If your life is anything like mine used to be, you probably know how hard it can be to build a real estate business while holding down a full-time job.

If you have a family, friends, hobbies, and a life, it can get even more complicated.

Most successful real estate investors are familiar with this juggling act. It's an essential first step for many of us. But how are YOU supposed to take care of all your pre-existing obligations AND carve out the time you need to run a profitable real estate investing business?

What My Life Used to Look Like

Take me, for example. Before I became a full-time real estate investor and educator, I had several things on my plate every day:

- I had a full-time, 8-to-5 job (I worked in commercial real estate banking) that consumed anywhere from 40 to 60 hours per week.

- I have a wife and two kids, each of whom requires (and fully deserves) a substantial slice of my time each day.

- Every week, I would put significant time and effort into publishing content for my blog (and a few others).

- I'm an active member of my church, neighborhood, and a couple of local economic groups, where I regularly participate in several extracurricular activities each year.

- I have a handful of other hobbies and fun activities that I thoroughly enjoy spending my time on (and without these things, I would probably lose my sanity).

Some days, it was no problem to keep all of these things working together in perfect harmony. On other days, it was a major challenge to keep it all straight. When one or more of these segments of my life started getting busy, life would get overwhelming fast.

How I Spent My Time

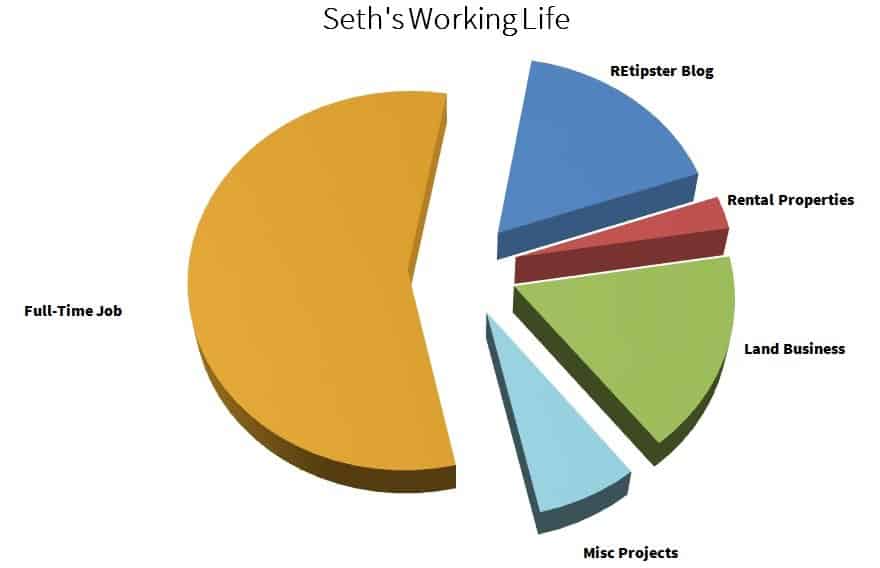

To start with, here's a chart of how I divided my time in an average week:

Depending on what projects were hot on the burner, some weeks required that I devote substantially more time to my rental properties (if I was buying a new one), or my land business (if I had a big transaction in the works), or my full-time job (when I got slammed with a massive load of projects to work on). All in all, though, if I averaged out all of my various working activities over an entire year, this was probably the most accurate representation of how my time was spent back when I had my full-time job.

And to be clear, this was my “working life,” so it excludes things like being a parent, husband, and other standard duties like cleaning the house, yard work, shopping, fixing stuff, etc.

My weekends (and some weeknights after 7 pm) were usually my most productive times of the week to make progress with my various business endeavors. This time was essential to me “getting ahead,” so to speak.

How I Made My Money

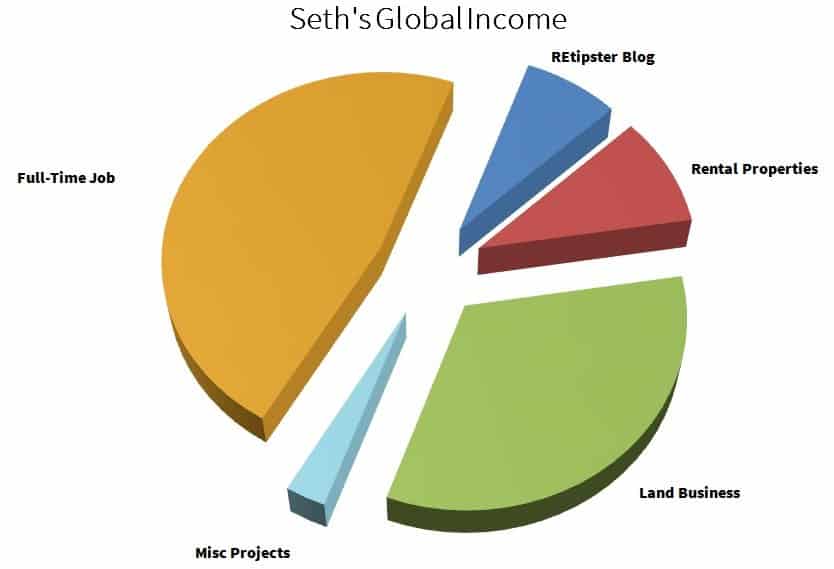

Now let's look at my different income streams when I was working my 8-to-5 job. These were the ways I made money and which income streams were responsible for my total take-home pay each year:

Again, my global income didn't look exactly like this every year. But for the first five years of running my land business, this was how the typical year looked on average.

As you compare these two pie charts, one thing might stick out: the activities that put the most money into my pocket weren't the same ones that consumed most of my time.

For instance:

1. My Full-Time Job

As far as jobs go, I had a pretty good one. I was required to be at the office for at least 40 hours each week (sometimes more, depending on my workload). My job paid me a set dollar amount twice every month as a salary. It also provided my family and me with health insurance, which helped contribute to what some people perceive as “security” (a.k.a., a steady, predictable paycheck that we could count on, regardless of what else was happening in life).

Of course, this “security” was more of an illusion (because I could've lost my job at any point in time, for any reason whatsoever). But I must admit, it was probably the most dependable source of income I have had for several years.

With this source of income, it didn't matter how busy I was, how productive I was, or how much stress it contributed to my daily life. I was earning the same amount of money with every paycheck, regardless of how much time it consumed relative to the other slices of my weekly time budget. For obvious reasons, this kind of fixed income could work to my benefit or my detriment.

2. My Land Investing Business

The land business investing is funny (at least mine is). Depending on the year, I can have a few grand slam deals that generate more profit than the annual income from my job (with only a fraction of the time). I could also have a year with a lot of “fluff” activity and less-than-stellar results. The month-to-month income can be “spikey” in nature, especially if there aren't many seller-financed deals on the books. It's not uncommon to have some properties that take longer than expected to sell, which simply delays the collection of my income.

When I was still working my job, my land business provided less of a feeling of “security” because it wasn't easy to predict my income each month and year. However, it did (and still does) generate some HUGE influxes of cash, which played (and continues to play) a pivotal role in building my financial freedom.

The only problem is, it's not always easy to predict when these will occur. The level of stability (or lack thereof) is also affected by how many monthly payments I've got coming in from the various properties I've sold with seller financing. These monthly payments can add a lot of financial predictability to the revenue from a land investing business.

Setting an End Game

The important thing I've recognized about my land business is that it's not the only income-generator I want to rely on. Some land investors choose to focus 100% of their efforts on their land flipping activity, but for me, I've decided to use it as an effective tool for generating the large influxes of cash I need to pursue my end game.

And what is the end game? My ultimate goal is to build a large portfolio of hands-free income-generating properties (e.g., rental properties, farmland, self-storage facilities, and the like). These are separate real estate investments that I buy and hold long-term because they will continually create sustainable income for the rest of my life. Without the cash generated from flipping vacant land properties, it would be tough to make this kind of business a reality.

3. My Rental Properties

I would still consider my rental property business a relatively small (but growing) operation at the time of this writing. It's not quite enough to live off of (yet). But the beauty of this income is that I only have to spend a couple of minutes each month running this arm of my business instead of 40 hours each week in a day job.

It's as easy as:

- Checking the monthly income report from my property manager.

- Verifying that the money has been deposited into my bank account.

- Making sure there are no looming problems that need to be handled.

And that's it.

The only reason I have it this easy is simple: I have a great property manager handling all my rental properties. A good property management company is essential to a good rental property business. With a good property manager in place, my rental properties are a hands-free operation that runs without my ongoing involvement (and this is very important).

This hands-free income isn't easy to create, especially in the beginning. But if you take the time to seek out the right rental properties and buy them the right way, you can experience this amazing phenomenon. If you ever do, you'll see what I mean. It's a beautiful thing!

RELATED: The Beginner's Guide to Buying Rental Properties (A Case Study)

4. Blogging Endeavors

The End Goal

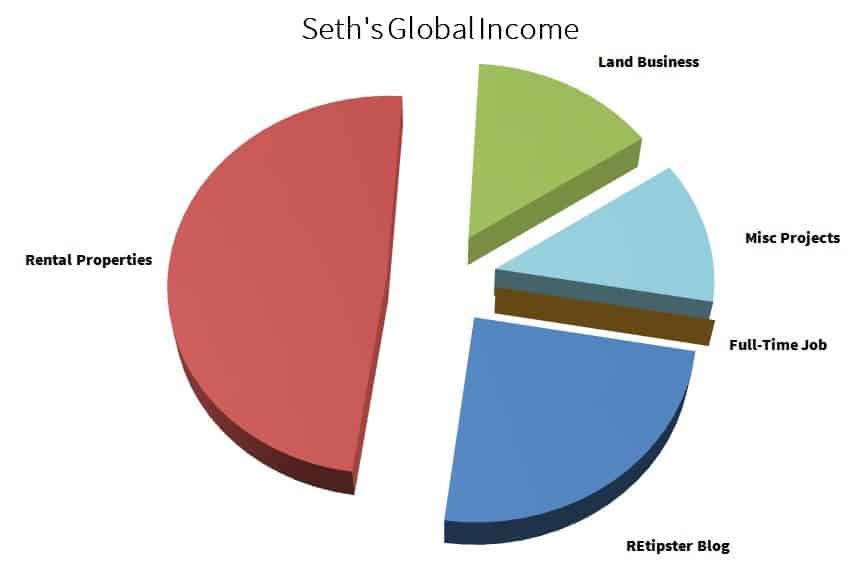

If I had to show you how I envisioned my life panning out over the next 20 to 30 years, this is probably the best representation of how I'd like to see my global income when all is said and done:

The full-time job is gone. Meanwhile, the other businesses are each standing on their own and generating more than enough cash to support all of my living expenses (and then some).

RELATED: Six Months After Quitting My Job – Here Are My Honest Thoughts…

Of course, knowing precisely how the future will pan out is impossible. An endless number of variables can potentially come into play and change the trajectory of my life. However, I believe it's important to have an idea of what direction you'd like to go.

With this in mind, this third pie chart (above) is probably the best projection I can show you.

How Do You Spend Your Time?

Now that you know how I spend my time, how I make my money, and what my end goals are—let's talk about YOU.

- What would your pie charts look like if you laid them out like mine above?

- Where do you spend the bulk of your time?

- Where is your money coming from? More importantly, how much money are you investing in your financial freedom?

Do you have an end goal in mind? If so—what does it look like?

Of course, you won't be able to answer these questions until you truly know what you're trying to accomplish. If you find it difficult to map out the same charts I've shown above, take a few minutes (or hours, if necessary) to organize your goals and figure out where you want to go and what your activities are doing to bring you toward that destination.

If you're lucky, you might just figure out some things that need to change… and better now than never.