What Is Financial Independence?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- A person has achieved financial independence when they can live comfortably without working a regular job, funding their living expenses with diverse investments.

- Achieving financial independence requires building wealth, managing expenses, diversifying income, and having a strong financial foundation.

- Benefits include personal freedom, improved health, better quality of life, and the potential for generational wealth.

- Due to capital appreciation and rental income, real estate can be a viable path to financial independence.

- Modern tools can help you manage your expenses and track your budget, while benchmarks like the 4% Rule help gauge financial independence.

- Financial independence is a milestone on the path to financial freedom.

What Does Financial Independence Mean?

A person or family has financial independence when they earn enough money and have sufficient resources to pay for their living expenses and live comfortably without having to work. Many people want to be financially independent because it gives them more control over their lives and allows them to follow their hobbies and interests without worrying about money[1].

Someone is financially independent when they have enough money to live however they want without needing a standard job (unless they want it) or a single source of income. It means they have enough money from different sources, like investments, rental homes, or passive income, to pay their bills and live the way they want.

Financial Independence vs. Financial Freedom

Financial independence and financial freedom are often used interchangeably, but they have slightly different meanings.

Financial independence means being able to pay for your own needs without a regular job. It means you have enough savings or idle income to sustain your lifestyle.

On the other hand, financial freedom is more than just being financially independent. It gives you more options in managing your money and living your life. It means making decisions in line with your values and interests without financial constraints.

Financial independence is about getting to a certain level of financial security, while financial freedom is about living on your own terms, doing meaningful work, and using your time and money as you see fit.

In other words, financial independence is one of the milestones in the journey toward financial freedom[2].

RELATED: Could You Quit Your Job Today? Use This Financial Freedom Calculator To Find Out!

Components of Financial Independence

Having more than one source of income is only one of many ways to be financially independent. Financial independence generally comes from various means (or a combination of them)[3].

Building Wealth

Building wealth is a crucial aspect of attaining financial independence. It means building up assets and businesses that bring in money and grow in value over time. Examples are stocks, bonds, real estate, business projects, and other investments.

Note that there is a difference between being “wealthy” and “rich.” The first’s meaning is more akin to financial independence while being rich means merely having high income (and usually having high expenses as well)[4].

Managing Expenses

Managing expenses is vital in achieving financial independence. It requires people to live below their means, budget their spending, and prioritize their financial goals. By keeping costs down and avoiding unnecessary debt[5], you can save and invest more of your income to become financially independent sooner rather than later.

RELATED: 129: Want to Shred Your Debt 10X Faster? Adam Carroll Explains How

Creating Multiple Income Streams

Diversifying your income is a key part of becoming financially independent. People who depend on a single source of income, like a job, are subject to economic downturns or other unexpected events. Don’t put all your eggs in one basket to lower your risk and stabilize your finances.

Building a Strong Financial Foundation

Establishing a solid financial foundation is essential for financial independence. This includes having an emergency fund to cover unexpected expenses, having adequate insurance coverage to protect against unforeseen events, and having a clear understanding of one’s financial situation, including debts and liabilities.

Benefits of Financial Independence

Financial independence confers several benefits, not just in the way you spend money.

Freedom and Flexibility

Financial independence allows people to make choices based on personal preferences rather than financial constraints. It allows them to pursue their passions, spend time with loved ones, travel, or engage in activities that bring them joy without worrying about the contents of their wallet.

Improved Health

Financial independence reduces the stress of waiting for the next payday. Knowing you have enough money to pay your bills and deal with unexpected events provides peace of mind, improving your mental health.

Studies have also suggested a correlation between financial stress and health issues as one ages[6]. Therefore, financial health and independence may also lead to better overall physical health.

Increased Control Over Lifestyle

When people are financially independent, they have more power over their lives. For example, they can choose their careers based on what they are passionate about instead of what will make them the most money. They also have more control over their time and can make choices that align with their values and priorities.

Generational Wealth and Legacy

Getting and staying financially independent can help future generations in the long run. People can leave a lasting legacy of financial stability[7] and chances for their children and descendants by building a solid financial base and passing on knowledge and resources.

Real Estate and Financial Independence

Real estate is a viable route to financial independence. Its dual offering of potential capital appreciation and recurring rental income makes it an attractive proposition for wealth accumulation.

Capital appreciation is the rise in a property’s market value over time. Historically, real estate has demonstrated robust appreciation rates, particularly in certain city centers[8].

However, it’s important to remember that even though most properties tend to go up in value, this isn’t always the case. Market patterns, local economic factors, and national trends all determine whether a property appreciates or by how much.

Rental income can also provide a steady stream of passive income. The security of this income often depends on where the property is, how much demand there is for it, and how good the tenants are, among other things. This income should pay the property’s operating costs and mortgage, plus give the owner extra money. As the principal on mortgages goes down over time, the net income from rentals can go up, leading the way to financial independence.

Real estate also offers benefits like tax deductions[9] on mortgage interest, property taxes, and depreciation, which can increase the overall return on investment (ROI).

However, investing in real estate isn’t without challenges. Initial cash needs can be high, managing properties can take time and work, and the market isn’t as liquid as stocks or bonds.

Like many avenues to financial independence, success in real estate requires careful research, a clear understanding of the local market, and sound financial planning. Getting advice from real estate professionals or financial advisors can help you make informed decisions.

Frequently Asked Questions: Financial Independence

1. How can you manage and minimize expenses while working toward financial independence?

Managing your expenses is a cornerstone of financial independence, but you don’t have to do it the traditional way. Modern tools and apps can be effective in helping you analyze your spending patterns and see where you can save money. One can even tell you which recurring subscriptions you’re subscribed to so you can decide whether to keep them or not[10].

Choices about how to live are also important. For example, living in a smaller room or moving to a less expensive area can significantly affect how much you spend each month. In the same vein, rethinking how transit works can save money. Options like taking public transportation, carpooling, or biking could be cheaper (and better for the environment).

Managing debt is another important thing to keep in mind. Getting rid of high-interest loans, like those from credit cards[11], can free up money you can use for investments or savings.

2. How should you approach risk and reward when aiming for financial independence?

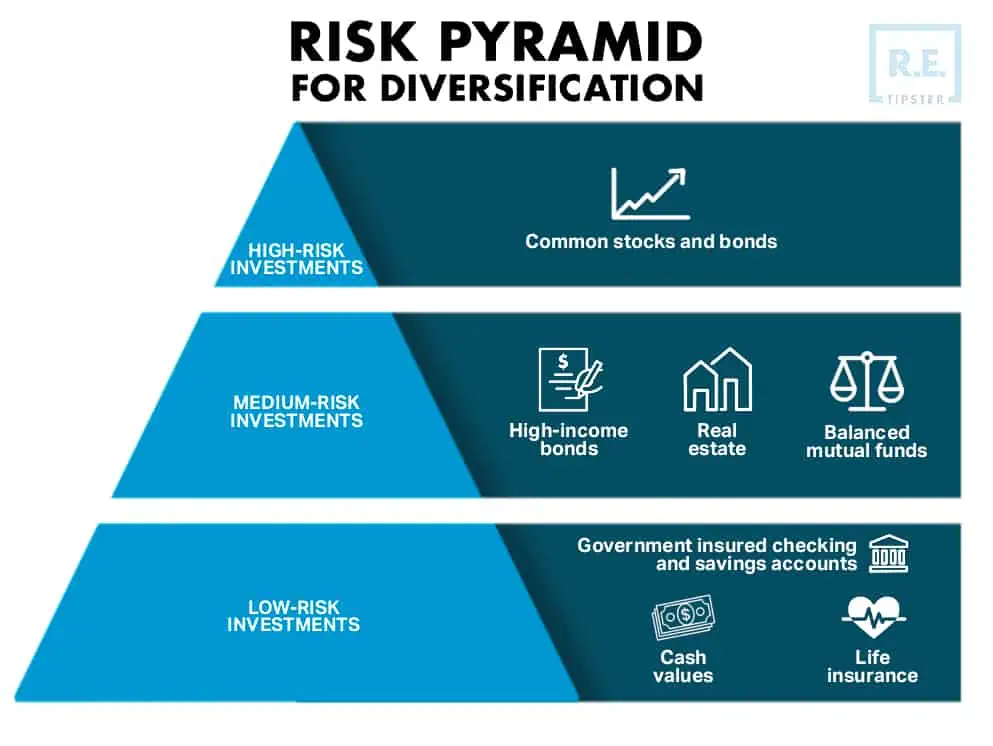

The relationship between risk and reward is one of the most important ideas in business, and one way to balance this is to diversify your portfolio. By investing in different types of assets and industries, a person can protect their wealth from severe downturns in the economy, such as a recession.

An emergency fund is advisable as a safety net for unexpected expenses. It’s commonly recommended that these funds cover three to six months of expenses[12]. In addition, an emergency fund prevents being pressured to sell investments at bad times when unexpected financial problems arise.

Lastly, it’s good to stay informed. This could mean watching market trends, attending workshops, or talking to financial experts. Such steps can give you a clearer picture of the risks associated with your money and help you tailor your approach.

3. How do you calculate the amount needed for financial independence?

The amount a person needs to be financially independent is often based on how much they spend each year.

A widely cited guideline, known as the 4% Rule[13], suggests that you’ve achieved financial independence if you can withdraw 4% of your investments each year without letting the principal go down. For example, if a person’s annual costs are $40,000, they would need a $1 million investment portfolio (since 4% of $1 million is $40,000).

Other FIRE (financial independence, retire early) enthusiasts instead adopt the Rule of 25[14]. This involves saving up to 25 times your annual expenses and withdrawing 4% or less per year in retirement.

Consider inflation, changing living needs, and possible market downturns when figuring out this number. Using tools like financial managers and investment calculators can help you set more specific goals.

Sources

- The Main Benefits Of Being Financially Independent. (2023, February 13.) San Diego Community Newspaper. Retrieved from https://sdnews.com/the-main-benefits-of-being-financially-independent/

- Dickerson, A. (n.d.) Financial Freedom vs. Financial Independence: How They’re Different, And How You Can Get There. GoodEgg Investments. Retrieved from https://goodegginvestments.com/blog/financial-freedom-vs-independence/

- Tamplin, T. (2023, September 4.) Financial Independence. Finance Strategists. Retrieved from https://www.financestrategists.com/financial-advisor/financial-planning/financial-independence/

- Costa, M. (2023, June 21.) Rich VS Wealthy: 3 Key Differences Between The Two. Clever Girl Finance. Retrieved from https://www.clevergirlfinance.com/rich-vs-wealthy/

- McGurran, B. (2021, November 19.) 6 Tips to Avoid Debt. Experian. Retrieved from https://www.experian.com/blogs/ask-experian/tips-to-avoid-debt/

- Frech, A., Houle, J., Tumin, D. (2021, June 15.) Trajectories of unsecured debt and health at midlife. SSM – Population Health, Volume 15, 100846, ISSN 2352-8273. Retrieved from https://doi.org/10.1016/j.ssmph.2021.100846

- Six financial literacy principles. (n.d.) RBC Wealth Management Group. Retrieved from https://www.rbcwealthmanagement.com/en-ca/insights/6-financial-literacy-principles

- Maloney, M., Rosenthal, S. (2022, June 27.) Why Do Home Prices Appreciate Faster in City Centers? The Role of Risk-Return Trade-Offs in Real Estate Markets. Syracuse University. Retrieved from https://ssrosent.expressions.syr.edu/wp-content/uploads/WhyDoCCPricesAppreciateFaster-6-27-2022.pdf

- Gariepy, L. (2023, January 12.) Tax Benefits Of Real Estate Investing: Top 6 Breaks And Deductions. Rocket Mortgage. Retrieved from https://www.rocketmortgage.com/learn/tax-benefits-of-real-estate-investing

- Suknanan, J. (2023, January 18.) This app can cancel unwanted subscriptions and negotiate your bills — here’s how to use it. CNBC. Retrieved from https://www.cnbc.com/select/truebill-review/

- Karp, G. (2023, June 22.) Why Are Credit Card Interest Rates So High? NerdWallet. Retrieved from https://www.nerdwallet.com/article/credit-cards/credit-card-interest-rates-high

- 6 Steps to Creating an Emergency Fund. (2022, December 15.) Morgan Stanley. Retrieved from https://www.morganstanley.com/articles/how-to-build-an-emergency-fund

- Williams, R., Kawashima, C. (2023, February 27.) Beyond the 4% Rule: How Much Can You Spend in Retirement? Charles Schwab. Retrieved from https://www.schwab.com/learn/story/beyond-4-rule-how-much-can-you-spend-retirement

- A roadmap to financial freedom. (2023, May 17.) Fidelity. Retrieved from https://www.fidelity.com/learning-center/personal-finance/how-to-retire-early