What Is Book Value?

Shortcuts

- Book value is a financial measurement showing an organization’s total assets minus its liabilities.

- The word “book” in book value originates from accounting books, the ledgers that record business or individual financial transactions.

- Accountants, investors, and analysts rely on book values to make well-informed decisions, conduct precise valuations, and set financial benchmarks.

- Despite its benefits, solely depending on book value can be unwise because it doesn’t account for inflation or the value of intangible assets.

Understanding Book Value

To understand book value, you first need to understand a company’s “book,” which is its balance sheet or accounting ledger. This ledger lists all assets, liabilities, and equity.

In this context, book value (also called book value of equity) is the difference between total assets and liabilities. In other words, it’s the remaining money if the company sells all assets and pays off all debts[1]. It serves as a benchmark for measuring a company’s net worth[2].

Book value represents a company’s net assets, including cash and inventory, and liabilities like debt and accounts payable. However, a company’s book value does not necessarily stay stable or increase over time; it can also decrease if liabilities increase or assets decrease due to depreciation or other losses.

Investors use book value to assess the investment potential of a company, as it offers insight into the company’s worth upon liquidation[3].

Why Is It Called Book Value?

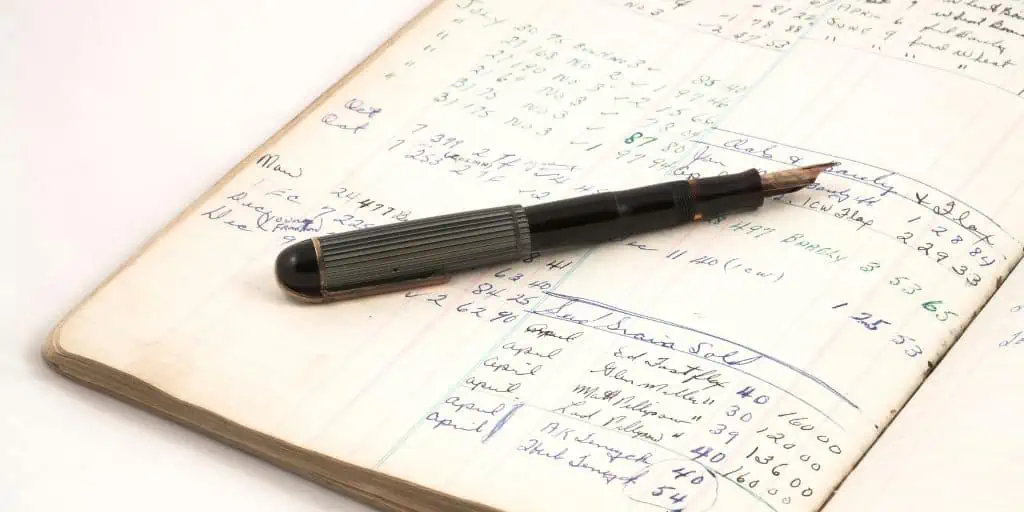

The term book value comes from “book,” an older term for an accounting ledger that records all financial transactions within an organization[4].

In the past, companies recorded all transactions and assets in physical books as they happened[5]. Over time, this practice evolved with the introduction of modern accounting software. Still, the term “book value” persists because it continues to denote the same idea: calculating the net worth of a company or asset after deducting liabilities and depreciation.

How to Calculate Book Value

You calculate book value by subtracting liabilities from assets.

There are two methods for calculating book value: the total method and the per-share method.

Total Method

The Total Method is the most direct way of calculating the book value of a company. In this method, you subtract the total liabilities of a company from its total assets.

The formula for the Total Method is:

In practical terms, follow these steps to calculate book value using the Total Method:

- First, identify all the assets a company owns. Assets can include everything from cash, accounts receivable, inventory, property, plant, equipment, and investments, to intangible assets like patents and trademarks. These figures can typically be found on the company’s balance sheet in their annual or quarterly reports.

- Second, identify all of the company’s liabilities. Liabilities can include accounts payable, accrued expenses, short-term and long-term debt, and any other financial obligations the company has.

- Finally, subtract the total liabilities from the total assets to get the book value of the company.

This method estimates what the company would be worth if it were to be liquidated, with all assets sold and all debts repaid.

Sample Computation

Let’s say we have a company, Company ABC. On their balance sheet, they report the following:

- Total Assets: $5,000,000

- Total Liabilities: $2,000,000

To calculate the book value using the Total Method:

Subtract Total Liabilities ($5,000,000) from Total Assets ($2,000,000): = $3,000,000

So, the book value of Company ABC is $3,000,000.

Per-Share Method

The Per-Share Method (or book value per share, BVPS) is another way of calculating book value, but it provides a per-share value, which can be more useful to investors comparing the book value to the market price of the stock.

The formula for the Per-Share Method is:

Here are the steps to calculate book value per share using the Per-Share Method:

- First, identify the total common equity. This is the amount of money that would be returned to a company’s shareholders if all the assets were liquidated and all the company’s debts were paid off. In other words, it’s what’s left for shareholders after a company’s obligations are met.

- Second, identify the total number of outstanding shares, often found in the company’s annual or quarterly report or other filings with securities regulators.

- Lastly, divide the total shareholder’s equity by the total outstanding shares to get the book value per share.

This method provides a measure of the accounting value of a share of stock, which can be compared to the market price to help determine if the stock is overpriced, underpriced, or fairly valued.

Sample Computation

Continuing with Company ABC, let’s assume the following additional information:

- Total Common Equity: $3,000,000

- Total Number of Outstanding Shares: 1,000,000

To explain, common equity refers to the amount that all common shareholders have invested in a company. It includes the total value of assets that shareholders would theoretically get if a company was liquidated minus the total liabilities of the company. In this context, “common equity” is synonymous with total book value.

To calculate the book value per share using the Per-Share Method:

Divide Total Shareholder’s Equity ($3,000,000) by Total Number of Outstanding Shares (1,000,000): = $3

So, the book value per share of Company ABC is $3. This means that each share of Company ABC represents $3 of the company’s book value.

Book Value vs. Market Value

The main difference between book value and market value is that book value shows an asset’s worth according to financial records, while market value indicates its selling price in the current market[7].

Book value reflects the net assets of a company (assets minus liabilities) based on historical cost, not their current market value. However, market value estimates the current economic conditions and the assets’ value at current market rates.

For instance, a company lists $10 million in assets and $2 million in liabilities on its balance sheet, resulting in a book value of $8 million. Still, the current market value of their assets may be much higher or lower due to prevailing market conditions.

Why Is Book Value Important?

There are many reasons why book value is important, including:

Helping Businesses Make Informed Decisions

By understanding their book value, organizations can make better decisions about their assets’ current state and resource allocation. For investors and market analysts, understanding book values helps make informed investment decisions[8].

Simplifies Asset Valuation

Book value offers an objective method to gauge a company’s worth without depending on fluctuating market forces. It aids businesses in recognizing undervalued or overvalued assets and adjusting accordingly.

Establishes Financial Benchmarks

A company can use book value as a benchmark to compare its past and present performance and measure progress. Book value also serves as a useful starting point for businesses to evaluate their assets and liabilities’ current worth.

Measures a Company’s Financial Health

Lastly, book value assesses a company’s financial health. If the figure is positive, the company has sufficient assets to cover its liabilities; if it’s negative, it has more liabilities than assets[9], indicating insolvency.

That said, multiple factors like market conditions and the original cost of an asset can affect book value. Therefore, considering other financial indicators is vital when evaluating a company’s actual value.

Limitations of Book Value

Despite its usefulness, book value also has its limitations[10].

Depreciation

Asset depreciation can create a disparity between a company’s book value and its actual market value. Remember, some assets, like real estate, may appreciate rather than depreciate.

No Adjustment for Inflation

Book value doesn’t account for inflation. With inflation, the purchasing power of money dwindles over time, which can affect the real value of the assets. Note that inflation doesn’t impact book value as it’s based on historical cost, not current value.

Outdated Values

In some cases, book value can be outdated as it only shows an asset’s original cost and current depreciation rate. Thus, if market conditions or prices have evolved over time, book values may not accurately portray an asset’s true value.

Excludes Intangible Assets

Book value only accounts for tangible assets. It doesn’t include soft assets like intellectual property or goodwill in its calculations.

Reflects Past Performance Only

While a company’s book value can shed light on its past performance, it doesn’t predict future growth. Depending solely on book value may lead an investor to make incorrect assumptions about an asset’s current and future value.

Sources

- Ward, A. (2020, October 2.) Net Book Value of Assets. Financial Edge. Retrieved from https://www.fe.training/free-resources/accounting/net-book-value/

- Hayes, A. (2023, February 7.) Book Value Defined: Meaning, Formula, and Examples. Investopedia. Retrieved from https://www.investopedia.com/terms/b/bookvalue.asp

- CFI Team. (2022, December 15.) Book Value. Corporate Finance Institute. Retrieved from https://corporatefinanceinstitute.com/resources/accounting/book-value/

- Mitchell, C. (2022, June 9.) Book. Investopedia. Retrieved from https://www.investopedia.com/terms/b/book.asp

- What is book value? (n.d.) Xero. Retrieved from https://www.xero.com/glossary/book-value/

- Book Value Per Share: Definition, Formula & Example. (2023, April 14.) FreshBooks. Retrieved from https://www.freshbooks.com/glossary/accounting/book-value-per-share

- Murphy, C. (2022, September 9.) Book Value vs. Market Value: What’s the Difference? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/how-are-book-value-and-market-value-different/

- Beattie, A. (2021, December 29.) What Book Value Means to Investors. Investopedia. Retrieved from https://www.investopedia.com/articles/fundamental-analysis/09/book-value-basics.asp

- Net Book Value. (n.d.) Causal. Retrieved from https://www.causal.app/define/net-book-value

- Mcbride, S. (2016, January 6.) The Problem With Using Accounting Book Value. New Constructs. Retrieved from https://www.newconstructs.com/problem-using-accounting-book-value/