What Is Equitable Conversion?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- The Principle of Equitable Conversion is a legal concept where a buyer becomes the equitable property owner upon signing a valid purchase contract, even before the legal title transfers.

- This principle affects real estate investing strategies such as wholesaling, seller financing, and 1031 exchanges by influencing ownership rights, tax implications, and transaction timelines.

- The principle may also influence inheritance and estate planning by determining how property rights are transferred if the buyer or seller dies before closing.

- While recognized in most U.S. states, the application of equitable conversion can vary by jurisdiction; consult your attorney for more information.

Understanding the Principle of Equitable Conversion

Equitable conversion (or the principle of equitable conversion) is a common law doctrine that gives the buyer an equitable interest or ownership of real estate. When you sign a real estate purchase contract, you become the equitable owner of the property. This means you have a right to buy it, even though the seller still legally owns it.

The principle is based on one of the Maxims of Equity, specifically: “equity regards as done what should have been done.”

Here’s how it breaks down:

- Equitable Ownership: The buyer has the right to buy the property. They’re essentially the owner in the eyes of the law, even though they don’t have the legal title yet.

- Legal Ownership: Also called legal interest. The seller still owns the property legally. They are responsible for taking care of it until the closing date.

- Conversion of Interests: The contract essentially converts equitable interest into personal property rather than real property (an ownership interest in the land itself), hence the name “equitable conversion.”

This principle helps determine what happens if something unexpected happens between signing the contract and closing the deal. For example, what if the property gets damaged? Or what if the seller dies before closing?

The Principle of Equitable Conversion ensures that both the buyer and seller have clear rights and responsibilities even before the actual transfer of ownership.

Equitable Conversion in Real Estate

Equitable conversion affects several aspects of real estate transactions, including the rights and responsibilities of both parties, risk, and inheritance issues.

Rights and Responsibilities

Under the Principle of Equitable Conversion, both buyers and sellers have specific rights and responsibilities:

Buyers:

- Have the right to any appreciation in the property’s value.

- May be responsible for maintaining insurance on the property.

- Have the right to sue for specific performance if the seller tries to back out of the deal.

Sellers:

- Must maintain the property in its current condition.

- Are responsible for any existing liens or encumbrances on the property.

- Have the right to receive the purchase price.

Risk

When you sign a contract to buy a house, you become responsible for any damage that happens to the house before you actually move in. This means that if a fire or storm damages the house, you might still have to buy it, even if it’s not in the condition you agreed to.

However, most contracts have clauses that can change this rule. For example, the contract might say that the seller is responsible for the house until you move in. Alternatively, the contract might give you the right to cancel the deal if the house is damaged too badly.

Estate Planning and Inheritance

If someone who signed a contract to buy a house passes away before they move in, their family (typically the estate) or their heirs and beneficiaries inherit the right to buy the house. This is because the contract made the house a personal possession, even though they didn’t own it legally yet.

Note that they aren’t obligated to buy the house; they only have the right to buy it. The heirs and beneficiaries will decide whether or not to proceed with the closing.

On the other hand, it’s a different case when a seller dies before the deal closes. If the seller dies before the buyer moves in, their family (typically their estate) is obligated to sell the property on behalf of the deceased. This is because the contract made the sale a legal obligation, even though the seller no longer owns the house.

Implications on Real Estate Investing

Equitable conversion has significant implications for real estate investors, affecting various investment strategies and transaction structures.

Let’s highlight some of these strategies and how this principle affects them.

Real Estate Wholesaling

When a wholesaler enters into a contract with a property seller, they gain an equitable interest in the property under the Principle of Equitable Conversion. The wholesaler is essentially selling this equitable interest when they assign the contract to an end buyer, particularly in a type of wholesaling called an assignment of contract.

Assigning a contract this way may require you to disclose several things to the end buyer. For example, if they find out the property has problems, they may need to tell the person they’re selling the contract to.

In addition, some states and jurisdictions treat transferring equitable interest and selling real property as the same thing. In these areas, wholesaling may fall under what would normally be considered the job of a real estate agent or broker. In other words, wholesaling in these areas means the wholesaler must have a broker’s license.

If you’re not sure about the rules in your area, you can check out our online guide, which has information for each state. This will help you understand what you need to do to wholesale properties legally.

RELATED: Wholesaling Real Estate: Is It Legal In Your State?

Seller/Owner Financing

When a seller finances the purchase, they essentially become both the property seller and the mortgage lender.

In seller-financed deals, the buyer gets the right to own (and even use) the property, but the seller still owns it legally. Even though the buyer is the “equitable owner,” the seller keeps a security interest in the property. This means the seller has some protection if the buyer defaults, or stops making payments. Since the seller still has the legal title, they may have different options to foreclose on the property compared to a regular mortgage lender.

The principle can also impact taxes for both the buyer and seller. For example, the seller may be able to spread out their taxes on the sale over time, reporting it as an installment sale. Meanwhile, the buyer might be able to claim property tax deductions, even though they don’t have the legal title yet.

1031 Exchanges

The Principle of Equitable Conversion can affect the timing of a special kind of real estate transaction called a 1031 exchange.

In a 1031 exchange, someone selling a property has a certain amount of time to buy a new property to defer paying taxes on the sale. There are some deadlines involved:

- They have 45 days to identify the new property they want to buy.

- They have 180 days total to actually complete the purchase of the new property.

The equitable conversion principle can impact these deadlines in a couple of ways.

If the seller signs a contract to sell the old property, they may be considered the equitable owner even before the final sale closes. This could mean the 45-day identification period starts when they sign the contract, not when the sale closes.

Similarly, if the seller signs a contract to buy the new property, they may be considered the equitable owner before the final purchase closes. This could mean the 180-day deadline is measured from when they sign the contract, not the final closing.

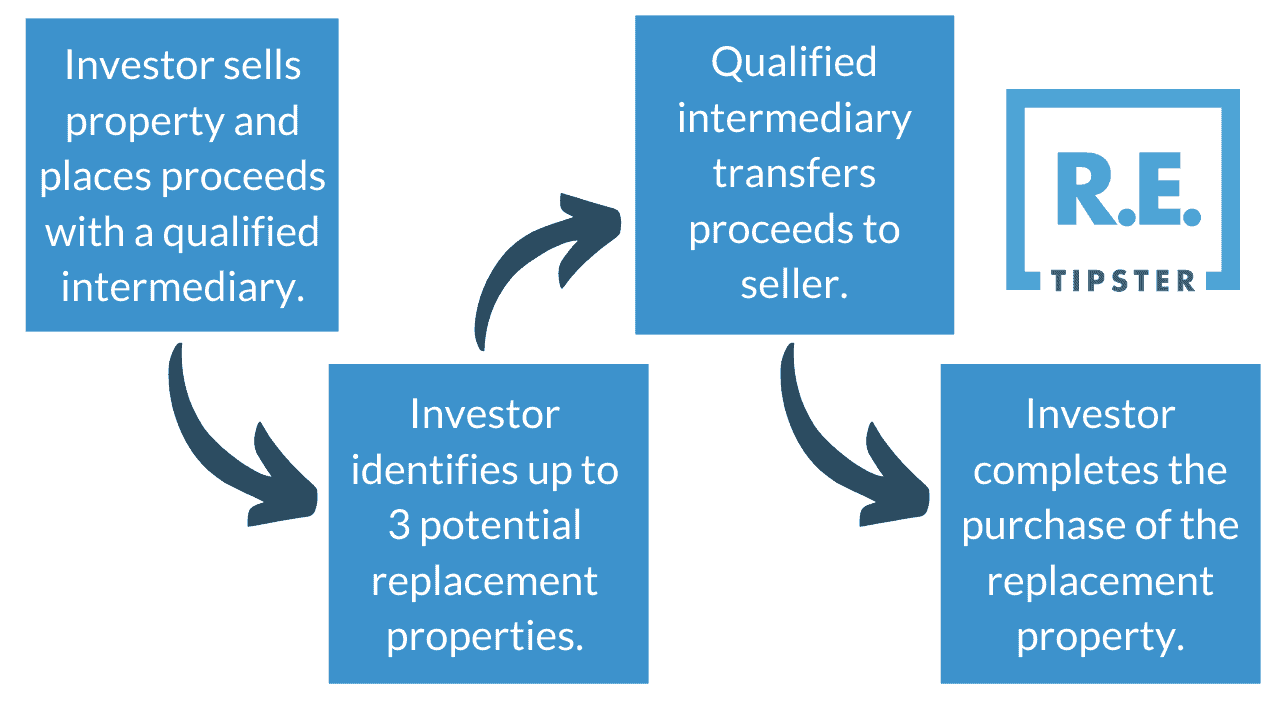

Here’s the typical flow of a 1031 exchange:

There’s also a special type of 1031 exchange called a reverse 1031 exchange. In this case, a third party, called an exchange accommodation titleholder (EAT), temporarily holds the new property until the old one is sold. The equitable conversion principle can impact when this third party is considered the legal owner of the new property.

Other Investment Strategies

The principle also affects other real estate investment strategies:

- Fix-and-Flip: People who buy properties, fix them up, and then sell them quickly need to understand when they become responsible for the property under the equitable conversion rule. This could affect their renovation plans and budgets if something goes wrong with the property before the final sale.

- Buy-and-Hold: Investors who plan to own properties long-term need to know how equitable conversion impacts their rights and responsibilities during the purchase process. This is especially important if they’re buying properties with tenants living in them already.

- Real Estate Syndications: In more complex real estate investments, such as group ownership structures (e.g., syndications), equitable conversion can determine when the investment group actually takes ownership and responsibilities for the property.

Frequently Asked Questions: Equitable Conversion

When does the Principle of Equitable Conversion take effect?

The principle typically takes effect when a valid, enforceable real estate purchase contract is signed. At that moment, the buyer obtains equitable title to the property, while the seller retains legal title as security for payment.

However, if the contract includes contingencies, the principle may not apply until these contingencies are satisfied or waived.

Does the Principle of Equitable Conversion apply in all states?

While the principle is recognized in most U.S. states, its application can vary. Some states have modified the principle through legislation or court decisions. Currently, forty-seven states recognize the principle of equitable conversion; Louisiana, Maine, and Vermont do not.

It’s essential to consult with a local real estate attorney to understand how it applies in your specific jurisdiction.

Does Equitable Conversion give the buyer the right to occupy the property before closing?

No, the principle does not automatically give the buyer the right to occupy or access the property before closing. The right of possession typically transfers at closing unless the contract specifies otherwise.

However, some clauses in a contract may allow a buyer to use or occupy property even if they haven’t obtained legal title yet, such as in seller-financed purchases of owner-occupied properties.

References

- American Bar Association, “The Equitable Maxims: A Primer.” https://www.americanbar.org/groups/tort_trial_insurance_practice/publications/the_brief/2018-19/summer/the-equitable-maxims-primer/

- Smith Buss & Jacobs LLP, “The Right to Sue for Specific Performance.” sbjlaw.com/blogs/the-right-to-sue-for-specific-performance/

- Farshchian Law, “What Happens If the Buyer or the Seller Dies Before a Real Estate Closing?” https://miamiprobatelawfirm.com/what-happens-if-the-buyer-or-the-seller-dies-before-a-real-estate-closing/

- CornerStone Title Company, “What Happens When a Death Occurs Before Title Closes?” https://www.cornerstonetitleco.com/blog/title-track/2023/07/18/what-happens-when-a-death-occurs-before-title-closes

- GRF CPAs & Advisors, “Installment Sales Can Be a Win-Win for Buyers and Sellers.” https://www.grfcpa.com/resource/installment-sales-can-be-a-win-win-for-buyers-and-sellers/

- Money.com, “1031 Exchange Timeline.” https://money.com/1031-exchange-timeline/

- University of Baltimore – School of Law, “Notes: When a Contract for the Purchase of Land Is Executed Prior to the Initiation of a Suit Involving the Propertys Title, Lis Pendens May Be Precluded from Affecting the Purchaser’s Interest under the Doctrine of Equitable Conversion.” https://scholarworks.law.ubalt.edu/cgi/viewcontent.cgi?article=1668&context=ublr

- The National Law Review, “Seller Financing After Dodd-Frank.” natlawreview.com/article/seller-financing-after-dodd-frank