REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Selling real estate notes changed my land investing game forever. When I first stumbled upon this strategy, I couldn't believe I hadn't thought of it sooner. For me, it totally supercharged my real estate investing strategy.

If you're in the dark as I had been, this could be the breakthrough you're looking for.

My Problem With Seller Financing

When I started selling properties with owner financing, my goal was to create as many streams of recurring income as possible. I wanted to give my business financial stability and predictability for years to come.

It made plenty of sense on paper—seller financing was a great tool for selling my properties faster and for higher prices. Not to mention the added profit from interest! But when my net proceeds were trickling in at a snail's pace, I couldn't redeploy those dollars and make more money from them.

There was a big opportunity cost, and it felt like a catch-22, where I wanted to have my cake and eat it too.

After selling many of my properties this way, I started to get frustrated. Having so much of my profit stuck in limbo while waiting for borrowers to pay off their loans slowed me down.

Eventually, the day came when I gave up on seller financing. Even though there was an undeniable benefit to selling my properties this way, I was tired of waiting for my money to arrive. I also didn't want to deal with the added complexities of trying to service these notes myself (among other things).

Unfortunately, I was unaware of a relatively easy way to utilize seller financing and quickly withdraw my cash from each deal.

I realized I could have my cake and eat it, too! And all I had to do was sell my notes.

The Benefit of Selling Your Notes

The benefit to selling your note now is that you can take your cash and pour this fuel back into your cash-generating machine. Meanwhile, the note buyer will step into your place of being “stuck” holding the bag and waiting for the rest of the payments to come in.

Of course, the note buyer actually wants to be stuck holding the bag because they don't need their cash back now. Their whole objective is to find an investment (like the note you created) that will perform and deliver a good return on investment (ROI) while they're holding it.

Once your note is sold, the remaining loan payments will go to the note buyer instead of you.

Likewise, if the borrower ever pays late or stops paying altogether after your note is sold, it's the note buyer's problem to figure out—not yours.

How Selling Your Notes Work

Let's say I just sold a property for $50,000.

When we closed on the sale, I collected a $10,000 down payment from the borrower. We then set up a loan for $40,000, which the borrower agreed to pay off over the next five years (60 months) at 10% interest.

In doing this, I created a stream of income that would pay me approximately $849.88/mo for the next 60 months.

60 payments of $849.88 come out to a grand total of:

- $40,000 of principal

- $10,992.91 of interest

- $50,992.91 TOTAL

That's a 27% ROI, which is pretty good, considering this is passive income. This is on top of the already astronomical 155% ROI I got when I bought the property for $20K and sold it for $50K.

The Value of Income Streams

In case you didn't know, many other investors want this kind of passive income and are willing to pay for it.

They don't want to do the work of finding and closing on the deals (like you already did), but they DO want the streams of income you've created.

If you know where to find these note buyers, selling your notes to them is not difficult!

The only catch is you'll almost certainly have to sell your note at a discount.

This could be a small or a large discount, and the size of the discount depends on several factors. I'll explain more about this below.

Why Is Selling Your Notes So Important?

The ability to sell your note(s) is a BIG game changer.

If you're like me and you get frustrated waiting ages to collect all your loan payments, you don't have to wait anymore!

If you're willing to take a small haircut on the loan balance when your note sells, you can get your money back much faster and keep the money machine running!

At the same time, you can also take advantage of the many benefits of seller financing for the seller.

You can still sell your property faster and for more money because you're making your property available to a lot more people who otherwise wouldn't be able to get financing (and with vacant land, this is especially important).

Selling Your Note for the Highest Price

Now that you know this exit strategy, you might as well start planning for it as soon as possible!

Even if you have no intention of selling your note, what if your plans change? What if you get tired of waiting for your cash to show up?

If there is even the slightest chance of selling your note someday, you might as well do what you can today to ensure those notes can fetch the highest possible price, right?

At this point, you may be wondering,

“How can I sell my notes for the highest price possible?”

If you want a higher percentage of your remaining loan balance when you sell, you need to understand and deliver what a note buyer wants to see.

What Note Buyers Want

Put yourself in the note investor's shoes for a moment.

If you were trying to buy a source of income, you'd want to be pretty confident the money will come in as planned, right? I sure would!

The best way to get this assurance is to verify that the borrower is reliable and has the financial means to continue making those payments. We discuss this at length with Max Bailey, below:

And also with Eric Scharaga, below:

Getting confident about the borrower's ability to repay is one big factor, but… what if the borrower isn't reliable? What if you don't feel confident the payments will come in as planned? Or worse yet, what if the borrower disappears off the face of the earth, and you have to repossess the property? How difficult, time-consuming, and costly will this process be? Would that scare you off and kill the deal?

If you (as a note buyer) see a lot of red flags when you're evaluating a note deal, it will change how much you're willing to pay for that source of income. And if it gets bad enough, it could be a deal-killer altogether, depending on your risk tolerance.

If the note seller can't demonstrate that they're selling a quality product (i.e., a reliable source of income), the buyer won't be willing to pay as much. This lack of certainty lowers the value of the note.

It works the same way with any product.

This is why any sane person is willing to pay significantly more money for a new car than an old car. A new car is much more reliable than an old beater with obvious signs of wear and tear. The inherent reliability of a new car is worth a lot!

Proper Documentation

Another important value-booster for a note is using the appropriate documentation when the loan is closed.

If that borrower ever stops paying, will the holder of that note have the legal right to repossess or auction off the property if necessary? Will it be a seamless process or a nightmare to regain control of their collateral?

Usefulness and Desirability of the Property

Another important issue is the usefulness and desirability of the subject property.

Suppose this property ends up back in the note buyer's lap after the borrower defaults. How difficult will it be for them to re-sell the property (for example, is it a property everyone wants and will sell fast, or will it take years to get sold, even at a steep discount)?

All of these things play a role in determining how much a note can be sold for. The more assurance you can provide for a note buyer, the more they'll be willing to pay. Conversely, the less assurance you can offer, the less they'll be willing to pay.

As such, if you close a seller-financed deal with the intent of eventually selling that note, you should do everything in your power to:

- Only offer seller financing on desirable properties that will be easy to re-sell.

- Do some basic investigation into your borrower to verify they are creditworthy and likely to pay on time, every time.

- If you find that the borrower has a poor credit score or has some other apparent risk factor, mitigate this risk by requiring a higher down payment at closing. A higher down payment can cover a multitude of sins.

- Ensure you're using the correct loan documentation for your state, with the right language that gives the lender all the powers needed to regain control of the property if the borrower defaults on their loan.

- Use a loan servicing company that will make it easy to redirect the borrower's monthly payment to the new note buyer after it's sold without causing confusion for the borrower or making them change where or how they have to make their monthly payment.

Again, you can see a detailed overview of how to evaluate your borrowers in episode 145 and episode 151 with Max Bailey and Eric Scharaga, respectively.

Attention to these details upfront will ensure you work with a stronger borrower, whether they pay you or someone else in the future.

By going through these motions, you're not just helping the future note buyer; you're also helping yourself!

Drawbacks to Selling Notes

As with anything, selling your notes instead of waiting it out and collecting all the payments yourself has a couple of drawbacks.

1. Loss of Income

If you enjoyed having your profits trickle in each month… that will all stop after your note is sold.

Even though you'll walk away with a good portion of the remaining loan balance, you will lose whatever stability or predictability those monthly payments provide.

2. Loss of Principal

In almost every scenario, you will NOT get paid 100% of the remaining balance when you sell a note.

In the best-case scenario, if the property is perfect, the borrower is ideal, the documentation is perfect, and there is a well-documented track record to prove that the borrower has made their payments on time, every time, you could expect to receive about 80% of the loan balance at the time of sale. It could be higher if the note has a steep interest rate and a low loan-to-value, but this would be unusual.

If the property has problems, if the borrower has problems, if the borrower has missed payments (a.k.a., a non-performing note), and/or if the loan documentation has issues, you should expect to get LESS than 80%, sometimes a lot less.

If the numbers, property, or documentation are bad enough, then at best, buyers would expect to pay a much lower percentage of the loan balance (somewhere between 30% and 40%, if you can find a buyer at all). Even with these drawbacks, many investors are happy to cut their losses and collect their cash sooner rather than later.

Why? Because if you understand the concept of net present value (NPV), the money you receive today is generally more valuable than the money you'll earn years from now.

How to Sell Your Notes

Now that you understand how to create high-value notes, how can you get your notes sold?

If you know an active note buyer buying land notes, you could always go directly to them and try to make a deal happen.

But… what if you don't know any active note buyers, or what if the ones you know aren't interested in buying your particular note for whatever reason?

I have good news.

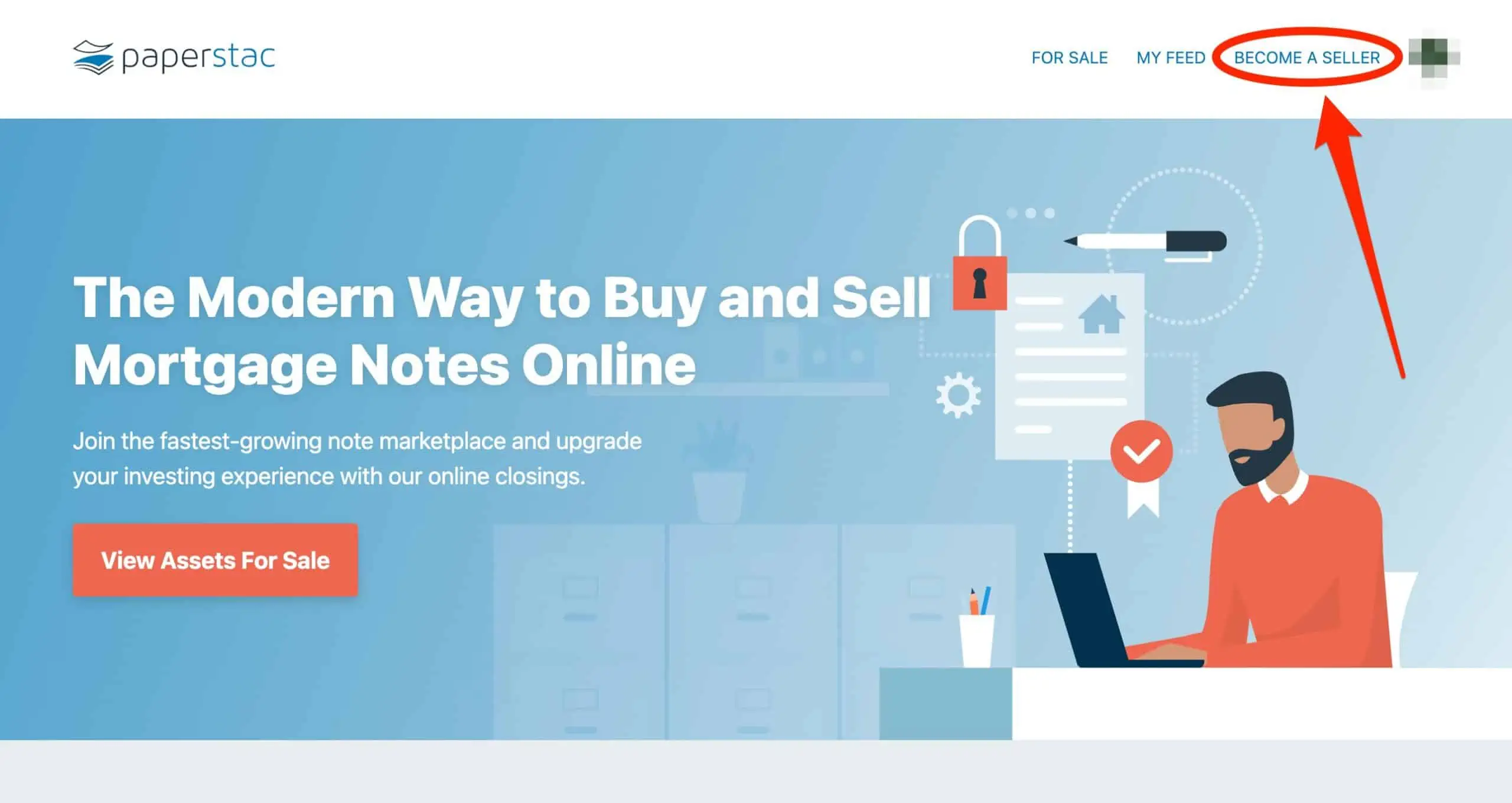

An online marketplace called Paperstac was built and designed for this exact purpose. This is where note buyers and note sellers come together to do business!

If you have a land note that you'd like to sell, you can probably do the job here.

This video explains how it works from the buyer's end.

Getting a note listed and sold involves a slightly different process. First, you have to sign up to create a seller profile.

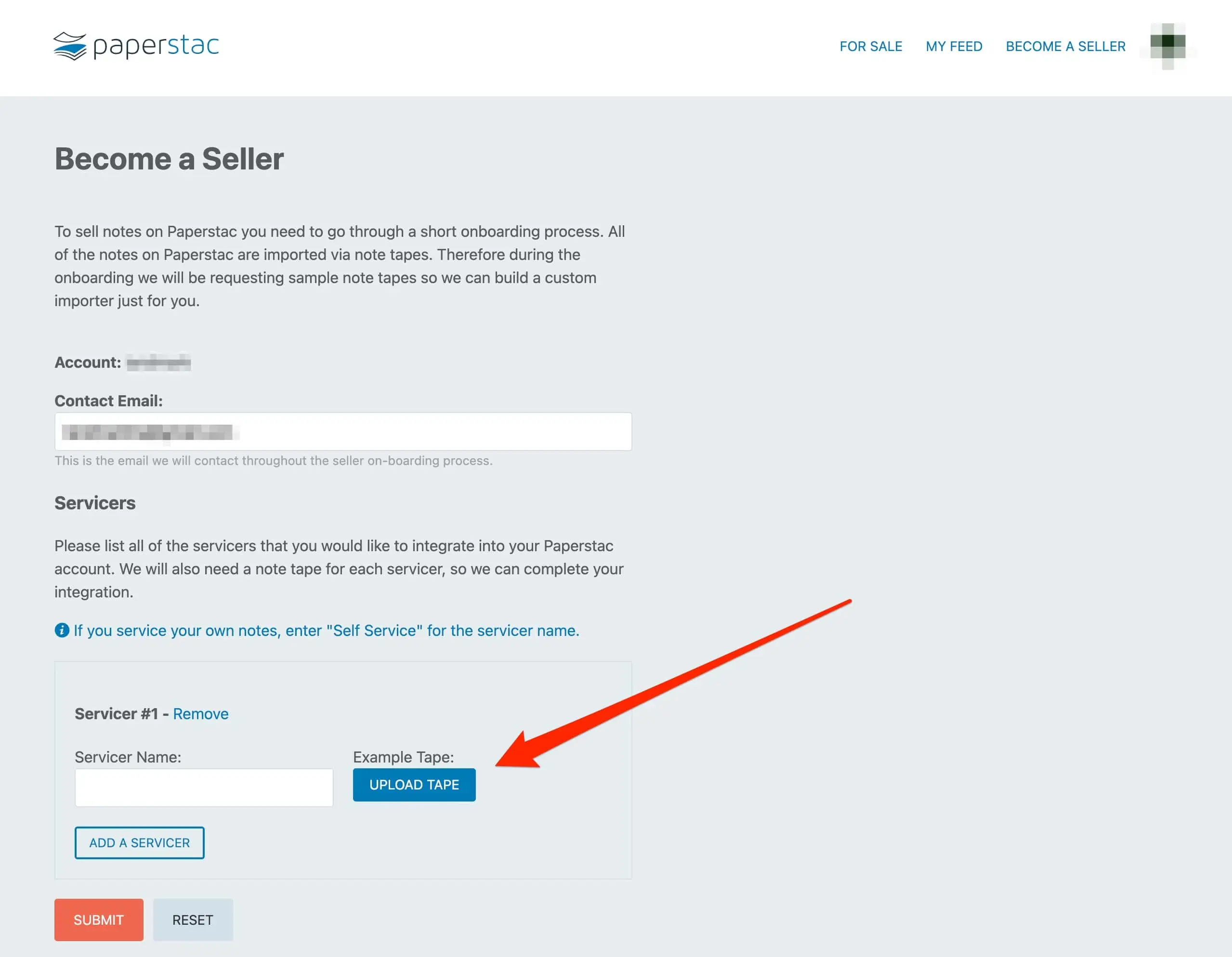

Then, you'll have to go through the “onboarding” process, which involves uploading some basic information about the note(s) you're trying to sell.

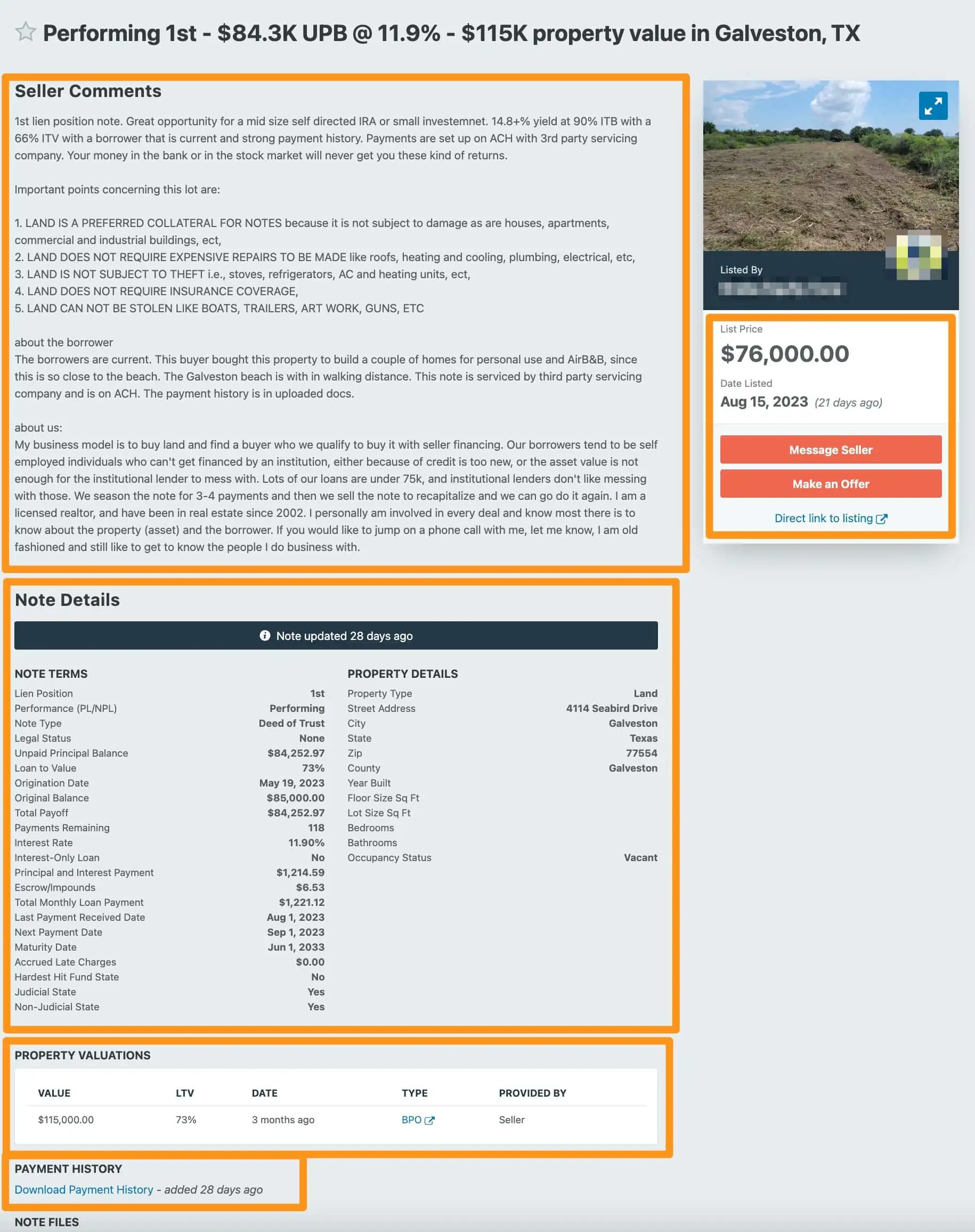

Once you complete all the paperwork and get your account approved, selling your note is similar to selling a property.

You'll want to include all the pertinent details about your property in your listing, answer all of the typical questions a note buyer will have, and then actively communicate with any active buyers who contact you about the note(s) you're selling.

As with most listing websites, you'll probably encounter some tire-kickers who aren't serious about buying. Try not to let this discourage or frustrate you. It's just part of the process until you find a worthy buyer.

If you try Paperstac and find it's just not working for you, you could also consider building your own buyers list so you can sell your notes faster to a more “pre-qualified” list of buyers who are ready to buy now and a good fit with your criteria.

Solving the Biggest Objections to Seller Financing

When I think about the biggest reasons NOT to offer seller financing, they boil down to these:

- When I want all my money now, not 3–5 years from now.

- If I don't want to learn all the rules, regulations, and documentation every time I sell a property in a new state (because things can dramatically differ from one state to another).

- If I want to avoid having to chase after borrowers who stop paying.

- When I want to avoid hiring an attorney to bring my properties through foreclosure if my borrower disappears.

- If I don't want all the extra moving pieces in my accounting software, tracking payments for years on end.

- If I want a simple, clean-cut deal, where I don't have to communicate and maintain a long-term relationship with a borrower (even if they do pay on time, as agreed… every new relationship is a new thing I have to monitor and pay attention to, which consumes mental resources I could be spending elsewhere).

These are all valid objections because most of these tasks are not required if you don't offer seller financing.

But, again, this is why the ability to sell your notes is such an essential factor to consider. If you sell your note immediately after or shortly after closing, you can eliminate most of these problems while still taking advantage of what seller financing offers sellers.

The one problem you can't solve completely is the necessity of learning the rules, regulations, and paperwork in each new state.

You can mitigate this by using a title company or attorney to close all your seller-financed deals and use their state-specific documentation, but it's still an additional set of moving pieces that wouldn't be required with a cash deal. However, assuming you did everything else right once that part is done, you can sell off that note and get cashed out pretty quickly.

When Seller Financing Is Essential

I understand why some land investors want nothing to do with seller financing. However, the fact is that some properties will be much harder and slower to sell if you don't offer seller financing as an option. We even outlined some of the reasons seller financing can allow you to sell properties much more quickly and for higher in our blog post “Why Seller Financing Makes Sense.”

If you want the benefits of selling faster and for more money with seller financing but DON'T want the hassles of managing seller-financed deals, then selling the note could be your next best option!

To learn more about the best practices for selling notes, check out this short presentation from Eric Scharaga.

Want to learn more about implementing seller financing in your real estate business? Be sure to check out SellerFinancingMasterclass.com!