What Is Homogenized Pricing?

Shortcuts

- Homogenized pricing in real estate signifies a market where properties are priced similarly, often with minimal price variations.

- Homogenized markets are often intertwined with homogenized pricing, reinforcing each other.

- Factors like market maturity, property or housing standardization, and regulatory policies contribute to homogenized pricing.

- Homogenized pricing (and homogenized markets in general) can also contribute to forming a real estate bubble.

Understanding Homogenized Pricing in Real Estate

When homes in a neighborhood, despite differences in features or condition, all hover around the same price point, we’re observing homogenized pricing in action. For example, imagine you’re attending a local art fair where every painting, regardless of size, style, or artist, is priced at exactly $500. While unusual in the art world, this uniform pricing mirrors what can happen in real estate markets.

RELATED: Finding the Best Markets for Land Investing

In a market with homogenized pricing, buyers might find it challenging to distinguish between properties based on price alone. Similarly, sellers may struggle to justify higher asking prices, even for properties with superior features or locations.

The concept of homogenized pricing is crucial for both buyers and sellers to understand. For buyers, it can simplify the process of determining fair market value but may also limit opportunities for finding undervalued properties. On the other hand, sellers might find it harder to stand out in a market where price differentiation is minimal.

Investors should be particularly aware of homogenized pricing. While it can provide stability and predictability, it may also signal limited potential for appreciation. As a result, investors might need to look beyond price and focus on other factors to identify properties with growth potential.

Impact of Homogenized Pricing in Real Estate

Homogenized pricing significantly influences several aspects of the real estate market:

- Market efficiency: In theory, homogenized pricing can lead to a more efficient market. When prices are similar, it’s easier for buyers to make decisions based on other factors, potentially speeding up transactions.

- Competition: With minimal price differentiation, sellers must find other ways to make their properties attractive. This could lead to improvements in property condition or enhanced marketing efforts, benefiting buyers.

- Valuation: Appraisers and real estate professionals may find it easier to determine property values in a market with homogenized pricing. However, this could also lead to overlooking unique features that might justify different valuations.

- Investment strategies: Real estate investors may need to adjust their strategies in markets with homogenized pricing. Instead of seeking undervalued properties, they might focus on value-add opportunities or look to different markets altogether.

The Relationship Between Homogenized Markets and Homogenized Pricing

Homogenized markets and homogenized pricing in real estate are closely intertwined, often reinforcing each other. In a homogenized market, properties share similar features, quality, and demand characteristics. This uniformity naturally leads to homogenized pricing as the perceived value of these similar properties converges.

For example, the abundance of similar properties on the market can drive prices to a uniform level. A study by the National Association of Realtors has revealed a correlation between large-scale housing development and market homogenization, which leads to homogenized pricing.

Conversely, homogenized pricing can contribute to market homogenization. When prices are uniform, developers may be incentivized to build properties that conform to the prevailing price point, further standardizing the market.

External factors can influence this cycle. For example, zoning laws in some cities have led to a proliferation of similar multi-family units, which can contribute to both market and price homogenization. Most municipalities adopt the International Building Code without modification, leading to standardized building requirements that result in similar multi-family designs.

Understanding this relationship is crucial for many real estate professionals since it could affect how they approach development, marketing, and investment in different market segments.

Factors Influencing Homogenized Pricing

Several factors can lead to homogenized pricing in real estate:

- Market maturity: Prices often converge as markets mature and become more established. This is particularly common in well-developed urban areas or popular suburban neighborhoods.

- Standardization of housing: Large-scale developments featuring similar home designs can contribute to price homogenization. When properties are nearly identical, it’s natural for their prices to align.

- Economic conditions: In times of economic stability, property prices also tend to stabilize. This can lead to a narrowing of price ranges within specific market segments.

- Information availability: The proliferation of real estate data and online platforms has made it easier for buyers and sellers to access pricing information. This transparency can contribute to more uniform pricing.

- Regulatory environment: Zoning laws, building codes, and other regulations can limit the diversity of housing stock in an area, indirectly contributing to price homogenization.

Pros and Cons of Homogenized Pricing in Real Estate

Homogenized pricing in real estate has its upsides and downsides. Let’s break it down:

Pros

- Simpler for buyers: With uniform prices, buyers can focus on a property’s features and location rather than complex price negotiations.

- Faster transactions: This simplicity can speed up the buying process.

- Clear benchmarks for sellers: It’s easier to price a property when similar ones have consistent prices.

- Market fairness: Similar properties sell for similar prices, creating a sense of equity.

Cons

- Hard to stand out: Sellers struggle to justify higher prices for unique features or improvements. This is especially true in residential subdivisions with HOAs, usually in the suburbs, which can be considered a form of a homogenized neighborhood.

- Discourages upgrades: Homeowners might avoid significant improvements if they can’t recoup costs in the sale price.

- Fewer bargains: Buyers and investors find it harder to snag undervalued properties.

- Masks differences: Important variations in quality or location might be overlooked due to similar pricing.

- Less dynamic market: Without price variations, the market may respond slower to changing conditions.

While homogenized pricing can make things more straightforward and stable, it might also reduce the diversity and flexibility that keep real estate markets healthy and exciting. Buyers, sellers, and investors must consider these factors when operating in such markets.

Frequently Asked Questions: Homogenized Market

1. How does homogenized pricing affect real estate appraisals?

Homogenized pricing can simplify the appraisal process by providing a clear baseline for property values in an area. Appraisers may find it easier to determine fair market value when comparable properties have similar prices.

However, this uniformity can make accounting for unique features or improvements that might justify a different valuation challenging. Appraisers may need to rely on other factors, such as property condition, specific location attributes, or recent renovations, to differentiate between properties.

This situation requires appraisers to be thorough in their assessments to ensure accurate valuations, despite the homogenized pricing environment.

2. Can homogenized pricing in real estate lead to market bubbles?

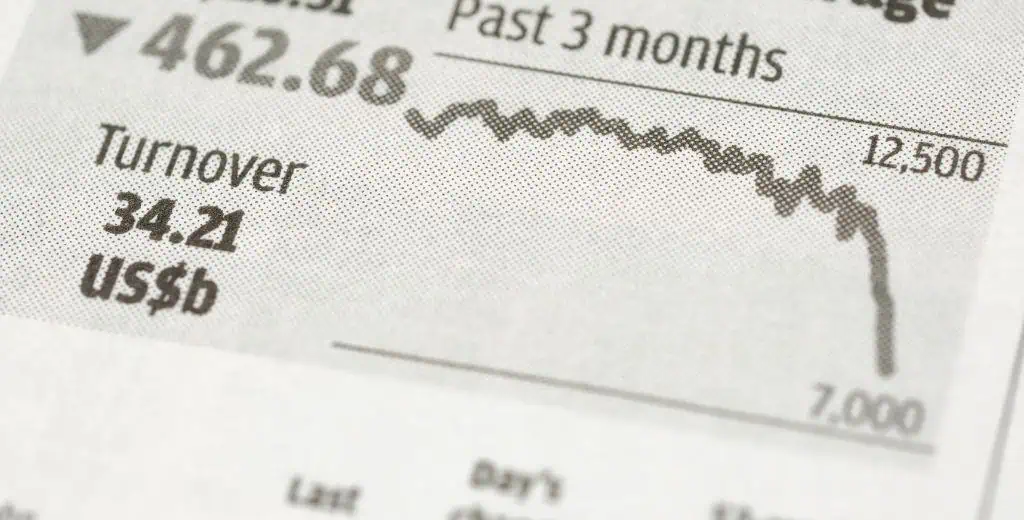

There is strong evidence that the homogenization of real estate, driven by factors like standardized zoning and building codes, can indeed contribute to market bubbles by reducing diversity, increasing substitutability, and enabling prices to deviate from fundamentals.

For example, when zoning laws limit the diversity of allowable multifamily developments in an area, it can lead to more homogeneous housing stock and market prices. This dynamic appears to be a key factor in the development and persistence of real estate bubbles.

Furthermore, housing prices tend to decline more slowly during a bubble burst than in more liquid financial markets. This can prolong the duration of a real estate bubble and exacerbate its impact.

3. How can real estate investors find opportunities in markets with homogenized pricing?

Real estate investors can still find opportunities in homogenized markets by focusing on value-add strategies. They might look for properties with potential for improvement through renovations or better management. Investors can also explore emerging neighborhoods on the cusp of price increases.

Another strategy is to focus on properties with unique features that the homogenized market might undervalue, such as larger lot sizes or distinctive architectural elements. Additionally, investors might consider alternative property types or mixed-use developments that stand out in a uniform market.

Thorough market analysis and creative thinking are key to identifying these opportunities amidst homogenized pricing.

References

- Corporate Finance Institute. “Price Appreciation.”

- Ibbaka. “Market dynamics and pricing scenarios (managing pricing in a time of uncertainty).“

- University College London. “The Impact of Large-Scale Property Developments on Nearby Housing Prices.“

- RSM. “The rising uniformity of multifamily housing.”

- University of Maryland, Baltimore County. “Post-War Suburbanization: Homogenization or the American Dream?“

- De Gruyter. “PRICE BUBBLE IN THE REAL ESTATE MARKET – BEHAVIORAL ASPECTS.”

- MDPI. “20 Years of Research on Real Estate Bubbles, Risk and Exuberance: A Bibliometric Analysis.”