If you’ve tried to buy a home in the last two years, you don’t need me to tell you how hard it’s been—and how it continues to be, at least for the foreseeable future.

Perhaps you want to know why buying a home is so hard. Or, more importantly, how you can break into homeownership if you’ve been locked out in recent years.

The good news is that with a little creativity, you can break into the housing market without a trust fund or rich uncle.

Context: Undersupply Dating to the Great Recession

One of the (many) problems that caused housing to crash in 2008 was the oversupply of housing. Back in the mid-2000s, real estate had been sizzling so hot that homebuilders went buck wild and overbuilt homes.

In the end, they got burned and lost billions of dollars in the ensuing 33% crash in home prices.

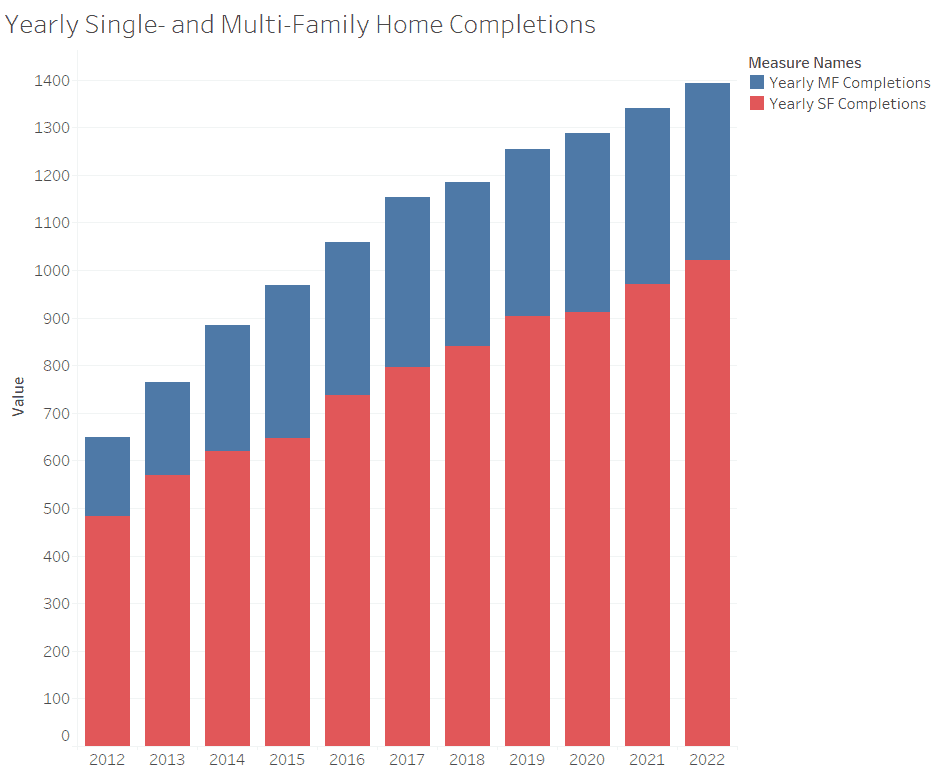

So, in the decade following 2012, homebuilders underbuilt by almost four million housing units. In that decade, 15.6 million new households formed, but developers only built around 8.5 million single-family homes and 3.4 million multifamily units.

Source: Realtor.com, “US Housing Supply Continues to Lag Household Formations; Multifamily Construction Offers Alternatives“

Where does that leave us today? Estimates vary, but economists agree that the U.S. has a housing shortage. Moody’s Analytics puts the shortage around 1.6 million housing units, while a report by Up for Growth pins it at a whopping 3.79 million units.

Regardless, the U.S. doesn’t have enough housing, and that shortage measures in the millions.

The Impact of Interest Rates

Imagine you borrowed $350,000 to buy a home for a 30-year fixed interest mortgage. If you bought in early 2022, you could have borrowed that mortgage at 3% interest. That would put your monthly principal and interest payment at $1,476.

Fast forward a year or two, and imagine you borrow the same mortgage at 7% interest. You’d instead pay $2,329 each month—over $850/month more, or a 57.8% jump in your housing payment.

Of course, people’s incomes didn’t jump 57.8% during that time. Which means homebuyers simply can’t afford to spend as much on housing.

But home prices haven’t dropped by much, or at all, in many markets. The median sales price of existing homes stayed around the same, from $391,400 in the third quarter of 2022 to $397,500 in mid-2023.

So what gives?

Lock-In Effect and Low Inventory

Most U.S. homeowners today enjoy low fixed-interest mortgages in the 2-4% range, given how low interest rates stayed for so long. If they sold today, they’d be borrowing money at today’s high rates to buy their next home—meaning they couldn’t afford nearly as much home as they currently have.

That, in turn, means most would-be sellers have decided to stay put. And in doing so, they deprive the housing market of inventory.

Specifically, the U.S. housing inventory has reached just 3.1 months of supply. That’s close to an all-time low and the lowest for this time of year.

source: tradingeconomics.com

Low supply buoys home prices and prevents them from dropping further.

Cash Is King—Especially During High Interest Rates

Not everyone has to pay high interest rates to buy a home. Homebuyers with deeper pockets and more liquidity can pay in cash and skip all those high-interest loan payments.

In a slow housing market, that also gives them better negotiating power.

The higher the cost to borrow money, the higher the value of cash on hand.

Would Lower Interest Rates Fix Affordability?

If you think the housing affordability crisis would disappear if only the Fed lowered interest rates, think again.

Buyers pay the going rate for real estate. If interest rates fall and the same monthly payment suddenly buys you a higher loan amount, buyers simply raise their purchase offers.

Prices would rise, and buyers would end up with a similar monthly payment.

So What Actually Drives Down Home Prices?

There aren’t many levers that actually push down real estate prices. But there are a few.

High interest rates often do, as outlined above. The nationwide numbers outlined above obscure a huge range of price swings in different cities. In the second quarter of 2023, 95 cities saw home prices fall, and that number represents a dip from 224 cities in Q1 and 253 cities in the Q4 of 2022:

But higher interest rates merely represent one way of curbing demand for housing. Other ways to quash demand and lower home prices include higher unemployment rates, lower incomes, and other ugliness that often walks hand-in-hand with recessions.

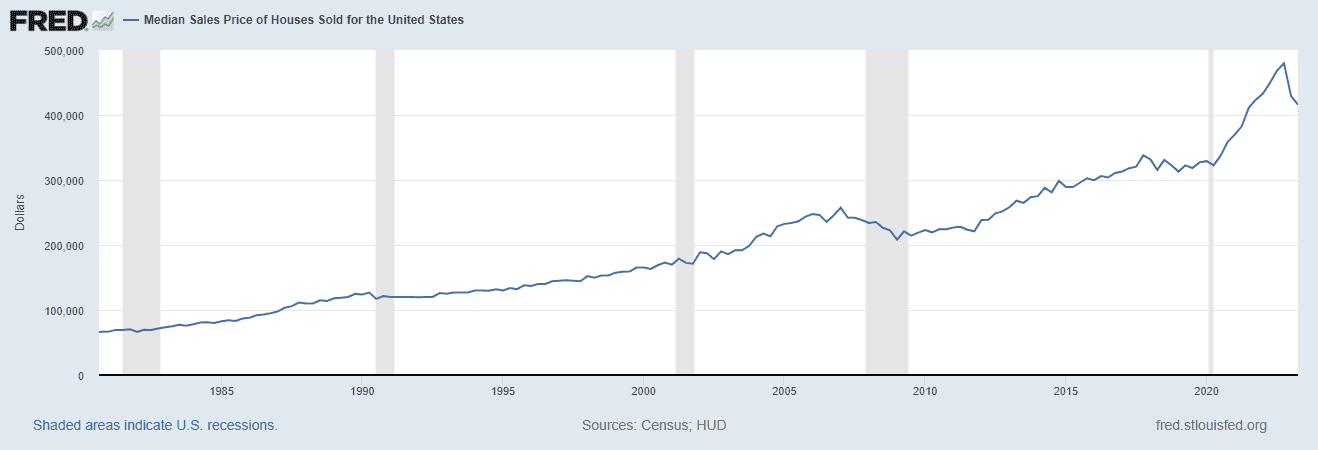

Sure enough, if you look at home prices over history, they often fall during recessions:

US median home prices from 1980 to present; shaded areas represent recessions (source: Federal Reserve Bank of St. Louis)

Of course, governments could put downward pressure on home prices in a happier way by finding ways to boost the housing supply. That starts with common sense moves like approving more housing permits, reducing burdensome housing regulations, and offering more tax incentives for building starter homes and low-income housing. Not that common sense ever plays much of a role in politics.

The numbers don’t look great on the supply side. Housing starts fell 11.3% month-over-month in August as homebuilders pulled back, and starts on single-family homes remain 16% lower than the 2020-2022 average.

How to Buy Your First Home in an Unaffordable Market

Struggling to buy a home?

If you don’t have much cash, you need creativity. Try these ideas to get your foot in the door of homeownership.

House Hack

I haven’t paid full price for housing since 2012. In some way, shape, or form, I’ve gotten someone else to cover most or all of my housing costs.

The classic house hacking strategy involves buying a multifamily property with two to four units, moving into one unit, and renting out the other(s). The idea is simple: your neighboring tenants’ rent covers your monthly mortgage payment.

Mortgage lenders count these properties as residential, so you can take out a conventional mortgage loan, including FHA loans, VA loans, USDA loans, and conforming loans. You can even use the future rents from the other units to help you qualify for the mortgage.

But that’s not the only way to house hack. Other house hacking ideas include renting to housemates, renting out part of your home on Airbnb, renting out your entire home on Airbnb when you’re not using it, adding an ADU (the so-called "granny flat"), renting out parking or storage space, or any other way you can think of to generate revenue with your home.

My cofounder, Deni Supplee, went so far as to host a foreign exchange student. The monthly stipend covered most of her mortgage payments.

Find a Job With Free Housing

Today, my family and I enjoy free housing through my wife’s job. She’s an international school counselor, but there are plenty of other jobs that provide free housing; you just need to look for them.

Get rid of your housing payment, and you can save for a down payment much faster.

Ask for Help From Family

Mortgage lenders typically don’t allow you to borrow any part of the down payment, but your family members or friends can give you a financial gift that doesn’t need to be repaid.

Or they could help in other ways, such as cosigning on your mortgage to help you get approved for a loan.

Assume the Seller’s Cheap Mortgage

Most homeowners today have low-interest mortgages, given how low interest rates stayed for most of the last two decades. You can take over the seller’s existing mortgage to avoid borrowing at today’s exorbitant rates.

Banks don’t like letting new borrowers assume an old mortgage because it’s not in their best interest (pun intended). But you could get creative with it, perhaps by negotiating seller financing with a wraparound mortgage.

Enter an Installment Contract

Many sellers don’t like offering seller financing because if you default on them, they have to go through the long, expensive foreclosure process. For them, it’s a lot of risk without much reward.

Plus, if you do a wraparound mortgage and the original lender finds out, they can call the loan.

An installment contract skirts both issues. You agree to the payment terms, but the deed ownership doesn’t change hands yet. Technically, you remain a renter, and if you default on your payments, the seller merely has to evict you.

The seller’s existing mortgage remains in place, plus extra for the difference in what you owe them. You agree to pay them off within a certain time frame, and they deed the property to you. That locks in your price at today’s pricing and gives you time to improve your credit and wait for (hopefully) lower interest rates.

Move Somewhere Cheaper

I live in Lima, Peru. I enjoy an oceanfront condo with three bedrooms, two full baths, and a balcony with a 180-degree view of the Pacific Ocean for the equivalent of $1,300 per month. (Which my wife’s employer pays, as I mentioned.)

But you don’t need to move to Peru for a lower cost of living. If you can’t afford to buy a home in San Francisco Los Angeles or New York, move to Columbus, OH or Lexington, KY.

While you’re at it, consider moving somewhere that lets you live car-free or drop down to a one-car household. My family went from two cars to one, and today we own none. It helps us save even more money towards our goals like buying properties and early retirement.

Final Thoughts

The massive millennial generation has entered its prime move-to-the-suburbs-and-pop-out-kids years. Except they don’t have any starter homes to move into.

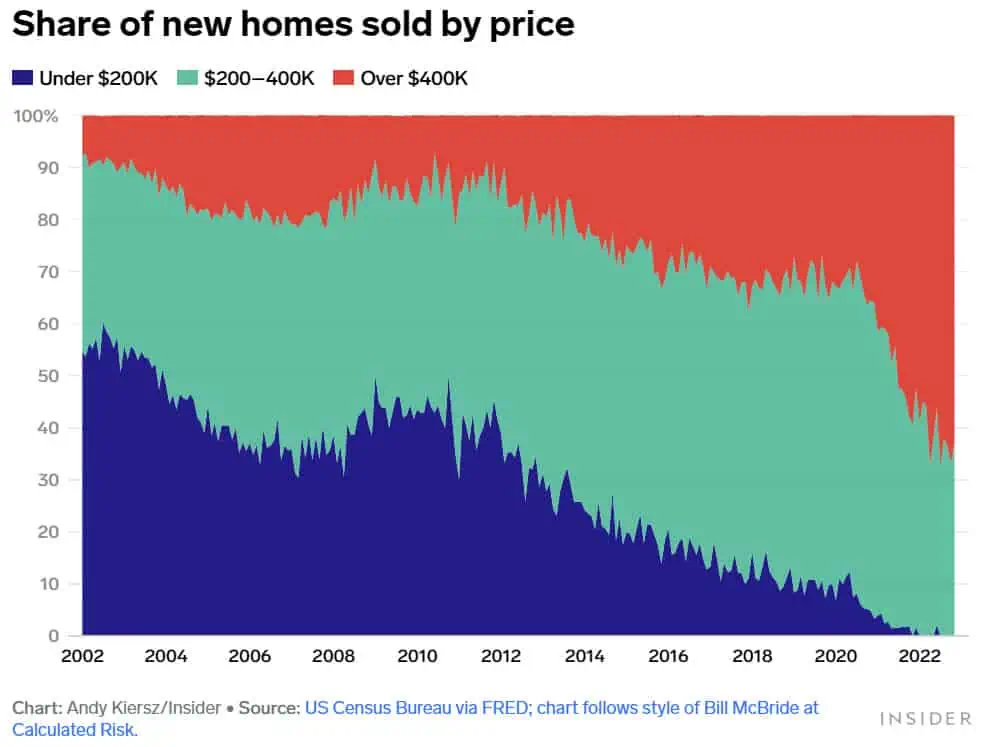

Part of the problem is that homebuilders just don’t build starter homes anymore because the profit margins are lower. In fact, not a single new home sold for under $200,000 during the last year. To really bludgeon home how homebuilding has changed, check out this chart from Insider:

To break into homeownership today, you need either cash or creativity. Use the latter to build up more of the former and squeeze into the ever-more-elusive American dream of owning your own home.