REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

It's been nearly three years since I bought my first coffee farm parcel in Panama from AgroNosotros.

Whenever the topic comes up in conversation, people always ask me,

“Is that farm producing any coffee?”

“Have you made any money yet?”

“Have you been down to visit your farm?”

These are all great questions, so I wanted to answer them all in this blog post.

Have I Made Any Money Yet?

Let's start with the #1 question everyone asks me,

“Have you made any money yet??”

As I mentioned in the original blog post and video, the company's pro forma stated that each new farm would take roughly three years to produce any harvest or revenue.

Why? Because all new coffee farms start out with seedlings that aren’t big enough to produce a harvest. It takes roughly three years until anything can be harvested.

Once the trees start producing coffee beans, the trees will continue to grow, along with the size of each year's harvest, which also increases the global revenue of the coffee farm, and that’s where things start to get fun.

The farm I invested in has been in this initial three-year start-up phase where nothing has been harvested yet, so there hasn't been much to report in terms of actual revenue.

When Will the Money Start Rolling In?

The first coffee parcel I bought was in November 2018. However, the farm wasn't actually planted until 2019, and that's when the three-year clock started.

I also bought two additional parcels in 2020 from an existing owner who wanted to sell out (a rare opportunity to invest more into the operation even though the original round of parcels had sold out). These additional parcels were situated in another farm that was situated near the first one I invested in, and it was also planted around the same time in 2019… so the farm was already on its way to production before I bought into it.

With coffee farms, there are certain times of year that are most ideal for planting, based on the amount of rain and seasonality throughout the year. For this farm, that time wasn't until 6 – 8 months after my money went in… so with the first parcel I bought, the farm didn't start growing the moment I wired my money to Panama.

Another factor that affects the growth of coffee trees is the altitude of each farm.

Some of these farms are at lower altitudes, which means the coffee trees grow faster and produce a harvest quicker, usually within three cycles (or years) from when they were planted.

However, the farms I invested in are at higher altitudes, which means the trees grow slower and take roughly another year to produce a harvest. As a result of the higher altitude, the trees also end up being stronger and producing a higher quality coffee bean in the end, but still, the first harvest is delayed by about a year.

This slower growing timeline supposedly doesn't change the long-term, anticipated ROI. The average annual return over the first 20 years is still projected at 12%, and I was told that a one-year delay doesn't have any substantial impact on this average number.

As I write this in November 2021, I have not received any payouts yet, and based on the time when these seedlings were planted and the altitude of the farms I've invested in, I don't expect to see anything until the 2022 or 2023 harvest season.

Have I Visited Yet?

Unfortunately, not yet.

I had every intention of flying down to Boquete, Panama in 2020, but then COVID happened. The regular coffee tours were put on hold (and even if they hadn't been stopped, international travel was still out of the question for me in 2020).

As 2021 came around the corner and I got vaccinated, it was looking pretty seriously like I would finally be able to take a trip down in November 2021 (right around now), but with some of the other things going on in my business and life, I decided to put the trip on hold again. Not because I couldn't make it. It was just a matter of inconvenience.

COVID Impact on Coffee Harvest and Sales

My trip to Panama wasn't the only thing that was disrupted by COVID.

Just like the rest of the world, COVID-19 had its unique impact on coffee farms around the world.

In my conversations with Darren Doyle (co-founder and president of the company), he said that life on the farm for workers was largely unaffected. They limited the movement of farm works by quarantining certain families to certain farms (whereas they used to move around freely from one farm to another). The quality of their coffee harvest was also unaffected by COVID.

And while it had nothing to do with COVID-19, there was some bad weather that affected their harvest a bit in 2020. Some of the farms had an overabundance of rain, which caused the coffee trees to flower too quickly and die prematurely, which prevented a lot of would-be coffee beans from sprouting.

This kind of weather susceptibility is just a reality of life for any farm operation and a good reminder that every investment has its set of risks. Returns and precise timelines are never guaranteed, especially when acts of God don't always gel with our plans.

Who Is Buying This Coffee?

Currently, all of the coffee produced by International Coffee Farms is either being sold in Panama or sold to buyers in Japan.

They plan to harvest 20,000 pounds of coffee in 2022, and as the farms continue to grow and produce, that number should grow into the hundreds of thousands each year.

Worldwide demand for coffee is growing, but the market is also changing because of the impact of COVID.

With all the restaurants, businesses, cruise ships, and other “points of coffee consumption” being shut down, people are doing a lot more brewing at home and even buying their own roasters, whereas they used to buy and consume their coffee from different places, they're handling a lot more of it in-house now (no pun intended).

These changes don't directly impact these coffee farms in Panama, but it is an interesting change in the industry to keep track of.

Parcel Titling Issues

One interesting thing about this original investment was how the land was supposed to be titled to each individual investor.

Each investor would pay $18,900 to buy a half-acre parcel of land. The investor would then become a deeded owner of that parcel of land (they can hold title personally, in an LLC, in a self-directed IRA, in a trust, or however else they want), and then they would sign a management agreement, giving AgroNosotros the right to farm the land as part of their overall operation.

Some of these farms have completed the feeding process, and every individual investor has received their deed. However, some of them (including the ones I invested in) have not.

As it was explained to me, there have been a few unforeseen complications in this process:

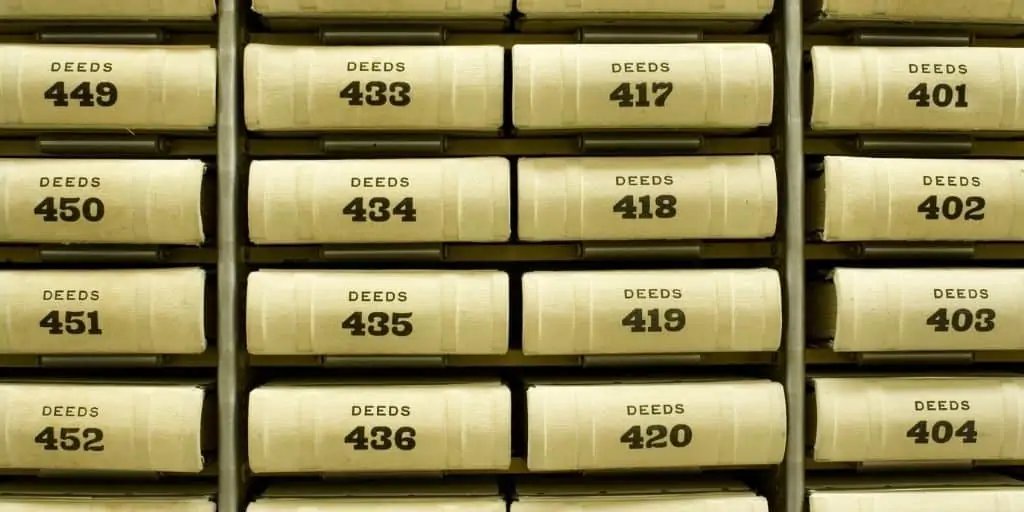

- In this area of Panama, the title office is very slow-moving (it's literally three ladies who work in a small office in rural Panama). Not exactly the same thing one might imagine in the typical county office in the United States.

- The Panamanian government has a difficult time comprehending certain types of U.S. entities like self-directed IRAs and trusts because of the custodian involved and/or differences in Panamanian trusts vs. U.S. trusts.

- When COVID broke out in early 2020, it took an already-slow operation and stopped it altogether.

As a result, some parcel owners still have not received the deeds for their parcels. This doesn't mean they won't receive their dividends from the profits of the farm, but it has caused some big delays in the titling process. I still have not received mine as of November 2021.

Am I concerned about this? Not really.

When I decided to get into this relationship with International Coffee Farms, I did it with the understanding that I trusted the company enough to handle this process and figure it out, and I still trust that they will get it worked out.

Regardless of whether it's currently titled in my name or not, there's more than enough of a paper trail to prove that I invested in these parcels and am entitled to the appropriate share of returns, so the deeds aren't a big concern to me.

Given the issues with this titling process, AgroNosotros has changed up its investment model so that all future farms will be acquired through the syndication model, using accredited investors who invest a minimum of $30K. This should solve these problems with titling on all future farm projects, but for the remaining farms that were sold as individual parcels, it continues to be an issue they are ironing out.

A New Coffee Brand

Now that International Coffee Farms has acquired several farms that are well into their production journey (some of them have already produced a full harvest, and some of them are expected to have their first harvest in 2022 and 2023), the company is repositioning itself from being an investment business to a coffee-selling business.

Cuatros Caminos Coffee Estates is their official brand that sells the coffee produced on these farms (it's basically what used to be known as International Coffee Farms). You can see each of the coffee farms they have in operation (the parcels I own are in Jaramillo 14 Ha and Jaramillo 37 Ha) and even buy packages of their coffee from their website.

Note: If you buy coffee and get it shipped directly from Panama, the cost of shipping will be 3x the price of the coffee itself, so if you'd rather not get ripped off on shipping, you can also buy it from this distributor on Amazon – Speciality Estate Blend, Speciality Terrior Geisha Coffee, Specialty Classics Catuai Lavado, Speciality Premium Catuai Natural).

Any New Investment Opportunities?

AgroNosotros isn't looking for investment dollars like they were back in 2018. Their coffee and cacao farm parcels are sold out, and unless you can find an existing owner who wants to sell you theirs, there are no individual farm parcels for sale at this point.

In my recent conversation with Darren Doyle, he mentioned that they're working on a private placement offering for a new cacao farm in Panama, open to a limited number of non-accredited investors (as it's a 506b), with a minimum investment amount will be $30K… but they would need to get to know the investors quite well before that could participate.

Interestingly, this whole rule about private placement offerings is an SEC rule in the U.S. Since AgroNosotros is in Panama, they don't technically have to abide by these rules, but since most of their investors are in the United States, these are the best and strictest rules to play by.

This new cacao farm will be 62.5 hectares (over 154 acres). And when it gets up and running, it will breathe a lot of new life into the local economy in an area of Panama that is basically dead right now.

If you're interested, you can contact Darren Doyle about it.

Note: This is not a sponsored plug for the company, this is not investment advice, and REtipster has no financial incentive for telling you about this. I'm just passing the information along for anyone interested.

Final Thoughts

As I sit here and reflect on where things are at after 36 months of having my money tied up with the company, some might wonder,

“Are you disappointed that this hasn't made any money yet?”

I don't think “disappointed” is the word I would use.

On one hand, I do wish I had something exciting to talk about at the three-year mark. It feels a little silly to write this whole blog post just to ultimately say that nothing has happened yet.

But, honestly, that's just the reality of some investments. Especially when the goal is to build a long-term stream of passive income, this type of investment tends to be slow, boring, and uneventful. Sometimes there are unexpected delays—and that's okay.

As long as the fundamentals of the investment are still sound, I'm okay with the slower timeline.

For example,

- The operators are still competent and capable.

- The land, workers, and trees are still on track to produce a quality harvest.

- There is still sufficient global demand to sell the product on the market.

These are the things that really matter. As long as these boxes are still checked, I'm confident everything will be alright.

Hopefully, I'll have something more exciting to tell you about in the next 12 to 24 months!