What Is Rehab?

Shortcuts: Rehab

- Rehab is the process of renovating distressed properties to increase their value through strategic repairs and upgrades.

- Three levels of rehab exist: light (cosmetic), medium (some systems), and heavy (major overhaul).

- There are two main ways of making money from rehabs: flipping it or renting it out for regular income.

- A third way, called BRRRR, combines the two, using money from refinancing to acquire another property.

- Create a budgeting plan when rehabbing, although there are some ways to engage in a rehab project with little money if you’re an advanced investor.

Understanding Real Estate Rehab

In real estate, rehab or rehabbing is the act of transforming old or damaged properties into valuable assets through careful renovation and repair. Unlike basic home improvements, rehab addresses fundamental issues that impact a property’s safety, functionality, and market value.

A rehabbed property is usually either sold again (called a fix-and-flip) or held for income generation, such as for rental income.

Rehabbing works because many homebuyers tend to avoid houses in need of significant repairs. In addition, these houses also often sell for much less than similar houses in good shape. This combination of low competition from buyers and discounted prices creates an opportunity for investors who know how to fix houses and can handle big projects.

Before starting a rehab, investors look at three main numbers:

- How much the house costs to buy.

- How much the repairs will cost.

- How much they can sell it for after fixing it up (called the after-repair value or ARV).

However, timing matters when you want to maximize every penny. Just like there are good and bad times to buy clothes or cars, there are better and worse times to buy and sell houses. Some investors buy houses in winter when fewer people are looking, fix them up, and sell in spring when more buyers are shopping.

Rehab vs. Fixer-Upper Properties

A rehab property is often confused for a fixer-upper, but there are subtle differences.

Fixer-uppers generally require cosmetic upgrades and repairs to bring them up to market value. For example, a fixer-upper may need new flooring, light fixtures, kitchen cabinets, and appliances before it is ready for sale.

A property in need of rehabbing needs extensive repairs to make it ready for occupancy. Rehabbing projects may include repairing water damage, shoring up structural elements, and bringing the property up to code.

One way to tell if a property is a fixer-upper or a rehabbing project is whether or not it requires licensed professionals to do the work. If a handyman can do most of the renovations and repairs, it is likely a fixer-upper. If it requires licensed contractors, it is probably a rehab project.

Cost is another differentiator. Cosmetic repairs for fixer-uppers are typically much less expensive than a full-fledged rehab.

Types of Real Estate Rehab Projects

New investors usually start with houses that need simple fixes like paint, flooring, and kitchen updates. As they learn more and build relationships with good contractors, they might take on bigger projects like fixing foundations or replacing roofs.

Rehab projects can generally be categorized into three types depending on the work involved.

Light Rehab

Light rehab projects focus on properties that are structurally sound but visually outdated. These houses often scare away regular buyers because they look worn out, but their good bones make them perfect for investors who can see past surface issues.

A typical light rehab might include:

- Kitchens: A kitchen rehab might involve existing cabinet boxes but replacing doors and hardware, updating countertops, and installing new appliances. This approach costs about half of a full kitchen remodel while delivering similar visual impact.

- Bathrooms: Instead of replacing the whole bathroom, a light rehab might include installing new fixtures, updating tiles, and refinishing the tubs. The key is identifying what can be salvaged versus what must be replaced.

- Flooring: Light rehabs may also entail laying new flooring over structurally intact subfloors. Some investors often find hardwood floors under old carpet that can be refinished for a fraction of new flooring costs.

The success of light rehab depends on careful material selection. For example, choosing luxury vinyl plank flooring in rental properties provides a high-end look while offering better durability than traditional hardwood.

Wall paint is also a great way to spruce up rooms, hide minor imperfections, or make a house look more expensive than it really is. You can even apply paint in a clever manner to make rooms look bigger, wider, or smaller, as we discussed in our blog post, “12 Cool Painting Techniques To Change The Size Of Any Room.”

Medium Rehab

Medium (also called moderate rehab in New York City) projects tackle houses with both cosmetic needs and system issues. These properties often look worse than they are, creating opportunities for investors who can accurately estimate repair costs.

Key aspects of medium rehab include:

- Electrical: These are the most common, which could mean replacing outdated panels and adding circuits for modern appliances. An example is upgrading from 100-amp to 200-amp service to handle today’s power demands.

- HVAC replacement: Installing new heating and cooling systems can be categorized as a medium rehab. Many investors who choose buy-and-hold exit strategies also gravitate toward energy-efficient upgrades to further slash ongoing expenses.

- Plumbing: This might address issues like corroded pipes or outdated fixtures while keeping the main plumbing stack intact. This might also involve replacing horizontal runs while leaving vertical stacks in place.

The trick with medium rehab lies in knowing which systems need complete replacement and which ones only need repair. For instance, updating electrical panels and branch circuits might be necessary, but existing copper wiring in walls could still be serviceable.

Heavy Rehab

Heavy rehab projects involve fundamental property issues that require extensive work. These projects offer the highest potential returns but also carry the most risk and complexity.

Some examples are:

- Foundation work: This addresses serious structural issues through methods like hydraulic piers, slab leveling, or complete foundation replacement. The key is understanding soil conditions and choosing the right repair method.

- Structural repairs: This demands repair due to water damage, termites, or poor construction. This might involve sister joists, wall rebuilding, or complete floor system replacement.

- Complete system overhaul: Think medium rehab, but all of it at once—electrical, plumbing, and HVAC systems. Modern building codes often require bringing everything up to current standards once you open walls.

The profit potential in heavy rehab comes from solving problems other investors avoid. For example, a house with foundation issues might sell at a steep discount, but fixing the foundation properly could unlock significant value in a desirable neighborhood.

Other Types and Variations

While the three-category system (light, medium, and heavy) is commonly used, some specific definitions and cost estimates can vary depending on the source, location, and industry context.

For example, some classifications include a “total rehab” category, which is similar to heavy rehab but may involve even more extensive work.

On the other hand, rehab projects are classified based on physical demands rather than construction scope, using terms like “sedentary,” “light,” “medium,” “heavy,” and “very heavy.”

How Much Does Rehab Cost?

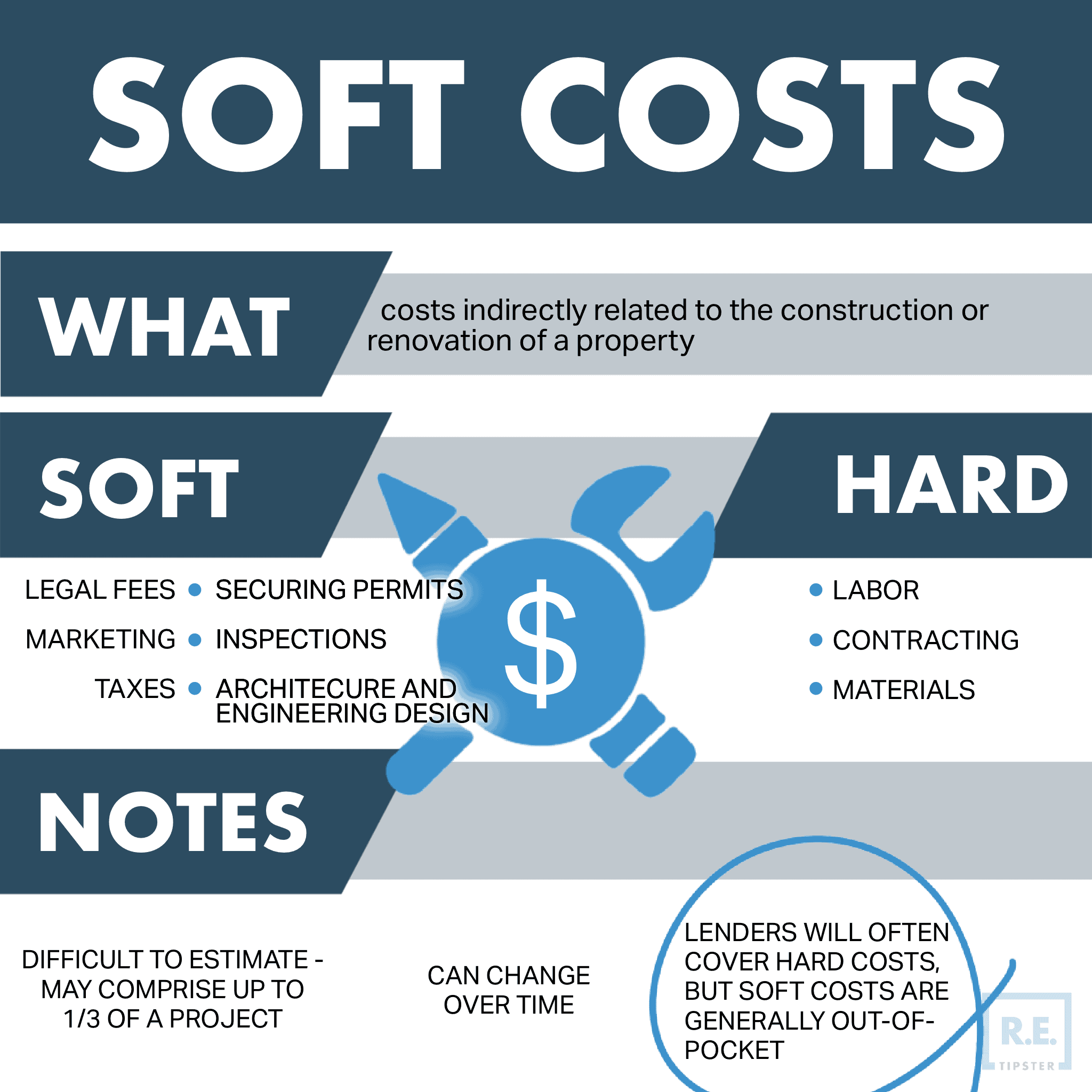

The true cost of rehabilitating a property extends far beyond the obvious expenses of lumber and labor.

First, create a budget. Break it down into three main areas: known repairs from inspections, likely issues based on the property’s age, and contingency funds for surprises. That said, you can even start a flipping project with little money if you know what you’re doing.

Initial Outlays and Ongoing Expenses

Before you even start fixing the house, money starts flowing out. You’ll pay closing costs when you buy the house, lawyer fees, and inspection costs. If the house is old—especially if it’s constructed before the 80s—you might need special tests for dangerous materials like asbestos. These costs surprise many new investors who only thought about the house’s price tag.

But that’s not all. Every month during renovation, you’re still paying ongoing expenses, such as:

- Loan payments

- Special construction or builder’s risk insurance

- Water and electricity for workers

- Property taxes

- Security cameras or guards to watch the property

If your project takes longer than planned, these monthly costs eat into your profit fast.

Unseen Problems Cascade

The scariest costs are ones you can’t see until work starts. The problem is, these problems often cascade, driving up costs further.

Say you’re updating a bathroom. You remove some tiles and find water damage, which rotted the floor underneath. Now you need an engineer to check if the floor is safe—turning your simple bathroom update into a major repair job.

When present, water issues rarely stay contained. A leaking window can rot sheathing, attract termites, and create mold problems. Each issue compounds the next. You have to fix all of these problems before you can even think about making the house look nice.

In addition, many outdated or distressed properties often have problematic electrical wiring. Many rehabbers often find more issues after fixing one problem, or sometimes even after opening one panel. Once you get permits for electrical work, you might have to update the whole house’s wiring to meet today’s safety rules.

Finally, building codes can make renovation expensive. When you get a building permit to fix something major—like electrical, plumbing, or heating—you usually have to bring everything up to modern standards. A study showed that code compliance alone is a significant driver of development costs, particularly in multifamily housing.

RELATED: 9 Types of Distressed Properties and How to Find Them

Making Money From Rehabs

How you plan to make money (your “exit strategy”) from your rehabbed property changes everything about your project. There are two main ways investors profit from rehab: a fix-and-flip or a buy-and-hold.

So which is better—fix-and-flip or buy-and-hold?

The short answer is there is no “best” real estate investment strategy. It depends on the investor’s goals and financial situation.

The main difference between the two strategies is that flipping a property generates active income while a buy-and-hold generates passive income. A fix-and-flip investor realizes their return in a lump sum once the property sells. A buy-and-hold investor generates regular ongoing income during the period of ownership.

Here’s a table that compares the two:

| Fix-and-Flip | Buy-and-Hold |

| Faster return on your money; capital is at risk for a shorter period | Ongoing income and cash flow; capital is at risk for several years |

| Higher upfront costs, including transaction costs, both at purchase and sale | Lower upfront costs; transaction costs are spread out over a period of years |

| Higher tax liability; if the property is held for less than a year, short-term capital gains tax rates apply | Lower tax liability; many costs (depreciation, repairs, management fees) are deductible. Rental income taxed at a lower rate than earned income |

| Less legal exposure because the property is held for a short time | Exposure to legal risks associated with being a landlord |

| May have several months of holding costs, especially if the property does not sell quickly | Possibility of high vacancy costs when the property is between tenants |

The key to success with either strategy is matching your renovation decisions to your end goal. Flippers need to create that “wow” factor that sells quickly, while rental investors need to think about durability and easy maintenance.

The BRRRR Method

Brandon Turner of BiggerPockets also pioneered a combination of the fix-and-flip and buy-and-hold strategies, called BRRRR. It stands for “buy, rehab, rent, refinance, and repeat.”

Like buy-and-hold, you’re renovating for renters, but like flipping, you’re aiming for a quick refinance.

This is how it works:

- Buy: Buy a property at below-market price. This typically involves a property that needs a little TLC.

- Rehab: You rehab and repair this property.

- Rent: Find a tenant for the property to generate rental income.

- Refinance: Do a cash-out refinance for the property.

- Repeat: Use the cash from the refinance to purchase another property.

A successful BRRRR rehab hits the sweet spot: nice enough to appraise well for the refinance, durable enough for tenant use, but not so expensive that it cuts into cash flow.

Frequently Asked Questions: Real Estate Rehab

What permits typically trigger code upgrades?

More often than not, getting an electrical or plumbing permit means updating whole systems to meet current codes. HVAC work often forces insulation upgrades, while structural permits can require seismic retrofitting in certain areas and in older buildings built before 1977.

It’s not just about fixing what’s broken—once you pull a permit, you’re committing to bringing that system up to modern standards. This catches many new investors off-guard, especially when working on older homes.

How do you assess rehab potential quickly?

The best way is to check major systems in your first walkthrough of the property. Check the electrical panel age, look for foundation cracks in the basement, smell for mold in crawl spaces, and test for floor bounce.

You can also use the 70% Rule for a quick financial assessment of the property. The 70% Rule suggests that you should avoid buying a property for more than 70% of its ARV. You can try our 70% Rule Calculator below.

What’s the most reliable way to estimate rehab costs?

Break down costs by system rather than by room. Price out major components like roof, HVAC, electrical, and plumbing separately, then add interior finishes. This method works better than room-by-room estimates because it forces you to think about how systems connect throughout the house.

Meanwhile, for older properties, always add a 20% contingency. You’ll often find surprises once walls open up. Getting multiple contractor bids helps verify your estimates, particularly for major system work.

References

- Bankrate, “What is the best time of year to sell a house?” https://www.bankrate.com/real-estate/best-time-to-sell-house/

- HomeAdvisor, “How Much Does a House Renovation Cost in 2025?” https://www.homeadvisor.com/cost/additions-and-remodels/remodel-multiple-rooms/

- New York City Housing Preservation and Development, “Classification Overview.” https://www.nyc.gov/assets/hpd/downloads/pdfs/services/rehab-classification-matrix-and-definitions.pdf

- Bluetti, “What Is Involved In Upgrading To 200 Amp Service?” https://www.bluettipower.com/blogs/articles/what-is-involved-in-upgrading-to-200-amp-service

- Lito Electrical Service, “20 Signs That You Need A Wiring Repair and Replacement.” https://www.litoelectrical.com/blog/20-signs-that-you-need-a-wiring-repair-and-replacement

- Real Estate Skills, “Estimating Rehab Costs: 5-Step Guide For House Flippers & Investors.” https://www.realestateskills.com/blog/estimating-rehab-costs

- American Society of Safety Professionals, “Job Demands Analysis: Defining the physical demands of the work for post-offer and return-to-work functional testing.” https://aeasseincludes.assp.org/proceedings/2007/docs/750.pdf

- Asbestos.com, “Guide to Asbestos in the Home.” https://www.asbestos.com/exposure/home/

- Stanton Insurance Agency, “Builders Risk Insurance Cost Calculator: Top 2024 Guide.” https://stantonins.com/builders-risk-insurance-cost-calculator/

- Angi, “Termite Damage vs. Wood Rot: How to Tell the Difference Between the Two.” https://www.angi.com/articles/termite-damage-vs-wood-rot.htm

- National Multifamily Housing Council, “NMHC Pulse Survey: Analyzing the Impact of Building Codes on Rental Housing Development & Affordability.” https://www.nmhc.org/research-insight/survey/nmhc-pulse-survey-analyzing-the-impact-of-building-codes-on-rental-housing-development-affordability/

- LinkedIn, “”Fix and Flip” vs “Buy and Flip” vs “Buy and Hold”: Choosing Your Real Estate Investment Strategy.“ https://www.linkedin.com/pulse/fix-flip-vs-buy-hold-choosing-your-real-estate-investment-nvuif/

- Permit Advisors, “Permits Related to Seismic Retrofits and Fault Lines.” https://www.permitadvisors.com/resource/seismic-retrofits/

- Style Plus, “How to plan and budget a house renovation.” https://www.styleplusrenovations.co.nz/blog/how-to-plan-and-budget-a-house-renovation/