REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Real estate in coastal, metropolitan cities is expensive.

I mean really expensive.

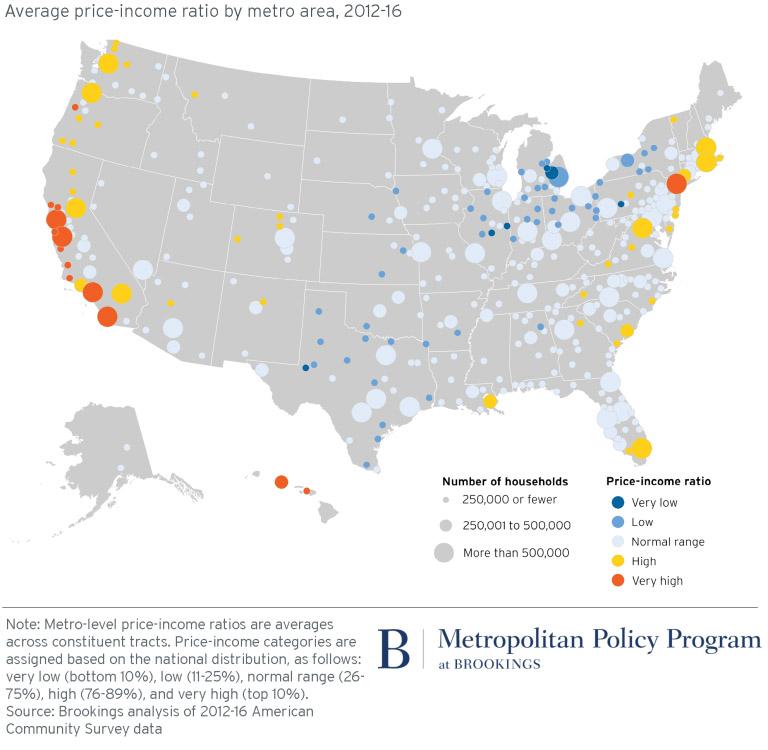

Two analysts at CityLab looked at the average price-to-income ratios in cities across the country and compared them to historical averages.

In a healthy market, average home prices are historically 2.6 times the average income.

In Los Angeles, average home prices are 9.6 times the average income.

L.A. isn't the only market with overpriced real estate. Here’s a map (courtesy of the Brookings Institute) of metro areas across the United States, color-coded based on price-to-income ratios:

With values so skewed in these high-priced coastal cities, it’s no surprise that real estate investors there are looking elsewhere.

The Rise of the Long-Distance Real Estate Investor

They say all real estate is local.

Well, not anymore; with the rise of virtual tours, virtual reality, 3D imaging, better communications technology, and turnkey investment property marketplaces, real estate investors are increasingly buying properties sight unseen.

A study by Redfin found that in just 16 months from mid-2016 to late 2017, sight-unseen real estate purchases nearly doubled, DOUBLED, from 19% to 35%. These numbers aren't skewed by professional real estate investors either… that group was largely composed of homebuyers, a finicky group less making a far more personal buying decision.

Turnkey marketplace Roofstock disclosed that a full 62% of all transactions on their platform involved a buyer over 1,000 miles away from the property.

Real estate investing is now a global game.

Choosing a Market

When you’re no longer tethered to your home market, it’s both freeing and overwhelming.

You can invest anywhere in the world!

At the same time, the world’s a big place, with hundreds of thousands of markets to choose from.

So how do you choose where to invest? Here are a few metrics to look for in a promising rental market:

Growing Population

Take it from someone who has made this mistake: you don’t want to invest in cities with declining populations.

Yes, there’s a small niche here for expert investors who buy dirt-cheap properties and milk them for all they’re worth. But it’s hard enough to do in person, and I don’t recommend it for long-distance investors.

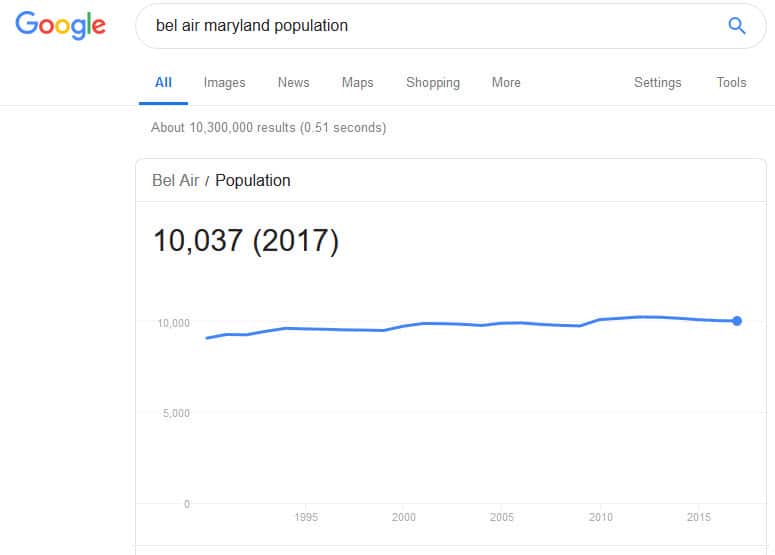

Population statistics are easy enough to find on a town or city level and a county level. A simple Google search will reveal a current figure and a graph, I’ll use my sister’s town of Bel Air, Maryland to illustrate:

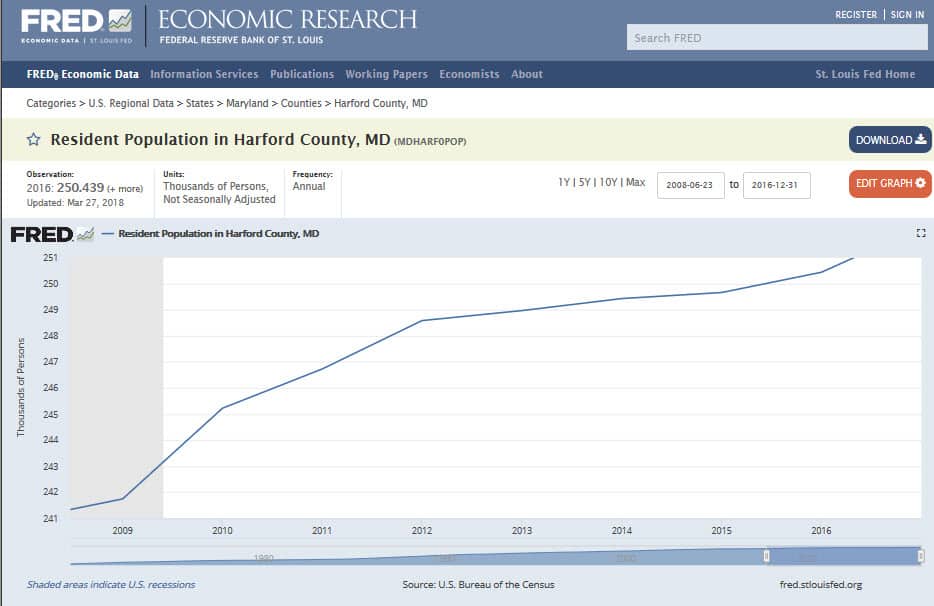

For a broader view, you can look up population growth on the county level through the Federal Reserve. Their website lets you zoom in on recent years for a closer snapshot of growth:

Look for a town and county that’s growing in population – and the faster, the better for real estate appreciation.

Age Distribution

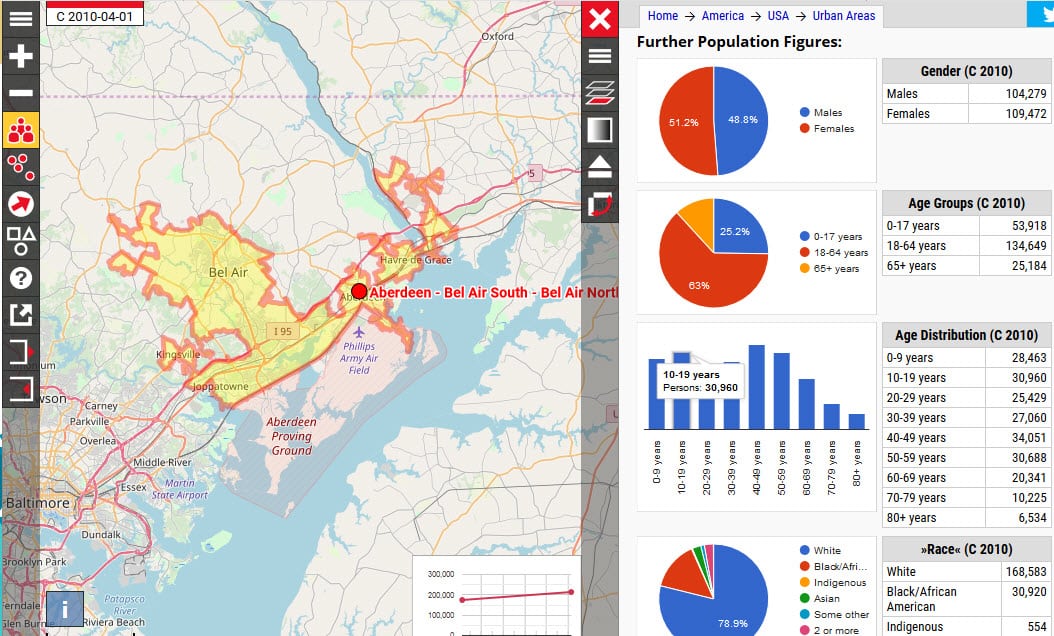

Similarly, a healthy and growing town should ideally skew young. More young people, both children, and young adults are a strong indicator of future growth.

You can see a graph of age distribution using CityPopulation.de:

Stable Employment

What’s the local unemployment rate? How does it compare to the rest of the state and the US as a whole?

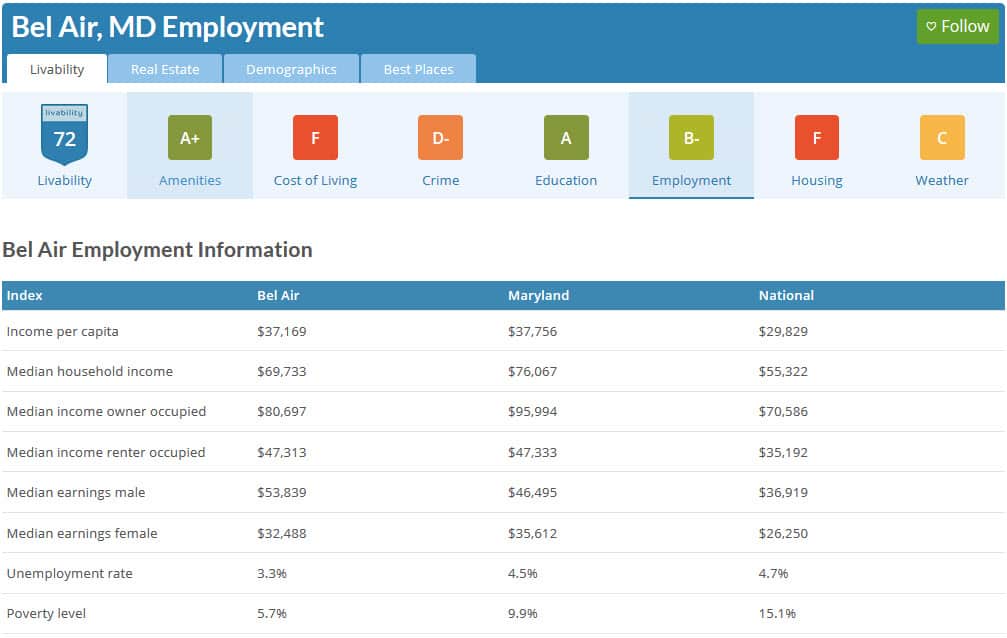

On the town level, check out AreaVibes:

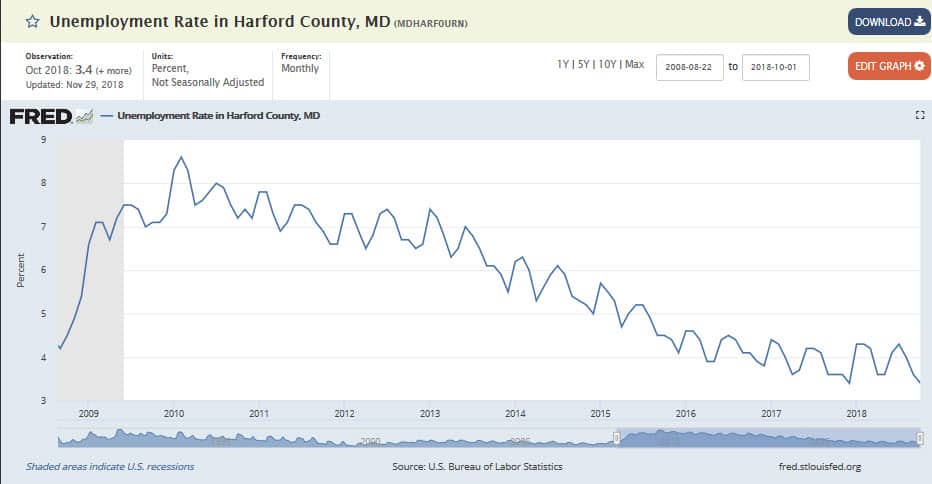

On the county level, the Federal Reserve offers a graph to help you look at the trending direction:

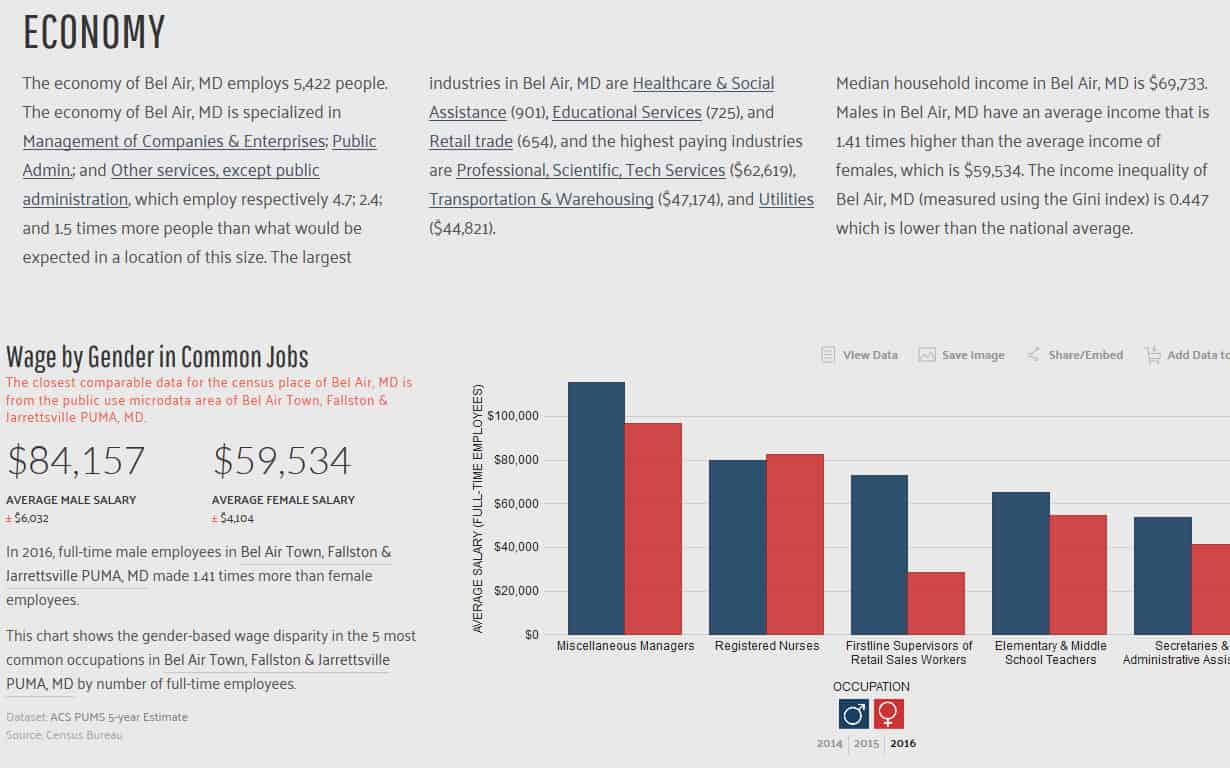

Beyond unemployment, look at how diverse the local economy is. A town that is dependent on a single industry is a sitting duck for economic collapse – look no further than old gold mining towns, coal mining towns, or manufacturing towns like Flint, Michigan.

You can find this information (and a lot more) at DataUSA.io:

Schools

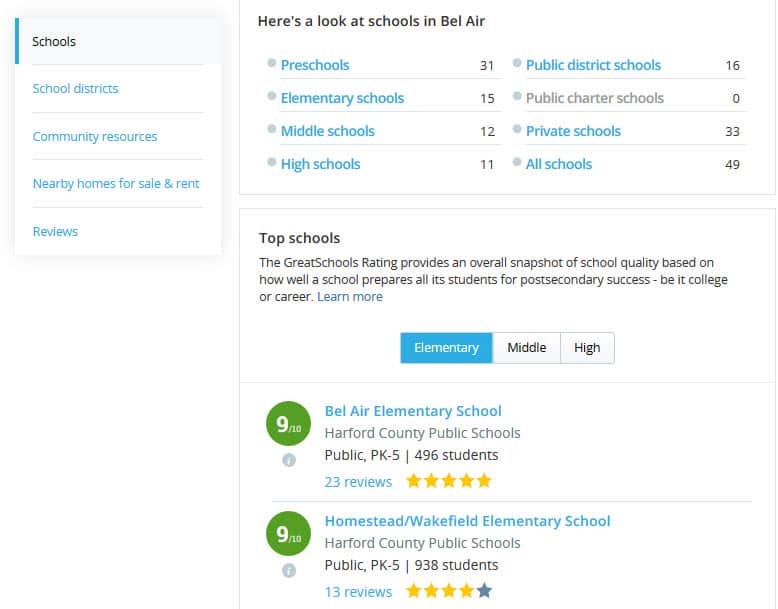

No one wants to live in a bad school district. By investing in one, you’re setting yourself up for a high turnover rate, as renters move on as quickly as possible.

GreatSchools.org offers a good summary of local school quality, along with school ratings and parent reviews:

Crime

The same goes for crime: tenants will move on as soon as they can afford to if the crime is high. Look for areas with low crime.

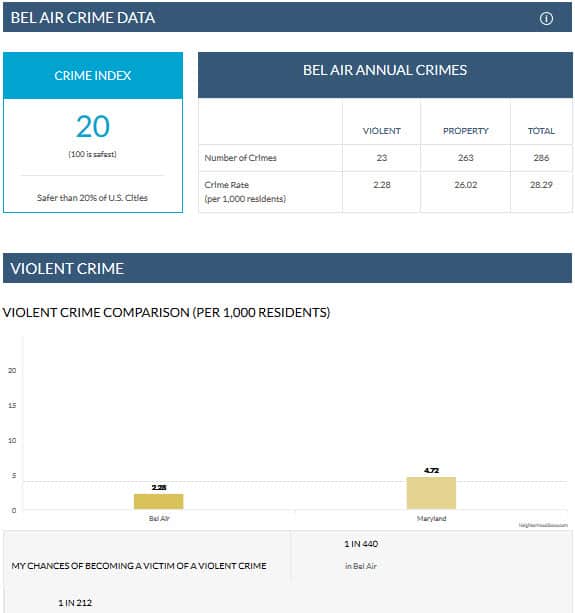

Try NeigborhoodScout.com for crime rates and summaries:

Vacancy Rate

Finally, how are housing vacancy rates? High vacancy rates are a glaring red flag, indicating low demand and high supply.

You can find information about vacancies on Moving.com:

Should You Partner with a Local Investor?

One option for long-distance investors is to partner with a local investor to be the eyes and ears on the ground.

They can scout properties, take their photos, oversee contractors and home inspectors, handle tenant screening and show the property. All you have to do is provide your share of the funds and make joint investing decisions.

So yes, investing far from home is easier if you have a partner who’s, well, not far from home.

It's worth mentioning, though, that there are also some downsides.

You must operate with absolute, 100% confidence and trust in your local partner. They could make poor decisions, from choosing bad properties to hiring shoddy contractors to bungle the property management.

Worse yet, they could actively cheat you if they were so inclined. It’s hard to know what expenses are truly needed (and legitimate) when you're working from 1,000 miles away.

Another challenge is that investment partnerships tend to work well for short-term fix-and-flips, but the longer the partnership lasts, the more room there is for disagreements.

If you buy a long-term rental property, what happens when one partner runs into financial trouble a year down the road and wants to sell, and the other partner wants to keep the property but can’t afford to buy out the other partner’s interest?

Local partners can be incredibly effective, but they also come with their own risks and complications. If you decide to use a local partner, congratulations – you can stop reading here because they’ll take care of everything locally for you.

If you want to invest long-distance on your own, read on.

The Long-Distance Real Estate Investor’s Survival Guide

New to the idea of buying real estate long-distance? Don’t sweat it!

Here are five tips, options, and ideas to help your long-distance investing go as smoothly as if you were investing in your own backyard.

1. Finding Deals from a Distance

There are several ways you can go about finding deals from a distance.

The traditional model is hiring a local Realtor to represent you (preferably one with plenty of experience working with investors). They walk through properties on your behalf, perhaps snap some of their own photos, and offer their opinions on condition, market value, needed repairs, and market rents.

But remember, Realtors are not your only option in today’s world.

Another route is to buy from a wholesaler or turnkey seller. The risk here is that you'll have no one specifically representing your interests; you’ll be stuck with the seller’s word for the condition (at least, until you have a home inspection done), and you’re on your own for estimating market rents. Without ever having seen the property with your own eyes.

Granted, you can still use a Realtor to represent you, even when buying off-market deals. But you’ll be responsible for paying their fee – don’t expect off-market sellers to chip in.

In recent years, another option has arisen: off-market marketplaces such as Roofstock and even eBay.

Roofstock includes an incredible amount of detail on market conditions, property performance, financials, and estimated returns. Here’s a quick video overview of their platform:

Roofstock is designed from the ground up to help long-distance rental investors buy sight unseen. They make it incredibly easy to buy with confidence without ever stepping foot into a property and offer several guarantees. Check out Seth’s comprehensive review of Roofstock here for full details.

The downside of Roofstock is that it’s hard to find outstanding deals. It’s a marketplace of rental properties sold by professional investors, so they aren’t leaving much meat on the bone, equity-wise.

2. Out-of-State Legal Entities and Addresses

If you want to hold your investment properties in a legal entity, you’ll need to decide whether to register it in your home state, the state where you’re investing, or some other state entirely. Regardless, you will need an in-state resident agent as an out-of-state corporate owner, to receive mail and notices for you.

In every state, you’ll find resident agent services, who charge a fee to serve as your resident agent and receive your official mail (Rocket Lawyer is one such example that offers these services throughout the United States). My experience has been that you can find good services for between $100 – 200 per year.

You can also use a private mailbox service, that can either forward or scan your mail for you digitally. I use St. Brendan’s Isle, based in Florida. Through my online account on their website, I can choose which pieces of mail to forward, which to open and scan, and which to shred.

3. Finding Local Contractors

Contractors can be difficult, even in the best of circumstances (and overseeing repairs from 1,000 miles away is not the best of circumstances).

Trustworthiness is very important. Start by asking for referrals from disinterested third parties, real estate investors who operate locally. Look for local real estate investing Facebook groups, and ask for referrals.

If you’re using a Realtor, they should be able to refer you to trustworthy local contractors as well.

As you get referrals, you can investigate them further using tools like Angi (formerly known as Angie’s List). You should also ask the contractors themselves for at least three references, and then call them and ask probing questions like “What didn’t go exactly according to plan, in your renovation project?”

Verify whether the contractors are licensed and insured, and ask them questions like:

- How long have you been in business?

- Who will be at the site and how will work be supervised?

- How and where are tools stored overnight, if the job takes more than one day?

- What guarantees do you offer, and are they put in writing?

- How do you prevent going over budget, or past the project timeline?

- Do you take care of pulling permits?

If you use a local property manager, they can also be an excellent source of contractor referrals.

4. Vetting and Hiring Property Managers

Historically, long-distance landlords hired property managers as a matter of course. While new technology makes it easier to self-manage even long-distance rentals (more on that shortly), many landlords still prefer to outsource property management to a local manager.

Seth wrote an excellent article on how to screen and hire property managers, so I won’t reinvent that wheel here. But I want to emphasize the importance of hiring an outstanding and trustworthy property manager.

My last property manager cost me over $30,000. They placed a “professional tenant” in one of my properties through careless tenant screening, who proceeded not to pay the rent and draw out the eviction process for nearly a year. Unpaid rent came to over $11,000, legal fees came to $800, and they caused over $20,000 in property damage before finally being evicted.

The property manager shrugged and said,

“Well, it’s not a great neighborhood.”

As a final thought, triple-check the exact fees a property manager charges before moving forward. I believe property managers should charge at most, two types of fees:

- a percentage of rent collected

- a new tenant placement fee (typically either half a month or one month’s rent)

Many unscrupulous property managers squeeze in hidden fees to nickel and dime their clients to death. Fees for vacant properties, fees for visiting properties, fees for calling contractors to make repairs.

Landlord beware.

5. How to Self-Manage from a Distance

I’ve previously managed rental properties from across the world, as I spend most of the year overseas.

One of the benefits of long-distance property management is that, in some ways, it forces you to manage more thoughtfully rather than just flying by the seat of your pants like so many landlords do.

To successfully manage properties from a distance – or for that matter, to better manage your properties even in your hometown – you need to learn what to delegate, what to automate, and what to eliminate and prevent. Here’s a quick breakdown of each.

What to Delegate

There are some things you can’t do from 1,000 miles away. For instance…

- You can’t show vacant properties.

- You can’t conduct walk-through inspections.

- You can’t appear in rent court.

You’ll need a leasing agent who can show properties for you and conduct inspections.

This could be a professional property manager, who you pay a one-time leasing fee. That’s the easiest route since no training or explanations are required (as a side bonus, they’ll be able to refer you to good local contractors as needed!).

Alternatively, you could hire a college student, grad student, neighbor, another one of your tenants, or a local friend or family member.

Leasing vacant properties is not rocket science; charisma and charm may be more useful in showing vacant properties than any trainable skills.

They’ll also need to walk through the property with new tenants before move-in to document the exact condition and again after move-out.

Separately, you’ll need a local eviction service. They will handle serving eviction notices for you, appearing in rent court on your behalf, and appearing at the lockout as your representative.

I can’t emphasize this enough: find an eviction service before you actually need them!

If you don’t know who to call when tenants break your lease, you’ll procrastinate and message your tenants that they can get away with paying the rent late or violating your lease agreement.

Be proactive in enforcing your lease; you’ll find you don’t have to enforce it very often.

What to Automate

Now we’re getting into one of my favorite topics.

In today’s world, technology can easily handle much of a landlord's workload. There are online landlord apps that post your rental listings to multiple websites that let you request rental applications and tenant screening reports with the click of a button that import that data into a lease agreement for you.

Then, on an ongoing basis, they collect the rent from the tenants for you and deposit it into your bank account.

Good systems will generate income and expense reports for you on command and generate your Schedule E tax statement.

As it so happens, I’m the co-founder of one such online landlord app provider. Here’s a quick video showcasing many of the automated property management features in under 100 seconds:

But SparkRental is not the only option available, and you have your pick of competitors to help you with many of these services.

What to Eliminate and Prevent

Turnovers, evictions, and major repairs are a landlord’s worst nightmares.

They’re extremely expensive and, in many cases, preventable.

One way to avoid major repairs is through preventative maintenance – here’s a detailed breakdown of preventative maintenance that can save you thousands of dollars in avoidable repairs.

As mentioned above, one way to prevent evictions is by, ironically, filing them.

Tenants will push your boundaries; it’s human nature. It’s your job to rigorously defend those boundaries by sending informal rent notices if the rent isn’t paid on the first, and formal eviction notices if it’s not paid by the fifth or whenever the grace period expires. The same goes for other lease violations.

Once tenants know their rent can’t be postponed, they’ll prioritize it over other bills.

Another way to prevent turnovers is to go out of your way to retain good tenants. Periodically ask them what repairs they’d like to see, and consider making them if they appear high-ROI. Send them holiday cards. Ask about their children, spouse, job, and hobbies when you call them.

It’s a lot cheaper to keep good tenants than to replace them.

Perhaps most importantly, screen your tenants aggressively to avoid bad tenants in the first place.

Final Word

In today's world, it's easier than ever before to do business from a distance.

As a real estate investor, the world is your oyster, and you have plenty of pearls to choose from.

However you choose to invest, do so strategically, with a thorough business plan before spending your first cent. Research markets in precise detail before investing and decide exactly how you plan to find deals once you’ve chosen a market.

Map out the personnel you’ll need in that market, and start networking with them. Once you have a strategy and the right people in place, you’ll be positioned to succeed no matter how far from home you choose to invest.

Have you ever invested long-distance? What were your experiences with it? Let us know in the forum!