What is Net Worth?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Net Worth Explained

Net Worth is the value of a person’s or entity’s assets minus their liabilities (also commonly referred to as Equity).

While net worth is often used to determine the true wealth of a person, it can also be applied to businesses, institutions, and countries. Any entity that owns assets technically has a net worth.

The net worth of an individual is a glimpse of their overall financial health. Most financial advisors recommend measuring their client’s net worth at least once every year to see how their finances are changing and whether they need to make adjustments.

How to Calculate Net Worth

Next, all of the individual’s outstanding debt obligations need to be tallied up as well.

One common tool for compiling this information is with a Personal Financial Statement, which provides line items for all of an individual’s assets and liabilities. Most banks and lending institutions have their own version of this document, but they all follow the same structure.

Here is one example from the Small Business Administration.

Finding the Value of Assets

An asset is anything that has monetary value. That includes the cash in a person’s wallet, checking accounts, saving accounts and money invested in securities like stocks and bonds. This also includes the market value of any real estate, cars, boats and other equipment (assuming the individual actually owns these items rather than renting or leasing them).

Another way to think of assets is anything that can easily be sold or converted into cash. These are also called liquid assets.

Assets are usually broken down into four categories:

- Tangible assets: Primary residence, investment properties, business properties, vehicles, art, jewelry, collectibles, personal property

- Equity assets: Stocks, business interests, retirement accounts, cash value life insurance, REITs

- Cash and cash equivalents: Checking and savings accounts, currency and coins, CDs, money market funds, treasuries

- Fixed income assets: Government, corporate, and municipal bonds

Most financial planners recommend factoring in anything worth at least $500 into the asset column.

For instance, if a person owns some instruments or a rare coin collection that are worth $500 or more, these would be worth including in their list of assets. It also helps to calculate the fair market value of everything in current dollars. This will provide a more accurate and reliable net worth to work with (e.g. – a 20-year-old car is probably not worth the original, retail value price).

While certain assets are very easy to determine (like bank accounts and investment statements), a bit more research may be required to decipher the fair market value of property like a personal residence. In most cases, hiring a professional appraiser to prepare a formal appraisal is the most reliable way to get this number, but even in the absence of this, there are several online valuation tools that can help in getting reasonably close. These tools compare the value of a home to the value of similar homes in the same general area. It’s also possible to enlist the help of a local real estate agent to conduct a comparative market analysis.

Once the fair market value of a property has been calculated, simply combine it with the total value of all other assets.

Finding the Liabilities

Once every asset has been accounted for, the next step is to list out all of the outstanding liabilities.

Liabilities are any money owed to another person or entity. Liabilities are generally classified as either secured or unsecured:

- Secured: Mortgage and home equity loans and lines of credit, vehicle loans

- Unsecured: Credit card debt, tax liabilities, personal (signature) loans, medical bills, current utilities due

Once all the liabilities have been identified, subtract all current debt from the current market value of all the assets.

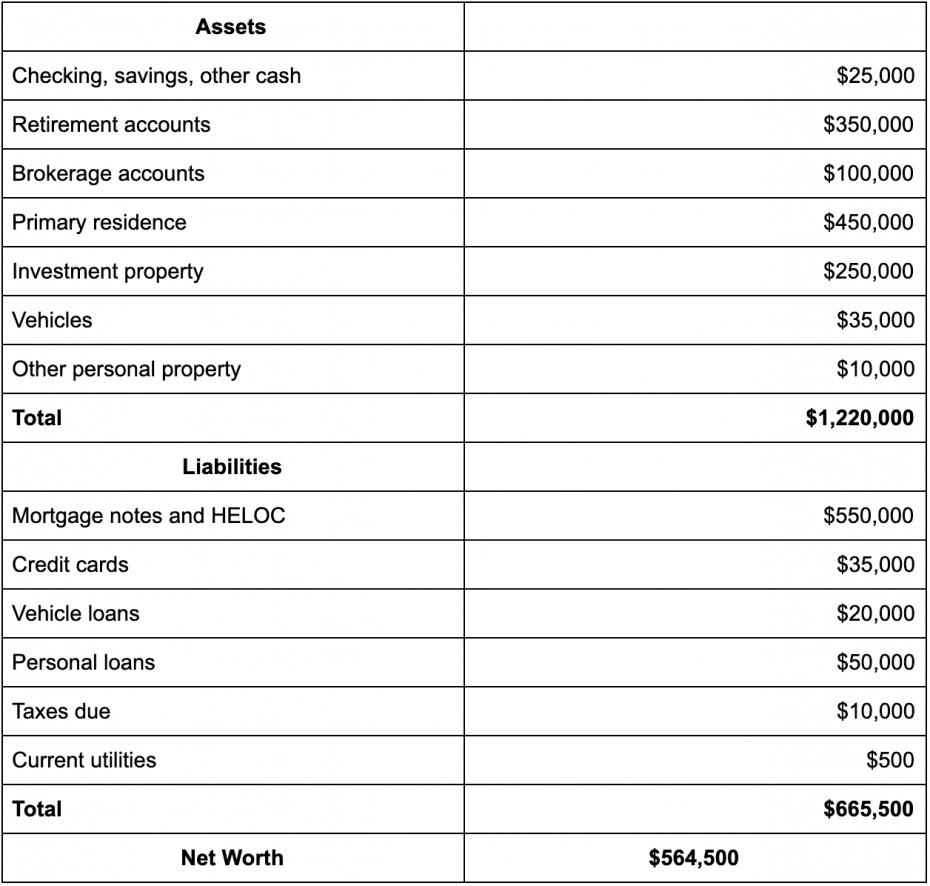

Here’s a quick example of how to calculate net worth:

Although it’s possible to do a back-of-the-envelope net worth calculation, to get a more precise financial picture, it’s recommended to have current market-value appraisals of real property and valuable personal property such as art and jewelry.

There are a number of online net worth calculators to simplify the process at:

Is Your Primary Residence Part of Your Net Worth?

Some financial experts disagree on whether or not one’s personal residence should be considered in net worth calculations. They argue that housing is a living expense on par with food and clothing, which is technically true because people will always have housing expenses, whether that comes in the form of mortgage payments or rent.

For this reason, people sometimes differentiate between true net worth and investable net worth. A primary residence can generate equity that contributes to net worth, but the equity is locked up until the home is sold. An investor can borrow against the equity in their primary residence to purchase an investment property, but that loan generates a corresponding entry in the liabilities ledger.

For reference, the Securities and Exchange Commission takes the view that one’s personal residence is not part of net worth. Home equity in a primary residence isn’t considered in net worth calculations for the accredited investor qualification.

What is a High Net Worth Individual?

Individuals with a net worth of $1 million or more (excluding their personal residence) are considered high net worth individuals or HNWIs. In addition to being desirable targets for wealth managers and investment bankers, high net worth individuals qualify as accredited investors by the SEC, which means they have access to unregistered securities and other investment opportunities such as private equity funds.

There is no formal high net worth accreditation process. Investors are required to apply with each fund they wish to invest with and supply the appropriate documentation. Some may require periodic requalification as an accredited investor.

Why is Net Worth Important?

Net worth can fluctuate over the course of an individual’s lifetime; its value on any given day isn’t necessarily as important as the overall trend. Negative net worth is sometimes viewed as a sign of financial irresponsibility, but that isn’t always the case.

A person may take on a high level of debt to start a business, temporarily resulting in negative net worth, with the expectation that future earnings will justify the investment. Student loan debt is another common drag on net worth that pays off in earning power over time.

On the other hand, persistent negative net worth may indicate a track record of poor investments or consistent overspending. It can be a wakeup call to re-evaluate financial habits and realign priorities.

Most advisors recommend calculating net worth on an annual basis to measure financial health and chart progress toward long-term financial goals. Seeing one’s net worth in black and white can be a powerful motivator to stay the course or make painful—if necessary—changes.

In lending, banks rarely look at an individual’s net worth to make credit decisions. Most lenders look at credit score and debt to income ratio. However, in business and commercial lending, net worth is a primary factor in determining financial health and creditworthiness.