What Is A Bond?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

How Do Bonds Work?

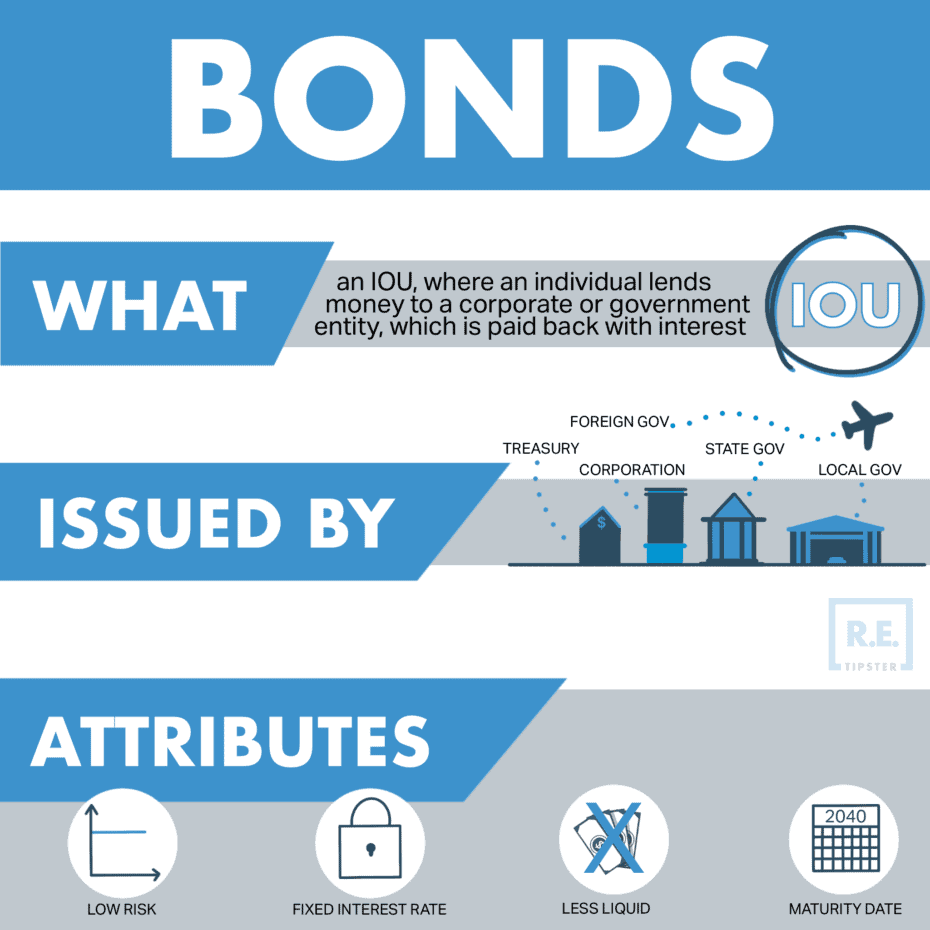

Bonds are loans given to a company or a government body by an investor. Companies issue bonds to bond investors so that they can obtain the financing needed to fund their projects, operations, or acquisitions. Likewise, governments can issue bonds to obtain more funding or supplement revenue streams[1].

The borrower (the bond issuer) is required to pay interest for a certain period, depending on the terms of the bond, and the balance on the principal upon maturity. Interest payments are paid to the bondholder (the investor or the lender who loaned the money to the issuer) in regular installments, often semiannually.

Upon maturity, the borrower needs to return the rest of the investor’s money. In a typical loan, this is often the principal, but the principal works slightly differently in a bond[2]. To begin with, the issuer pays the face value or the par value of the bond. Depending on market conditions, this value might be different (either higher or lower) from the price that the investor has purchased the bond for since the face value is usually issued in $1,000 denominations.

Bonds are marketable[3], which means they can be sold to another investor if the original investor no longer wants them or there is a bond that offers higher interest rates. For example, suppose an investor holds a bond with a 4% interest but they want to trade it with another bond with a 5% interest rate. The other bondholder would typically refuse this deal due to the lower return unless the investor with a 4% rate sells the bond at a discount, or below the face value of the bond. Similarly, if the investor sells the bond at a price above the bond’s face value, it is said to be sold at a premium.

The prices of bonds tend to move in the opposite direction from interest rates[4].

How Are Interest Rates Set for a Bond?

Some bonds have fixed interest rates while others have variable or “floating” interest rates that can move up and down over the life of the bond. Typically, the interest rate on floating-rate bonds is set at a specific amount above or below a benchmark rate, like LIBOR (the London Interbank Overnight Rate) or SOFR (the Secured Overnight Financing Rate).

Other factors that influence a bond’s interest rate include the risk associated with the borrower and their project. Longer bonds, shakier borrowers, and callable bonds typically have higher interest rates to compensate the lenders for the additional risk they are taking on. The interest rate on a bond is also generally higher the longer the term of the bond.

Investors and financial analysts also use “basis points” or bps to refer to interest rates and bonds. A basis point is 1/100 of a 1% interest rate, which means 100 basis points equals 1% interest. Basis points are used to denote differences in bond yields (see below), or when the Federal Reserve changes the federal funds rate[5].

Terminologies Used in Bonds

Here are some common terms that are used when dealing with bonds.

Coupon

Coupon means the amount of interest that is paid by the bond issuer to the investor. This can be paid in regular installments, typically semi-annually[6], but may also be annually, quarterly, or monthly, depending on the terms of the bond. The coupon rate is the same as the interest rate on the bond.

Yield

Yield is one of the most important concepts about bind investing. It is the measure of return an investor receives on the bond.

One of the simplest ways to compute a bond’s yield is the coupon amount divided by the current price[7]:

Bond Yield = Coupon Amount / Current Price

Bond Equivalent Yield

Coupon rate adjusted for compounding.

Yield to Maturity

An estimate of the return an investor will earn on a specific bond. Yield to maturity incorporates both the discount or premium paid by the investor (compared to face value) for the bond as well as the coupon payments they receive.

Face Value

Face value is how much the bond is worth upon issuance, often broken into $1,000 denominations. It is also called par value.

Price

Price is the amount of the bond that would currently cost on the secondary market.

Default

When a borrower violates some of the terms of the bond. Typically this happens when the borrower misses a payment, but a default can also be caused by violating other terms of their agreement with the lender/investor.

What Are Different Types of Bonds?

There are several kinds of bonds including corporate, government, and agency bonds. Each has different interest rates, payment, and features.

Corporate Bonds

Companies utilize corporate bonds to fund their daily operations, expand their products or services, operate research and development, or pay for their acquisitions. This type of bond is subject to federal and state income taxes.

Treasury Bonds

Treasury bonds are issued by the federal government. Treasury bonds belong to the larger category of U.S. debt. They are considered low-risk investments[8] because the U.S. government’s ability to tax its citizens offers a great deal of security that other types of bonds cannot.

Agency Bonds

Government Sponsored Enterprises (GSEs) can issue agency bonds to fund federal mortgage, education, and agricultural lending programs. This type of bond is subject to federal tax, but some bonds are exempt from state and local taxes. The most common agency bonds are mortgage-backed securities, for example, those issued by Fannie Mae and Freddie Mac.

Municipal Bonds

Municipal bonds are issued by the states, cities, and counties to help fund local community projects. The interest earned on this type of bond is tax-free at the federal level and sometimes at the state level for investors who buy them at the same state where they reside. For investors who purchase bonds out-of-state, they may be subject to state taxes where the bond and borrower are located.

Zero-Coupon Bonds

Zero-coupon bonds do not have interest payments so investors buy zero-coupon bonds for a discount. They are repaid during their maturity.

Callable Bonds

Also known as redeemable bonds, callable bonds allow the issuer to pay off the debt before the bonds’ maturity date, a process known as “calling the bond” (hence the name). Calling the bond this way often has provisions before the bond is issued. Typically, a borrower would call the bond if interest rates have dropped[9]. With lower interest rates, they could sell new bonds at a lower interest rate and use the funds to pay off the older, higher-interest bonds.

Puttable Bonds

Puttable bonds are also known as “put bonds.” These bonds give investors the option to redeem them earlier than their maturity date. They are offered either on single or several different dates for early redemption.

Convertible Bonds

Convertible bonds are corporate bonds that can be converted into shares of the company’s stock before they reach their maturity date. Investors and financial advisors work together to help choose which bonds can provide the best income, tax advantages, and bond features that fit the investors’ goals.

How Do Bond Ratings Work?

All types of bonds carry the risk of default. If a corporate or government bond issuer declares bankruptcy, that means they will likely default on their bond obligations, making it difficult for investors to get their principal amount back.

Bond credit ratings help the investors understand the risks that are involved with their bond investments. They also suggest the likelihood that the issuer will be able to reliably pay the investors the bond’s coupon rate.

Credit bureaus collect the credit information of individuals and sell them to creditors, while credit rating agencies assess the financial health status of bond issuers. The top credit rating companies are Standard and Poor’s, Fitch, and Moody’s.

Where to Buy Bonds?

Bonds are not publicly traded and are not traded on a centralized market like stocks. Instead, investors can buy them from legitimate bond brokers, while Treasury bonds can be bought directly from the government.

It is not always clear for a bond investor to know if the bonds they purchased were bought at a fair price. A broker may sell bonds at a premium price while other brokers may have higher premiums, lower premiums, or no premiums at all. The Financial Industry Regulatory Authority (FINRA) is the governing body that regulates the bond market, allowing them to post the transaction prices of bonds.

Advantages and Disadvantages of Buying Bonds

One of the advantages of bonds is that it provides a more predictable return on investment. Since the investor already knows the interest amount, the schedule of the payment for the interest, and when the maturity date is to pay the face value of the bonds, bonds are considered low-risk passive income streams[10]. Bonds are therefore ideal for people who have fixed income or are planning to retire because they know how much regular income they can get from bonds.

Note that callable bonds do not have this advantage because the bond could be repaid in full at the borrower’s discretion.

Bonds also have an advantage over stocks when a bond issuer declares bankruptcy. Certain forms of bankruptcy, such as a Chapter 7 bankruptcy[11], have specific terms for resolving issues with bondholders, who typically recoup some (but not all) of their money through a bankruptcy proceeding. This gives bonds an advantage over stocks in a bankruptcy situation, which renders stockholders completely out of luck.

RELATED: Chapter 7 vs. Chapter 11 vs. Chapter 13 Bankruptcy – What’s the Difference?

Investors also have to tolerate some inflation risk when investing in bonds because inflation reduces the value of payments year after year[12]. This risk is particularly prevalent for investors who have bonds at a fixed rate of interest. However, for bond with a floating-rate interest, its value will usually tick up as inflation rises, which can help protect the investor in an inflationary environment.

Other risks include a liquidity risk, where the investor cannot find a market to trade a bond, and a call risk when the lender retires the bonds before it reaches its maturity date, which may happen when interest rates decline.

Takeaways

When an investor buys a bond, they are effectively lending money to a company or a government body for a certain period, while requiring regular interest payments known as coupons. These interest payments may be paid semiannually, annually, quarterly or monthly. Once a bond reaches its maturity date, the company or government entity will have to repay the loan at its original face value.

Companies issue bonds to finance projects, expand their operations, or acquire new assets while governments issue them so they can fund new projects or supplement revenue from taxes. Bonds are marketable, so when they are sold they can be sold at a discount rate (a lower amount than its original value) or at a premium (a higher amount than its original value).

Corporate bonds can be bought from bond brokers while treasury bonds can be bought from the government. The Financial Industry Regulatory Authority regulates the bond market and publishes the transaction prices of bonds.

Reviewed by Chris Wiesehan, CFA and President of CJW Capital

Sources

- Napoletano, E. Curry B. (2021) Fixed-Income Basics: What Is A Bond? Forbes. Retrieved from https://www.forbes.com/advisor/investing/what-is-a-bond/

- Chen, J. (2020.) Principal. Investopedia. Retrieved from https://www.investopedia.com/terms/p/principal.asp

- Elkins, H. (2020.) Marketable Vs. Non-Marketable Securities. Chron. Retrieved from https://smallbusiness.chron.com/main-difference-between-notes-payable-bonds-payable-36843.html

- Luthi, B. (2021.) Why Do Bond Prices Go Down When Interest Rates Rise? The Balance. Retrieved from https://www.thebalance.com/why-do-bond-prices-go-down-when-interest-rates-rise-2388565

- Financial Industry Regulatory Authority. (n.d.) Bonds and Interest Rates. Retrieved from https://www.finra.org/investors/learn-to-invest/types-investments/bonds/bonds-and-interest-rates

- The Strategic CFO. (n.d.) Coupon Rate Bond. Retrieved from https://strategiccfo.com/coupon-rate-bond/

- Desjardins. (n.d.) Understanding bond yields. Retrieved from https://www.desjardins.com/ca/co-opme/action-plans-tips/savings-investment/understanding-bond-yields/index.jsp

- Lam-Balfour, T. (2021.) U.S. Treasury Bonds, Bills and Notes: What They Are and How to Buy. NerdWallet. Retrieved from https://www.nerdwallet.com/article/investing/u-s-treasury-bonds-bills-and-notes-what-they-are-and-how-to-buy

- Securities and Exchange Commission. (n.d.) Callable or Redeemable Bonds. Retrieved from https://www.investor.gov/introduction-investing/investing-basics/glossary/callable-or-redeemable-bonds

- MoneyCrashers. (n.d.) Investing in Stocks vs. Bonds – Differences to Consider. Retrieved from https://www.moneycrashers.com/investing-stocks-vs-bonds-differences/

- Project Invested. (n.d.) What Happens to Bondholders When a Company Files for Bankruptcy? Retrieved from https://www.projectinvested.com/markets-explained/corporate-bankruptcy-your-investment/

- CNN Money. (n.d.) Bonds: Bond investing risks. Retrieved from https://money.cnn.com/pf/money-essentials-bonds-risks/index.html