REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

When you've been in the land flipping business for a while, you may eventually find yourself yearning for something more, something grander, something to reignite that spark of excitement.

Sure, those same old land flips will bring in decent profits, but for some, the thrill of the chase starts to fade. It's like eating the same flavor of ice cream every day – it's good, but eventually, you crave something different, something more satisfying.

If you're nodding along and feeling like it's time to level up and chase after those bigger, juicier deals, you're in the right place. We're about to shake things up and change the ‘traditional' land-flipping business model you've been following this whole time.

This lesson will explore the natural progression many land-flipping professionals go through.

We're talking about seizing those high-value opportunities that promise hefty paydays and heart-pounding excitement. It's a whole new ball game with different rules and strategies to master. So buckle up because things are about to get interesting!

Why Bigger Deals Mean Bigger Business

As you gain experience and build your reputation in the land-flipping industry, it makes sense to start targeting more valuable properties.

By shifting your focus from smaller, entry-level flips (properties worth less than $50K) to larger deals (with values in the $50K-$500K range), you'll open the door to significantly higher profits from each transaction you do.

This will allow you to spend less time making more money from a smaller volume of transactions.

Note: If you're looking for another take on the concepts in this lesson, read Chapter 2 of The Land Investor's Playbook by Travis King. In it, Travis does a beautiful job explaining this new business framework when going after bigger land deals in what he calls the B.O.S.S. Play.

Mastering the Art of the Offer

When dealing with higher-value properties, the first big mindset shift we must undergo is how we make offers.

When going after properties in this higher value range, we won't deal nearly as much with smaller, less desirable properties with limited uses that most people don't want.

As the larger numbers imply, properties worth over $50K will undoubtedly be more desirable, with more valuable uses than bargain basement properties.

Most of these landowners will be aware of the higher value and won't be quite as eager to let their land go for pennies on the dollar.

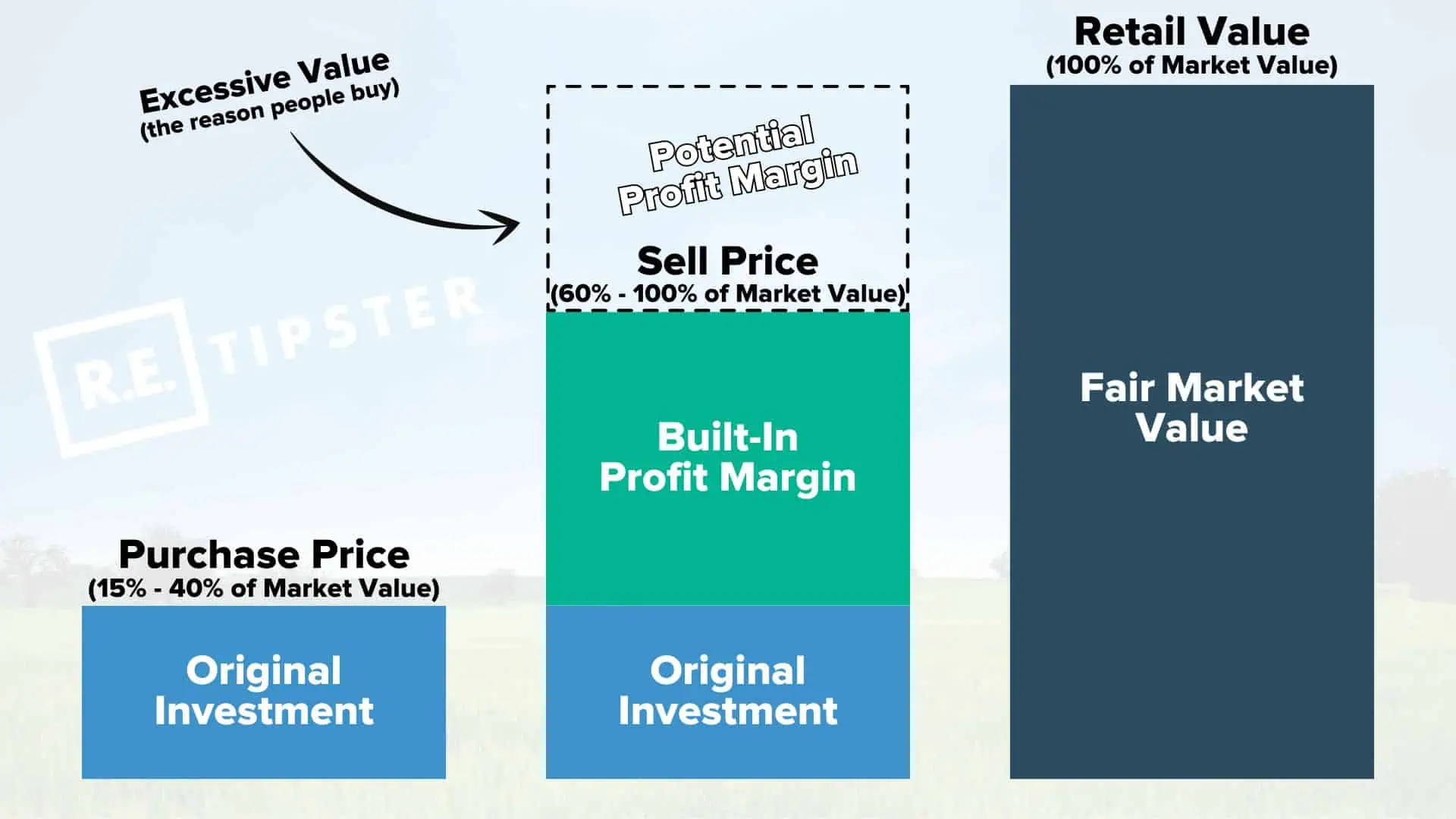

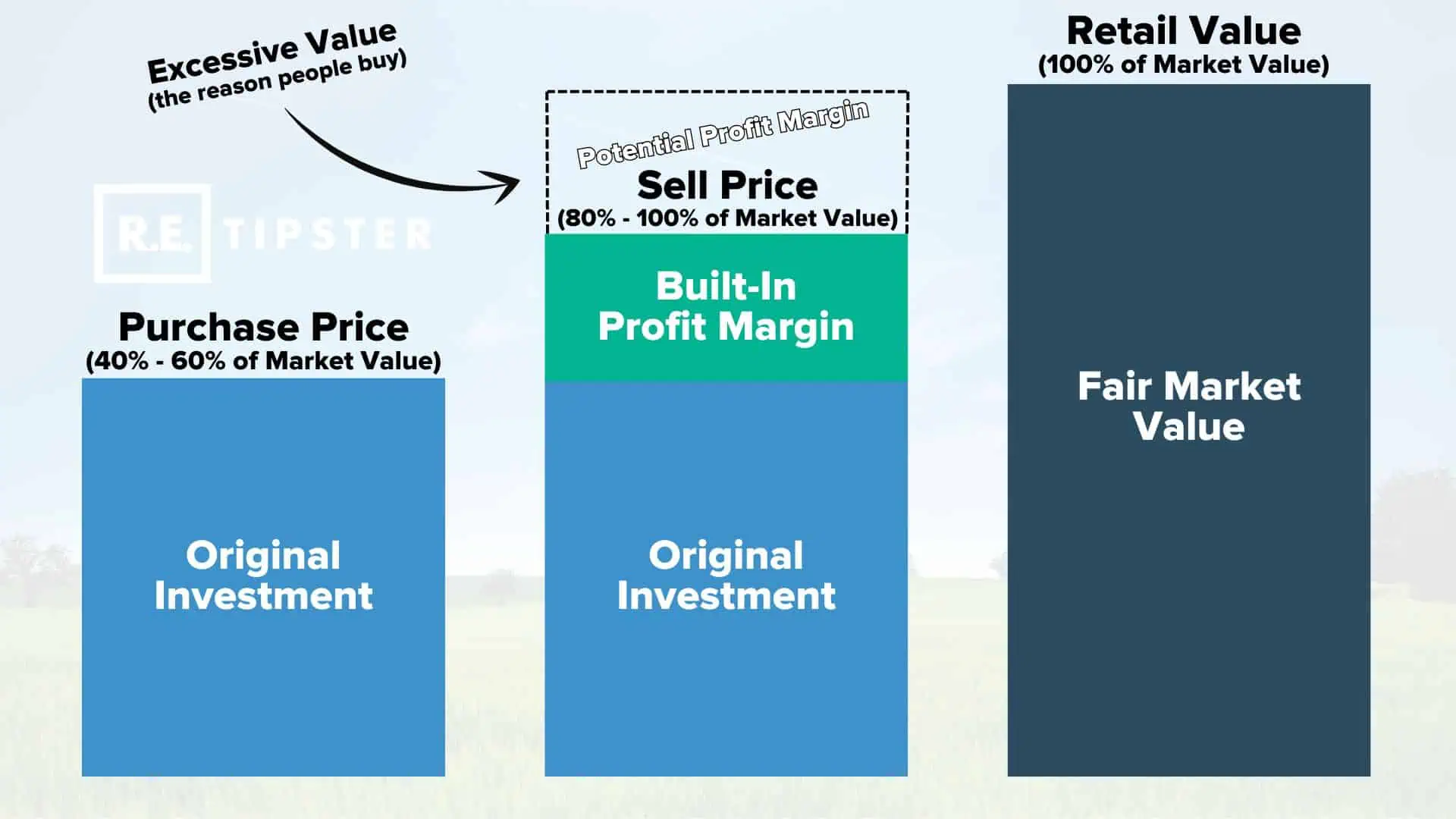

While the smaller, cheaper properties can realistically be had with offers around 15-40% of market value, larger deals will require a more aggressive approach. If you want to play ball in this league, you must step up to the plate and start swinging like a major-league hitter. In other words, you'll have to adjust your offer strategy.

Granted, I'm not saying you'll never be able to buy higher-value properties for 15-40% of market value, but if you adhere strictly to this model, the odds won't work out nearly as well as when you're only working with the cheapest vacant lots in your market.

ROI vs Absolute Profit: Which Matters More?

Now, I know what you're thinking because I used to think the same thing,

“But Seth, won't that hurt my ROI? Isn't it too risky to make such high offers?”

When my land-flipping business was in its infancy, I was utterly obsessed with my Return on Investment (ROI).

For every dollar I invested into a property, I wanted to see at least 2-3X that amount coming back to me after it sold.

That's why I militantly followed the model we've discussed up to this point in the course. I always offered 10-30% of market value and maybe as high as 40% if I felt dangerous.

When you deal with cheap land and make enough offers, you can certainly find deals like this, but when we move up to the big leagues, we need to change our thinking.

ROI starts to matter less with larger properties because we're more concerned about the absolute profit we're walking away with, and this goes beyond looking at mere percentages.

Absolute profit is the raw financial gain from each deal, the difference between the total revenue generated and the total costs incurred. For instance, if you buy a property for $100,000 and sell it later for $150,000, your absolute profit would be $50,000.

ROI always matters to some degree, but it's not everything, and as we bring larger sums of money to the table, looking strictly at ROI doesn't make sense.

When ROI Matters Less

I once did a deal that earned me a 4,900% ROI.

Sound impressive, right?

This was based on a property I bought for $500 and sold for $25,000.

It was a great deal by anyone's measurement, but what if we removed a couple of zeros from those numbers?

Suppose I bought a property for $5 and sold it for $250.

A $245 profit isn't quite as exciting, is it?

It's the same ROI, but what can you do with $245? There's not much to write home about!

On the same coin, what if we added one or two zeros to the original numbers?

What if the property was worth $250,000?

In that case, the ROI could be significantly lower, and we would still make a very exciting profit!

We could pay a whopping $200,000, sell it for $250,000, and our ROI would be much smaller at 25%, but we'd walk away with a $50,000 profit!

Heck, even a 15% profit on $200,000 would be $30,000!

You see… the bigger you go, the more you'll realize that ROI isn't everything.

Why? Because what we're ultimately looking for is our absolute profit.

How many dollars will we walk away with when the deal is done?

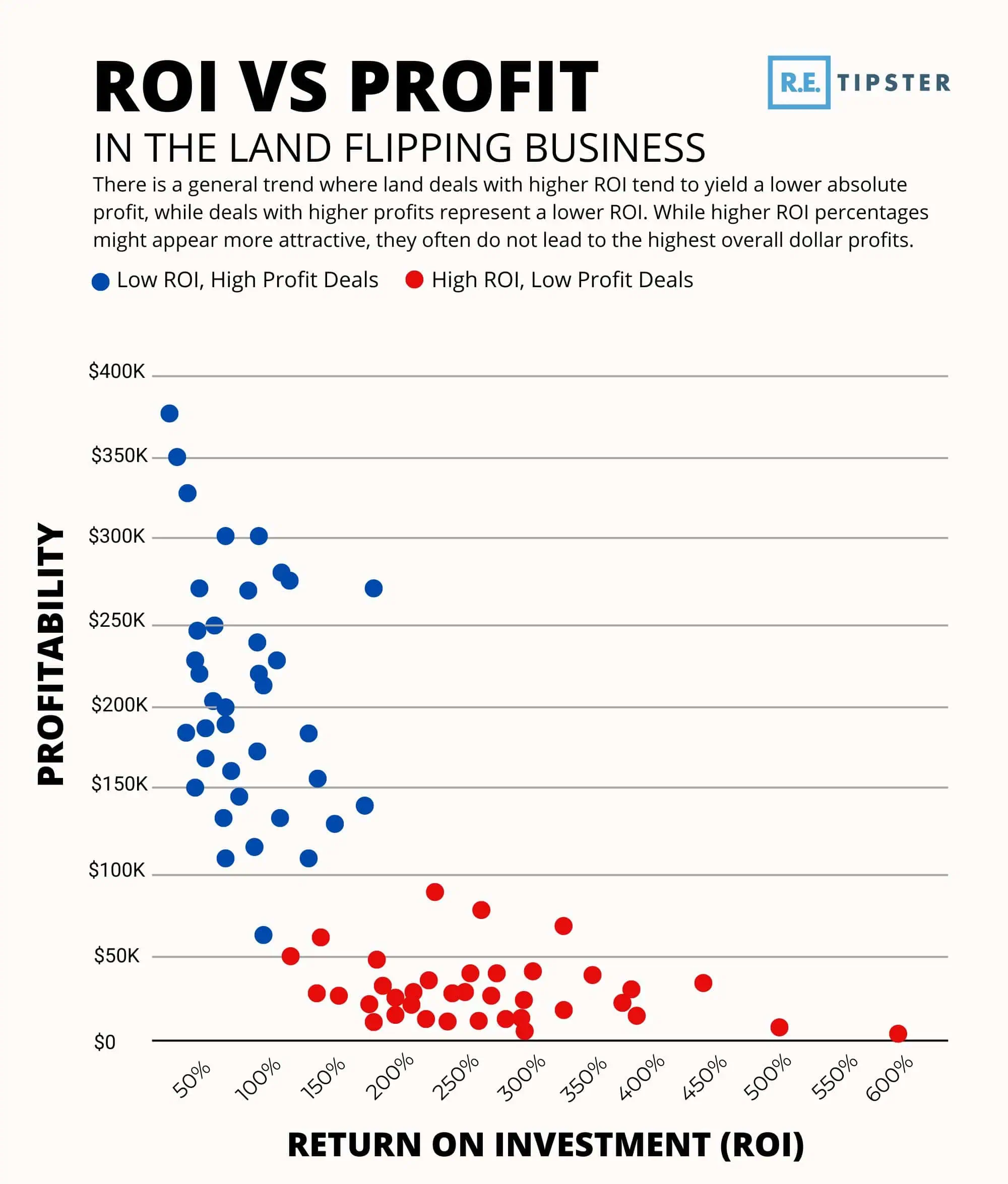

As the scatter graph illustrates, there is a general trend in the land investing business: The higher ROI deals typically yield a much lower absolute profit, and the higher profits deals yield a lower ROI.

While higher ROI percentages might appear more attractive, they often do not generate as much of what really matters: the absolute profit!

For lower-value properties, a high ROI is more important.

For higher-value properties, a high ROI is less important.

The New Offer Framework

If I'm trying to buy a vacant lot worth $100,000, I'll have a much harder time finding motivated sellers who will let their property go for 10-40% of its market value.

Unless the property has some BIG, obvious problems (like being landlocked or covered from end to end with wetlands), most landowners of larger properties just won't let their nice, desirable real estate go for such a huge discount.

I won't say it's impossible to find these deals (after all, I've found them before), but they are FAR less common. You could spend a lot of time and money looking for these deals, and if you don't know when to stop, your marketing costs could even lead to a net loss!

When I make offers on larger deals in a solid market where I know the property will sell quickly, my offers will start in the 40% to 60% of market value range, which gives me a much better shot at getting the deal. I may even go higher, depending on the specifics of the property and how I plan to use or resell it.

In a very real way, the business model has changed, and my offer-to-value looks more like this:

But keep in mind, even though the margins are getting thinner, the absolute profit is still thicker because this revised offering structure deals with much larger denominations.

The Advantage of Subdivided, Entitled, or Improved Land

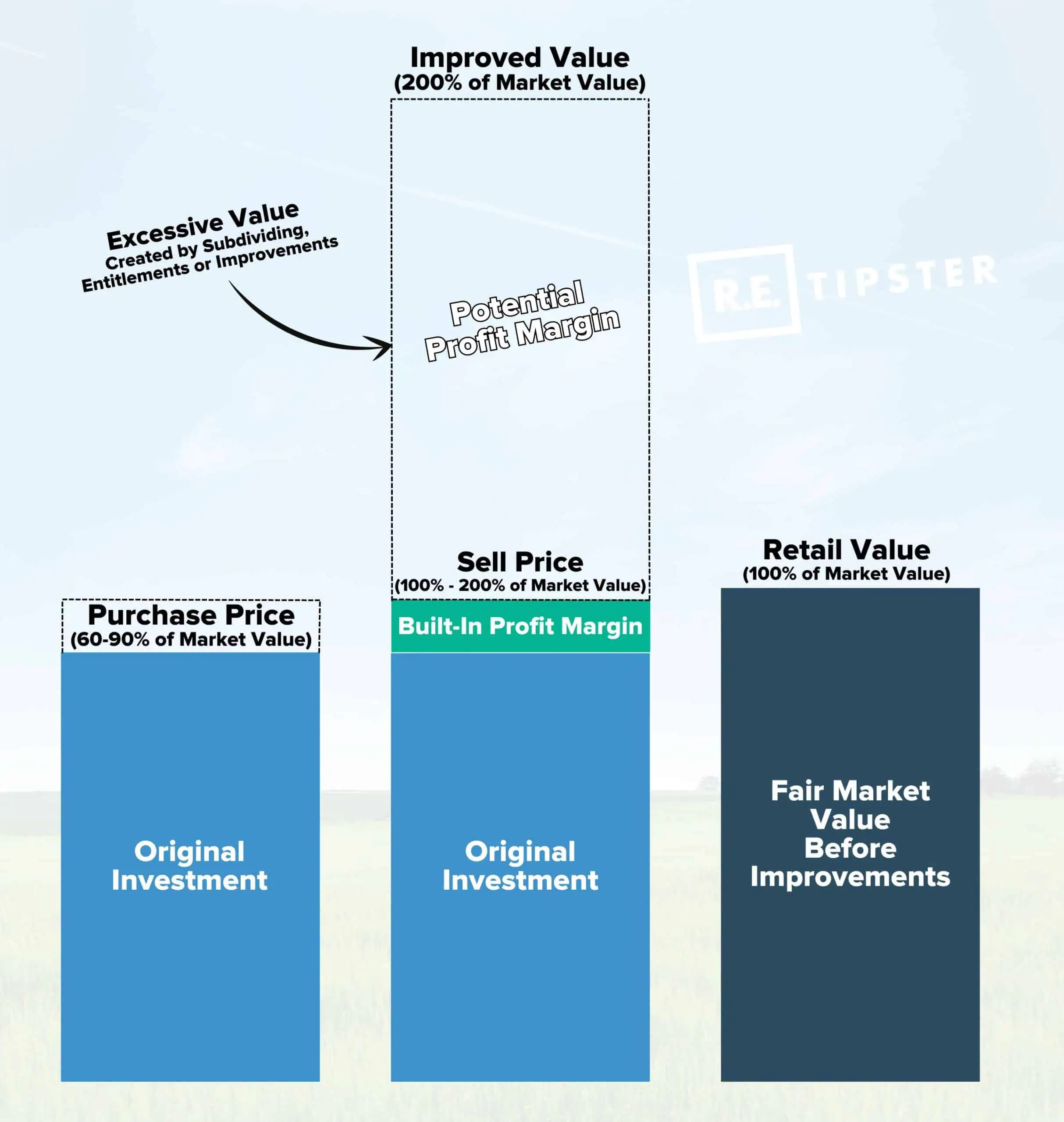

Now, if I'm buying a property that I can subdivide, get new entitlements, or make some other improvements, in those cases, I'm thinking more about the property's future value after I make whatever improvements I plan to make.

Think of how house flippers make offers using the 70% rule. They look at the ARV (After Repair Value) or, in our case, the ‘After Improved Value' and make their offer based on 70% of that number.

For example, if a house's ARV is $100,000, the 70% rule says that the investor can spend up to $70,000 to purchase the property and make any necessary repairs. If the investor estimates that the repair cost is $20,000, the rule says their maximum allowable offer (MAO) is $50,000, which leaves enough room for their $20,000 repair bill.

Make sense?

When I look at a higher-end land deal involving improvements, I like to work between the house flipper's 70% and the revised 40-60% of market value offer.

Let's say I find a vacant lot worth $100,000.

After I pay $15,000 for a surveyor to subdivide it and cover my closing and holding costs, I can sell it for $200,000.

- Future Value: $200,000

- Current Value: $100,000

I could easily offer 70-100% of the property's current market value if I'm confident in these numbers. Maybe even higher!

Why? Because I can force the appreciation and make it worth a lot more.

When you can force appreciation into the properties you buy, the margins increase, giving you more financial muscle to use when making offers.

In essence, you'll be working a completely different business model than other land flippers because:

- You'll be offering more.

- You'll be pursuing very specific types of land with development potential.

- You'll have to develop certain areas of expertise that most land flippers don't even think about.

Once again, this is getting into a very different model of how we make offers, and it looks more like this:

Improvements to your properties will completely change the game, but it will take some work.

Most land flippers either don't know how to do this work or are simply unwilling to do it.

And I'll be the first to admit that subdividing, entitling, or improving vacant land is more complicated and time-consuming than a simple land flip. Still, if you're willing and able to do this extra work, you can easily offer more than any of your competitors and get deals nobody else can get.

It's not for everyone, but the land investors willing to do this work tend to become millionaires much faster.

Valuing Each Lead

When you're looking for larger land deals, the marketing process is still a numbers game, but you also don't need to do as many deals to make the same amount of money.

Of course, if you want to make much more money, you can keep pushing just as hard on your marketing, but you won't have to.

When you start making 10X more per deal, you can focus more on quality instead of quantity.

Because of the nature of these higher-value properties, the value of each lead is also higher.

This means when a property owner raises their hand to express interest in selling their property (by calling you back, visiting your website, or responding to your initial message in some other way) if they respond at all and say anything other than “No,” this is a high-value lead.

Even if they aren't ready to sell today, it's worthwhile to continue following up with them every month or so to remind them that your offer is still on the table.

By contrast, when you work with cheaper properties, this kind of follow-up isn't always vital because you can just as well spend the same money exploring new markets. However, higher-value properties are different because each one holds the potential to make much larger profits. Because of this potential behind each lead, it's worth the time and trouble to squeeze each one until they tell you to stop contacting them.

Selling Land at a Premium

In my first few years, when I struggled to buy and sell dozens of cheap lots by myself each year, it seemed like I always had to sell my properties at a discount if I wanted them to sell quickly.

Part of my problem was working in a slow, depressed market. But another BIG part of the problem was that I was trying to sell ‘garage sale properties,' which naturally attracted shoppers who wanted to pay ‘garage sale prices!'

When you start working with larger properties at higher prices, you start dealing with a completely different type of clientele. These buyers have the money and can get whatever loans they need to take these larger properties off your hands.

Your land is just one part of a much larger picture to them because these buyers often have much larger plans to build big houses or developments, and buying the land is the first of many steps they plan to take.

Sure, they'll buy it for a discounted price if you advertise it to them that way, but when you've got a premium property in a growing market, you won't have to! The right buyers will gladly pay the price you want for it.

Funders and Capital Partners

If you're anything like most people, you might be asking yourself,

“Where will I get the money to buy all these larger deals? I hardly have enough cash to buy smaller properties, and I don't have enough cash to buy a $100,000 property!”

I have great news: You don't need the cash to buy these properties alone!

These days, if you have a good property under contract at a good price, it is surprisingly easy to find land funders who will partner with you to complete your deal.

Every land funder is unique in how they structure their partnerships, but if you go into this type of relationship with reasonable expectations, you'll probably find that working with a funder is a far better scenario than trying to do the deal yourself, even if you do have all the cash available to buy it on your own!

The downside of working with funders is that most of them will expect a big chunk of the profits. Like I said, they're all a little different in how they structure the arrangement, but most of the funders I know will expect to hold title to the property, they will ultimately have most of the control over the deal, and they'll expect to keep anywhere from 30-70% of the profits when the deal is done.

This might sound like a lot of money to sacrifice… but it's actually quite the opposite. Here are at least three solid reasons why:

1. Your cost of funds is $0.

When a funder is fronting all the cash to acquire a property, you don't have any money in the deal, which means your cost of funds is ZERO! This is a huge advantage because when your money isn't tied up in your inventory, there's technically no financial limit to how many deals you can do at a time. Even if your preferred funder doesn't have the cash to fund your next deal, that's okay; find another funder to do the next one!

2. The funder is a valuable second set of eyes on your deal.

When buying bigger properties, the quality of your due diligence becomes exponentially more important. With the tricky nature of land, it is easy to overlook the finer details. If there was ever a time to get another set of eyes to review your property and ensure it's a good deal, these bigger deals are where you want it. Now, granted, not all funders are sophisticated and experienced with land, but if you can find one who is (and several of them are out there), this kind of valuable oversight is exactly what you'll get!

3. The funder is taking 100% of the financial risk.

Imagine this nightmare scenario: You find a property you can buy for $200,000. After all due diligence, you and the funder agree it will probably sell for $300,000.

One month after closing, you discover a big issue: a building moratorium is in place, and nothing can be built on this property for the next 5-10 years. Because of this, the most it will ever sell for in the short term is $100,000.

I sincerely hope you never experience this, but if you did and had a funder involved, this would be far more the funder's problem to sort out than yours.

Granted, it may depend on what responsibilities are spelled out in your agreement with the funder, and this may or may not damage your relationship with the funder. Still, this catastrophic financial burden would not be on you for most intents and purposes because your financial partner took on all the risk in the deal so you wouldn't have to.

Mastering Due Diligence

As you transition to higher-value properties, thorough due diligence will become more important than ever.

When examining the zoning restrictions, property boundaries, access issues, potential easements, any potential issues with flood zones, wetlands, perc tests, etc., don't just look at the county maps online and call it good.

You should be ready to pay for professional surveys from licensed surveyors, wetland delineations (when necessary), environmental reports (on commercial and industrial properties), and anything else you'll need to have absolute certainty about the value and usability of each property you're buying.

By identifying and addressing potential obstacles early on, you can avoid costly surprises and ensure a smooth transaction on both sides of the deal.

The more you know about a property and its faults (and there are always some faults if you dig deep enough), the better equipped you'll be to negotiate the best price and close the deal without overpaying.

Building a Dream Team

As your deals grow in size and complexity and you start funneling much larger paychecks into your account with each deal, it will become increasingly affordable to stop doing everything yourself.

This is a HUGE upside to focusing on bigger deals!

Not only will you start making a lot more money for your time, but you'll also be able to pay the great people to come alongside you, so you can get much further than you would on your own!

It's hard to hire great people, pay for title companies, and give away a chunk of your profit to an agent when you're only making a few thousand bucks on each deal… but when you're making tens or even hundreds of thousands on deal, it's a no-brainer to pay good professionals to carry the ball for you!

You can start by partnering with experienced land agents who can provide invaluable insights on pricing, market trends, and listing strategies. You can also cultivate relationships with title companies and closing agents who can handle any closing you need. You'll also be able to rely on land use consultants, surveyors, and attorneys who can help navigate the intricacies of these high-value transactions.

Every land investor I know who pursues larger deals like this has completely outsourced the entire selling arm of their business to land-specialized agents.

That means half of their business is done by outside professionals who are better and faster at selling vacant land. This frees up a lot of time for the land investor to find more and better deals!

Cultivating a New Mindset

To succeed in the world of high-value land flipping, it's crucial to adopt this new mindset. This means seeing yourself not as a solo operator who can only afford a few cheap properties at a time but as the leader of a team of experts. You must pull together the right professionals and find the money from the right funding sources so you can work together to close deals and generate much larger profits than you could on your own.

You're not working by yourself anymore. You're leading an organization capable of generating mind-boggling profits that could never be achieved alone.