What Is the Cost Approach in an Appraisal?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- The cost approach appraisal estimates a property’s value by calculating the cost of rebuilding the same structure on the same land.

- It involves assessing land value, totaling construction costs (materials, labor, permits), and accounting for depreciation in building value over time.

- This includes physical wear and tear, outdated design (functional obsolescence), and external factors like economic changes or environmental issues.

- The resulting figure from these computations is the appraisal value.

- Real estate professionals don’t use the cost approach appraisal on its own but usually combine it with other methods, especially for unique properties.

How the Cost Approach Appraisal Works

The cost approach appraisal works on the assumption that if a buyer can build a similar house or building for less money, they wouldn’t pay more to buy one that’s already built.

Think of it this way. Imagine you want to buy vacant land with a house on it, but at the same time, you have the funds to buy the components of the property and build it yourself. The cost approach appraisal allows you to check the price of each piece and its associated labor; if it’s cheaper and easier to buy the pieces and DIY it, why would you pay more for the property with a house on it?

In other words, the cost approach appraisal looks at how much it would cost to build the same building from scratch instead of buying one that’s already there.

In general, there are four key steps in the cost approach appraisal method:

- Valuation: First, find out how much the land itself is worth as if nothing is built on it. This is done by looking at how much similar pieces of empty land have recently sold for.

- Costs:Next, add up all the costs needed to build the main building and any other structures, like garages or sheds. This includes the price of materials, paying workers, design fees, permits, and other costs.

- Depreciation: Over time, buildings get older and less valuable. This loss in value, called depreciation, is subtracted from the building costs.

- Reconciliation: Finally, add the land value to the adjusted building cost. This gives the total property value using the cost approach.

The formula below can serve as a representation of this:

Cost Approach Value = (Estimated Land Value + Replacement Cost New of Improvements) – Accrued Depreciation

Each step is discussed in detail in the sections below.

1. Cost Approach Appraisal: Valuation

The first thing to do is figure out how much the land itself is worth as if it were vacant. Start by looking at how much similar vacant parcels in the area have sold for recently.

Here are the things to consider:

- Location: Things like the view, how noisy it is, how close it is to places like stores or parks, and whether there are any undesirable areas.

- Size: The parcel’s total area. Usually, smaller pieces of land cost more per square foot than bigger ones, so adjustments are made based on size.

- Zoning: What you’re allowed to build there and how big these structures can be.

- Topography: The flatter the land is, the better. Hilly or oddly shaped parcels generally fetch for less on the market.

- Utilities: Whether there are basic services like electricity, water, and sewer lines available.

Other things like clearing the land or leveling it can also affect its value.

2. Cost Approach Appraisal: Costs

A cost approach appraisal uses the replacement cost value (RCV) to find out how much a property is worth. This means we think about how much it would cost to build a similar, modern version of the property.

An RCV includes all direct and indirect expenses of reconstruction:

Direct Costs

- Materials: Type, grade, and quantity needed and used.

- Labor rates: Regional prevailing wages paid for each trade.

Indirect Costs

- Architect and engineering fees.

- Construction financing costs, including interest and loan fees.

- Building permits, surveys, and title insurance.

- Insurance and legal fees.

- Contractor’s overhead, profit, and supervision.

- Taxes and insurance during construction.

- Cleanup and debris removal fees.

To accurately estimate these costs, you need special, sometimes even insider, knowledge. For example, appraisers use sources that give information on local prices for building materials and labor. They might also talk to people who build houses, contractors, or experts who estimate costs. How much detail they go into depends on what kind of property it is, how complicated it is, and what kind of report they need to make.

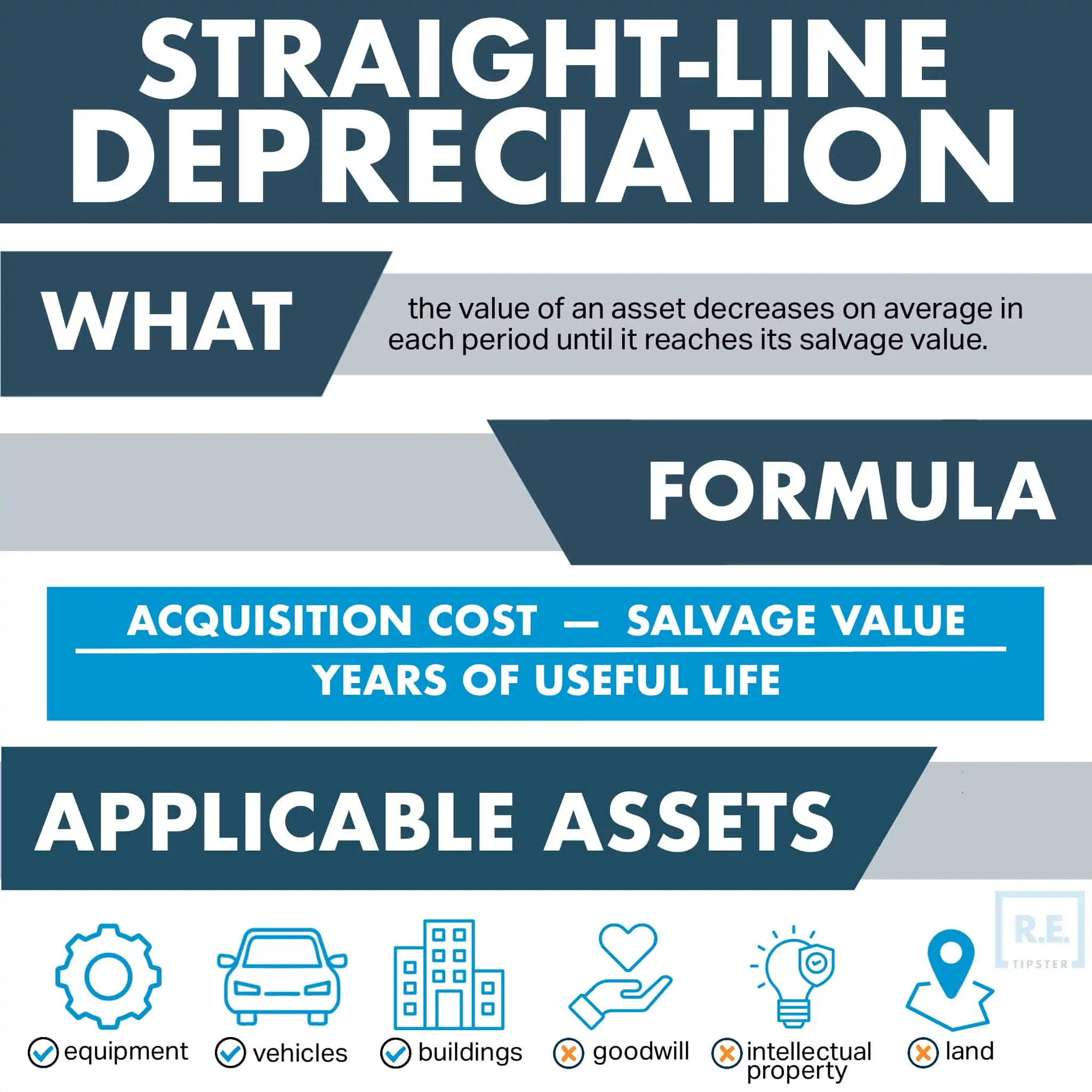

3. Cost Approach Appraisal: Depreciation

After figuring out the RCV for all buildings, the appraiser takes out any costs for improving the site, like landscaping, because these are handled separately. The total RCV for the main house and any other buildings determines how much the property’s value has degraded over time—called depreciation.

All buildings depreciate for three reasons:

Physical Deterioration

This happens when parts of a building, such as the roof, walls, plumbing, and heating systems get old and worn out. They then need repairs or replacement. The older the building, the more wear and tear it likely has.

Appraisers check each part of the building to see how long it’s supposed to last. They walk through the property to see what’s damaged or needs fixing. Sometimes, they bring in experts to look at specific systems like electrical or plumbing.

Functional Obsolescence

This is when a building’s design becomes outdated. For example, it might not meet the needs of people today, even if it’s still strong and intact.

Some design problems can be fixed, like turning an unused basement into a living space. Others can’t be fixed easily or are too expensive to change, like having too many hallways or staircases.

External Obsolescence

This happens because of outside factors that the property owner can’t control. Things like economic downturns or a recession, changes in the neighborhood population, new government rules, nearby commercial development, or environmental pollution can all lower a building’s value.

How to Quantify Depreciation

To figure out how much value a building has lost, appraisers look at the selling prices of similar buildings and how much it would cost to build them new. They also use detailed analyses showing how long different parts of the building are expected to last.

For damage from things like fires or storms that insurance might cover, any loss in value not paid by insurance is also considered wear and tear. Insurance usually doesn’t cover the full cost of replacing everything, so any unpaid amount is added to the building’s overall depreciation.

4. Cost Approach Appraisal: Reconciliation of Values

The final step is to combine the separate indications of value for the land and improvements, minus depreciation, to reach the property’s total value. The appraiser checks how reliable and appropriate the data they used is, keeping in mind any limits to their analysis.

Appraisers usually don’t rely only on the cost approach. They often pay more attention to other appraisal methods that are better at showing why buyers would pay a certain price to acquire property. However, using the cost approach is still important because it adds extra information to the valuation and helps figure out how much the property should be insured for.

Frequently Asked Questions: Cost Approach Appraisal

What building costs are included?

The cost approach looks at all direct and indirect expenses to develop the property improvements as they stand currently. This encompasses hard construction costs like materials and labor, as well as soft costs like construction financing, permits, professional fees, insurance, and contractor overhead and profit.

What is the difference between replacement cost and reproduction cost?

Replacement cost is about building a new property that is just as useful as the old one but using modern designs and materials. It’s about creating something similar but with today’s technology and style.

On the other hand, reproduction cost is about making an exact copy of the original building using the same materials and building methods used the first time. It’s like creating a duplicate of the old property.

Why can’t the cost approach be used alone?

Using just the cost approach usually isn’t enough to get a reliable value for a property. This is because it doesn’t really consider how many properties are available for sale (supply) and how many people want to buy them (demand) or why people decide to buy or sell properties.

The main idea behind the cost approach is that a buyer could build a similar property instead of buying the existing one. But this doesn’t fully consider other important factors that can affect a property’s value, like location, neighborhood trends, or economic conditions.

Therefore, the cost approach works best for specialty-use properties and/or combined with other valuation methods.