REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Real estate investing may seem like a complicated business, but most investors lose money in just a handful of ways.

If you get these few, critical pieces of the puzzle right, the rest will usually fall into place as mere logistics.

Some of these risks are faced by both flippers and long-term rental investors, while others are unique to one or the other. The same principles often apply to land, commercial and mobile home investing as well.

Here are eight big risks to focus on as a real estate investor, along with specific ways you can mitigate each one.

For All Residential Investors

Both flippers and long-term, buy-and-hold investors face these two risks, so no matter your strategy, don’t fall prey to these two missteps.

1. Underestimating Repairs

Unless you buy turnkey rental properties, you will likely find some repairs or updates are needed when you buy an investment property. After all, forcing equity is a real estate investor’s bread and butter.

Repairs could range from minor cosmetic retouching (a paint job, fixing a backsplash, etc.) to a complete gut and renovation. When you evaluate a potential property for purchase, one of the most crucial jobs you assume as an investor is accurately estimating repair costs.

Once, on my second day into a renovation, I got a call from my general contractor saying the framing in my unit had rotted behind the walls and much of the house would need to be reframed. The total cost of this fix? A whopping $10,000.

While that house was intended as a flip, I ended up keeping it as a rental because I would have lost money if I had sold it. But, because I hadn’t prepared for renting as a contingency plan, the cash-flow numbers were ugly. I still ended up losing money on the deal in the end.

I'm certainly not an outlier in this situation. Most seasoned real estate investors have a story like this from early in their career.

Mitigation

First, include a contingency clause in your contract allowing you to withdraw from the deal – with a full deposit refund – if the home inspection reveals unknown issues with the property. (Read more about how to exit any bad deal here.)

Next, find the most thorough, nitpicking, anal-retentive home inspector in your local market, and send them in post-haste.

Be sure to also walk through the property with at least a few trusted contractors for their opinions on needed repairs. Ask them probing questions about what issues may not be visibly obvious, but nonetheless need addressing.

Wiring, framing, plumbing, ductwork, the furnace, the roof, the hot water heater, the air conditioning condenser — do the best inspection you can of each and get opinions from your Realtor, home inspector, and contractors.

Also, be sure to ask the seller about the age of each of the above, as they may be able to provide details. Just make sure you corroborate their word with expert opinions and invoices (if available).

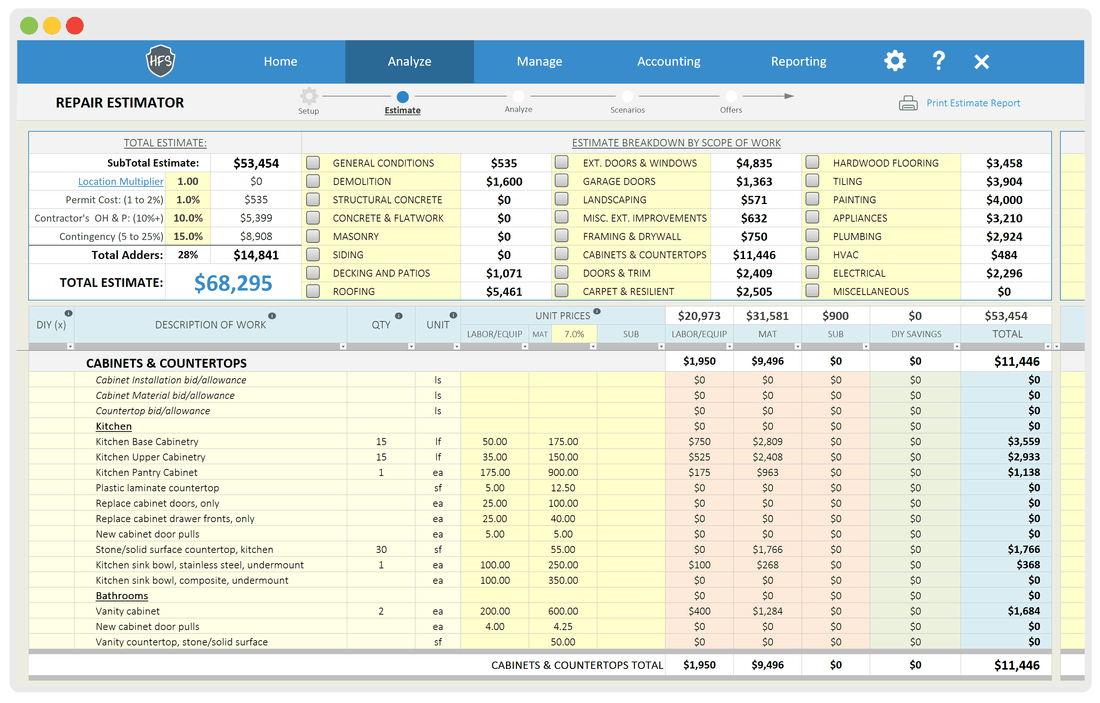

One useful mobile app for real estate investors is Property Fixer (available only on iPhones, iPads, and Macs). Another way to estimate repair costs is through HouseFlippingSpreadsheet.com’s free downloadable estimator tool:

The same company offers a web-based tool if you prefer to use it on the go.

2. Overpaying Contractors

Beyond the risk of underestimating needed repairs, there’s also the risk of being ripped off by contractors even when you accurately diagnose which repairs are needed.

Contractors are notoriously difficult to work with, and finding trustworthy, affordable, reliable contractors is an enormous challenge for many real estate investors. As difficult as it is to screen, hire, and manage contractors in person, it’s exponentially harder when you’re investing long-distance.

Unscrupulous contractors love to find ways to upcharge you over the course of the renovation:

“Well, we could do it the way we discussed in the original contract, but it would be better to do it this way … which will cost an extra $3,000.”

It’s classic bait-and-switch, where they attract your business with a low contract bid, then find ways of charging you more once you’re committed to them for the project.

Mitigation

Always, always, always get at least three quotes for any significant repairs at your investment properties.

Beyond the number of quotes, improve the quality of your quotes by building relationships with contractors whom you trust over time. Try new contractors on small jobs first, and, if they do good work on time and on a budget, then you can try them on a slightly larger project, and so on.

Trust takes time to build — especially when you’re working with assets worth hundreds of thousands of dollars.

When asking for a quote, make it clear that you expect all contracts to be completed on budget and on time. Also, ask contractors if they are aware of any risks of surprises in the investment property/properties in which they conduct work. If they respond that there is a risk, ask for specific details and the potential extra expense in a worst-case scenario.

Ask for second and third opinions from other contractors, to see if they agree with the main contractor you've employed. Then, do whatever you can to minimize the risk of extra expenses, and make sure that even in the worst-case scenario you will not lose money.

Before signing a contract, get your Realtor’s opinion on the contractor’s pricing and timeline. If they approve, ask at least one other local real estate investor for their opinion. Always verify contractors’ references, view their previous work, and check other clients’ reviews on websites like Angi (formerly known as Angie's List).

Here's how you can use Angi to do more research on your contractor:

Once you’ve signed a contract, stay in daily contact with your contractor. Visit the work site at least three times each week and inspect the quality of the work. Voice any concerns immediately with the contractor in a professional but firm way.

It’s your project, and you are ultimately responsible for making sure that all repairs are completed well, within your budget constraints, and by the agreed-upon time frame.

For Flippers

The above tips apply to nearly all residential real estate investors. But, what are some unique ways that flippers lose money (and ways they can avoid doing so)?

3. Overestimating ARV

If you overestimate the after-repair value (ARV) of a property you flip, you’ve set the stage for losing considerable amounts of money.

You must not, under any circumstances, overestimate the ARV. Without an accurate sales price, your profit goes from being a mathematical forecast to being anyone’s guess.

If you buy a property for $50,000, put $25,000 of repairs into it, and expect to sell it for $105,000, only to miss the mark and end up selling it for $80,000, you will lose money. That’s because you’ll still rack up soft costs – more on those shortly.

Mitigation

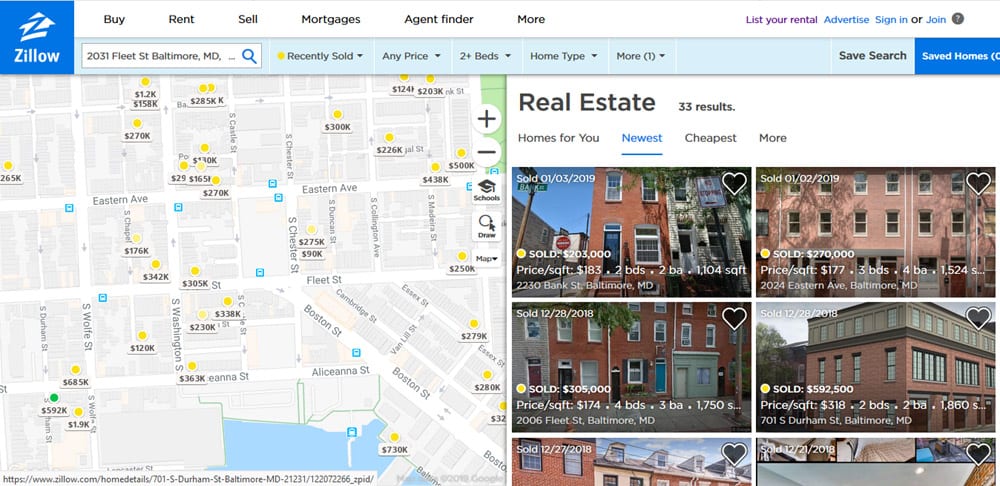

It’s easier than ever before to research comparable property sales (comps) and estimate current and post-repair property values.

Start with Zillow as a free, easy tool:

Remember, the less similar and the older that the comp is compared to your property, the less reliable it is. A condo with the exact same floor plan, in the same condition, that sold last month in the same condo community is a very accurate comp that you can use confidently. Find a house that’s vaguely similar, a few miles away, and in worse condition than your property? You’ll need to factor in more wiggle room.

To handle the risk inherent in calculating the ARV, set three numbers:

- An ultra-conservative minimum ARV (“This is my worst-case scenario.”)

- A moderately conservative ARV (“I think I can do better.”)

- What you genuinely think the ARV is (“This is my target.”).

These numbers can serve as a guideline for you and a reminder that you are working with probability, not certainty.

Your ultra-conservative, worst-case-scenario ARV? Make sure that doesn't leave your profit in the red. With luck, the property will sell higher than your target … but professional investors don’t bank on luck.

4. Underestimating Soft Costs

In the property-flipping game, soft costs are every expense other than direct renovation, material, and labor costs.

Soft costs include closing expenses (for both the purchase settlement and your second closing to sell), lender fees, interest, utilities, taxes, insurance, and any other costs you incur along the way.

Note that some of these expenses are carrying costs you incur every month you own the property. The longer you own a property, the higher your soft costs and the lower your eventual profit.

That’s why it’s so important that contractors finish the job not only on budget, but also on time.

Mitigation

Think of soft costs in three categories:

- One-time purchase costs

- Monthly carrying costs

- One-time selling costs

Your one-time purchase costs include expenses like the appraisal, the home inspection, lender points/fees, title costs, and property insurance. Get a good-faith estimate of closing costs from your lender, and add some padding to the estimate to be on the safe side.

When calculating your monthly carrying costs, be sure to include loan payments, utilities (e.g., gas and electric), water, and property taxes.

Unlike many homeowners’ insurance policies, investors’ insurance for flips is typically not refundable on a pro-rated basis, so it is not a monthly carrying cost, but rather a one-time purchase cost.

Your largest cost at the eventual sales settlement is, of course, your Realtor’s commission, but check to see if your Realtor charges any additional fees as well. Also, ask your Realtor about any other settlement costs that are likely to fall to you at this second settlement.

One mobile app that can help you estimate both renovation costs and soft costs is REI Estimator Pro for Investors (note that, after a free trial period, it costs money). For a free online alternative, try out RealMarkits’ flipping calculator.

Just as underestimating repair costs can ruin your returns, so can underestimating soft costs.

Flippers’ profits depend on accurately forecasting two things: expenses and ARV. Get these numbers right, and you will earn predictable, strong returns. Get them wrong, and you could be in for months of stress followed by thousands of dollars in losses.

When in doubt, estimate on the high side for expenses and the low side for ARV.

For Long-Term Rental Investors

Like flippers, long-term, buy-and-hold investors face their own unique challenges. Here are the most common ways these individuals tend to lose money.

5. Overestimating Rents

Just as flippers run the risk of overestimating ARV, rental investors risk overestimating rents.

Missing the mark by $100 can mean the difference between a moderate return and monthly losses. You must get rents right when forecasting a property’s cash flow.

Mitigation

The same tools that help you estimate property value can help you estimate rental rates. Check local comps using tools like Zillow. Here's a quick example of what Rentometer's free service provides:

You should also use lower-tech tactics to review comps, as not every rental property lists on Zillow. Start with oldie-but-goodie Craigslist to review other local rental listings. Also, check local circulars and newspaper classifieds, and then go walk the neighborhood looking for for-rent signs.

Put yourself in the mindset of a prospective renter. For instance, attend a few open houses of comparable properties listed for rent. How do they compare to yours? Your goal is to get a gut-level understanding of local rents.

Lastly, don’t count on rent appreciation. Rents nearly always rise over time, but “nearly always” is not the same as “always,” and you never know when a recession will knock rents down a few pegs.

6. Underestimating Rental Expenses

Nearly every new landlord underestimates the costs of owning and managing a rental property. Doing so often leaves them with negative cash flow and a sour taste in their mouth for landlording.

Here are some of the expenses you can expect to encounter as a landlord, along with common ratios:

- Vacancy rate: 4-8% of the rent

- Property management: 10-12% of the rent (including new tenant placement fees)

- CapEx/major repairs: 7-10% of the rent

- Maintenance: 5% of the rent

- Taxes: Varies widely by jurisdiction

- Insurance: 5-10% of the rent

- Administrative, travel & miscellaneous: 2-3% of the rent

These vary widely, of course. In lower-end neighborhoods, expect these expenses to be higher. As a general rule of thumb, the “50% Rule” is surprisingly accurate, stipulating that around half of the rent will go to non-mortgage expenses.

You will, of course, have to factor in your mortgage payment as well if you buy with financing.

Mitigation

By doing your homework, you can pull together accurate estimates for every expense listed above.

Start by speaking with other landlords and property managers who work in the same neighborhood, and ask about vacancy rates. You can also look up vacancy rates on Moving.com, but only down to the level of ZIP code, not the exact neighborhood:

You can (and should) have a specific property manager in mind, even if you plan to self-manage. Know their pricing, and, again, even if you intend to self-manage, budget for management. It’s a labor expense, regardless of whether you’re doing the labor or someone else handles it for you. To ignore it is to discount all the work that goes into managing rental properties.

Older properties will need more major repairs, so budget accordingly. Keep in mind that preventative maintenance can significantly reduce your long-term repair costs.

When checking the property taxes, don’t just look at last year’s tax bill. Make sure that the assessed value will not dramatically change based on the transfer. If it will reset, calculate the new tax bill based on your purchase price.

Get a custom quote for property insurance too.

We include a free rental property calculator on SparkRental, to help you calculate cash flow, ROI, and include mortgage and interest expenses. Here’s a quick video showcasing how to use it:

Like every other property-related expense discussed in previous sections, be conservative and estimate on the high side.

7. Unpaid Rents & Evictions

Few things ruin a landlord’s returns faster than rent defaults and evictions.

I’ve had nightmare tenants cost me tens of thousands of dollars. It’s a reality of rental investing, and a significant risk, as you’re entrusting an asset worth tens or hundreds of thousands of dollars into the hands of a stranger.

Don’t expect sympathy from judges. Most state and local landlord-tenant laws are designed to protect tenants more than landlords, and that goes double for larger cities. It literally took me 11 months once to remove a tenant from my property. The entire time they lived rent-free, using every loophole in the law to postpone eviction.

Read up on some of the other options to get rid of bad tenants, and you’ll notice that none of them are particularly fast or cheap.

Mitigation

There’s a simple way to avoid bad tenants: thorough, aggressive tenant screening. The problem is that it’s work – a lot of work, if you do it right — and most landlords just don’t feel like putting in that work.

Collecting rental applications and running tenant screening reports is the easy part. We offer it free of charge to landlords, as do some of our competitors. Here’s how you can run tenant screening reports in 90 seconds or less:

But the real work starts after those reports come back to you.

First, set aside a few minutes per applicant to read their rental application, credit report, criminal report, and eviction report in detail. Those latter two should be quick, as they hopefully don’t include any hits.

If the applicant still looks promising, pick up the phone and start calling past and present landlords, employers, and personal references. Follow these steps to steer clear of horrible tenants.

Note that you don’t need to be local to do any of this. You can screen applicants and manage your rentals from anywhere on earth.

8. Tenant Damage

It’s worth reiterating: When you sign a lease, you hand over possession of an asset worth hundreds of thousands of dollars. Anything can happen from that point forward.

Tenants can throw raging parties, leave the heat off when they go on a two-week ski trip in January, or punch through every single cabinet in the kitchen (that last one actually happened to me once, unfortunately).

Mitigation

Again, landlords can prevent tenant damage through aggressive tenant screening.

When you contact present and former landlords, ask specifically about how well the tenant treated their property. Specifically, ask about their cleanliness and conscientiousness — but don’t stop there.

As a final step in the tenant-screening process, go and physically inspect the tenant’s current home, and give them as little notice as possible. You want to get a snapshot into their daily life, because you can be sure the way they treat their current home is exactly how they’ll treat yours.

If you can't do that for some reason, walk them to their car and peek inside. Most people treat their car the same way they treat their home.

Include in your lease agreement a clause specifying semi-annual inspections – and actually perform them. That serves two purposes:

- It alerts you if the tenants aren’t treating your property well, so you can serve a notice to cure.

- It sets expectations and sends a crystal-clear message that you hold the property in high respect and them accountable to do the same — that you will not tolerate abuse or neglect of your property.

As noted, it can be a time-consuming task to perform these inspections, but the risk of not running them outweighs the hassle of actually doing so.

Final Word

None of the above is particularly difficult. Yet, new real estate investors get it wrong all the time and lose thousands or even tens of thousands of dollars.

Why? Because all of the mitigations outlined above take work. This isn’t your 9-to-5 job where you have a boss standing over you and specifically telling you to do this due diligence.

As a real estate investor, you’re the boss, and if you choose to rush your tenant screening or ARV analysis so you can spend your Saturday with your friends and family, no one will reprimand you (or even remind you, for that matter). You’ll just lose money on your real estate deals. And then, you’ll yell and scream and curse the “market” or “those evil tenants” or real estate in general as being a risky investment, when in fact it was you who failed to put in the hard work.

Direct real estate investing is not passive. If you want passive exposure to real estate, buy into an REIT.

If you want to earn excellent returns from real estate, focus on avoiding the pitfalls above, and you’ll find that it’s virtually impossible to lose money as a diligent real estate investor.