What Are Bull and Bear Markets?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

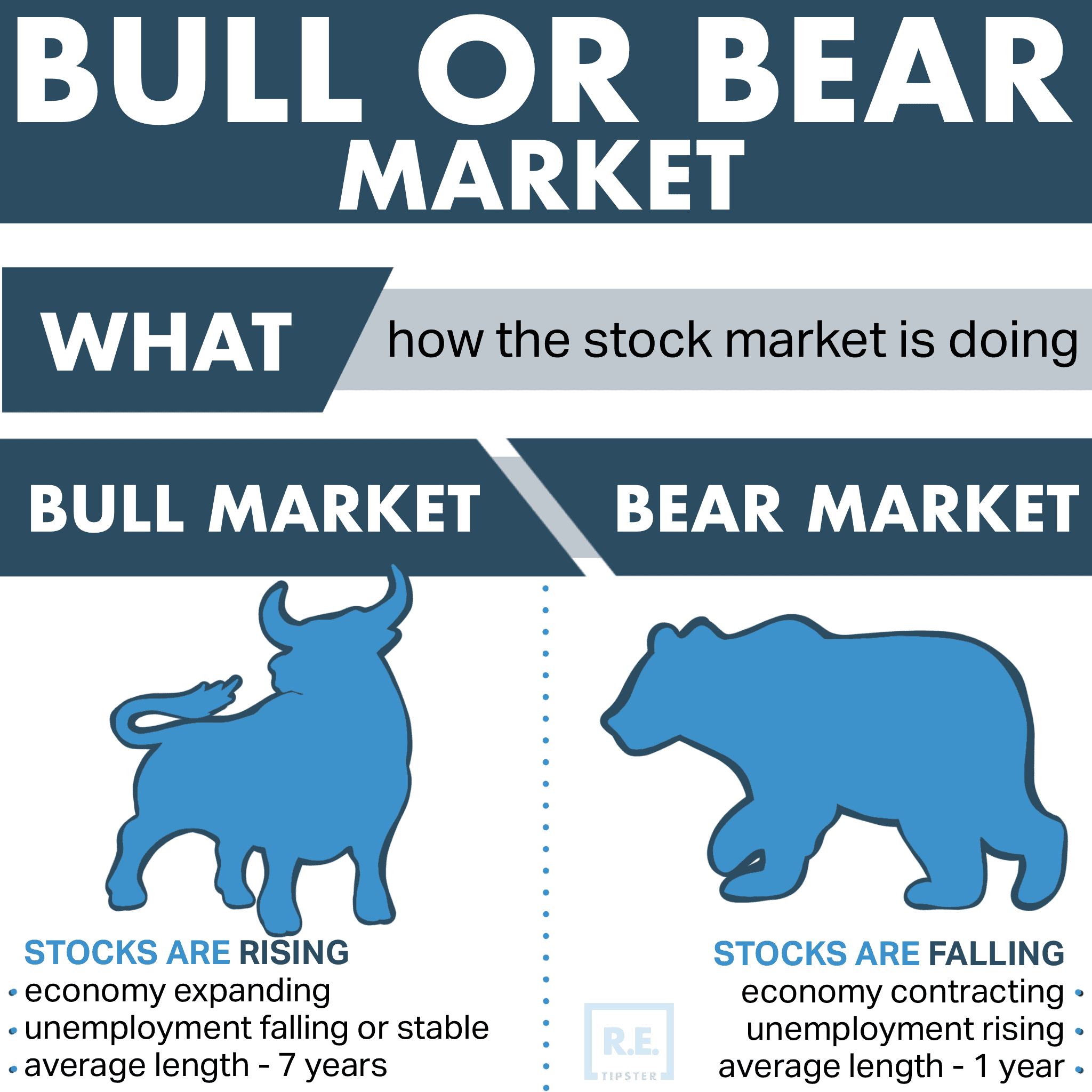

What Constitutes Bull and Bear Markets?

One of the popular origins of the terms “bull” and “bear” in this context is metaphorical[1]. The idea stems from the way these animals attack. The bull thrusts its horns up in the air, representing the upward trajectory of asset value. The bear, on the other hand, slashes with its claws downward, symbolizing the fall of prices. Both bull markets and bear markets occur cyclically, but bullish periods usually last longer than bearish ones.

Normally, bull and bear markets are associated with equities. However, they also apply to anything that can be traded, like real estate[2]. These terms can also indicate how investors feel about the market.

In the stock market, the conditions are bullish when the prices have jumped by no less than 20% since the most recent deep downturn.

In a bull environment, optimism reigns. The value of stocks keeps rising due to the belief of most investors (known as “bulls”) that their assets are going to appreciate over the short term. Occasionally, market corrections[3] prevent things from overheating and make the bull market more sustainable.

Market conditions become bearish when prices decline by at least 20% and keep going down. As the negative trend continues, investor sentiment turns sour. The optimists become pessimists (now known as “bears”), convincing other investors to park their funds elsewhere.

There are other indicators of how bullish or bearish the market conditions are. Here are three of them.

Gross Domestic Product (GDP)

Growth in GDP signifies a bull market. An expanding economy denotes that the revenues of local businesses and the incomes of their employees are increasing. This can fuel higher consumer spending, creating upward feedback.

On the other hand, GDP shrinkage is characteristic of a bear market. When the sales of businesses are weak and the workers’ incomes decline or stagnate, the economy contracts. As a consequence, investors try to preserve their wealth instead of buying relatively risky assets.

Unemployment

Decreasing unemployment signals a bull market, while a high rate of joblessness indicates a bear market.

Inflation

During a bull market, prices are higher, corresponding with the demand for goods and services. Conversely, things become cheap when the bear market is in full swing because consumers hesitate to spend. However, inflation may still happen under bearish conditions.

Is a Bull Market Good?

A bull market is an opportunity to invest in assets that can increase in value more quickly than others within a short period.

In equities, growth stocks[4] tend to perform well under bullish market conditions. Many investors gravitate toward them because they are likely to yield greater and faster returns. The strong demand for growth stocks makes them more expensive, but bulls do not mind since they feel that the reward outweighs the extra cost.

In a bullish stock market, realized profits can get reinvested into real estate and commodities like precious metals. The investors that take this route want a stronger hedge against inflation and a more diversified portfolio, allowing them to continue generating passive income even after the bullishness of the market fades.

In addition, while real property is normally not liquid, it can increase one’s net worth through appreciation. In a hot market, it can provide positive cash flow through rent.

Savvy investors take profits during bull runs. They cash in their assets that have appreciated enough since they bought them to capitalize on widespread optimism. They also plan their exit strategies when the bulls begin to outnumber the bears without necessarily timing the market peak, which is difficult, if not impossible.

Is a Bear Market Bad?

Contrary to face value, a bear market still presents opportunities to make money.

A bearish period is an opportunity to pull a profit when the bull market rolls around. This is particularly important to investors who feel that they missed the previous bull run.

Lackluster economic conditions may keep asset prices low, so the bear market investors will use this time to accumulate and increase their holdings.

Typically, investors pour their funds on value stocks[5] when market conditions are bearish. Such assets are attractive because most investors believe that they are underpriced in

the present and are almost guaranteed to appreciate in the future.

By contrast, diminishing returns can render value stocks less appealing to new investors during a bull market. They may still have room for growth, but much more capital may be needed to drive up their prices to new heights.

The Real Estate Cycle and the Bull and Bear Markets

The real estate market can experience ups and downs like the bull and bear periods, but it does not alternate in the latter’s sense. Instead, it has a cycle consisting of four key phases.

1. Recovery

During the recovery phase, the value of properties is still down. Rental growth remains stagnant, and property construction is at a standstill.

Despite the prevalent bearish market conditions, some signs indicate those most affected by the latest recession are beginning to feel more optimistic about the future.

2. Expansion

During the expansion phase, the interest of ordinary homebuyers and renters in the real estate market is back. When demand is on the upswing, the price of properties goes with it as the available inventory gets consumed.

3. Hyper-Supply

During the hyper-supply phase, developers, builders, and flippers[6] work double-time to increase the housing stock in response to the market’s rising demand.

Eventually, supply starts to exceed demand, although this is not always because of too much inventory. Pessimism in the economy can change market sentiment for the worse, reversing the existing bullish conditions.

4. Recession

During the recession phase, property prices crash. Foreclosures are record high or nearing historic levels; a significant number of homeowners have underwater mortgages[7], if not in default already, and rental growth is negative since many landlords are forced to charge less to avoid sustained vacancies.

In this bearish environment, however, real estate investors are in an excellent position to purchase distressed properties at a discount.

On average, real estate cycles last about 15 to 16 years[8]. However, some are much longer than others due to the unpredictable nature of the factors involved in shaping them.

Factors That Affect the Real Estate Cycle

The real estate cycle develops in phases due to the influence of several factors. Most of these factors can be predicted, observed, and/or calculated, except for so-called “black swan” events[9].

Some of the following factors greatly affect market conditions in real estate over time.

Demography

The demographics in an area determine which properties are in high demand. Typically, different age groups have different needs and financial capabilities.

For example, if a housing market is home to retirees who intend to downsize, one-bedroom dwellings on relatively small lots will likely become the priority of builders. On the other hand, if a housing market is a destination of indebted mobile professionals[10], rental apartments will generate interest.

The Health of the Economy

If a country’s economic outlook does not inspire optimism, consumers will feel more encouraged to continue renting, avoiding the challenges of homeownership. On the flip side, if the economy is booming, renters will be keener on moving to a bigger place and taking out a mortgage.

Government Policy

Policymakers can step in and inject life into an ailing economy. They can also intervene to slow down unsustainable economic growth. Whatever the authorities do, they can affect the bullishness or bearishness of the housing market.

Interest Rates

Interest rates can influence the affordability of properties. The Federal Reserve, for example, can raise rates[11] to dampen demand and drive down prices. Reduced interest rates can signify that interested homebuyers are waiting before committing to a refinance or property purchase.

Takeaways

A bull market begins when stock prices rise by at least 20% from the last downturn, while a bear market starts when the value of a broad range of stocks falls by at least 20% and continues to trend lower. Bull and bear markets follow one another, marked by periods of optimism and pessimism about the performance of stocks.

Investors can be bullish or bearish toward stocks and other asset classes like real estate. However, traditional bull and bear markets do not occur in real estate. Instead, it undergoes a long cycle of recovery, expansion, hyper supply, and recession. Many factors can fuel the different phases of a real estate cycle, including demographics, economy, government policy, and interest rates.

Sources

- Banerjee, P. (2009.) Why Are They Called “Bull” and “Bear” Markets? Bonds Are for Losers. Retrieved from https://bondsareforlosers.com/why-are-they-called-bull-or-bear-markets/

- Scott, G. (2021.) What is a Bull Market? Retrieved from https://www.investopedia.com/terms/b/bullmarket.asp

- Curry, B. & Marquit, M. (2021.) Investing Basics: What Is a Market Correction? Forbes Advisor. Retrieved from https://www.forbes.com/advisor/investing/what-is-market-correction/

- Levy, A. (2021.) Investing in Growth Stocks. The Motley Fool. Retrieved from https://www.fool.com/investing/stock-market/types-of-stocks/growth-stocks/

- Corporate Finance Institute®. (2020.) What Are Value Stocks? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/value-stocks/

- Robinhood. (2020.) What Is a Flipper? Retrieved from https://learn.robinhood.com/articles/91XZuKLKO2IT8ygZdGMMQ/what-is-a-flipper/

- Robertson, C. (2020.) What Is an Underwater Mortgage? The Truth About Mortgage. Retrieved from https://www.thetruthaboutmortgage.com/what-is-an-underwater-mortgage/

- Lee, A. (2020.) How Long Does a Real Estate Cycle Last? Money Inc. Retrieved from https://moneyinc.com/real-estate-cycle/

- Waschenfelder, T. (2021.) Why You Should Expose Yourself To Positive “Black Swan” Events. Wealest. Retrieved from https://www.wealest.com/articles/positive-black-swan

- Mizes, B. (2020.) More Millennials Are Renting. This Is Why. rent.com. Retrieved from https://www.rent.com/blog/millennial-generation-renting/

- Ostrowski, J. (2021.) How the Federal Reserve Affects Mortgage Rates. Bankrate. Retrieved from https://www.bankrate.com/mortgages/federal-reserve-and-mortgage-rates/