What Is a Land Survey?

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

What Does a Land Survey Do?

Even if you think you know everything about a piece of real estate from the legal description, there are things you need to know that affect a property’s value and its potential uses that often can’t be seen from a satellite map or the seller’s description.

A land survey defines the boundaries and features of a parcel of land, including roads, utility lines, structures, and natural elements such as ponds and streams.

The survey report is used to make maps and plots for legal documents, determine the size limit of planned structures and the proper foundation depth, whether there will be any use restrictions on the property and whether any other easements cross over the subject property, among other things.

RELATED: Legal Descriptions: How They Work and Why They Matter

Types of Land Surveys

Mortgage or ALTA/NSPS Survey

This is the comprehensive survey most lenders need for underwriting requirements. It ensures the property is as described in the legal documents and covers all the features and characteristics of the property.

For many years, ALTA/ACSM standards used to be the go-to for land surveying in the U.S. “ALTA” stands for American Land Title Association, and “ACSM” was the American Congress on Surveying and Mapping. Together, they made guidelines for surveys that title companies and real estate professionals commonly used.

In 2016, ACSM merged with another organization and became NSPS, the National Society of Professional Surveyors. At that time, the ALTA/ACSM standards were replaced by the new ALTA/NSPS standards.

ALTA/NSPS surveys are known for their detail and accuracy. They follow strict guidelines and provide a lot of information about a property, including boundaries, easements (if a neighbor has the right to use part of the land), rights-of-way, and other elements that could affect ownership.

Because they follow the ALTA/NSPS standards, these surveys are consistent, making them easier for lawyers, title companies, and lenders to understand them, no matter where the property is in the U.S.

They are often required for legal and insurance purposes, as they help protect everyone involved by providing a clear and accurate description of the property.

Boundary Survey

A boundary survey can be used to locate the corners of a parcel of land. This type of survey includes both record and field research, with the surveyor visiting the property oh-site and staking each corner of the parcel to indicate where it sits on the earth.

Location Survey

This is a boundary survey augmented with information about interior improvements. It’s usually used for lending purposes and zoning permits.

Site Planning Survey

This survey combines a topographic survey of roads, ditches, utilities, and embankments with a boundary survey. Site planning surveys are used to design home lots and subdivisions, commercial and industrial developments, transportation infrastructure, and recreational facilities.

Subdivision Survey

If you invest in vacant land you want to develop a larger parcel, a subdivision survey is necessary to divide the parcel into lots or tracts. It’s filed with the county recorder and used to design streets, drainage, and other essential elements. Sometimes referred to as a plat map, this type of survey provides a visual representation of how one property is divided into parcels or lots, shown to scale.

Topographic Survey

A topographic survey (sometimes referred to as a contour survey) is essentially a 3-dimensional map of a property that portrays all the surface features, natural features, and elevations of the property. This type of survey is often necessary as a first step in planning out new development projects, designing a road or bridge, designing or improving grading or drainage projects, among other things.

When Do You Need a Land Survey?

There are many potential reasons why a property owner or a related party (like their lender or property insurance agent) might require a survey.

Some of the more common reasons why land surveyors are ordered are as follows:

- To determine the size, shape, location, and dimensions of a property

- Fulfilling the requirement of a lender

- Resolving disputes with neighbors about boundary lines

- Finding the location of any/all utility lines

- Updating an old land survey

- Identifying the presence of any easements

- Obtaining a title insurance policy

- The first step in designing and building a home or buildings

An updated land survey, based on all available information in the title history along with the property’s legal description is the most accurate way to determine the current size, shape, location, and dimensions of the property and any improvements or easements or rights of way sitting on or running through the property.

When Is a Land Survey Useful?

Once you sign a purchase agreement, you should get a title commitment from the seller. The title commitment has a list of all the records related to the property, which your surveyor will need to complete a land survey.

For example, there may be rights-of-way or easements related to the land that need to be mapped in the survey.

The land survey gives you essential information about the property, such as:

- Are there any land features such as steep hills or flood zones that would make development difficult?

- Is the land accessible? If there are no roads available, can you obtain an easement?

- What utilities are available and will you be able to arrange them on your own if they’re not?

- Are there any restrictions that will affect your plans for development?

- What is the precise size, shape and dimensions of the property?

Most lenders require a land survey to confirm property boundaries and verify the value of the parcel they’re lending against. Title companies may also ask for a survey before issuing a title on vacant land to look for unrecorded easements or encroachments.

Even if your title company or lender doesn’t require a survey, it’s usually in your best interest to get one. A survey shows you exactly what property you’ll own and any regulations you should be aware of before you build. In addition, if your title company doesn’t get a survey, it might not cover issues the survey would have revealed (i.e. items that don’t appear in the public record).

Finally, if you have a solid survey contingency in your purchase contract, the survey gives you the opportunity to either resolve any issues uncovered by the survey or legally get out of the agreement without losing your deposit.

Things to look for in a Land Survey

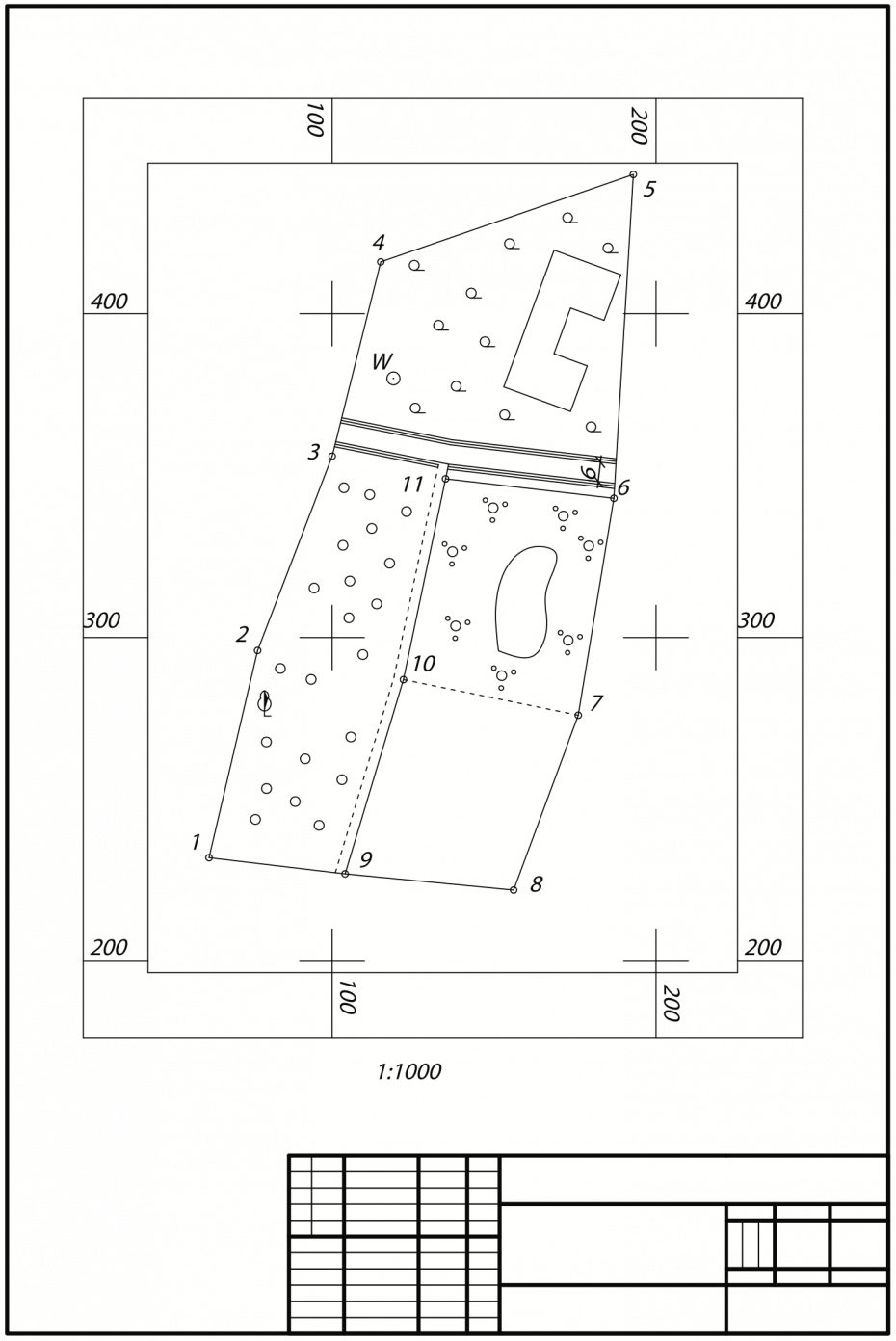

Land surveys can be complicated documents, but you can get some important information if you know what you’re looking for.

In addition to property boundaries, you may see other lines, including setbacks, utility lines, paving edges, bodies of water, and the outlines of any structures. Utility structures will be mapped out with symbols such as these:

Underground utilities aren’t typically included unless the buyer specifically requests them.

Space is limited on survey documents, so most notations are abbreviated. Sometimes you can figure them out intuitively, such as ASP for asphalt and S/W for sidewalk. Look for the certification that indicates the survey was performed following state standards. The survey should also be signed and sealed by the surveyor.

How Much Does a Land Survey Cost?

According to Home Advisor, the average cost to hire a surveyor in 2020 is about $500, but it varies a lot depending on the type of survey you need. For example, here are some average figures from the Home Advisor survey:

- Boundary survey – $100 to $600

- Topographic survey – $500 to $1,200

- Mortgage survey – $500

- New construction survey – $1,000 to $2,000

- ALTA survey – $2,000 to $3,000

- Plot plan – $75 to $200

Who Pays for a Land Survey?

That depends on why the land survey is done. In most states, if your lender need will require a mortgage survey, then the borrower will pay the surveyor fees as part of their closing costs. There are five states in which the seller is responsible for survey costs at closing: Alaska, Illinois, Kansas, Missouri, and Nebraska.

On the other hand, if an easement issue caused a lien against a property, the seller may need to hire a surveyor to get it resolved before the property can be sold. In that case, the seller pays the fee.