REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

One of the most common challenges every land investor encounters is access to funding.

Even though vacant land deals offer some incredible profit margins, when you're buying and selling properties for cash, you will inevitably run out of cash. When that happens, all of your liquidity will be tied up in your land inventory, which is either:

- Listed on the market and waiting to be sold.

- Sold with seller financing, and you're collecting the sale proceeds in slow motion.

When all your cash has been depleted, your business will be dead in the water until you sell another property and collect the proceeds so you can keep moving.

But what if there was another way?

Well, there is!

If you're out of cash to acquire new properties but still want your business to move forward, there are many ways to get the money you need.

In this blog post, we will talk about a creative financing option available to most people, but many either aren't aware of it or overlook it altogether.

Fast, Easy Funding Options

In 2023, I was the moderator of a panel discussion where I interviewed four professional land investors about the creative ways they've funded their land deals.

Two of these land investors were Bryan McCarthy and JT Olmstead, and they were both using a very similar approach to obtaining capital for their land businesses.

When they got offers from companies trying to lend them money, they didn't ignore those messages. They would actively seek out these kinds of personal loans and business lines of credit from lenders like AMEX, Quickbooks, PayPal, Stripe, and others.

I'm talking about emails like this…

When one of these companies would solicit them about borrowing money, they wouldn't ignore these messages like most of us would; they would pursue them to find out how to get the money!

Why borrow from a lender like this?

Two Reasons: Speed and Flexibility

In many cases, these lenders will approve loans and advance their funds very quickly.

Here are some examples of these lenders:

- Stripe Capital

- PayPal Small Business Loans

- AMEX Small Business Lines of Credit

- QuickBooks Small Business Loans

- Bluevine Bank

These loan applications can be completed in a matter of minutes, and when they fork over the money to their borrower, they have minimal scrutiny or restrictions about what the money can be used for or where it can be spent. They only want you to pay them back with interest (and, in most cases, a lot of interest).

And that brings us to the drawbacks of using these kinds of loans.

Borrowing this kind of money can be expensive. Sometimes, very expensive.

Interest rates can be as low as 10% (with points due immediately upfront) and as high as 19% with no upfront fees or points. In some cases, interest rates can be as high as 35%, with 3.5% of the loan taken out as an upfront fee (this kind of interest rate is absurdly expensive and would only be used as a last resort).

Some of them (like AMEX, for example) have a range of interest charges depending on how long you want the loan to be out for.

Some of these loans will require that you take 100% of the money immediately, and you will owe interest on the ENTIRE balance of the loan on day one, with payments required in weekly increments. Others are structured more like a line of credit and are much more flexible with how much money you need to draw and how frequently interest payments are required.

The flexibility and costs associated with these types of loans vary widely among these lenders and loan options.

These loans are not an apples-to-apples comparison, but they all have in common that they make it fairly fast and easy to get the money, and there is a lot of flexibility in what you can use these funds for.

Loans vs. Lines of Credit

It's worth noting that some of these funding sources are structured as “loans” or one-time sources of funding, where you have to take 100% of the money immediately after approval and then pay it back according to the terms of the loan agreement.

These are not interest-only loans; they are fully amortizing loans, with set amounts of principal and interest due every month (for example, if you borrow $55,000 at 16.38% interest under one of these loan arrangements, you would owe $5,000 per month for 12 months until it's repaid in full).

Other sources are structured as a “line of credit” or “revolving line of credit” (a.k.a., revolver), which means you can draw however much money you want if/when you need it, and each time you pull from it, that amount is added to the loan balance, and the amount you'll make interest-only payments on.

This is similar to how a HELOC (home equity line of credit) works, where you can borrow however much you want from your line and make interest-only payments during the term of the loan.

Other Loan Sources

If you don't want to pay an exorbitant interest on the money you borrow, you could also try working with a more conventional lender and go after a more traditional loan. Any conventional bank like Chase Bank, Wells Fargo, Bank of America, or whatever local bank you're working with will have loan options like this.

While you will probably get a lower interest rate with this type of loan, it's also a different type of animal that will take longer to get the money and requires more scrutiny from the lender to approve you.

The main benefit of getting the more expensive, higher-interest loans is that they're fast, easy to get, and don't ask questions about where you spend the money.

0% Interest Business Credit Cards

When I first heard about these unconventional funding sources and the high interest rates, I immediately thought of Fund & Grow, a company that can help you find and apply for business credit cards with 0% interest for 12 – 18 months.

RELATED: My Experience With Fund & Grow: 0% Interest Loans for Real Estate Investing and Beyond

I know many people who have gone this route (whether they used Fund & Grow to find the credit cards or they just found them on their own), and it seems to work… but one common issue is that not all credit cards will allow you to do whatever you want with the money.

While it's great to have a funding source that charges 0% interest, it's important to note that these lines of credit must be paid off in time, or you will pay a lot of interest. Similar to the unconventional funding sources mentioned above, it's essential to have a system to track which loans are due and when so you can make your payments on time.

How to Find Small Business Loans?

Even though there are plenty of examples of lenders and loan sources above, you may wonder what else you can find.

It's easy to do your own research! If you want to do some of your own homework, you could search for keywords like:

small business loans

small business lines of credit

personal lines of credit

Note: When you find a “small business loan” or a “line of credit,” they don't always mean the same thing from one lending institution to another, so be sure to dig into the details of each one rather than accepting what the lender says on their landing page.

How Many Loans Can You Get At Once?

Since all of these lenders will take at least a quick look at your personal credit and/or debt-to-equity, they will all care about how much existing debt you have at the time of application.

But will they care how much debt you have 30 days after they approve you? Maybe… but even if they do, they probably won't be able to do much about it after they've approved your loan and you have the money.

Now that you're aware of this (because I just told you 😀), one way to get around this is to apply for as many loans as possible on the same day so each individual lender can't see the full picture of all the loans you're trying to get approved simultaneously.

Remember, all they're looking at is your financial picture at a specific point in time, and if you haven't gotten approved for any other loans or drawn any other money yet, you will look like a clean(ish) slate when each lender looks at your application.

Business Loans vs. Personal Loans

Should you be applying for a business loan or a personal loan?

If you're a new land investor, you'll probably have a hard time getting approved for a business loan because your new business won't have any track record or historical financials to prove that you have a functioning, healthy business.

If this sounds like you, a good first step may be to apply for a personal loan instead of a business loan.

The biggest difference between these loan types is that, when getting approved for a personal loan, it's less about your business credit and more about your personal financial situation.

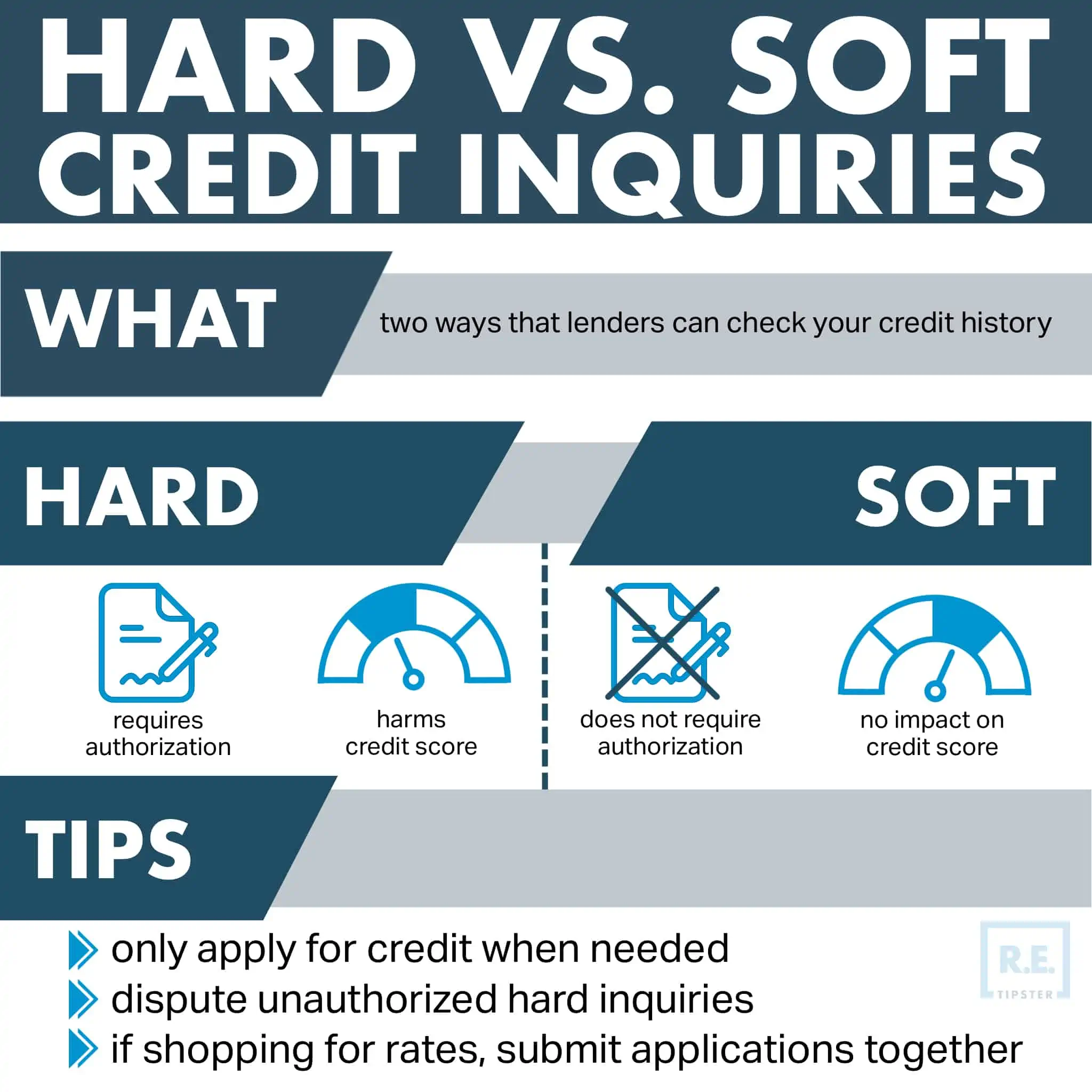

A lender will look at your personal credit for either a personal or business loan. However, a personal loan typically does a “hard credit inquiry,” whereas a business loan will likely do a “soft credit inquiry.”

What's the difference between hard and soft inquiry?

With a “hard pull,” the lender will thoroughly check your credit report for a lending decision, and this will often affect your credit score and show up on your credit report.

A “soft pull” is an initial check that does not affect your credit score nor show up to other inquirers on your credit report.

With a personal loan, the lender will not look at your business credit or financial history because they want to see your personal income and net worth (whether it's coming from a job, business, or some other investments) to determine how much money you make on a personal level.

RELATED: Hard vs. Soft Credit Inquiries: What's the Difference?

With a business loan, the lender will look at your business income and will likely check your business bank records, tax returns, and year-to-date financials to see how much money goes in and out of your bank accounts. They care much more about your financial health than they do about your personal financial health. Not that your personal financial situation doesn't matter at all, but it's not the primary driver of their decision.

Since a new business won't have much cash flow to show in and out of their bank account, a new business owner would have no choice but to start with a personal loan rather than a business loan.

Writing Off Business Interest

If you get a personal loan, keep in mind you can write off the interest expense as a tax-deductible expense IF you keep a clean paper trail and prove you used the money for business purposes.

For example, you could set up a new business checking account, deposit 100% of the personal loan proceeds into that account, and then show that all the money pulled from that account was used for business purposes. As long as you don't co-mingle those funds with any other personal expenses, you could write it off (and of course, this isn't tax advice; check with your CPA to verify this before you implement it).

Have you ever applied for and used a personal or business loan in your land investing business? How did it work out for you? Let us know your experience in the forum!