REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Are you still using Excel files to track your rental properties’ financials?

Most new landlords don’t realize how much data and information they need to track on an ongoing basis for each rental property.

Sure, landlords need to track income rents and outgoing mortgage payments. But there's much more to the story, including expenses like repairs, maintenance, property management fees, taxes, insurance, bookkeeping, accounting, mileage, and more.

And of course, this says nothing of other financial information such as property values and mortgage balances or all the documentation that goes along with them, like lease agreements, move-in/move-out condition statements and photos, property management contracts, appraisals, home inspection reports, and insurance policies.

Once upon a time, landlords and property managers kept track of their numbers and stored paper documents in a huge filing cabinet. In recent decades, they have kept electronic files saved on their hard drives.

Today, it's easier than ever to automate rental property financials through online applications like Stessa.

Introducing Stessa

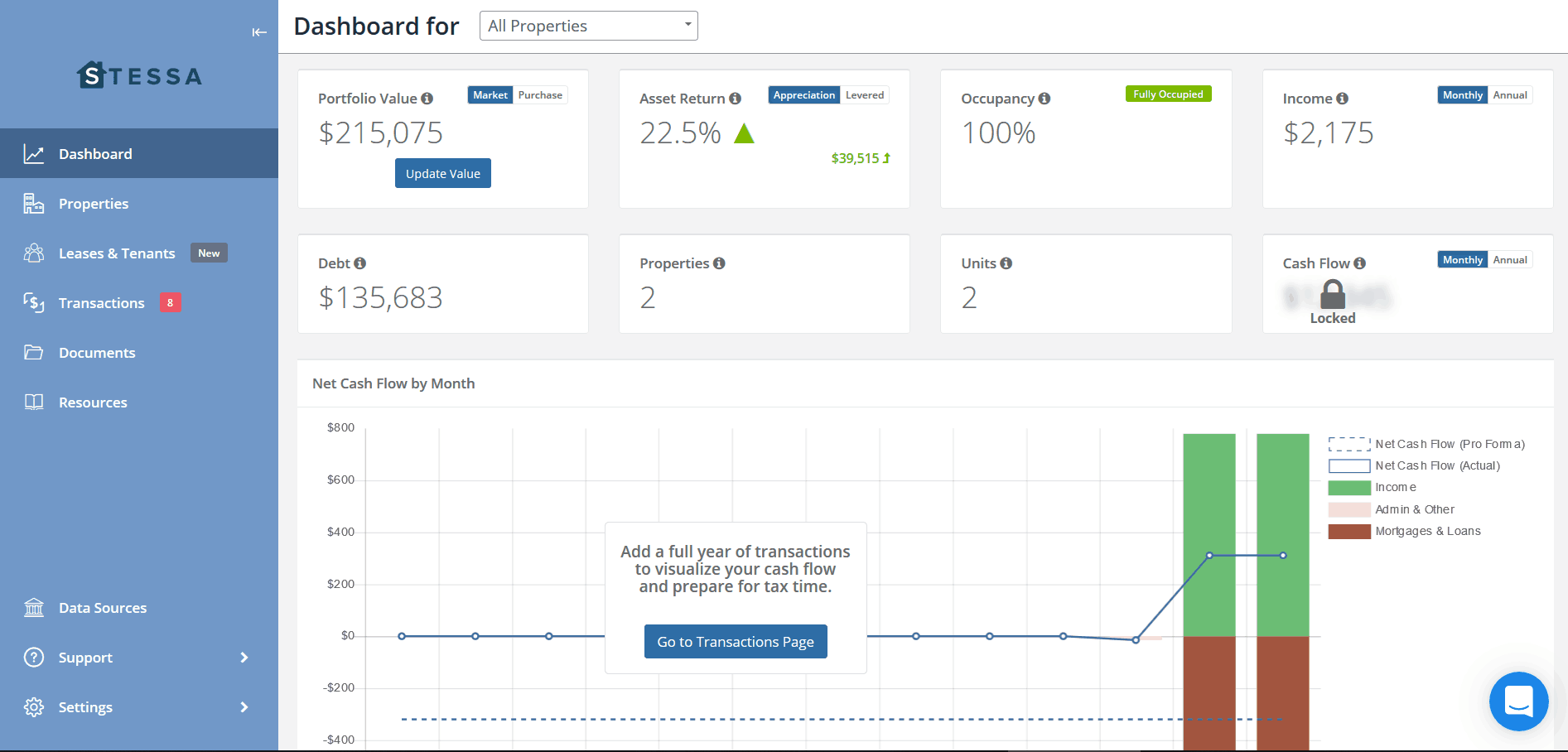

Stessa is a free software that can track your financial data and documents automatically every month.

After taking a closer look at the software firsthand, we found that they largely succeed by syncing with your bank accounts, mortgage lender accounts, Zillow, and other live data feeds.

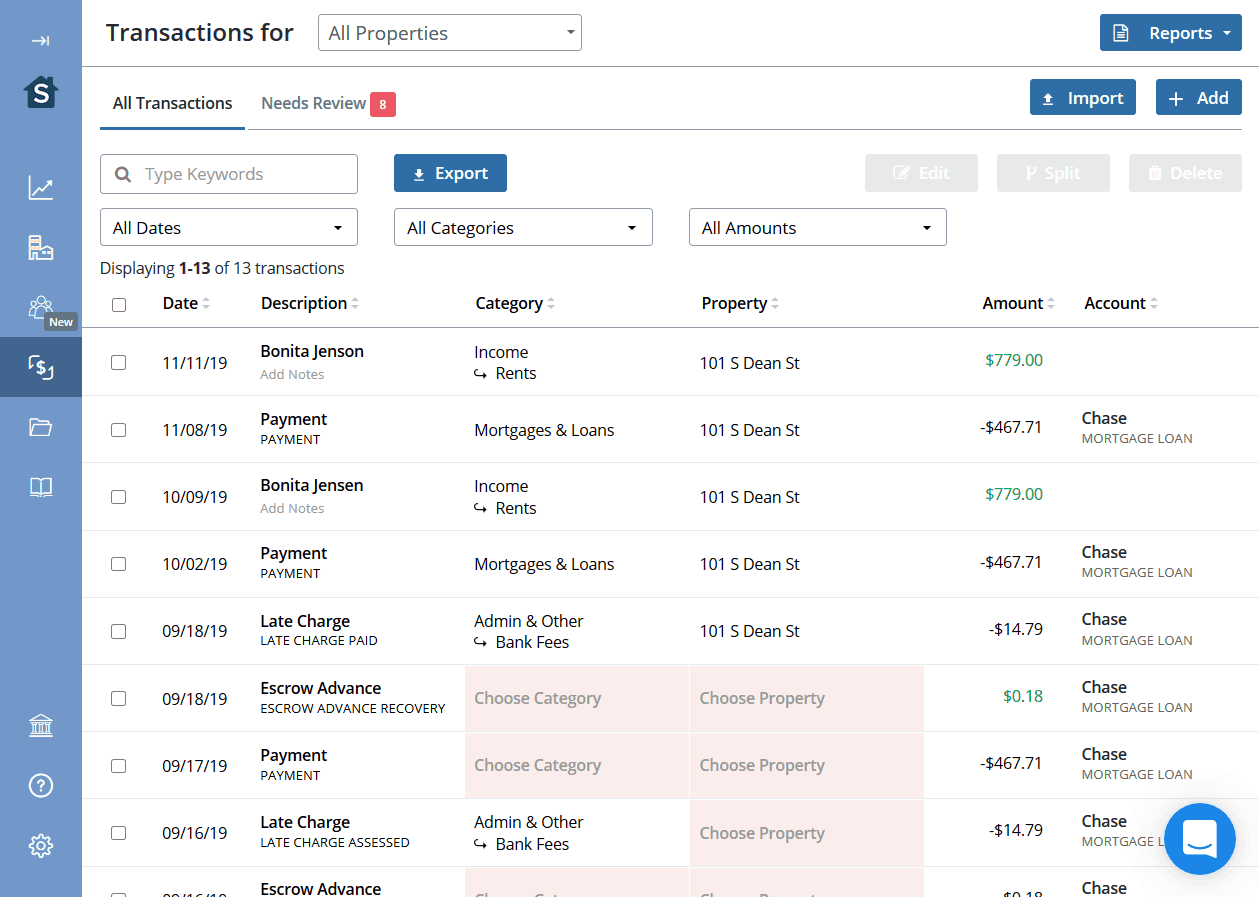

When you connect a mortgage or bank account to Stessa, you assign it to a particular property. Stessa then pulls transaction data in real-time, so your account updates when you make a mortgage payment, when your tenant deposits rent, or when you pay a plumber for a repair. They do a good job of automatically tagging and labeling different expenses (although sometimes you need to label them manually).

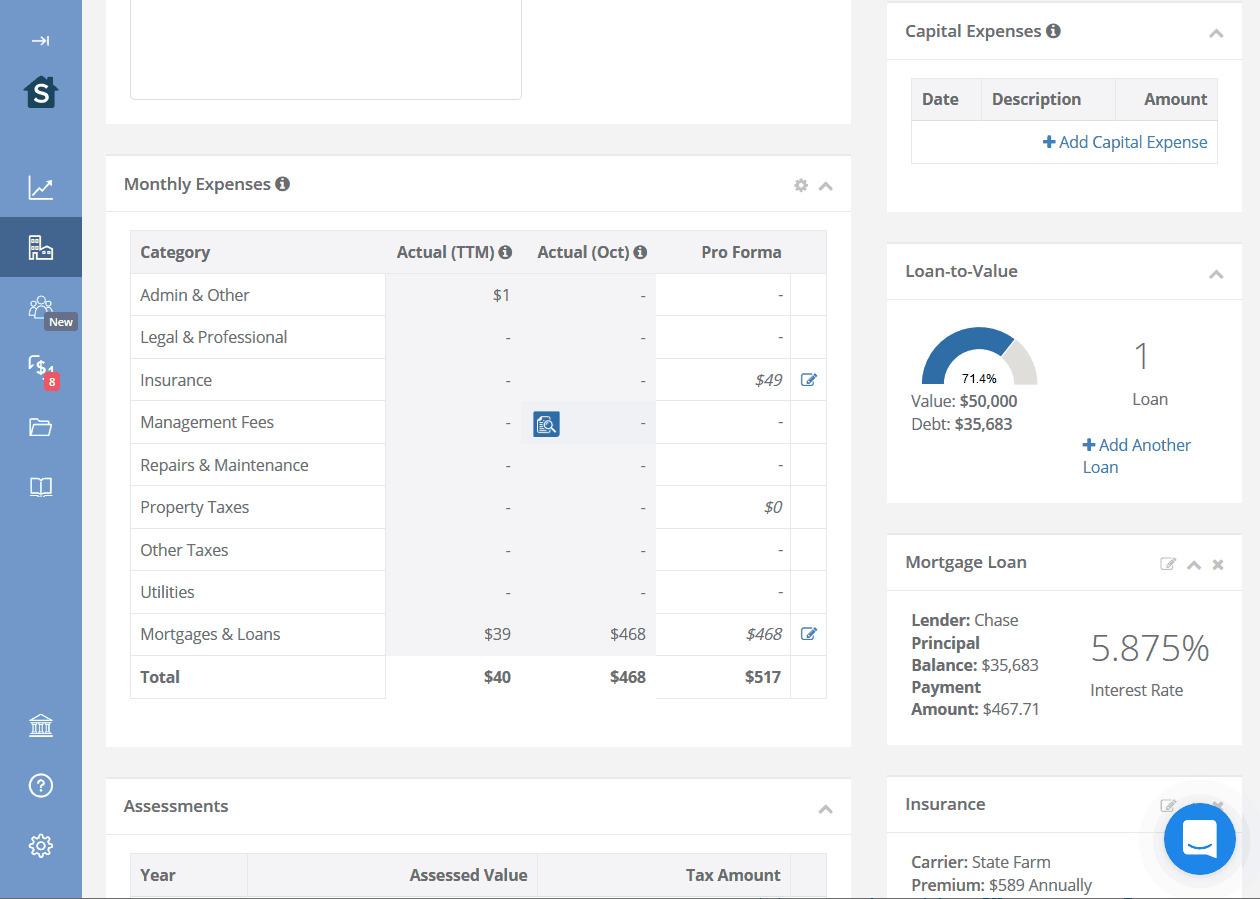

You can log in any time to check on each property’s performance, down to the individual rental unit. Instant reporting includes income or expenses, cash flow, return on investment, current equity, and many more.

How Stessa Works

Stessa is extremely easy and intuitive to use.

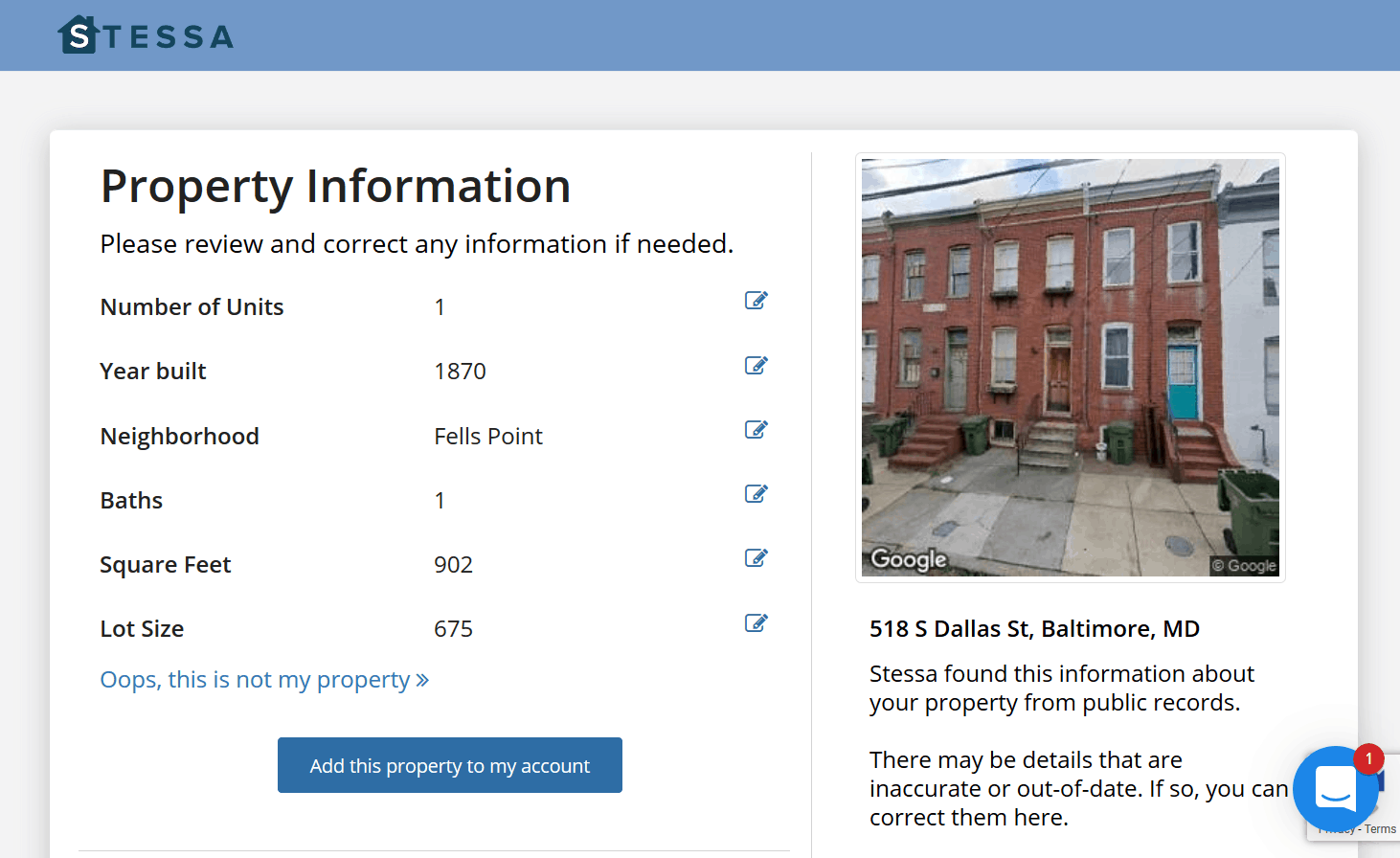

When you first register, Stessa asks you a few simple questions to initiate your account. They start by asking how many properties you own and a property address to kick off the process. From there, they pull up public record data about the property, and you’re off and running.

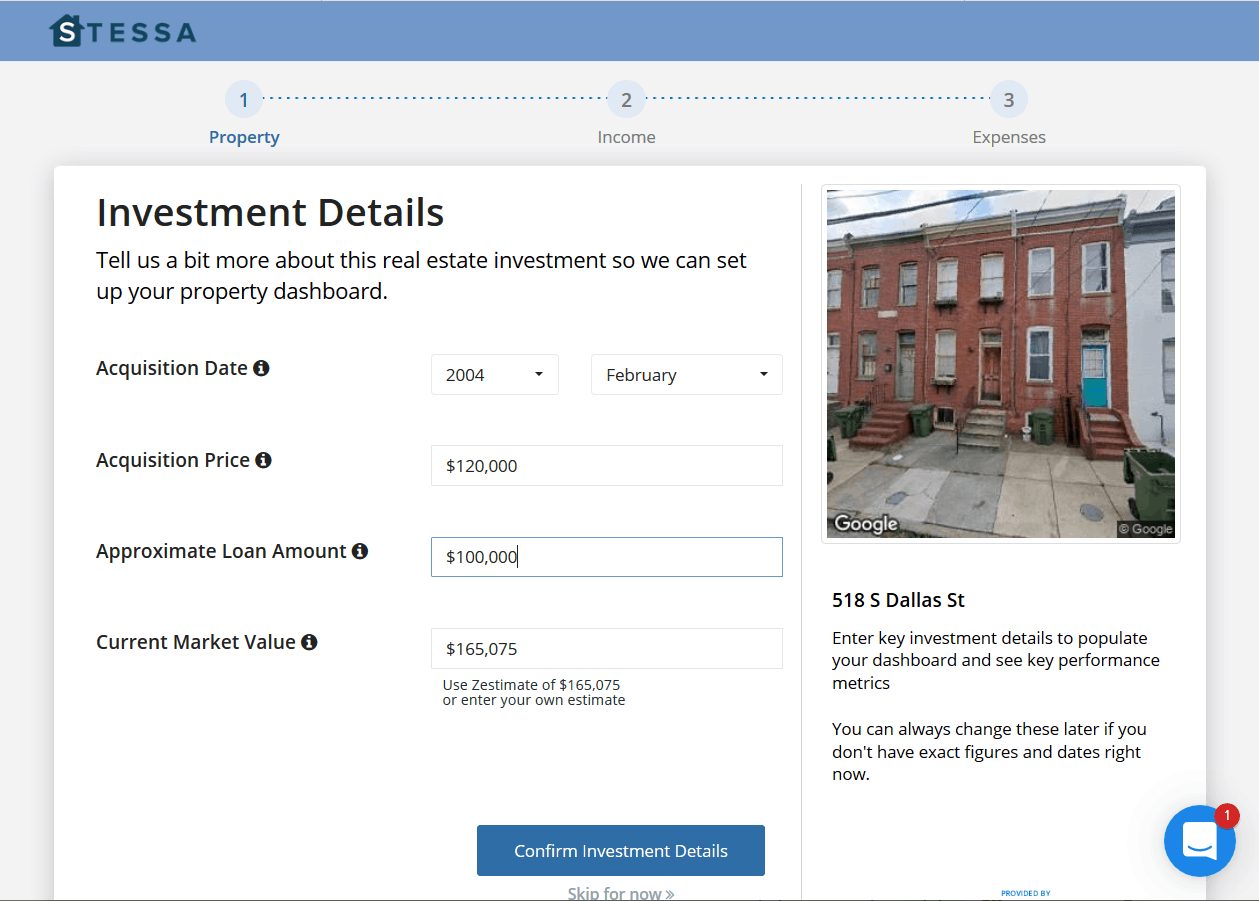

You then enter basic details about the property, such as:

- When you bought the property

- Your purchase price

- Original loan amount

- Current monthly rent amount

Stessa pulls Zillow’s Zestimate of the property’s current value, which you can edit based on your opinion of its value.

That’s when things get really interesting.

Connecting Your Mortgage Account

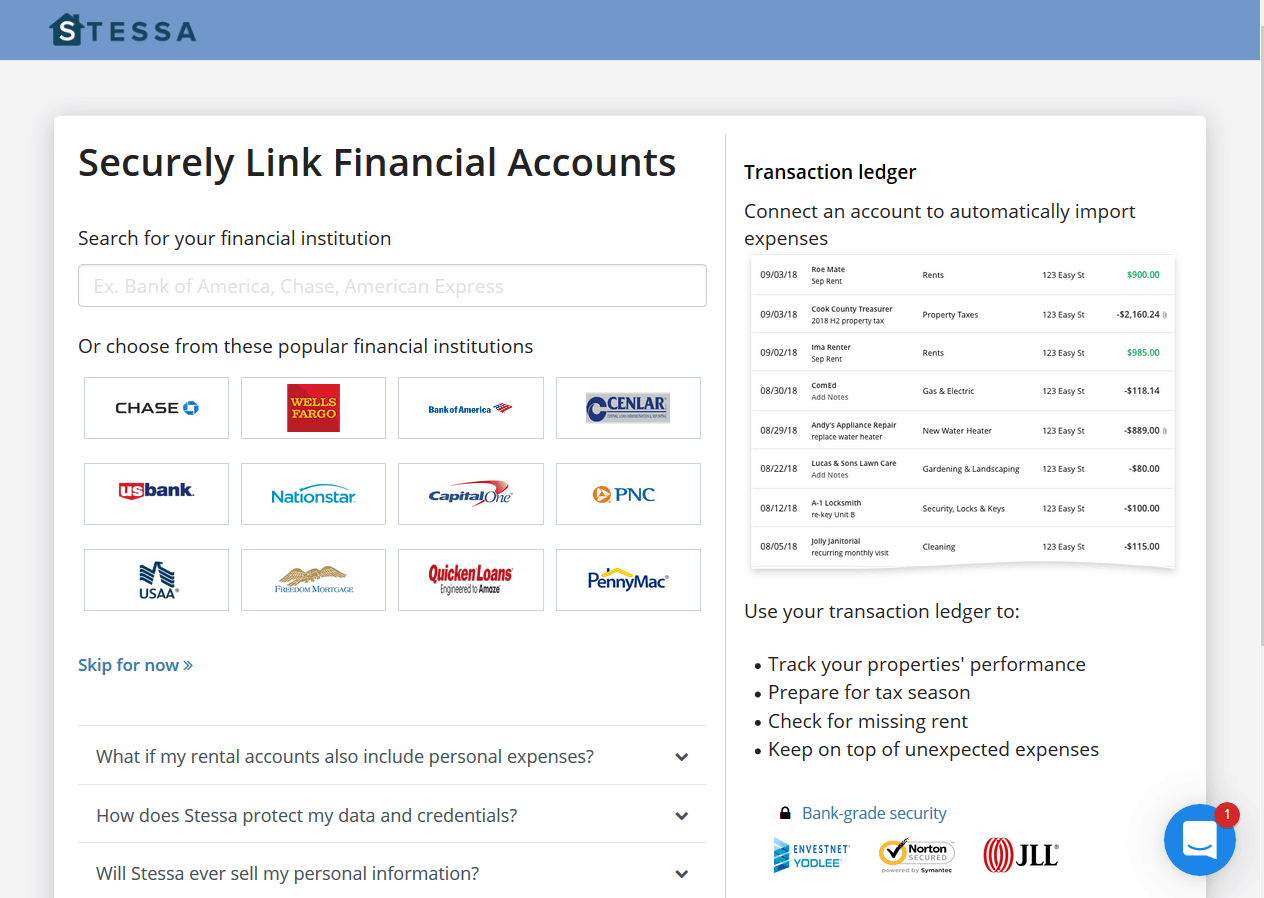

Stessa can connect to your mortgage account and pull data in real-time.

Your monthly payments, principal balance, late fees, escrow information, and other mortgage-related information all feeds into your Stessa account automatically.

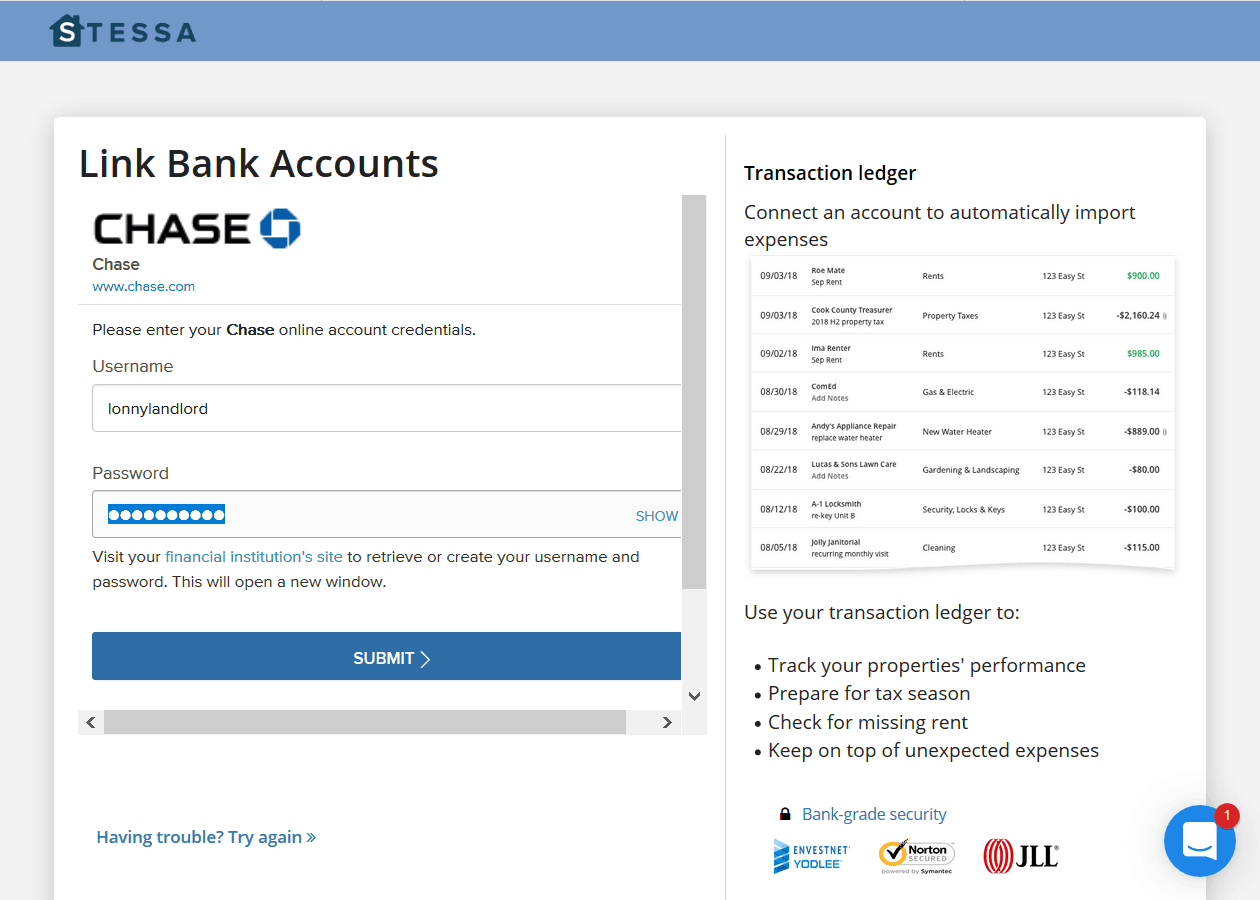

You must authorize Stessa’s access by linking the lender account and signing in to it with your username and password.

Stessa can link with major lenders like Chase, Bank of America, Wells Fargo, and so on, but their list of “syncable” lenders also includes dozens of smaller mortgage lenders.

If your current lender can’t sync automatically with Stessa, you can still upload a CSV file with your transaction history.

Connecting Your Bank Account

Similarly, you can connect your bank account to sync all other expenses and income. It works best if you keep separate bank accounts for each rental property. That way, you can associate each bank account with each property saved on your account, and it automatically applies income and expenses to that property.

As rents come in and expenses like repairs go out, Stessa pulls the transaction data from your bank and does its best to label it. Sometimes you'll still need to get in and clean up the transactions a bit, however.

Again, Stessa can connect with most major banks and many smaller banks. For banks that can’t be synced with Stessa or cash transactions that never end up deposited in the account, you can either add income or expenses manually or upload a CSV file or Quicken QIF file to add these transactions with a single click.

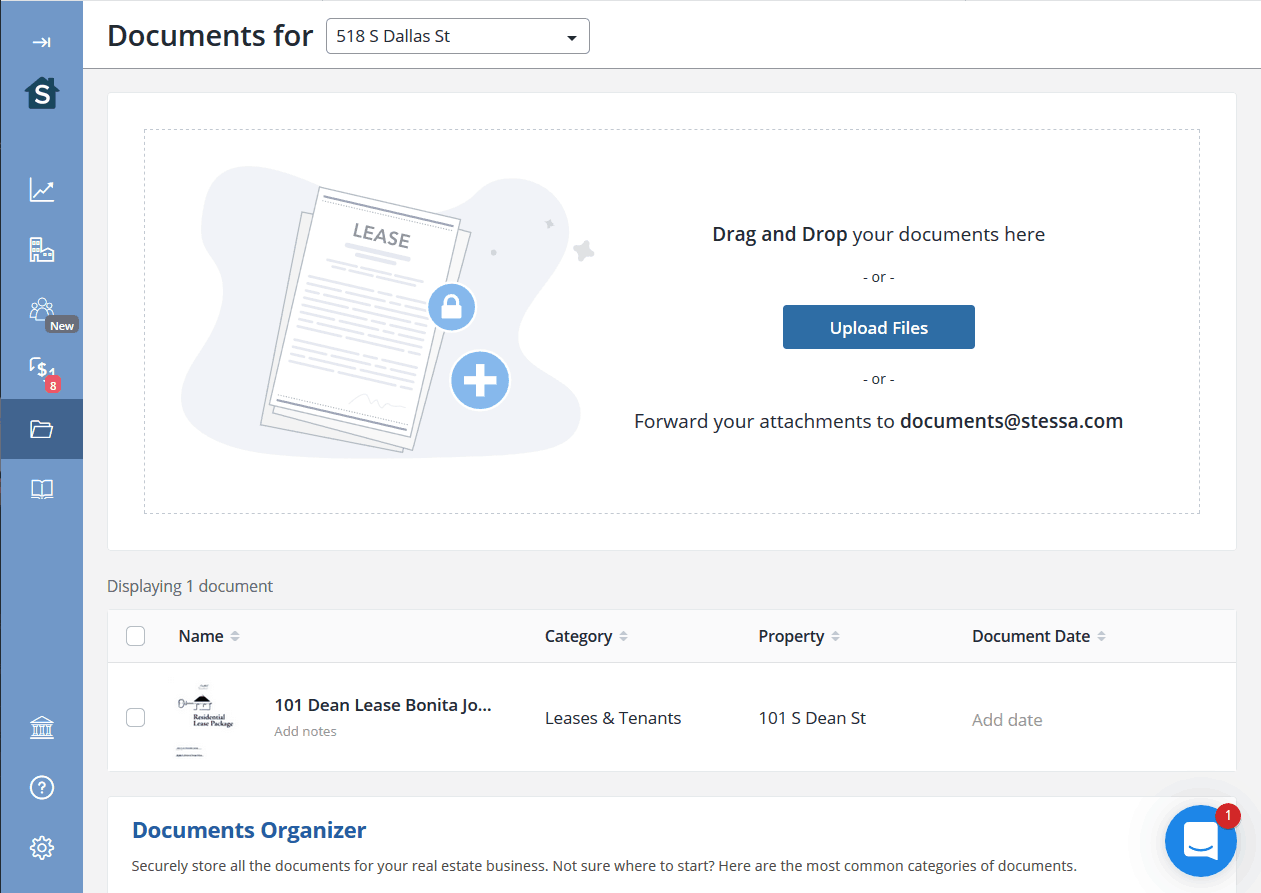

Organizing Documents

Any self-managing landlord or property manager knows that rental properties come with a ton of paperwork.

You need to track everything from lease agreements to property management contracts, mortgage notes to settlement statements, insurance policies to appraisals.

On Stessa, you can upload and store all your documents, each labeled and assigned to a specific property or unit. You can sort by property, date, or document category when you need to access your documents.

It sure beats storing documents on your hard drive or worse, keeping an enormous filing cabinet in your basement.

Tracking Property Performance

One area where Stessa excels is reporting. At any time, for any portfolio, property, or unit, you can generate any of several financial reports.

The four main reports Stessa provides are:

- Income Statements

- Net Cash Flow

- Capital Expenses

- A Tax Package

If the report includes uncategorized transactions, the system will prompt you to label them properly.

The tax package reporting proves exceptionally useful, whether you’re preparing your own tax return or paying an accountant to do it for you. It breaks down each property’s or portfolio’s net income and other salient details in an easy-to-read summary.

Beyond the exported reports, the application itself lets you view online reports in real-time, with visualizations.

You can see your equity, expenses, and cash flow all at a glance.

Additional Resources

While not the core of Stessa’s service, they offer a handful of additional resources, largely centering around tax preparation and education.

These guides and tools include lists of tax deductions for landlords, tax preparation checklists, and other tax-related resources. All of it can be found elsewhere online, but it’s nice to have these tax tips handy come tax time.

Stessa's Business Model & Pricing

One of Stessa’s greatest selling points is that it’s free.

Of course, this begs the question,

“How do they make money?”

Like many online businesses, they don’t sell anything but simply earn money by referring users to related services that do.

Stessa’s case includes mortgage lenders, insurance companies, and other real estate investing-related services.

Even so, these affiliate partnerships remain surprisingly subtle, with no direct messaging or push toward them from Stessa that I could find.

For example, in an article about landlord insurance, they mention toward the bottom that they’re partnered with Hippo Insurance, but the monetization ends there.

From what I can tell, Stessa hasn’t rolled out its complete monetization. Here’s what they have to say on the matter:

“We plan to sell optional services for real estate investors such as mortgages, refinancing, and insurance.”

They also claim to sell things like,

“optional, premium services for real estate investors for a fee, to assist with things like rent analysis and market research,”

…but I didn’t see any of these premium services being actively promoted on the platform.

What I Love About Stessa

As outlined above, it’s hard not to love the price point. Free services that provide real value at no cost make a compelling case.

Beyond the price (or lack thereof), the automated bank and lender integration is a standout feature. While it requires a small manual cleanup, Stessa does a great job of pulling in your transactions and other financial data in real-time.

The same goes for automatically pulling public records such as the purchase date, purchase price, square footage, bedrooms, bathrooms, etc. And they even go a step further to pull data such as the estimated property value from Zillow.

Stessa also makes it easy to segregate properties by portfolio. You can, therefore, view reporting details for individual portfolios, properties, or down to the unit level. It also helps come tax time if you own multiple properties under different legal entities.

Creating multiple portfolios also serves property managers, who serve multiple landlords. That helps property managers keep each client’s property separate for reporting purposes.

And speaking of reports, I love how easy Stessa makes this. From income and expense reports to tax-friendly reporting packages, Stessa excels at reporting.

The home dashboard presents an excellent birds-eye view of your property portfolio and performance for quick reference.

Stessa also makes it easy to manually add or edit transactions. And alternatively, if you have a CSV file with transaction data (perhaps exported by a bank that can’t sync with Stessa), you can simply upload these files for easy data importing.

Finally, Stessa lets landlords add access to their accounts to third parties, such as property managers. That keeps everyone in the loop and uses one centralized platform for tracking financials.

RELATED: Finding the Right Property Management Company

What I Don't Love About Stessa

I found Stessa a bit clumsy in its failure to retroactively assign transaction data to associate with a specific property. Even with only one property saved in the system and one mortgage account hooked up, it didn’t automatically register the mortgage as being associated with my one property.

Even after I assigned the mortgage account to the property, it didn’t go back and associate my previous mortgage payments with that property.

Online rent collection is another feature that would make Stessa even more powerful and automated. If Stessa could process tenants’ rent payments for the landlord or property manager, it would keep the entire process on one platform with flawless income reporting – at least for rent payments processed on the platform.

This raises an important point: most online property management software services offer financial reporting. For many landlords and property managers, Stessa’s financial tracking is redundant if they already get similar functionality through their other management software.

But overall, Stessa offers excellent rental property financial tracking at no cost at all to you as the user.

Final Verdict

If you’ve ever used Mint.com, you know how useful it is to track your financial accounts, expenses, and overall net worth in one place. Looking at quick summaries and visualizations, then drilling down into the details, helps keep your financials tangible and easy to understand.

Stessa serves a similar role but is specialized in rental property data and financials.

The transactions and equity are largely automated, requiring minimal cleanup on your part. You can easily spot trends early, generate monthly and annual reports, and even prepare tax reports.

The ability to split properties into portfolios makes the service friendly to property managers and larger landlords. And granting access to third parties, such as property managers or landlord clients, improves the service’s flexibility.

Overall, I think it makes a great platform for landlords and property managers looking for a single platform to track their properties’ financials. Stessa does one thing and does it quite well.