What Is a Dividend?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- Public companies pay dividends to shareholders as a reward for their investment.

- Dividends can be paid in cash, equity, a mix of cash and equity, or company-owned properties.

- Dividends are generally recurring and paid on schedule annually, quarterly, or monthly, but they can be non-recurring too.

- Real estate does pay dividends, but only through a REIT, which are publicly traded securities like stocks.

4 Types of Dividends

A dividend can be paid in cash, in stocks, a combination of cash and stocks, or property. The board of directors decides the payout rates[1] and frequency of payments.

Cash Dividend

Cash dividends are paid directly in money, usually credited to investors’ brokerage accounts. The recipients of these funds can either reinvest them or withdraw them and keep them in their personal bank accounts.

Among the four dividend types, cash dividends are the most common.

Stock Dividend

Stock dividends manifest themselves as additional shares in investors’ accounts. They are also known as dividends in kind.

The issuance of stocks as dividends drives down the price of each share after the fact. That is because the pool of stock shares grew while the company’s total market value remained the same.

As a result, shareholders gain real value from these rewards only when they sell their stocks after their price increases enough to exceed the one before the dividend distribution.

Hybrid Dividend

A hybrid dividend payment combines cash and stock rewards, offering the best of both worlds. For instance, an investor with 150 public company shares will receive $60 and 15 additional shares in a cash-and-stock dividend payment of 40¢ per share plus 10% of shares owned.

Property Dividend

Property dividends are non-monetary but have monetary value. Typically, they are an alternative to cash or stock dividends.

Property dividends can be anything of value. A good example is shares of the issuing company’s subsidiary. It can also be a physical asset the corporation owns like real estate, inventory, or equipment.

Although property dividends are not typically liquid[2], they can be advantageous to investors who aim to hold onto assets that may increase in value or want to defer their taxes.

Why Do Investors Want Dividends?

Investors gravitate toward dividend-paying companies for different reasons. Some of the more common ones include the following.

- Partial return on investment. Receiving dividends is one way to cash in from owning equity in publicly traded companies. For example, most S&P 500 investment returns come from dividends[3]. These rewards, especially those paid by dividend aristocrats[4], tend to grow over time, making dividend stocks a regular revenue stream.

- Stock evaluation. Dividends help investors identify which stocks are worth their capital. Dividend-paying companies are typically well-managed and have real cash flow. The payout history of a public company is a good indicator of its financial strength.

- Risk mitigation. Dividend stocks are typically more resilient to economic downturns than their non-dividend-paying counterparts. In addition, dividend stocks are not totally immune to the effects of sell-offs[5] but are less volatile[6], making them a safer bet during bear markets.

- Purchasing power preservation. Dividends can offset stock price dips and complement increases to help outpace inflation.

- Tax reduction. Qualified dividends[7] are taxed as capital gains at lower rates than ordinary incomes. As a result, investors whose ordinary income tax rate is in the lowest brackets[8] can receive qualified dividends tax-free.

BY THE NUMBERS: The annual growth of dividends per share outstrips inflation by 2.4%.

Source: MarketWatch

How Often Are Dividends Paid?

Dividends are usually paid quarterly. Some public companies issue annual dividend payments, and only a few pay monthly. Whether the payment date is set annually or quarterly, companies have an ex-dividend date—the date investors must own shares to receive the next dividend payment.

Some dividend-paying companies may process payouts on schedule even when they generate less profit than usual during a particular period. This is because they may decide to do so to keep their track record of making recurring dividend payments.

In some sectors, public companies are more capable of maintaining dividend payments. Usually, these are energy, basic materials, financial, healthcare, and utilities stocks.

By contrast, many tech stocks that pay dividends cannot sustain scheduled payouts. As a result, it is common for emerging tech companies to encounter cash flow problems because they need to make more money to pay shareholders regularly. As a result, they usually have to prioritize research and development and business expansion to keep growing.

Furthermore, public companies may issue one-time special dividends[9] individually or on top of their recurring payouts.

What Are the Disadvantages of Dividends?

For companies, the biggest downside to paying dividends is having less money to reinvest and fund future growth to justify increased stock prices.

Even worse, some companies issue too much net profit to investors, driving up the share price for the wrong reasons. On the other hand, a public company can positively affect market sentiment by having a reputation for being an excessively generous dividend payer, potentially causing its stock price to soar[10].

The drawbacks for investors depend on the dividend type since each is unique and valued uniquely. For example, an investor who puts a premium on price per share may find stock dividends undesirable.

What is nearly certain is that investors will pay taxes on their dividend funds. However, not everyone is happy to split investment gains with the government, so many investors explore legal ways to avoid paying taxes on earnings from dividend-paying stocks[11].

Does Real Estate Pay Dividends?

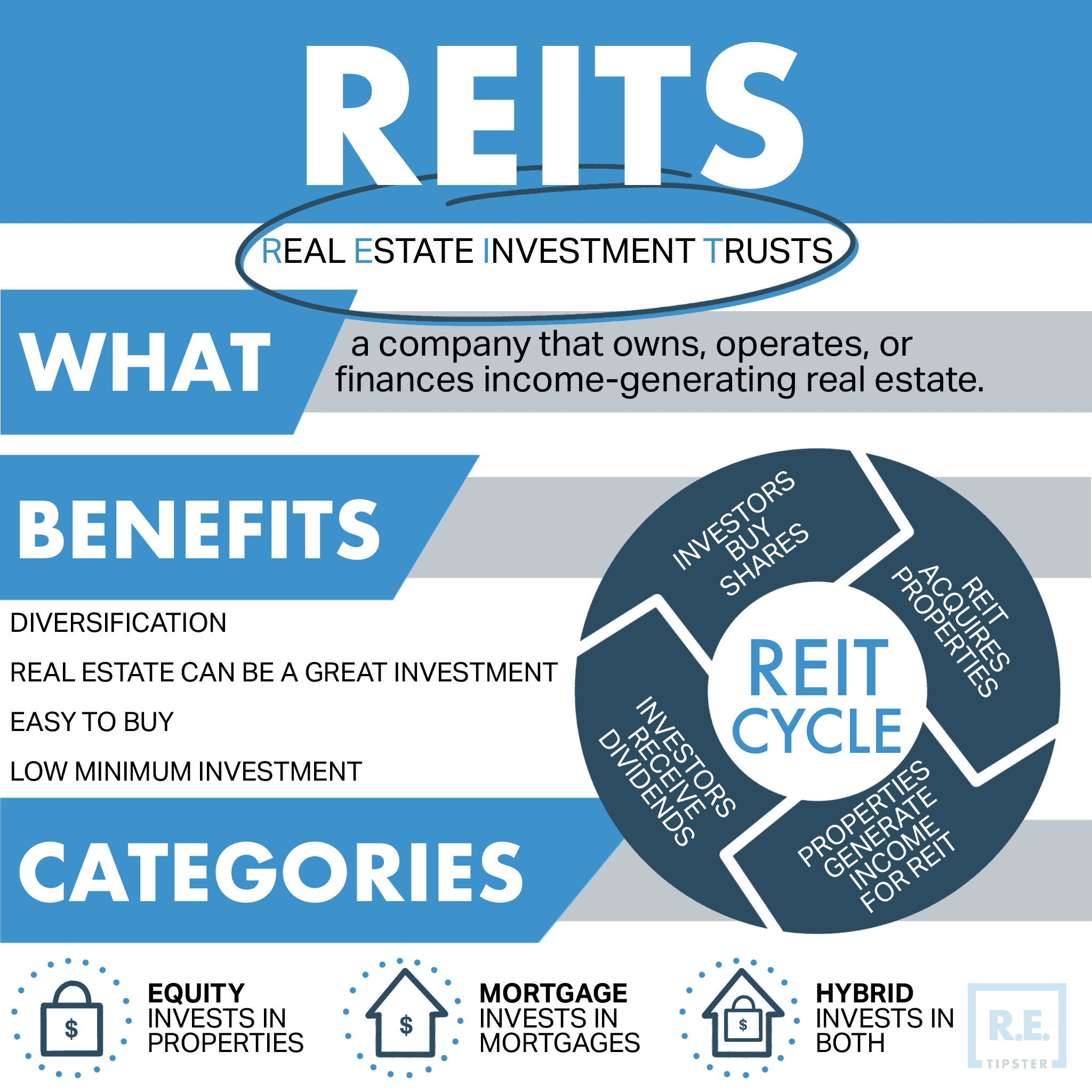

Real estate pays dividends through a real estate investment trust (REIT).

REITs own, rent, operate, or finance properties that generate income using the resources they pool from shareholders. They invest in different property types, including:

- Apartment buildings

- Hotels

- Medical facilities

- Offices

- Retail centers

- Warehouses

Most are traded on major securities exchanges, allowing the public to invest in real estate without the hassle of owning physical property.

Among others, REITs appeal to investors because they provide shareholders with a steady stream of passive income.

In addition, REITs offer steady dividend income. The dividends they issue are generally paid either monthly or quarterly. The more often investors get paid, the more they can exponentially grow their money over time through compounding[12].

BY THE NUMBERS: REITs offer an average dividend yield of over 3%.

Source: The Motley Fool

Do Dividends Count as Income for Mortgage?

Dividends count as income. In fact, dividends are one of only two forms of investment income one can use when taking out a mortgage. The other is interest payments[13].

In short, investing in dividend-paying companies can help increase one’s chances of qualifying for a mortgage.

Sources

- Hicks, C. (2020.) Dividend Rate vs. Dividend Yield: The Difference Investors Should Know. U.S. News. Retrieved from https://money.usnews.com/investing/investing-101/articles/dividend-rate-vs-dividend-yield-the-difference-investors-should-know

- Markwat, T. & Molenaar, R. (2016.) The Ins and Outs of Investing in Illiquid Assets. Chartered Alternative Investment Analyst Association. Retrieved from https://caia.org/sites/default/files/AIAR_Q2_2016_05_InsandOuts.pdf

- GFM Asset Management. (2019.) 75% of S&P 500 Returns Come From Dividends: 1980-2019. Retrieved from https://gfmasset.com/2019/07/75-of-sp-500-returns-come-from-dividends-1980-2019/

- Asim, H. (2022.) 10 Highest-Yielding Dividend Aristocrats for 2022. Yahoo. Retrieved from https://www.yahoo.com/video/10-highest-yielding-dividend-aristocrats-162709327.html

- Cheng, T. (2020.) Why Did Dividend Indices Underperform during the Coronavirus Sell-Off? S&P Global. Retrieved from https://www.spglobal.com/en/research-insights/articles/why-did-dividend-indices-underperform-during-the-coronavirus-sell-off

- Merrill Edge. (n.d.) In volatile markets investors may find comfort in dividends. Retrieved from https://www.merrilledge.com/article/in-volatile-markets-investors-may-find-comfort-in-dividends

- Corporate Finance Institute. (2019.) What is a Qualified Dividend? Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/accounting/qualified-dividend/

- Internal Revenue Service. (2021.) IRS provides tax inflation adjustments for tax year 2022. Retrieved from https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

- Springer, L. (2022.) 10 Spectacular Stocks Paying Special Dividends. Kiplinger. Retrieved from https://www.kiplinger.com/investing/stocks/dividend-stocks/604227/spectacular-stocks-paying-special-dividends

- Zinn, D. (2021.) Here’s What Causes a Stock’s Price to Go Up or Down — And How to Protect Yourself From Market Volatility. NextAdvistor with TIME. Retrieved from https://time.com/nextadvisor/investing/what-causes-stock-prices-to-go-up-and-down/

- Medithi, V. (2021.) Here’s How to Avoid the Capital Gains Tax on Stocks. Nasdaq. Retrieved from https://www.nasdaq.com/articles/heres-how-to-avoid-the-capital-gains-tax-on-stocks-2021-04-22

- Ashford, K. (2022.) The Life-Changing Magic Of Compound Interest. Forbes Advisor. Retrieved from https://www.forbes.com/advisor/investing/compound-interest/

- Discover Home Loans. (2019.) What Income Is Considered When Applying for a Mortgage? Retrieved from https://www.discover.com/home-loans/articles/what-income-is-considered-when-applying-for-a-mortgage/