REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

As real estate crowdfunding platforms go, Groundfloor is one of my favorites.

It pays strong returns (an annualized average of 10%) without the long-term commitment and requires just $10 to start. Diversification is easy, and the company has a strong track record of paying investors back.

Best of all, Groundfloor is open to everyone, not just wealthy accredited investors. As for February 2025, it has completed over 5,800 projects with over $1.6 billion in retail volume invested.

As you explore real estate crowdfunding options, look at Groundfloor as a strong contender.

Groundfloor Rating

-

Overall Rating

Summary

Groundfloor pays strong returns without the long-term commitment and requires just $10 to start. Diversification is easy, and the company has a strong track record of paying investors back. Best of all, Groundfloor is open to everyone, not just wealthy accredited investors.

As you explore real estate crowdfunding options, look at Groundfloor as a strong contender.

Pros

- Short Term Investing

- Strong Returns

- Transparency in Returns and Performance

- Open to Non-Accredited Investors

- Low Minimum Investment

- Automatic Diversification

- Low LTV Loans

- Automated Investing Available

- Weekly Repayments

Cons

- Lack of Liquidity (though based on fractionalization, you'll enjoy weekly repayments)

- Higher Risk in Cooling Markets

- Company Not Yet Profitable

What Is Groundfloor?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

But they don’t have a vault of gold sitting around to fund all these loans. They raise much of the capital from people like you and me. Through their award-winning real estate investing platform, they offer individuals the opportunity to pool funds and invest in real estate projects with investors earning repayments in properties relative to their investment amount.

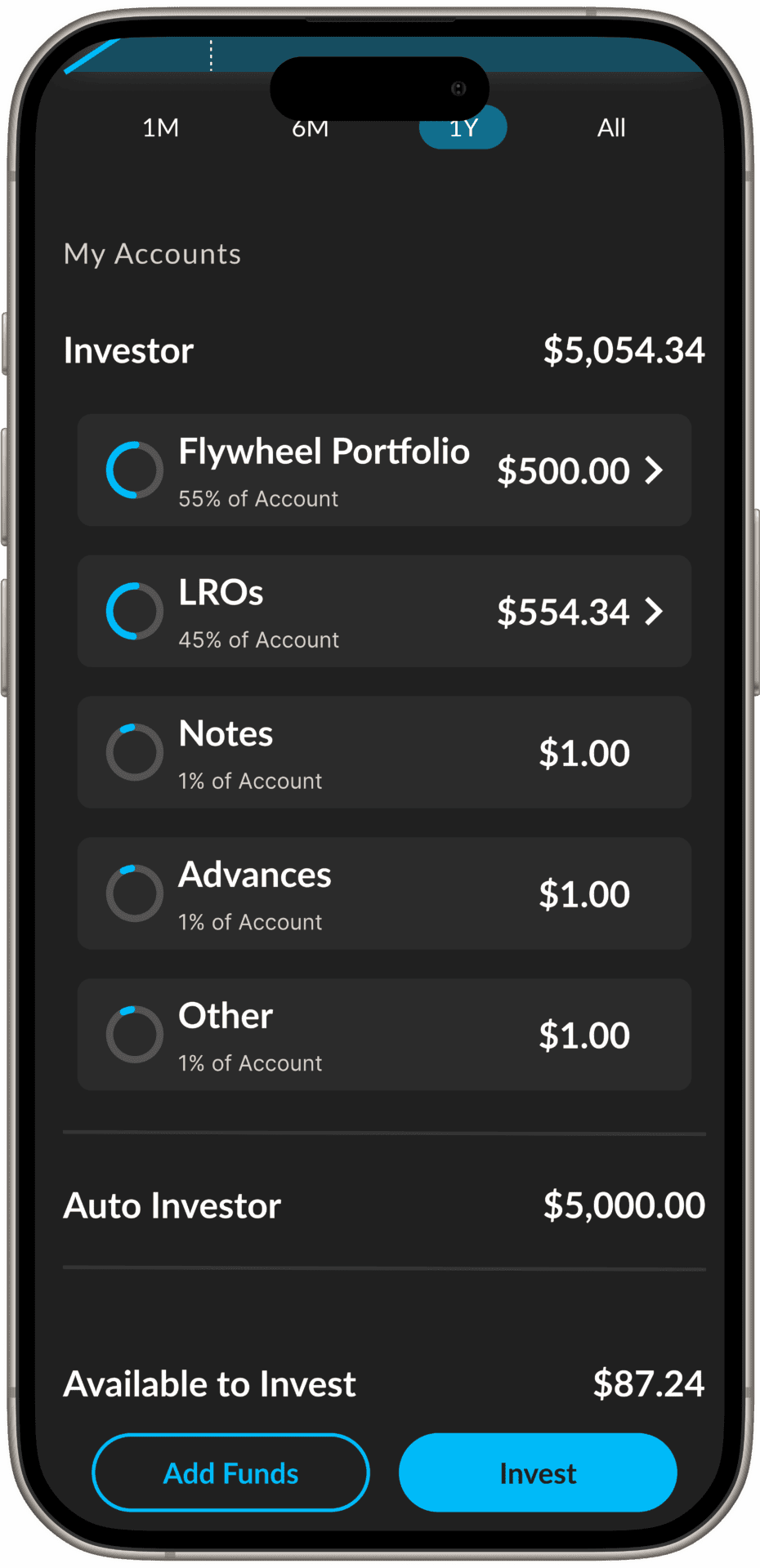

With the Flywheel Portfolio, you are automatically diversified into 200-400 loans at once, with fractions of a dollar going toward any single loan. This hyper-fractionalization and diversification helps to mitigate risk.

How Groundfloor Works

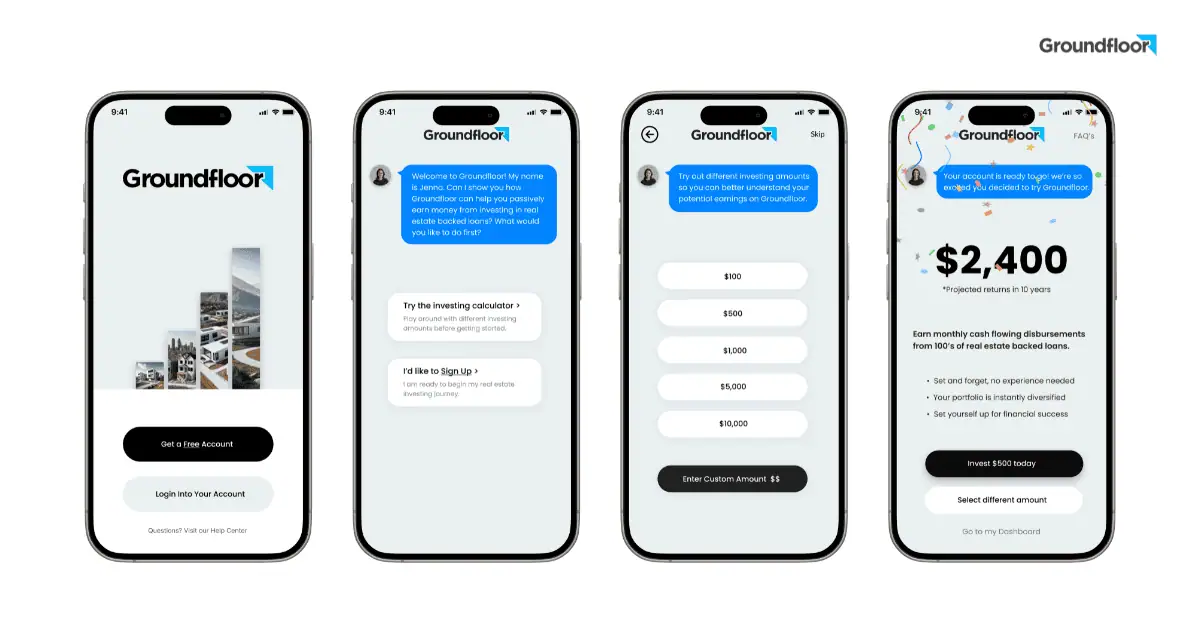

When you create an account with Groundfloor, you connect your bank account to it so you can easily transfer funds back and forth between the two. Once you transfer money to your Groundfloor account, you can let Groundfloor handle the work with their set-it-and-forget-it investing experience, the Flywheel Portfolio, introduced in October 2024. Here’s how it works:

- Groundfloor packages 200–400 short-term, high-yield loans into a collection (the Flywheel Portfolio), offering instant hyper fractionalization and diversification.

- Groundflooor originates and pre-funds these loans, and the Flywheel receives SEC qualification.

- Accredited and non-accredited investors alike can transfer funds on a one-time or recurring basis at a $100 minimum. These funds automatically invest and get diversified across this portfolio of hundreds of loans. Users pay no fees upfront, but there is a 0.50% to 1% management fee assessed at the time those funds are disbursed back to investors, along with their share of the interest. Groundfloor’s historic 10% annualized returns are included in this fee.

- Investors can see repayments in as little as seven days.

- Groundfloor boasts a strong record with over 5,800 loans successfully being repaid to date, indicating its dependability and stability as an alternative investment avenue.

Groundfloor Pros

Groundfloor is an investment platform with plenty of advantages. There’s a lot to like.

Short-Term Investing

Groundfloor bucks the trend that every real estate crowdfunding investment has to be long-term. Despite my positive experiences with Fundrise, for example, I don’t love leaving my money invested for five years or getting hit with penalties.

All Groundfloor loans are short-term loans. You get your money back in as little as seven days and enjoy consistent weekly returns with the Flywheel.

Assuming everything goes to plan, of course. Not every investor pays back the loan on time, or at all for that matter. Occasionally, Groundfloor has to foreclose on defaulting borrowers to recover their (your) money.

The good news is that it’s almost always in first-lien position on these loans, so their asset management team is able to yield strong results from the underlying asset — the physical property. This is why they have such a low loss ratio, as investors typically still recoup funds when properties go into default (although it can take longer).

Still, even in the worst-case scenario, you aren’t looking at a five-year commitment to get involved.

Strong Returns

From January through January 2025 (the latest data available at this writing), they’ve returned an average of 9.88%.

Those numbers may not get your blood pumping like a dog in heat, but they’re nothing to scoff at. They’re in line with average stock market returns, except without the wild mood swings and volatility, plus you have steady payments.

Transparency in Returns and Performance

Groundfloor wins top marks for transparency.

You earn the loan interest rate, period. They don’t take any fees upfront to invest in the Flywheel. Instead, the Flywheel administers a management fee of 0.50% to 1.0%, assessed at the time those funds are disbursed back to you, along with your share of the interest.

Compare this fee and return the structure to HappyNest, with its fee information buried in the legalese of their SEC circular.

I also like that Groundfloor publishes monthly performance reports on how many loans they funded, how many loans were repaid, and the interest rates of those loans. On the rare occasion that I’ve contacted Groundfloor to ask for more information about their performance, they’ve quickly responded and supplied it.

Open to Non-Accredited Investors

Many real estate crowdfunding platforms only allow accredited investors to participate. It makes for easier regulation on their part, but it leaves most Americans unable to invest.

Groundfloor lets anyone invest, with minimal cash to boot.

Low Minimum Investment

Not many investments let you get started with $100.

With your $100 minimum investment, Groundfloor lets you invest into 200-400 loans at once, removing any excuse that you “can’t afford to invest.” Skip the lattes this week and invest some money in real estate!

Easy Diversification

That low minimum investment in each loan makes it easy to spread your money among many different loans secured by properties nationwide. With the Flywheel Portfolio, you’re instantly invested and automatically reinvested into a collection of hundreds of loans.

I know that a certain small percentage of these loans will default and won’t pay me the full interest promised. That’s where the Flywheel Portfolio shines. The instant diversification into a collection of hundreds of loans helps mitigate this risk. But most will pay as promised, so the occasional low or negative return will just blend into my average returns each year.

Low LTV Loans

Groundfloor underwrites loans at a relatively low percentage of the property value as a hard money lender.

If the borrower defaults, that leaves plenty of equity for Groundfloor to recover the loan if they take a deed instead of foreclosure or, in the worst-case scenario, foreclose on the property.

In the three years I’ve invested with Groundfloor, I’ve never lost money on loan. The worst that’s happened has been a return on my original investment with no interest.

Automated Investing Available

The Flywheel Portfolio, Groundfloor’s most popular product, offers automatic investing and reinvesting for consistent compounding, annualized 10% returns.

Get repaid weekly and can elect to have your returns reinvested into projects, down to even fractions of a cent.

Groundfloor Cons

Every investment has its downsides, or else investors would flock to it, and suddenly it wouldn’t have to pay high returns anymore.

Keep the following drawbacks in mind as you consider investing in Groundfloor.

Lack of Liquidity

When you invest in a loan on Groundfloor, you commit your money until the loan repays. Whenever that might happen, there’s no way to pull your money out of a loan early, though you get weekly repayments with the Flywheel Portfolio.

Most loans repay on time, or at least close to it. But a significant minority of borrowers don’t sell or refinance their loans on time, and you get your money back later than expected.

Higher Risk in Cooling Markets

Low-LTV hard money loans don’t come with many risks when housing markets boom at 5% to 20% appreciation.

But when home prices cool off, suddenly those low-LTV loans don’t look quite as bulletproof. Instead of your loan making up 70% to 90% of the property value, it might make up 80% to 100% of the newly cooled value, which doesn’t leave much (if any) leeway should you have to foreclose to recover your money.

Company Not Yet Profitable

Despite raising billions of dollars in hard money loans, Groundfloor has never turned a profit. That should give you pause as you consider investing money through their platform.

Granted, a lien backs your investment against a specific property. Even if Groundfloor goes bankrupt, you’ll still receive your money back when the borrower repays the loan. But a lender in bankruptcy isn’t exactly the steady hand you’d want to handle loans that default.

At some point, Groundfloor will either turn a profit, or their investors will run out of patience and stop funneling money into them.

How Groundfloor Compares

Groundfloor offers high returns on short-term investments—a combination you don’t see very often.

You can potentially earn higher returns through real estate equity platforms like Fundrise, where Seth earned an average return of 14% over five years. But you must leave your money invested long-term, paying the penalty if you withdraw in under five years.

I’ve collected strong dividends from Streitwise, averaging 8.4% over the last few years. But they, too, come with a long-term commitment and early withdrawal fee and have underperformed Groundfloor’s 9.5% to 10% returns.

If you need fast liquidity, try Concreit or Stairs. Neither pays as high returns, but you can pull your money anytime.

Final Thoughts

Overall, Groundfloor stacks up well in transparency, returns, and lack of a long-term investing commitment.

While you don’t directly benefit from real estate appreciation like you would in an equity investment, you can collect strong interest backed by a real property lien. I’ve found Groundfloor to offer moderate-to-high returns with low-to-moderate risk—a ratio I’ll take any day.

The greatest risk with Groundfloor loans lies in a housing market collapse. If we had a 2008-style real estate crisis, with home values falling by double digits and mass foreclosures, many of your Groundfloor loans would lose money. That said, you’d still get something back on your loan investments after Groundfloor forecloses to recover as much of your investment as possible.

Despite housing markets cooling from their overheated pandemic highs, the U.S. still has a housing shortage. I don’t see a real estate market collapse on the horizon, and I feel confident that I’ll get my Groundfloor investments back with strong interest.