustee and vote on the proposed plan. If the borrower doesn’t propose their own plan, or their proposed plan is voted down, the creditors may propose their own plan to restructure the company’s debts while allowing them to stay in business.

Note that either the borrowing company or the lenders can initiate a Chapter 11 bankruptcy, unlike with consumer bankruptcies.

Sometimes real estate investors opt for a Chapter 11 over a Chapter 13 bankruptcy. As many real estate investors operate under business entities such as LLCs, some choose a Chapter 11 bankruptcy when their debt levels exceed the limits on Chapter 13 bankruptcies.

Chapter 11 bankruptcies appear on your personal credit report for ten years and on your business credit report for up to 20 years.

Less Common Types of Bankruptcy

There are a few other types of bankruptcy that only affect niche borrowers. You’ll probably never encounter these as either a borrower or a lender, but it doesn’t hurt to be aware of them.

Chapter 12 Bankruptcy

This bankruptcy applies to family fishermen or farmers who can no longer afford to repay their debts as agreed. It allows them to restructure their debts without having to sell off their working equipment or vehicles, their land, or their home. Chapter 12 bankruptcies allow more flexibility than Chapter 13, along with higher debt limits.

Chapter 15 Bankruptcy

Created in 2005, Chapter 15 bankruptcies allow international cooperation when a foreign business declares bankruptcy. The US joined 47 other countries including Japan, Canada, China, Australia, the UK, Russia, Germany, Saudi Arabia, and Mexico to allow for a simplified process for creditors to be represented in court across borders, and to allow borrowers to stay in business when possible. If you lend money or invest in a foreign business, and that business declares bankruptcy, you can participate as a creditor through a US bankruptcy court and trustee.

Chapter 9 Bankruptcy

This bankruptcy applies to local government bodies who become insolvent. For example, the City of Detroit filed for a Chapter 9 bankruptcy in 2013. In this case, the court and its trustee step in to reorganize the government’s finances and repay creditors — such as investors who bought municipal bonds — to the best extent possible.

Final Thoughts

Whether you’re a borrower or a lender, the bankruptcy process aims to protect you as much as fiscally possible. The laws are designed to be both transparent and fair, so all parties know what to expect.

If you worry a bankruptcy looms in your own or your borrower’s future, consider speaking with an attorney to help you minimize your losses. Bankruptcy laws can get complex quickly, and the better representation you have, the less likely you are to lose large sums when the dust settles.

Reviewed by Mark H. Zietlow, Innovative Law Group