What Is a Deed in Lieu of Foreclosure?

Shortcuts

- A deed in lieu of foreclosure frees a financially distressed borrower from mortgage-related obligations in exchange for handing over the property to the lender.

- It can benefit both sides since all parties usually want to avoid foreclosure proceedings as much as possible.

- A deed-in-lieu takes less time to complete than a short sale, plus its terms may allow the borrower to rent the property from the lender for a certain period.

- However, a deed-in-lieu can damage one’s credit and cannot be removed from credit reports unless it shows up by mistake.

- It stays on a credit record for less time than foreclosure.

Why Use a Deed-in-Lieu?

A deed-in-lieu can benefit both borrowers and real estate lenders because it helps avoid the time-consuming and costly foreclosure process[1].

For borrowers, it provides an opportunity to reduce the credit impact of non-payment and to decide how to vacate the property[2]. In fact, some DILs even let the borrower lease the property for a certain period[3]. Meanwhile, for lenders, it reduces expenses and potentially increases profits if the property is sold in a hot market[4].

However, before agreeing to a DIL, lenders consider several factors, such as debt size, estimated property value, equity, and market conditions. In cases of negative equity, lenders may require borrowers to settle the deficiency, although it may be possible to negotiate this in some situations.

Deed in Lieu of Foreclosure vs. Short Sale

When considering options for avoiding foreclosure, a deed-in-lieu may be more attractive than a short sale for several reasons.

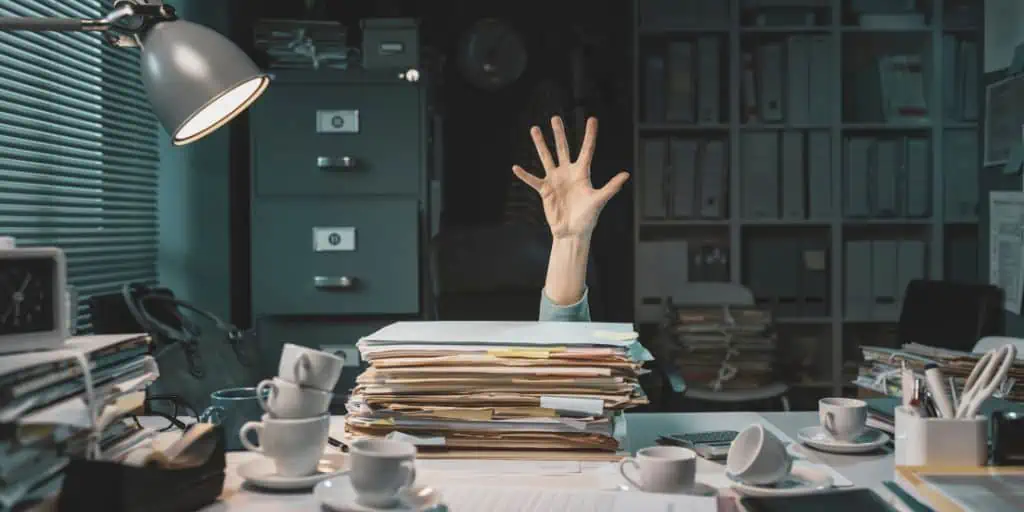

First, the timelines for completing a deed-in-lieu are much shorter than those for a short sale, typically taking only 90 days[5]. By contrast, a short sale can drag on for a year to get the lender’s approval.

Second, short sales can be lengthy and involve mountains of paperwork, requiring the borrower to prove fresh financial distress that was not disclosed at the time of the mortgage approval.

Third, lenders may be reluctant to approve short sales due to the possibility of a deficiency that they may be unable to collect, resulting in a loss for the lender.

In contrast, a deed-in-lieu is also preferable for a defaulting borrower because it allows them more time to find a new place to live. In most cases, the borrower only has 30 days to vacate the property after a short sale[6], while a DIL can give them more time to make arrangements.

Deed-in-Lieu Considerations

Before considering a deed-in-lieu, it is important to exhaust all other alternatives to foreclosure[7]. However, a DIL can still cause significant damage to one’s creditworthiness, especially for those with excellent or very good standing[8].

On the bright side, a deed-in-lieu stays on a borrower’s credit report for only four years, three years shorter than a foreclosure.

Recovering From a Deed-in-Lieu Record

Recovering from a deed-in-lieu record is possible, but it takes time and effort. Moreover, getting rid of the blemish from one’s credit record is challenging, as credit bureaus only remove such marks due to errors.

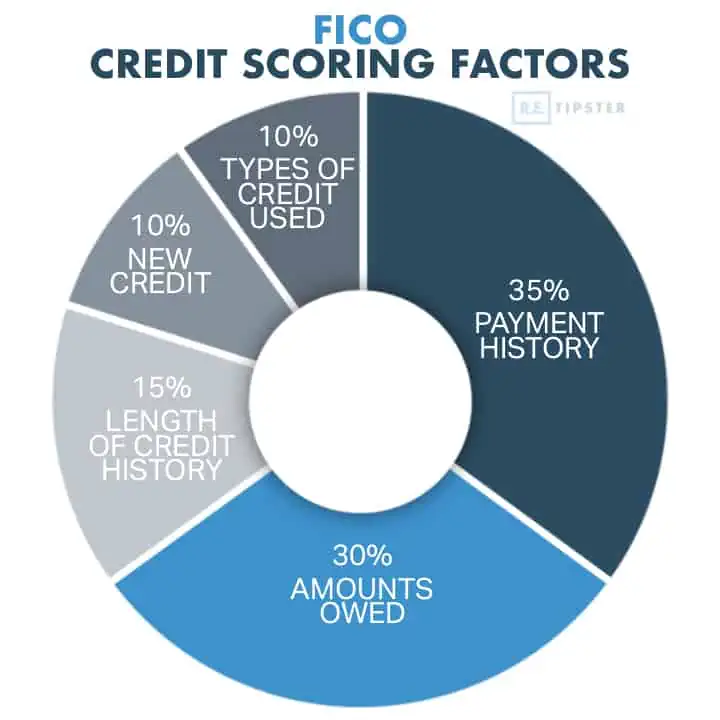

The best way to rebuild credit is by maintaining a good payment history and low credit usage, as these two factors account for 65% of FICO scores[9]. Payment recency also carries a lot of weight, and late or missed payments (which generally stay on a credit report for 7.5 years) become less impactful over time[10]. Note that VantageScore might weigh these differently.

In short, borrowers who have pursued a deed-in-lieu and have a reputation for being unreliable mortgage billpayers are incentivized never to be delinquent again.

BY THE NUMBERS: A deed in lieu of foreclosure can knock 50 to 125 points off one’s FICO scores without a deficiency balance.

Source: Nolo

Sources

- Lee, C. (2022, January 1.) How Foreclosure Affects Homeowners and Lenders. Upsolve. Retrieved from https://upsolve.org/learn/what-is-foreclosure/

- Kalinowski, R. (2020, September 21.) How to Evict Someone After Foreclosure. SF Gate. Retrieved from https://homeguides.sfgate.com/evict-someone-after-foreclosure-1761.html

- Armour, S. (2008, May 17.) Foreclosures Take an Emotional Toll on Homeowners. ABC News. Retrieved from https://abcnews.go.com/Health/MindMoodNews/story?id=4873943

- Luthi, B. (2022, September 27.) Buyer’s market vs. seller’s market: What’s the difference? Bankrate. Retrieved from https://www.bankrate.com/real-estate/buyers-vs-sellers-market/

- Bermudez, R. (2022, July 8.) What Is a Deed-in-Lieu of Foreclosure? LendingTree. Retrieved from https://www.lendingtree.com/home/mortgage/deed-in-lieu-of-foreclosure-what-is-it/

- Weintraub, E. (2021, December 24.) When Should You Move Out During a Short Sale? The Balance. Retrieved from https://www.thebalancemoney.com/when-should-you-move-out-during-a-short-sale-1799158

- Egan, J. (2021, February 18.) How Can I Stop Foreclosure? Experian. Retrieved from https://www.experian.com/blogs/ask-experian/how-can-i-stop-foreclosure/

- DeNicola, L. (2022, June 9.) Your guide to credit score ranges. Credit Karma. Retrieved from https://www.creditkarma.com/advice/i/credit-score-ranges

- Are FICO® Scores and VantageScore® Different? (2019, August.) Equifax. Retrieved from https://www.equifax.com/personal/education/credit/score/difference-between-fico-scores-vantagescore/

- Barroso, A. & O’Shea, B. (2022, September 24.) Minimize Credit Score Damage From Late Payments. NerdWallet. Retrieved from https://www.nerdwallet.com/article/finance/late-bill-payment-reported