Among the more established real estate crowdfunding platforms, RealtyMogul offers both REITs and fractional ownership in individual properties. It boasts a strong track record, a transparent website, and plenty of options for investing.

If you’re an accredited investor, that is. Non-accredited investors can only access RealtyMogul’s two REITs.

Still, RealtyMogul stands out as one of the better real estate crowdfunding websites on the market. Consider the following as you decide where to invest your hard-earned capital.

RealtyMogul Rating

Summary

RealtyMogul offers two REITs for non-accredited investors and a convenient platform for investing in real estate syndications for accredited investors.

With a strong track record and a transparent website, RealtyMogul makes for one of the better and more established real estate crowdfunding options on the market. But its high minimum investments will turn off plenty of new real estate investors.

Pros

- Options for non-accredited investors

- Established track record

- Transparent website

- Early redemption option for REITs

- Options beyond multifamily

- Simple platform for syndication investing

- 1031 exchanges possible

Cons

- High investment minimums

- Private placements only available to accredited investors

- Non-liquid, long-term investments

What Is RealtyMogul?

RealtyMogul owns and manages two real estate investment trusts (REITs). The RealtyMogul Apartment Growth REIT targets long-term price growth over cash flow, paying quarterly dividends at a 4.5% annual yield. The RealtyMogul Income REIT focuses more on income (thank you, Captain Obvious), paying monthly dividends at a 6.0% annual yield. RealtyMogul allows non-accredited investors to participate in these private REITs.

The other investing model lets you invest in private placements or fractional ownership in individual properties. In other words, real estate syndications. However, RealtyMogul merely offers a platform for syndicators to raise money for deals—these aren’t owned or operated by RealtyMogul itself. Only accredited investors can invest in these private placements.

How RealtyMogul Works

Investors can buy shares in RealtyMogul’s REITs with a minimum of $5,000. The net asset value or share price is based on the value of the underlying investments, which (hopefully) grows over time.

And to date, they have. The Growth REIT has earned a lifetime total return of 8.08% annually, and the Income REIT has earned an average lifetime return of 9.21% at the time of this writing. Nothing flashy, but a solid performance with strong diversification and little correlation with stock markets.

Those returns are net of fees, by the way—RealtyMogul charges between 1% to 1.25% as an annual fee for assets under management.

You can sell your shares with no penalty after three years. If you want to sell before, RealtyMogul offers an early redemption program with small penalties for selling between one and three years of buying (more on that shortly).

Accredited investors can take advantage of private placements in addition to the REITs. RealtyMogul vets syndication deals and allows the best to raise money on the platform. As an investor, you can review the deals available at any time and choose to invest in the ones you like.

Like most real estate syndications, these require high minimum investments. That usually means $25 to $50K per deal.

It’s up to you to review each private placement deal for sponsor fees and risk, but RealtyMogul provides a wealth of information for each deal.

RealtyMogul Pros

Why have investors put in over $200 million to RealtyMogul in the decade since its launch?

Here are some of the advantages of investing through RealtyMogul.

Options for Non-Accredited Investors

Non-accredited investors have limited options in the world of real estate crowdfunding and private equity. So it’s nice to see a platform offering two established investment options for middle-class investors.

Track Record

Launched in 2013, RealtyMogul can boast a longer track record than most real estate crowdfunding platforms.

It has overseen 223 realized investments at an average IRR of 20.7% compared to an average target IRR of 15.0%. View RealtyMogul's full track record here.

Transparency

I appreciate that you can find so much detail on RealtyMogul’s website about their track record, past offerings and their performance, and current offerings. All without creating an account or logging in.

Not every platform is so forthcoming, so it inspires confidence that you can find so much information without heavy digging.

Early Redemption Option for REITs

Many real estate crowdfunding platforms require you to lock your money up for five years or longer, often with no early redemption option.

RealtyMogul does require you to leave your money invested for at least a year, but after that, but you have yearly redemption options. Between one and two years of investing, you can withdraw funds with a 2% penalty. Between two and three years, you pay a 1% penalty.

And after three years, you can withdraw funds at any time with no penalty.

While it still doesn’t make these REITs liquid assets per se, it's still more liquid than most crowdfunding investments.

Options Beyond Multifamily

Multifamily properties are all good, but there’s much more to real estate than apartment buildings.

In both REITs and private placements, RealtyMogul includes other types of properties. That includes office buildings, retail, and sometimes even self-storage facilities, mixed-use properties, and beyond.

Simple Platform for Syndication Investing

It’s not always easy to find and vet real estate syndicators. Private equity markets remain, well, pretty private.

So it helps when you can log into one platform to find and evaluate open real estate syndication deals. While you should still vet sponsors yourself, RealtyMogul does put syndicators through their paces before allowing them on the platform.

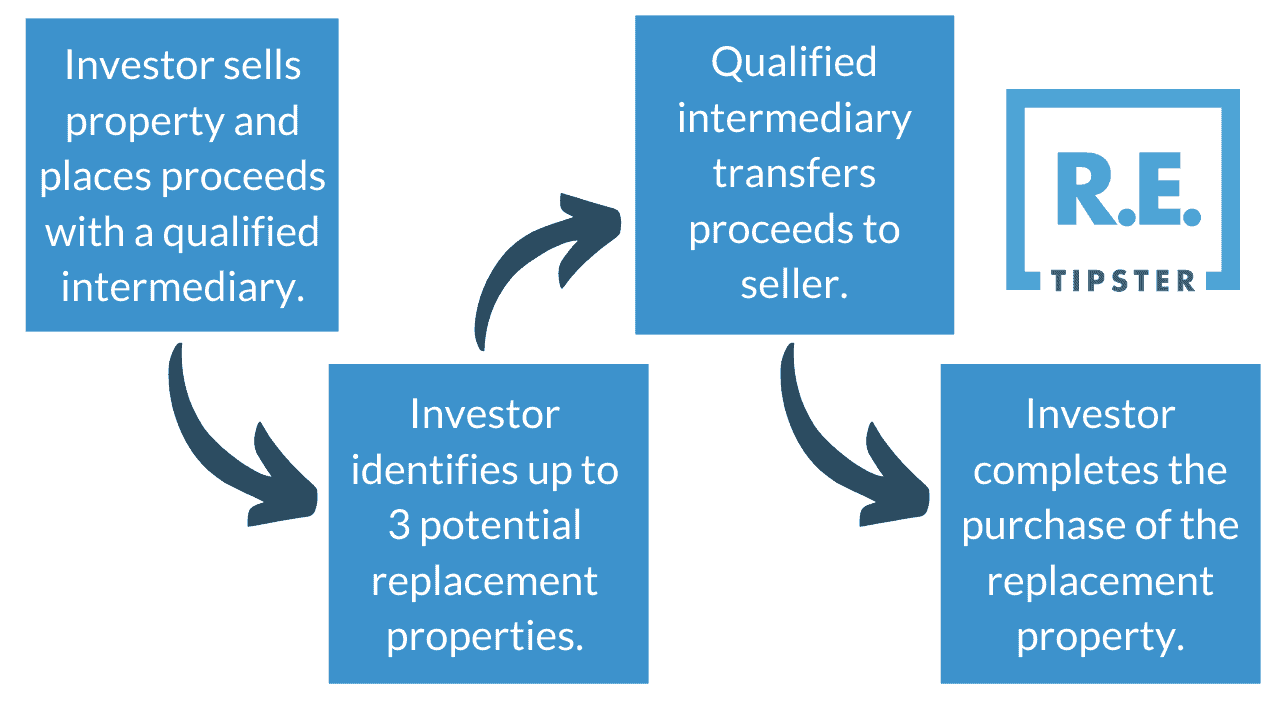

1031 Exchanges Possible

A minority of private placements on RealtyMogul allow you to invest via a 1031 exchange.

Structured as a Delaware Statutory Trust (DST) instead of the more common LLC, these syndication deals are clearly marked on RealtyMogul’s platform as “1031 Eligible.” Don’t expect to find many on the platform (there aren’t any available at the time of this writing), but they do occasionally pop up.

The same 45-day identification period and 180-day replacement period apply, of course. Read more about 1031 exchanges with RealtyMogul here, and plan on contacting them for more detail if you’re interested.

RealtyMogul Cons

No investment or platform is perfect, and RealtyMogul is no exception. Beware of the following drawbacks as you explore RealtyMogul.

High Minimum Investments

Even for the REITs, RealtyMogul requires a high investment minimum of $5,000. For anyone thinking about dipping their toe in the water, that can make you think twice.

For private placements, the minimums are far higher at $25 to $50K. That makes it hard to diversify your investments, even for accredited investors.

Private Placements Only Available to Accredited Investors

Middle-class investors need not apply, at least for private placements.

Granted, the SEC doesn’t allow syndicators to advertise publicly to non-accredited investors, and the whole point of sponsors using a platform like RealtyMogul is to advertise.

But it’s still a bummer.

Non-Liquid, Long-Term Investments

Don’t expect to pull out your money from RealtyMogul at a moment’s notice.

You can’t sell your REIT shares within the first year at all, and for the two years after that, you pay the penalty. And there’s no way to sell your ownership of private placements, like most syndication investments.

How RealtyMogul Compares

Compare RealtyMogul’s REITs to competitors like Fundrise, Streitwise, and Concreit or Stairs by Groundfloor.

Seth has had money invested with Fundrise for over five years now and has earned a total annualized return of around 14%. That beats RealtyMogul’s REITs’ performance, but RealtyMogul offers solid returns on diversified real estate portfolios.

RealtyMogul has delivered a similar five-year return as Streitwise, with a similar minimum investment (see our full Streitwise review for details). And it has beat Concreit and Stairs’ returns, although those platforms offer full liquidity from Day 1 with no penalty on your principal and let you invest with as little as $1.

On the syndication side, RealtyMogul’s closest competitors are CrowdStreet and EquityMultiple. Both allow you to invest as a limited partner in private equity property deals and give you additional platforms to check out deals available at any given time. All three do a great job of giving accredited investors easy access to real estate syndications.

Final Thoughts

For non-accredited investors looking to diversify their real estate portfolios, RealtyMogul’s REITs offer an easy way to do so with some liquidity. Just don’t expect to test the waters with chump change, as the minimum investment is still $5K.

RealtyMogul particularly shines for accredited investors, offering a simple platform to invest fractionally in commercial properties. I particularly like the strong track record and transparency of the website.

Again, you’ll need to cough up significant cash to invest, though. Plan on $25 to $50K per deal, locked up for years with no way to access it.