REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

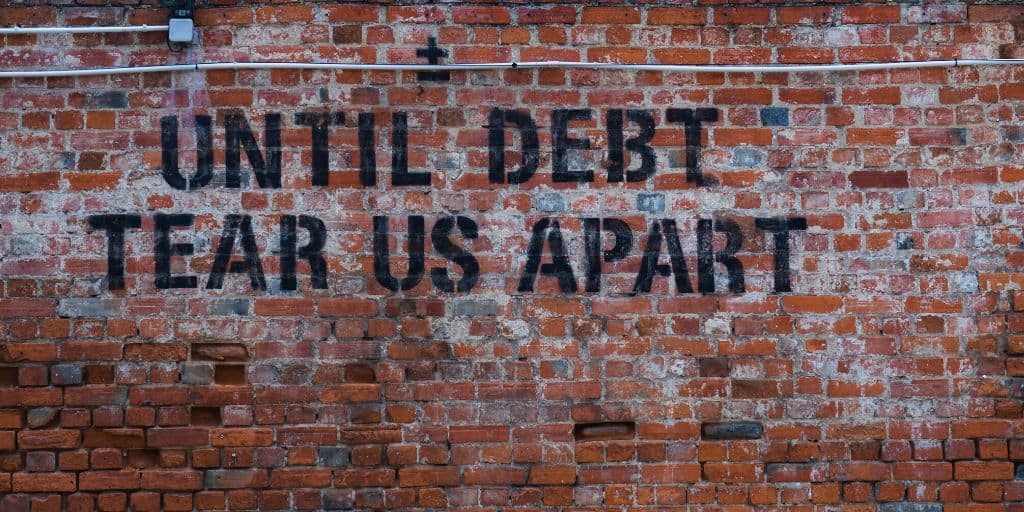

What's the deal with debt? Is it a crucial tool for building wealth or a detrimental curse to a person's long-term financial health?

In this episode, we're talking about two competing ideologies from two GIANT names in the business and personal finance space – Dave Ramsey and Robert Kiyosaki.

Dave Ramsey is perhaps the most well-known radio personality who introduces each of his radio shows saying,

“Debt is dumb, cash is king and the paid-off home mortgage has taken the place of the BMW as the status symbol of choice.”

Robert Kiyosaki has sold tens of millions of books, and is noted for saying things like,

“Good debt helps you get rich, Bad debt makes you poor: If you want to get rich, load up with ‘good debt’. When you want to become rich fast, it is important to have enough starting capital, and borrowing ‘good debt’ helps multiply the capital that you start with.”

They can't both be right… can they?

We'll explain our thoughts in this episode.

Links and Resources

- Dave Ramsey

- Total Money Makeover by Dave Ramsey

- Robert Kiyosaki

- Rich Dad Poor Dad by Robert Kiyosaki

- Cash on Cash Return Calculator

- House Hacking: The Official Guide On How to Live (Almost) Mortgage Free

- Where The Simple Things Are Blog

- 045: LIES! Most Conventional Money Advice Is Wrong – Keith Weinhold Explains

- 029: Are You a Victim of These Money Myths? Keith Weinhold Sets the Record Straight

- 010: Jaren Barnes Changed His Life With One Land Deal

- Mr. Money Mustache: The True Cost of Commuting

- Mr. Money Mustache: Raising a family on Under $27,000 per Year

- Western Michigan University Sales and Business Marketing Program

Episode 61 Transcript

Seth Williams: Hey everybody, how's it going? This is Seth Williams and I'm here with my co-host Jaren Barnes, and you're listening to the REtipster Podcast. This is episode number 61. By the way, if you want to check out the show notes for this REtipster.com/61. In today's episode, Jaren and I are sitting down pretty much unscripted here. Nothing, I think we thought about this for maybe three minutes before we started recording, but we're going to be talking about this debate between two very different ideologies concerning debt, and that is the whole camp of Dave Ramsey, where debt is dumb, cash is king. Just any kind of consumer debt is bad. Versus Robert Kiyosaki, who does not necessarily think debt is dumb. He's more of the mentality of there is good debt and bad debt. So there is a time and a place to have it and not have it.

Seth Williams: This is something that I know I've certainly wrestled within my mind because I think it was back when I was about 18 years old, just getting out of high school when I first heard about Dave Ramsey and went to one of his seminars in Grand Rapids and my mind was blown. I mean, I thought he was just such a good presenter, and the content of his presentation was awesome. Obviously, it makes a lot of sense or he wouldn't be a big of a deal as he is. But then also a few years later I found Robert Kiyosaki, and I think they sort of would agree on a lot of fundamental things, but when it comes to that debt issue, there's definitely a disconnect. They see things and recommend things that are very different from one another. So we just wanted to kind of have an informal chat about that and dissect it a little bit. Not that we're going to have the ultimate answer for you, or maybe we will. I don't know, I guess we'll see where this goes.

Jaren Barnes: Seth will, definitely.

Seth Williams: But I don't know, it just might be kind of fun to hash this out and maybe it can help you guys process your thoughts about this whole issue as well.

Jaren Barnes: I'm excited. I actually wanted to originally write a blog post about this called Cash on Cash Return proves that Dave Ramsey is wrong. Very controversial title, but I decided against it because Dave Ramsey is not wrong. Dave Ramsey is a really solid influencer, he has a really solid program and philosophy on personal finance, and he's the right fit for a certain type of person. So I don't want to throw Dave under the bus. I have a lot of respect for him and all that, but I do have some things that I probably would disagree on. So if we're going to take sides in this conversation, I'm probably more aligned with the Robert Kiyosaki side. So I have an inherent bias there, so everyone is aware.

Seth Williams: I did actually hear, I mean, not that this has always been true by any stretch, but I remember hearing years ago when I used to listen to Dave Ramsey's podcast, he was talking about how there's a lot of people out there who disagree with me and disagree with this idea that debt is bad, and they're all broke too and they're up to their eyeballs in debt, and they can't get out from under the load. I thought that was actually ... I mean, again, I don't know that you can say that for everybody, but at the time I worked with several people who were very vocal about how they thought Dave Ramsey was dumb, and guess what? They were up to their eyeballs in debt. They had car loans left and right, and all kinds of financial stress. I don't know, I think again, not trying to paint broad strokes or say that anybody who agrees or disagrees with somebody is wrong, but that was just kind of interesting because he had said that, and I noticed he was actually right for a lot of the people that I knew.

Jaren Barnes: Yeah. I don't know. I just know that when it comes to real estate and it comes to investing, the less you can have money, your own capital tied up in some kind of vehicle that makes a profit, the better it is for you because it's the upside. It's the whole Cash on Cash Return thing. So the goal I think in any kind of investment endeavor is to be like okay, can I put up a $100 to have the spending power of a $1,000 and then use that to make $5,000? Can I do that, or even just make a $1,000? And for me and for most people the answer is 100% yes. If I can put up a little bit of a down payment and then a monthly payment in order to have the spending power of a whole lot more money that's not mine and then I can just pay whatever interest on top of that and then use it to turn a profit. That's how you really scale, I think. I don't know how else.

Jaren Barnes: I mean, I understand from a personal finance perspective where Dave comes from, but every single business that is at a mass scale, every single one of them uses leverage and uses investors. So I don't understand how if we talk about it from the business world, we can actually say that debt is bad, because the entire world, the entire economy is founded on debt, a large portion of it is anyway.

Seth Williams: Yeah. Well, to make a statement like debt is bad, I mean, that's just a ridiculously oversimplified statement. It's like saying fire is bad, where it's like maybe if you do something stupid with it like burn yourself with fire then yeah, that's not a good thing, but if you use it to warm your house, or cook your food, it's a pretty good thing, and you sort of having to have it or you're going to die, in some parts of the world anyway. So it's all in the context of what are you using debt for and is this debt that is going to pay for itself and put money in your pockets, and what is the risk that it might not do that at some point? Because some things are much riskier than others.

Seth Williams: I know Jaren you're talking about, you've mentioned a couple of times Cash on Cash Return. For the listeners out there who have no idea what you're talking about, do you want to explain that quick or do you want me to? I've got it pulled up right here if you want.

Jaren Barnes: Well, if you've got it pulled up, give an official definition. So go for it.

Seth Williams: By the way, you can find this on REtipster.com/CashonCashReturn. That's what I'm reading from right now. It's a wonderful write-up written by one of our writers Brian Davis, who did an awesome job. But also have a calculator here too so you can plug in the numbers and find out what your Cash on Cash Return is for whatever property you're looking at. So the idea behind Cash on Cash Return is just a measure of how hard your money is working for you. For example, if you were to go out and buy a house, say the house is $100,000 if you don't take out a loan at all, you just take $100,000 cash, buy the thing, and it throws off, I don't know, we'll say $10,000 a year in income. Your Cash on Cash Return is not going to be very high. I mean, your cash is not working very hard for you because you're not leveraging, you're not using a bank's financing to do that. You're totally carrying the load all by yourself with the money that you've thrown into it.

Seth Williams: However, if you were to only put down say 20%, or 10%, or really as little as possible into that property, your Cash on Cash Return is going to be much higher because that small portion that you invested into the property is working a heck of a lot harder for you because you're getting all of the income, but only a small portion of that investment cost is actually being shouldered by the money that you put into it. So that's what leverage is all about.

Seth Williams: So basically the higher that number goes, you Cash on Cash Return, the harder your money is working. Theoretically, if you bought a property where you put literally nothing into it, not even one penny, you have infinite Cash on Cash Return because I mean, you're making money from the money you didn't even put into it. Anyway, all of this is only possible if you're okay with debt. If you take the approach of no, sorry, debt is evil across the board. There's never a situation where it's okay, which is basically how I've always heard Dave Ramsey explain it, even in the context of a business, and maybe I'm wrong about that, but I'm pretty sure I've kind of heard that approach.

Seth Williams: I mean, if you take that stance, then you're just going to be severely limited in what you can do. I mean, you could probably survive in something like the land business because it's one of the few business models I know where you can actually buy properties outright, with no debt, just using the cash in your pocket, but outside of that, I mean, maybe you could wholesale houses that kind of thing, but I mean, if you're not going to use debt, you need to have a heck of a lot of cash. You basically need to already be independently wealthy before you even get into real estate or just pull together a lot of different people's funds and do it that way.

Jaren Barnes: But even in that case scenario, depending on how you look at it, it's still debt. I mean, you could structure it as a partnership, but it's still, you're taking somebody's money and then you're paying them back something for using that money. So whether you want to call that debt or you want to call that equity, I mean, it's just how you structure it, right? It's still the same concept in practice.

Seth Williams: Yes and no. I mean, it technically is not debt if you're partnering with them because you're not making a regular monthly payment with interest that is not an amortized amount that you're paying back. That's kind of like what constitutes textbook debt, but you're right. I mean, you don't get the whole share of the pie. You got to cut it up a lot of different ways and give it to other people, whereas if you did have debt, you could get all of that. I mean, granted, you have to make debt service loan payments, but still, all of that income flows to your account first and then you have to make those debt payments.

Seth Williams: So I think the Dave Ramsey mentality, it certainly has a place, and I think if you're somebody who is either currently in a situation where you're up to your eyeballs in debt, and none of it is good debt, it's not paying you money, it's just costing you for assets that are depreciating like a car, then yeah, debt is kind of dumb, it is evil, and I would try to get rid of it ASAP.

Jaren Barnes: Now, I want to give you a little pushback here, a little bit.

Seth Williams: No, sorry. I'm not going to allow that.

Jaren Barnes: He's like, "You're fired." Get out of here. No. So I agree with you 100% that in most situations if your debt is not making you money, then it's bad debt, you should get rid of that thing as soon as possible because that thing is just going to suck you try. It's just payments, it's kind of like paying rent, in my opinion, or even in a lot of ways paying a mortgage. I mean, I know that there's some upside on when you own a property because you have just basic market appreciation over a given time period, but I'm a big fan of house hacking because if I'm paying $1,500 a month in mortgage cost, in practice yeah, I have some appreciation, but that's a big hefty monthly payment that I'd rather put elsewhere. In rent, there's no real return on that. So I like house hacking where I'm offsetting my monthly mortgage cost as much as I possibly can, sometimes under certain circumstances you can easily structure where the tenant is paying for everything and you're making a $100 a month to live there, but as long as I'm between let's say 650 or less per month, I'm happy with that because you have depreciation and et cetera, et cetera. You have a number of different perks with house hacking.

Jaren Barnes: But here is where I might disagree with you. When it comes to a car. So I was talking to my wife literally yesterday and I was looking and what it could cost for us to buy a van, and a decent van, Toyota Sienna, we like Toyotas, is going to be anywhere between 15 to 25,000 for a really nice used Toyota Sienna. If I want to take that $15,000 or that $25,000 and put it in my land business, I could do a lot of deals with that. I mean, I'm probably, let's say 5,000, that's five deals if we did 25, or at least three, three to five deals, right? Most people don't have the luxury of an investment vehicle like the land business, so for most people, I agree that just paying cash for it and moving on is better, but I would rather take the big lump sum of 15 grand or 25 grand and park it in my land business and then just pay payments on it.

Seth Williams: So you're saying, in that case, the debt on the car is okay because you're going to take the cash you would've put into it, put it in your land business, make money from that and then make payments that way. Yeah, that makes sense. I think the drawback to that is if you're paying the right price for most vacant land properties, it's not that risky in the first place, but still. There is always the possibility that something will not go according to plan, or the property won't sell as quickly as you think it will. You are adding wrinkles to the process by taking that money and putting it somewhere else. Wrinkles being just whatever level of uncertainty that investment is going to pay back in the amount that you'd think and in the timeline that you were assuming. So there is that, but I mean, on paper if you knew predictively that yes. This investment will return this amount within this amount of time and I can then use that to pay for the car, then yeah, I would agree. I think that makes a lot of sense.

Seth Williams: I think Dave Ramsey would probably say something like, "Just buy a much cheaper car, like 3,000 bucks, or don't buy a car at all. Share one car as the whole family. If you have problems, sell the car." The car is usually the biggest drag out of most people's finances that people think it's necessary but they don't realize there's definitely a way to do it without that. It's going to be harder, but it would do a lot for your financial situation if you got rid of that.

Jaren Barnes: I don't know that, man. I don't know if I want to align myself with a scarcity mentality or extreme frugality. I understand being wise and all that, but I'm going to put my wife and my kid who I love, and I work hard for, super hard for to provide them a good life and a $3,000 van. What kind of man am I if I do that?

Seth Williams: Well, let me ask you this. What is a $3,000 van versus a $25,000? What does that have to do with giving them a good life? Is that really what it's about? Is that how you measure a good life?

Jaren Barnes: Well, to some degree yeah. I mean, just being candid. I know a lot of people in our culture, in American culture, we turn our noses up a little bit at financial wealth or value in material things, and to an extent I agree. Extreme materialism where it's all about the stuff, where it's all about the toys, and the junk, and adding on and on all this stuff to your life. I think that's all noise and going extremes in that is really, really bad. I have a friend named Tim Harrison who has coined this concept at his blog The Simple Things or Where the Simple Things Are called not minimalism, but intentionality or something like that. Everything has to have a purpose. So if you have a big TV or you have a big van, or you have nice things, that's totally fine, but don't have a lot of extra stuff that is just sitting in your basement and what have you. Everything that you have, if it's high quality, should be used on a regular basis.

Jaren Barnes: When we talk about a car, like my church is 45, sometimes up to an hour and 15 minutes from my house. We spend a lot of time. The grocery store that we go to all the time is an hour from where I live right now in Northwest Indiana. I do the majority of my life in Chicago, so I spend a ton of time in the car. To get a $3,000 van that has high mileage probably is going to create a lot of maintenance issues like things are going to break down, wear and tear, all that stuff, and just practically it feels dumpy inside, just so that I'm out of cash or out of pocket $3,000 and I have a functional car. No, I work really, really, really hard so that my wife can have a car that she's like, "Ooh, I'm in a really nice car." Now, does that mean I need to go buy the Tesla version of a van? No. But maybe finding a deal around 12,000 or 15,000 would be suitable, but even at 12,000 I can take that and put it in the land business and make a whole lot more money.

Seth Williams: Yeah. It sort of sounds like we're talking about two separate things here. We've got this conversation or is it wise or is it not wise to take the money, invest it and use that investment income to pay for the car, so that's kind of topic number one. But then we're also getting into what makes me happy. What kind of car is going to give my family a good life, and that's kind of a different conversation. On paper this idea of investing the money and using that cash to pay for the car, if that was your plan all along, then yeah, totally. I mean, at least on paper where everything looks all neat and tidy. I don't know why or how you would disagree with that, unless you had, say if you were planning to use that investment income to retire or pay for college, and then you ended up diverting it to the car instead. That's kind of a different story. That's kind of shooting yourself in the foot a little bit because you're changing your plan. But I mean, if you bought it with that intent, I don't see how that's a bad thing.

Seth Williams: Getting back to that issue though of like what is considered a nice car. What is even considered wealthy? I mean, if you compare yourself to anybody else in the world, if you're making more than 32 grand a year, you're already in the top 1% of wealthiest people in the world. So it's like what is a dumpy car? How do you define that? I think it sort of gets down to what makes a person happy and how do you measure that, and is it possible that happiness can come from different things. By the way, I don't want you to take this in any way like I'm telling you you need to be happy about other things or I'm judging you, because I've had plenty of these battles myself and continue to have them all day long, but for me this kind of crystallized in my head when I was reading the Mr. Money Mustache blog because he talks about this a lot, at least he used to years ago.

Seth Williams: This whole issue of cars, and stuff, and houses, and status. What he's really trying to get at in his life is happiness. What makes me happy? That's ultimately the point of getting nice things, is to be happy with that, and he sort of figured out psychologically like does happiness come from a nice car or does it come from a bank account with a million dollars and the ability to work if and when I want from wherever I want, zero financial or obligations that I handle. Is that more important or is it important to have this car that hits this certain milestone, or cable TV, or a super expensive phone with a data plan. I mean, fill in the blank with whatever it is. He posts pictures of both of his cars and they're both arguably what I would consider to be kind of dumpy. I wouldn't be ashamed to be in those cars, but it's not what I would consider nice by any stretch, but they were paid off, and he doesn't have a home mortgage, and I think his family budget each year is like 32,000 bucks a year or something like that. Don't quote me on any of this stuff. This is just my vague memory from reading his blog, but it just begs the question of what do you really need?

Seth Williams: Even he's got another blog post about the real cost of commuting, and this hit me hard because I used to have like a 30-minute one-way drive to work. By the way, I'll link to his article in the show notes for this episode because it's pretty brilliant, you should check it out. He gets into the numbers about how much it really costs you, not just in gas but also in the wear and tear on your car and the cost of your time. If you're driving hours, and hours, and hours to a place that you go every single day and how much that adds up, and how much your time is actually worth, you can actually justify buying a significantly more expensive house if you just live closer to where you go every day, close enough to ride your bike even because you're eliminating the cost of driving so much and spending a lot of time in the car.

Seth Williams: I don't know, just I think a lot of us have these ideas of well, this is just the way it has to be. I have to drive this far to work, or I have to own this kind of stuff, or this kind of house, and it's like, not really. You can wipe all of that out and just rewrite the script and realize that happiness doesn't necessarily come from a certain amount of money or having a certain thing, or living in a certain place. It's all in your head. Understanding what you think is going to be happy, and kind of defining and just telling yourself I am happy with this because I have this amount of freedom instead of money or things. For me that was kind of when I realized I can quit my job a lot sooner than I thought I could because I don't actually need to make that much money. I can just choose to be happy with less, and there's tons of people who work way harder than they have to years beyond the retirement date that they could've had so they can pay for really stupid stuff. All kinds of little odds and ends that add up that you don't need. For some reason we think we do, but we don't.

Jaren Barnes: Yeah, but going back to happiness, it's not about need, it about wants. If you just take a step back and you think about what's really important to you and make those the priority for what you spend on, I think that's the name of the game. So for example, I'll get personal into my whole situation, right? I live in 950 square feet with four adults and a baby. I live in a duplex, I'm in the process of buying and I'm on land contract, but the tenants pay for my monthly payment, so I'm out of pocket for insurance, and taxes, and everything. I'm out of pocket around $250 a month. It's not luxurious. My wife can't stand the kitchen. There is definitely some deferred maintenance. The windows are really terrible, it gets really cold, especially upstairs where I sleep. I have two bedrooms and one bathroom which is one the upstairs floor. So I work in the basement. In order to go to the bathroom, I got to go up two flights of stairs. I don't have a television set up. I don't really watch TV. I don't think that it's important, I don't want my family culture to be raised around watching TV every day.

Jaren Barnes: In terms of sacrificing now, so doing what nobody else would do now do that I can, all right, what he says is like in order to live like nobody else, in order to have whatever.

Seth Williams: Live like no one else.

Jaren Barnes: Yeah, something like that. I'm definitely doing that. I have two cars, one is paid off and one is on payments. I don't know if you guys remember, but Seth interviewed me a long time ago about me making just under $40,000 in one land deal. Well, at the time I was very indoctrinated in the ideology of Dave Ramsey and I was like, all right. My two biggest things of worth that have debt are my cars. So I'm going to pay them off. So I took the $38,000 or whatever that I made and I paid off both of my cars. I had a van at the time. Long story short, me and my wife had some contention around the van. She ended up trading it in for the Prius that we now have because she wanted to drive for Uber, and I was very adamantly against it, and it was probably a dumb decision, but anyway, I digress. I don't want to get into all that. I took $38,000 and I paid off both of my cars. I had some money left over for future investing and stuff like that, but if I would've taken the money that I would've spent on investing, in paying off my cars, and just double down and put it back in my land business, I probably would be able to do a whole lot more deals at this time because there is a compound effect there.

Jaren Barnes: I mean, I probably spent something like 25, 30 grand. So I might have had about 10,000 leftover. If we just take $5,000 per each land deal, roughly maybe 6,500 with closing costs or whatever, but that's a lot of deals that I could've done and I could've turned within the last year and a half, two years or so. I actually look back on it and I think that it was probably one of the worst decisions that I've made financially, paying off the cars.

Jaren Barnes: So if you look at your circumstances, for me I would rather with ... My wife doesn't like to fly. She doesn't feel comfortable with it. It's like a fear thing. She doesn't like flying, she likes to drive. So if we go and do family trips, her preference is going to be to drive on those family trips. So if we're sacrificing, and we're house hacking and living with tenants next door, and living in a place that has a bathroom on the very top floor and all that, I think it makes sense for me to pay, what? $200 a month, or worst case $250, $300 a month to have a really nice car. It's important and I think that it would be a nice experience and a nice addition to our life for me and for my wife mostly. If it was just me and I was a bachelor, 3,000 bucks, heck yeah, dude. I wouldn't even buy a van. I'd probably have some dumpy truck and not even worry about it. But because the whole reason why I do what I do is so that my wife, and my family, and her family can really experience life to the fullest, that's something that would be important to us.

Jaren Barnes: So I think are we speaking to the morality of you shouldn't have stuff. I don't think that's really the heart behind the conversation we're having. I think it's more don't let stuff, have you. Make sure that the stuff that you do have is very intentional and has a purpose in your life and adds value.

Seth Williams: Yeah, it reminds me of a William Shakespeare quote I heard not long ago. It's something to the effect of nothing in life is either good or bad, but thinking makes it so.

Jaren Barnes: I love that, that's good.

Seth Williams: That was one of these mind-blowing quotes when I heard that because so much of life is this internal dialogue of what you tell yourself. This happened, uh-oh, that's not good, or this is going to happen, oh, that's great. Why do you think that's good or not good, and is that, are you lying to yourself? Maybe it's just kind of a neutral thing, it doesn't even matter and you're just telling yourself it's terrible. I do this constantly, all day long. I just tell myself all these horrible things about just what's happening in the regular course of life. It's like a huge burden to carry around, honestly. It's one of my major flaws that is in my brain. But my first house that I lived in, Jaren, was actually like very, very similar to yours.

Seth Williams: A lot of the attributes you're talking about. It was about 900 square feet. I remember we only had one bathroom on a different floor. I had to run to the bathroom in the night, climbing up and downstairs. It was terrible. The worst thing anybody has ever had to deal with. But I remember a similar thing. I wanted to get out of there. I was just tired of it, but a lot of that had to do with what I was telling myself. I was allowing myself to get really annoyed by that. Not thinking about hey, a lot of the world lives in a either no house or one that's 75 square feet in size with no bathroom in it at all. So I could focus on how much better my situation could be, and it certainly could've been and it got better, or it's like ... I don't know, it's all relative to the narrative you tell yourself.

Jaren Barnes: It's all subjective, 100%.

Seth Williams: Well, I mean, going back to the whole debt situation. Is debt good or bad? I mean, I think we've already established that it's just way too broad of a question. There are so many variables that go into that. But just in illustration from my own life. It's always been a dream of mine to pay off my house and have no mortgage, even after the two very enlightening podcast interviews we had with Keith Weinhold where he totally dismantled that idea and why it's ... If you're an investor, that's not smart. There are much, much better ways to use your money. So even with that full knowledge, I still wanted to pay it off. It was almost like, it was kind of like when I got my MBA. It was completely unnecessary, has not really served that vital of a purpose other than just being interesting and learning a few things here and there, but career-wise it hasn't done a whole lot for me. It was just a life goal I wanted to check off, and that's fine. I decided that was important for some reason, but paying off my house was a similar thing, where it's like I knew objectively it's not the smartest use of money, but Dave Ramsey said I should do it, and I guess apparently the grass is going to feel differently once my house is paid off. At least that's what he always says.

Seth Williams: So anyway, so our house is within 8,000 bucks of being paid off right now. We're just waiting for the last few payments to take it out, and I've come across this, as inevitably I would be a real estate investor, I've come across this investment opportunity that would normally require a commercial loan for a couple $100,000 to buy this thing, but the problem with that is commercial loans generally are a lot more than a couple $100,000, and most banks don't really want to waste their time underwriting that small of a commercial loan. An alternative, a much easier way to buy this property would just be to refinance my house. So start it all over again with the original mortgage, take that money, and buy this commercial property free and clear. I mean, now that I'm actually being confronted with this situation, I'm realizing it probably wasn't that smart to pay off my house because if I had just pocketed that cash I'd be able to move a lot faster and have just a lot more speed, and agility, and power to buy this exact type of property that I'm going after right now.

Seth Williams: I mean, granted, you can always take out a home equity loan, like I'm looking at doing. That's an option as well, but to just have a blanket statement of yes, it is always smarter to have no home mortgage. That may be true for somebody who is not an investor and is never going to be dealing with those situations, but if you kind of want to do what we do, I don't know. I mean, you just can't make that bold of a statement. There will probably come a time when it's a heck of a lot better to have that liquidity, and a home mortgage is super cheap money with a 30-year amortization if you wanted. I mean, if I were to try to get a commercial loan, the amortization would have to be 20 years, which means my payments would be a lot higher with a much higher interest rate. So the ability to use that home equity is really powerful. So I don't know if you can say it's always better to just pay it off because you're throwing away a lot of options when you do that.

Jaren Barnes: And with the FHA loan, you can come to closing with very little out of pocket, like maybe worst case 10 grand, 15 grand. Especially if I and my wife have had pretty lengthy conversations that we're planning on house hacking for the next several years of our life and marriage. Our kids will probably grow up in a house hack situation. We'll probably end up upgrading from this place that has a little bit more square footage and maybe three bedrooms and hopefully two baths, but we'll always be at least in a two, three, four-unit just because you have your tenants paying down your mortgage, even if you're a little bit out of pocket. It's just so much better in every single way, and you have tax benefits, you have depreciation, you have all these amazing things happening in your favor when you do a house hack.

Jaren Barnes: Now going back to what I was saying about the FHA loan, it's pretty phenomenal because I can get a four-unit, I can get a quadruplex for three and a half percent down, which from a Cash on Cash Return perspective, that's nothing. That means that I'm putting up maybe 10 grand for maybe a 250 or $300,000 property because a lot of the times if you're working with a more flexible lender, they can factor in some of the rental income as additive income for your salary.

Jaren Barnes: So long story short, it's pretty phenomenal what you can do in real estate. I would really encourage you guys to consider using the FHA loan for your primary residence if you can help it because it's like yeah, yeah, PMI and other things that you have to pay for, but it's like going back to that Cash on Cash Return, man, it's hard to beat that.

Seth Williams: Yeah, and if you're house hacking, even if you're not actually making money out of the deal but a tenant is paying a very large portion of a mortgage payment that you otherwise would have to pay out of pocket, oh yeah, totally, man. FHA is amazing. That's just a great way to consume very little of your money to have somebody else build equity for you.

Jaren Barnes: It's awesome.

Seth Williams: Actually I wanted to do that long before I ever had this house hacking term. I wanted to do that as my first property, but my wife was not on board. That's actually a whole other discussion we can talk about another time, but she just wanted to be normal. I think it just comes down to do you have a strategy that makes sense that's going to not bleed you dry, but at least pay for itself, or better yet make you money in the process, because if it does and if it's reasonable to think that income stream will always be there unless something crazy happens, it's just smart. I don't know why you would say automatically no to that.

Seth Williams: I think the reason Dave Ramsey's advice makes so much sense for so many people is that there is not very good financial education in any school system that I've ever seen. It's just not something that you learn. So as a result, a lot of people have no idea what they're doing with their finances. They just don't even pay attention. They let go of the wheel and that's how they get just buried in debt. I mean, they have no real way of knowing how to get out of that because if you're not an investor or entrepreneur and you don't understand how money works, you just kind of keep piling it over your head. Because a lot of people are in that situation, as black and white as the message is, it is the right message for a lot of people, because if you're never going to be smart about debt, then yeah, it doesn't make sense to have it. Get rid of it. But if you're kind of on that next level of understanding how money works and how to create a good debt situation that's paying you, then you kind of have to see past that. I think that's where Robert Kiyosaki comes in and opens up a lot of people's minds because he explains that pretty well in a lot of his books.

Jaren Barnes: I would like to kind of address college debt in this conversation because I feel like that's a whole nother animal, and I'm actually really anti-school debt. I think that if you're going to go to university you should do anything and everything that you can within your power to exit out of school with no debt because that, student loan debt is nasty, man. That thing will follow you until the day you die. A lot of people go to school and don't really know what's going on. They're young, they're just starting off in life, and four years into being an adult they all of a sudden have a mortgage that they're on the hook for and they can't get rid of.

Jaren Barnes: I am so thankful that, from this perspective, I'm so thankful that I dropped out in freshman year and I just went and pursuit other things because I don't have that hanging over my head. Whereas I know a lot of people where they just can't get out of the hole because they're on the hook for this insane amount of student debt and they got a degree in English. If you're an engineer or you're a doctor, or there is a very clear ROI if okay, I'm going to put up, I'm going to be on the hook for a 100,000 or 200,000, but I'm making out of the gate once it's all set and done 300,000 a year, well then you can take half of your salary in the first year and then pay off your student loan debt and you're good. That makes sense, but most people don't look at school as an investment and they don't approach it that way. They look at it like oh, this is the coming of age thing to do, so this is the time of my life. So I'm no longer in high school, I'm in college, whoop-de-do, and then I have no idea. They have absolutely no strategy.

Jaren Barnes: I think that actually brings up a good point, man. I feel like what you just said and what I just said is really the meat and potatoes of this conversation. People need to have a strategy when it comes to finances in their life. If you don't have a strategy, that's when you're going to get into trouble. That's when you're going to get stupid debt and you're going to go buy a boat when you shouldn't be buying a boat and all of that. It's all about having a plan.

Seth Williams: I know when I was in college-age it was totally the message coming from everywhere, if you want to amount to anything in life, you got to go to college. You're not going to make it if you don't do that. I mean, I don't know if anybody ever just blatantly said it like that, but that was totally the vibe I got from a lot of people. I totally believed it, and so I went to college, and barely got through. I mean, it was, I went to a really, really hard academic school. When I got done it was a pretty terrible job market. I got a job but not with ease. I mean, it was pretty hard. It was very, very competitive to get a job, especially where I lived, in Michigan. I mean, the economy was terrible at the time. It was not just a perfectly paved road where everything was easy. I mean, it was tough. Part of that was probably because I wasn't an academic genius. I didn't have a 4.0 GPA, and I wasn't the pedigree that every employer was looking for. But yeah, I mean, generally college did not just automatically solve all of my problems.

Seth Williams: I think when I look at you, Jaren, you're like one of the best examples I personally know of why college is not a necessity for success because I would take a 100 of you before I would take a lot of people with this four-year degree, or even master's degree. I mean, the degree really doesn't mean a whole lot. It's kind of like a stress test to prove that you have some intellectual capacity, but it doesn't mean you don't have it just because you didn't get those. It just means you didn't jump through those hoops. When it comes to deliverables and people who can actually put out the results that are needed, there are endless examples of people who have college degrees that are terrible at their jobs.

Seth Williams: Knowing what I know now, it's like, would I still have gone to college? I definitely had some amazing experiences there and met great people, and it was a very eye-opening experience in a lot of ways, but I probably could've had very rich life experiences in other avenues as well. I was never in the military, but sometimes I wonder maybe if I had done that for a couple of years, where that would've taken me, who I would've met, what I would've learned. I don't know, I never will know. But yeah, I agree though. I think if you've got rich parents who were paying for everything, awesome, you're golden, but to just blindly go down a path, not really knowing what you want to even do or if you're going to be good at it, or even if you do know what you want to do, but it's definitely not going to pay enough to cover that debt. I mean, that's just kind of foolish. I don't know why you would knowingly do that, but a lot of people when they have to make those decisions.

Seth Williams: I think about where I was at when I was 18 years old. I didn't know what I was doing. I was totally just like well, this is what you're supposed to do now, so I'll do it. I get why a lot of people end up in that situation. It's kind of messed up when you think about it.

Jaren Barnes: I want to say thanks, man, for the compliment there. That means a lot. I don't want to paint a picture that ... Let me just say it like this. College is a very good option for the right people, and one of the drawbacks of my path in life of not going to school and getting a four-year degree is that I have to be extremely self-reliant, and my skillset is extremely niched. I have content marketing experience, working on blogs and podcasts, and what have you, and I have real estate experience, but outside of those two worlds if, god forbid, but Seth were to shut the doors and be like, "Well, I'm done. I'm going to go live on the beach somewhere, Jaren. See you later." I have real estate in place now, so it's a lot better, but a few years, I mean, I pretty much had to go work for Uber. Any time I'm in transition I just take up driving for Uber or kind of, I don't want to say dead-end jobs because that's kind of demeaning, but transitional jobs. You have to kind of think on your feet and you have to be self-reliant, and you have to be a self-starter, and you have to go create your own opportunities, and not everybody is like that.

Jaren Barnes: A lot of personalities out there are just kind of show up, clock in, clock out, and go home. If you're like that, there is no shame in that. I'm not shaming you at all, but if that's more of your personality, then having a college degree is nice because you have a fallback plan. You can at least get a semi-decent job in a good economy, whereas me, I don't know, maybe now that I have some experience, I'm in a different spot, but for a number of years it was not like that. I just had a lot of really good breaks, and had to really hustle in order to get where I'm at today, and I have to continue to hustle in order to where I want to get to in the future. But I think that's kind of the same with whether you have a degree or not. I'm just trying to say that with a degree it's nice to have a safety net. You have a fallback plan that I don't really have.

Jaren Barnes: That being said, I just want to reemphasize. I would approach university with an investor mindset. So I would say okay, this is how much it's going to cost, this is how much I'm going to be on the hook for. Am I going to get a clear ROI? And if your career that you're pursuing has a very high likelihood of you landing a job that you could pay off your student debt in a year to two years, three years maybe, or maybe even five years. As long as you have a definitive plan on how you could pay the thing off quickly, you're good. But if you go study creative feminism or something like that, even though it might be really, really interesting, there are not many jobs that you can get from those types of studies.

Seth Williams: It sounds like a good time to recite this Jim Rohn quote where he said, "Formal education will make you a living. Self-education will make you a fortune." Wow, let that sink in for a minute.

Jaren Barnes: That awesome, man. Great quote.

Seth Williams: The funny thing is when I think about, I don't know if I'd say these are the most valuable things to know, but they're up there. I mean, they're incredibly valuable and just practical, is understanding how to manage finances like investing for example, and knowing how to be an effective salesperson. Selling yourself, selling your ideas. I mean, just being persuasive in general. I don't know of any colleges that have a course on sales or a course on how to manage finances or invest. I'm sure they're out there somewhere. Western Michigan University I think is one of the few in the country that has a course on selling or a full-blown degree on sales, but it's very, very rare, and that kind of blows my mind that things that are that important would not be taught in college that is meant to train you for life in your career. Why would they not talk about it? I mean, at least pay some kind of service to it, but they don't, on the places I've been at, anyway,

Jaren Barnes: Yeah, man. I think there are some programs that are getting better. They have entrepreneurial studies and things like that, but I don't know, maybe this is a bit biased, but I would rather go get paid to learn by joining a sales team than pay a college to teach me about sales so that I could go get a sales job, you know?

Seth Williams: Yeah, that's true.

Jaren Barnes: I'm sure that the program would be great, but there are fewer things better than actually getting the first-hand experience. There is inherent limitations though, like again, it makes you much more niched. You're not going to know the ins and outs, the history of sales, and how modern-day, who is the father of modern-day sales, blah, blah, blah, but you're going to know how to practically pick up the phone and call somebody and make a sale, right?

Seth Williams: Yeah, that's a good point though. I mean, on the job training, man, just in my experience it's been infinitely more valuable than anything I ever learned in school. When I think about my first day on the job, when I was working at banking, man. There was very little of my college education that I drew on to start doing that job. I mean, maybe like 10% of it at the most was stuff I had learned in school, and the other 90% it was all specific to that job and what I had to do. I mean, it almost made me wonder, why is a college degree even needed for this? I mean, the only thing I can think of is it proves that you went through that mental stress test, but that's it. It doesn't by any means mean that somebody who is not college educated can't do the job. I sort of get it, but it's terribly inefficient and it doesn't add up. One does not necessarily equal the other.

Jaren Barnes: Yeah, it's fascinating stuff, man. I will say though, to reiterate, if you got to go become a brain surgeon, I want you to go get a college degree. If you're going to work on my brain, you better have a doctorate in medicine, you know?

Seth Williams: Yeah. I got an uncle who is a craniofacial surgeon. He can literally reconstruct your face and make you look different. It's crazy. He can do stuff that there are not that many doctors in the world who can do this, and he had to go to college, post high school for a total of 16 years before he could finally fully do his career. It's just like man, that is a ton, a ton of school. I think he was like in his late 30s when he finally got out of school and could start doing his job. He makes a lot. I think it's enough to cover his student loans and that kind of thing, but it's pretty crazy.

Jaren Barnes: If I look back on my career, on the job training, that and reading widely, being an avid reader, and podcast listener, but mostly books, I attribute a lot of it to business books and personal development books. That and then just throwing myself and being willing to be Johnny-on-the-spot at all cost. I've seen other guys, especially my age. For whatever reason, there is a tendency within people in my age group to be entitled or have a chip of their shoulder, or they'll go into a job interview and be like, "These are the perks that I want." La, la, la, la, la. They don't have anything that they're bringing to the table. They don't understand negotiations and how all that stuff works. But me being willing to scrub toilets, or be the first one at the office, the last one to leave, all those things really, really helped bring me to where I am today. From a Cash on Cash Return perspective, you're getting paid to learn instead of paying to learn. So you're way in that positive.

Seth Williams: Yeah, and that's a great point. I mean, I've always, I think I've always had this mentality, just self-evaluating here, but just that willingness to do nasty, hard, non-glorifying work. It's just slogging through stuff. It's not fun, but I'm willing to do it. If that's what I've got to do, I'll do it. It's not like I'm above anything like that. I know you've totally lived by that, Jaren. I mean, seeing you work pulling late hours, working the weekends. I'm not even asking you to do it, you just do it. That kind of thing. I mean, that kind of thing makes an employer love an employee, and really just want them to succeed and go further.

Seth Williams: It just says a lot to do that kind of thing, and I don't think I was ever quite that gung ho for my employer when I was, there were a few times I had to work really late, but that was very rare. I would only do it if there was a gun on my head. But yeah, I mean, just advice for people out there who want to get ahead, whether it's in a job or just if you want your employer to help you along and be motivated to give you more opportunities. I mean, that goes a long way being there before the boss gets in and there after they leave. I mean, that sends a message, and that can take you a long way in life.

Jaren Barnes: Just take ownership of the company as if it was your own. That's what I always try to do. It's like if I'm working there, and to be fair, at this point in my career I can be a little bit more picky, right? When I was working as a fryer at Wendy's part-time, I left that job within a month and a half. When I worked security at night I would bring my laptop, sneak it in, and then I'd start working on startup stuff that I was doing and I ended up getting fired from that. So it's not that every single job I've been super passionate about to work, but if you can find something that you can align with and really go all-in on, go all in, and really go all in because you'll be very pleasantly surprised where that leads you.

Seth Williams: Yeah, for sure. Well, so what's our conclusion? Did we solve the problem of who is right, Dave Ramsey or Robert Kiyosaki?

Jaren Barnes: I think we did. I think what it boils down to is you just need to be intentional about what you're doing with your finances and with your life. You just need to have a game plan and debt can be a tool, for sure, but it can also be something that can radically destroy your life and make it, like you'll feel like you're living in prison and you can't breathe. So I really liked your fire analogy, Seth. I think that looks at debt like fire. It's very powerful and in certain circumstances, it can burn down a city, and then in other circumstances, it can cook food for a family. You just have to use it in the right context.

Seth Williams: It is probably worth noting if your goal is to never really be an investor, you're not really gung ho about starting a business, or doing anything fancy like that, you're just content stocking money away in your IRA or something and doing that, then Dave Ramsey probably is a good person to pay attention to, because it's pretty simple. You don't have to think much more beyond just your paycheck, but if you want to be an entrepreneur, start a business, buy real estate, stock market, anything like that, then I think you definitely have to listen a lot more to Robert Kiyosaki, and if you're going to go down that road, realize that brilliant business is an extremely, extremely complex thing. There are so many different variables that can get in the way and screw up your plans. You can literally get PhDs in nothing other than how to make projections, where we think finances are going to go for a business because there's just so much that goes into it.

Seth Williams: I mean, you're trying to predict the future, and anytime you analyze that rental property or an investment property, that's kind of what you're doing. You're making a lot of assumptions based on the information you can get and the quality of that information, and trying to guess what the future is going to do, and it's never going to be a 100% right. Something will be a little bit off, but hopefully, if you've done your research well and god is good to you, things will go hopefully somewhat according to plan. This is all stuff you don't have to think about if you're going to go the Dave Ramsey route and just be a nine-to-five, but if you're going to go down Robert Kiyosaki's lane, just be ready for a lot more complexity and a lot more thinking and analysis to get to where you want to go.

Jaren Barnes: For me I feel like the biggest takeaway in this conversation is that you want to approach debt with the mindset of an investor. So if there's not a clear ROI for you using debt, don't do it. If you're going to use debt to go buy the high-end speakers so that you can sound really cool when you drive down the street in your souped-up car, that's dumb. There's no clear ROI. Debt is a tool that needs to have a return on investment, and as long as it does and you have a really solid plan, go for it, but otherwise stay away from it.

Seth Williams: Yeah, totally. Well, thanks again to all the listeners out there for joining us. I hope you guys got something interesting out of this. If you guys want to get updates on what we're doing at REtipster.com, here's what you do. Take out your phone and text the word free, that's F-R-E-E to the number 33777 so you can get notified of all the best stuff we have coming up. You'll get access to our library of guides, free investing calculators, learn about opportunities to engage with us, and maybe even get featured here on the podcast. We've also got a ton of great conversations going on in our Facebook group. You can get access to all of that stuff by texting the word free to 33777. Thanks again everybody for joining us. Hope you're having a great day. We wish you all the best in your business and life. We'll talk to you next time

Sign up to receive email updates

Enter your name and email address below and I'll send you periodic updates about the podcast.

Share Your Thoughts

- Leave your thoughts about this episode on the REtipster forum!

- Share this episode on Twitter, Facebook, or LinkedIn (social sharing buttons below!)

Help out the show!

- Leave an honest review on Apple Podcasts Your ratings and reviews really help (and I read each one).

- Subscribe on Apple Podcasts

- Subscribe on Spotify

- Subscribe on Stitcher

Thanks again for listening!