What Is Principal?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- The principal is the original sum of money borrowed in a loan or invested.

- Principal applies to various financial scenarios, including mortgage, personal, and investment loans.

- Amortization spreads out loan payments over time, initially allocating more to interest and gradually increasing the principal portion.

- The length of the loan term affects the monthly payment amount and total interest paid, with longer terms leading to more interest.

- The principal is not directly taxable, but the way principal is repaid can be subject to tax.

Overview of Principal

In finance, the principal usually refers to the original sum of money borrowed in a loan or invested. This amount of money is used to calculate interest on the loan.

This concept is integral to various types of loans:

- Mortgage loans: In a mortgage, the principal is the amount borrowed to purchase a property. As you make monthly payments, a portion goes toward reducing the principal, reducing the overall loan balance.

- Car loans: Similar to mortgage loans, the principal in car loans is the money borrowed to buy the vehicle. The repayment structure typically includes both principal and interest components.

- Personal loans: The principal is the initial amount borrowed for various personal needs, from debt consolidation to home improvement.

Note that the principal refers specifically to the total original dollar amount borrowed, not the loan’s remaining balance[1]. When making payments, the remaining or unpaid principal balance decreases as part of each payment chips away at the initial sum. Statements show both figures.

Types of Principal

There are several common types of principal:

Mortgage Principal

The principal portion of a mortgage loan refers to the amount of money borrowed from the lender to purchase a property.

Every payment made on a mortgage goes toward reducing the outstanding principal balance. The larger the down payment, the smaller the principal will be. Each payment reduces the principal, which means the borrower is slowly paying back the loan.

Loan Principal

Besides mortgages, principal also applies to other types of loans like auto, personal, student, and business loans.

The principal is the dollar amount borrowed from the lender to finance a purchase. Borrowers are responsible for paying back the full principal on top of accrued interest charges over the life of the loan. Most loan balances show the remaining principal owed.

Investment Principal

When investing in stocks, bonds, mutual funds, or other securities, the principal refers to the amount of cash initially used to purchase the investment[2].

Any gains or losses from interest, dividends, and capital appreciation or depreciation are calculated based on changes in the principal amount. Investors aim to grow their principal over time through compound returns without touching the initial investment.

Bank Account Principal

Any money deposited into a savings account, checking account, certificates of deposit (CD), or money market account is considered the principal balance.

This principal amount earns interest at the account’s stated annual percentage yield. Banks do not allow the account balance, including the principal, to go below zero. If this happens, the bank will charge you for overdraft[3].

Principal Repayment and Amortization

Repayment and amortization of a principal (i.e., the money you borrowed) significantly influence how you repay the loan.

Amortization

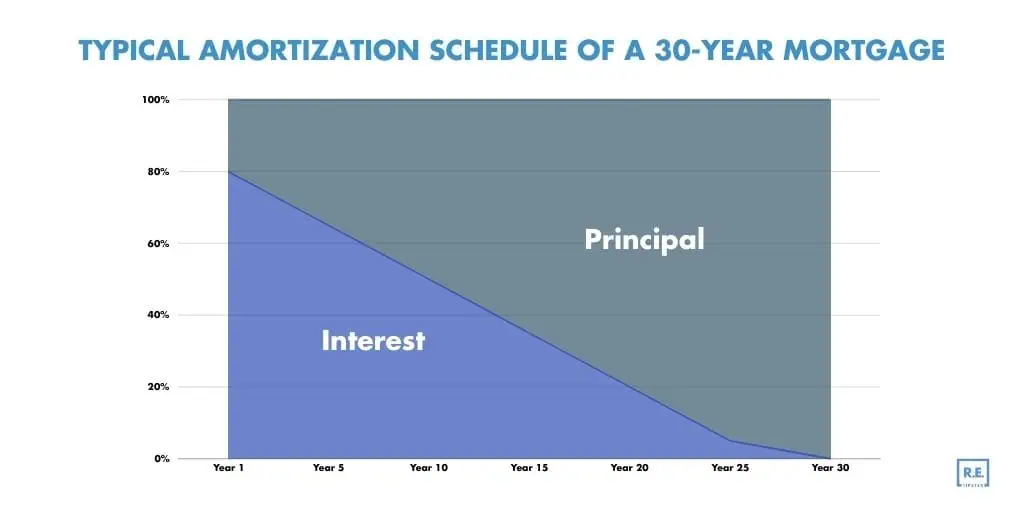

Amortization is a process that spreads out loan payments over time.

In a typical amortization schedule, each payment is divided into two parts:

- Paying down the interest.

- Paying down the principal.

Early on, interest usually takes up a bigger chunk of each payment[4]. This is because the interest is based on the principal’s amount, which is highest at the start of the loan term.

Typical inverse relationship of interest vs. principal payments (used for illustrative purposes only)

Eventually, the principal gradually decreases with each payment, and the interest portion of each payment also reduces. Consequently, more of your payment goes toward the principal, accelerating the pace at which the loan balance decreases.

This shift fundamentally impacts how quickly homebuyers and investors can build equity (in the case of a mortgage) or reduce their overall debt.

Loan Terms

The longer the loan term (the loan’s lifespan), the smaller the monthly payments you make. However, this also increases the total interest paid overall because you’re paying the principal down much more slowly.

Conversely, a shorter loan term results in higher monthly payments but less total interest paid because you’re paying down the principal faster.

For borrowers who can afford higher monthly payments, paying extra toward the principal can result in savings on the total interest paid over the life of the loan. On the other hand, those who need lower monthly payments may opt for a longer term, keeping in mind that this will increase the total amount of interest paid over time.

Principal in Real Estate Investing

In real estate, investors use principal to invest in property. Whether you are purchasing a residential property, a commercial building, or even a piece of land, the principal amount is the cornerstone of your investment.

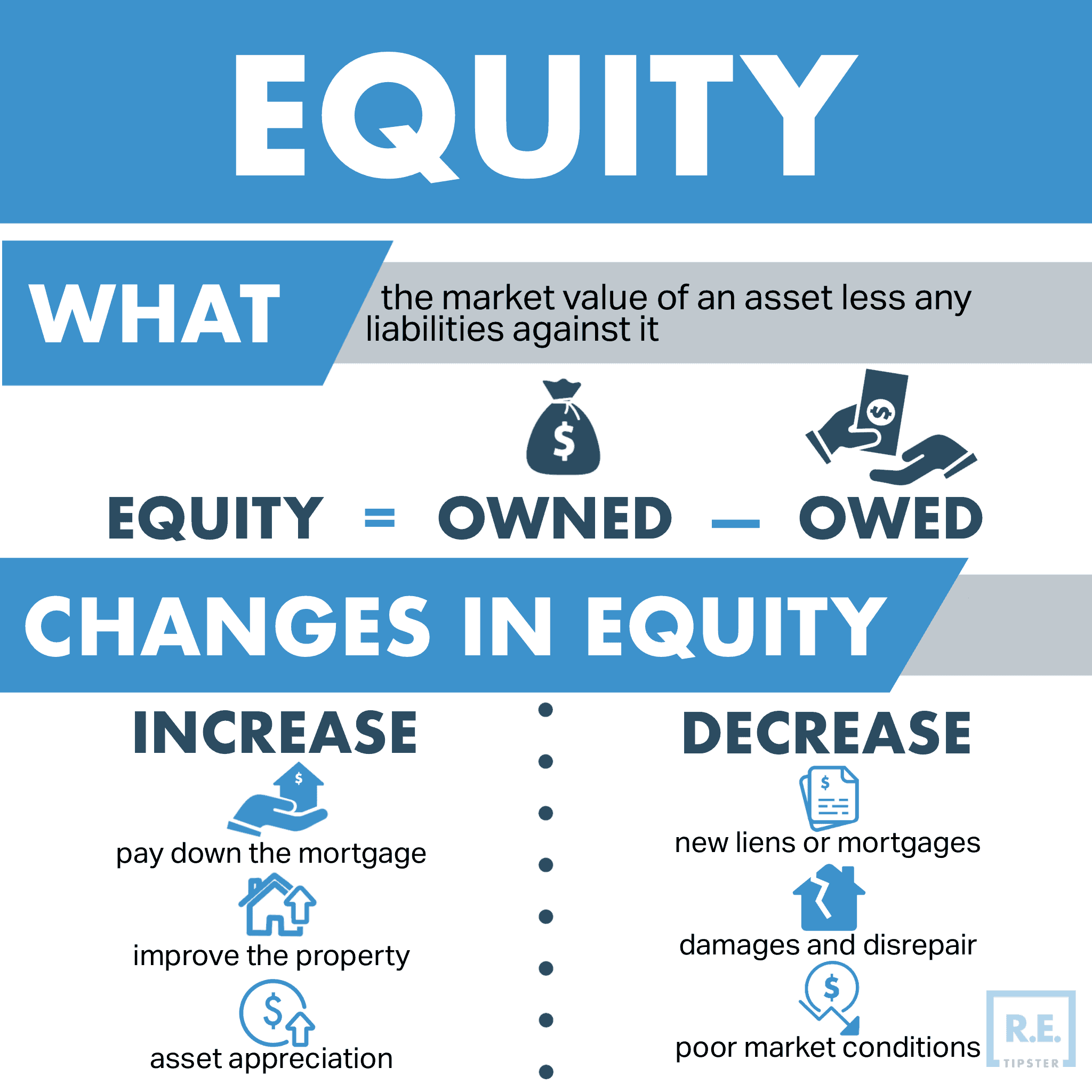

Equity and Principal

Equity is the percentage of your ownership in an asset like real estate. For example, the more a homebuyer pays down the principal on a real estate loan, their equity in the property increases.

Suppose you purchase a property for $300,000 with a $60,000 down payment. Your initial equity is worth $60,000, or 20%. As you continue to pay off the principal of your mortgage, this equity increases.

Equity is also crucial when considering the loan-to-value (LTV) ratio[5]. This ratio is a metric that lenders use to evaluate the risk of a loan. To calculate LTV, divide the mortgage balance by the property’s appraised value.

As the principal is paid down, the LTV ratio decreases. A lower LTV ratio is often beneficial for investors seeking to refinance or obtain additional funding, as it indicates lower risk to lenders.

Refinancing

When an investor refinances a property, they replace the existing loan with a new one, often with different or more favorable terms.

Refinancing at lower interest rates primarily affects the monthly payment and total interest paid[6]. For instance, if interest rates have dropped since the original mortgage, refinancing can reduce the monthly payment amount, part of which goes toward the principal.

Alternatively, some investors may refinance to a shorter loan term, which usually involves higher monthly payments but leads to a quicker principal reduction.

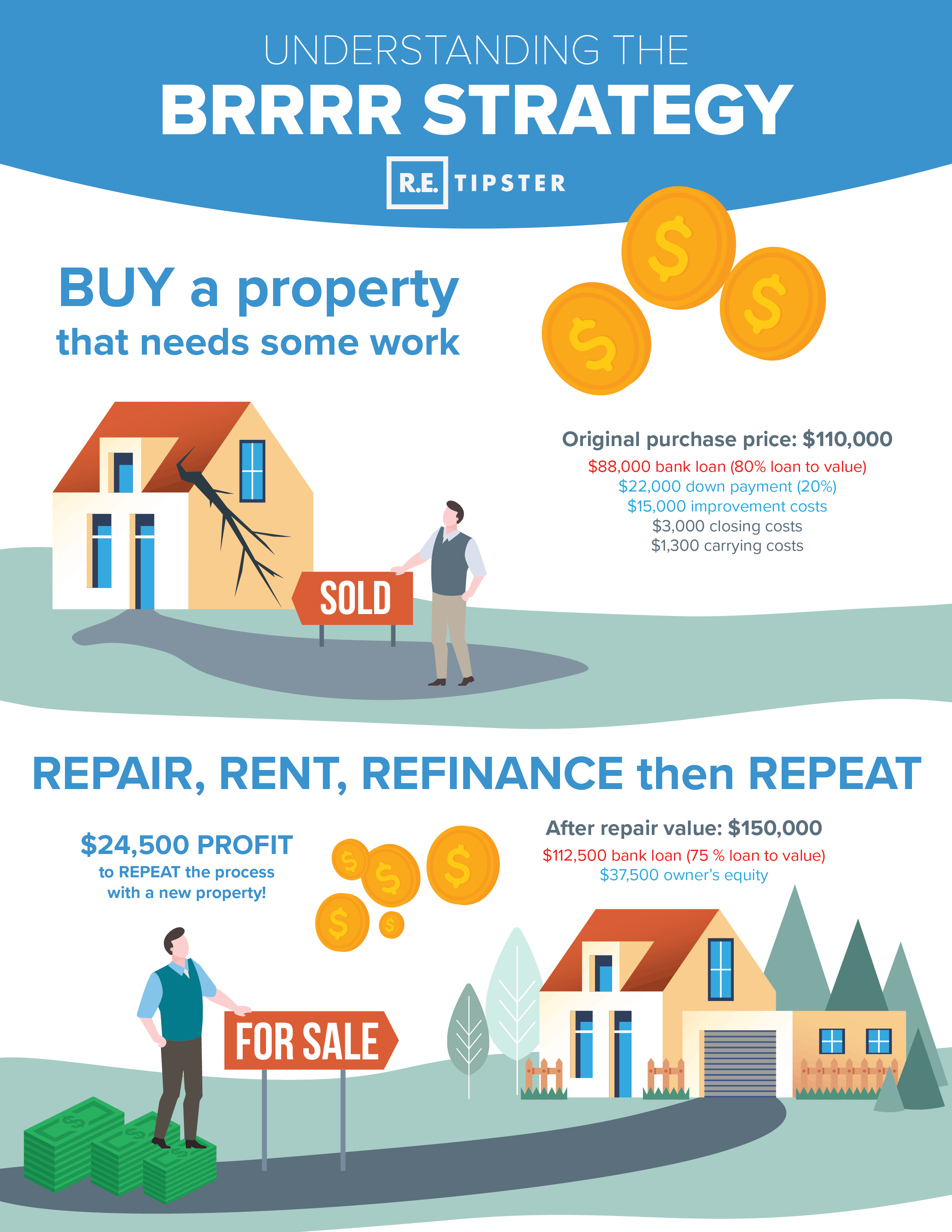

Moreover, an investor can use cash-out refinancing to invest in additional properties, spreading the original principal across multiple investments while potentially increasing overall returns. This is a cornerstone of the BRRR strategy in real estate, as explained in the graphic below.

Tax Implications on Principal

Generally, the principal amount of a loan or investment is not subject to taxation. This is because the principal typically represents the return of your own capital rather than income or profit[7].

However, how principal is paid can have significant tax implications, especially in real estate and other investments.

Tax Deductions and Credits

For instance, while the principal portion of mortgage payments is not tax-deductible in real estate, the interest component often is. The principal paid on a mortgage can indirectly affect the interest paid and, consequently, the interest deduction.

Investors and homeowners can take advantage of various tax deductions and credits related to principal payments. For instance, some programs for first-time homebuyers, like the mortgage credit certificate (MCC)[8], offer tax credits that can be used to lower the mortgage principal amount, lowering the overall tax burden.

Capital Gains

Additionally, capital gains tax is a critical consideration for investors, particularly in real estate and the stock market. The principal amount plays a central role in calculating capital gains.

Capital gains are the difference between an asset’s selling price and its purchase price, which includes the principal amount. For example, if you buy a property for $300,000 (principal) and sell it for $400,000, the capital gain is $100,000, which may be subject to tax.

One way to minimize capital gains tax in this scenario is to adjust the basis of the investment[9]. For example, improving and making additions to real estate increase the basis of the investment, potentially reducing the taxable capital gain when the property sells.

Frequently Asked Questions: Principal

How does principal differ from interest?

The principal is the original sum of money borrowed or the amount of money invested. In contrast, interest is the cost of borrowing that money, calculated as a percentage of the principal.

Over the life of a loan, payments are typically divided into principal and interest portions. As the loan matures, the proportion of each payment that goes toward the principal increases, thereby reducing the overall balance owed.

Can paying extra on principal reduce loan term?

Yes, paying extra toward the principal can significantly reduce the loan term. By doing so, you’re decreasing the overall balance faster than scheduled, which means less interest accrues over time. This not only shortens the loan period but also leads to substantial savings on the total interest paid.

This strategy is particularly effective in long-term loans like mortgages, where even small additional payments toward the principal can have a large impact over time.

Do market fluctuations affect principal?

Market fluctuations can influence the principal amount in investment scenarios, particularly stocks and real estate. This is because the value of a stock is the amount of principal used to buy them.

For example, in the stock market, if the stocks’ value rises[10], the principal investment’s worth increases. Conversely, if the market experiences a downturn, the principal can decrease in value.

Sources

- Baluch, A. (2023, January 12.) What Is Loan Principal? The Balance Money. Retrieved from https://www.thebalancemoney.com/loan-principal-what-is-it-5078182

- Hayes, A. (2023, October 3.) Principal: Definition in Loans, Bonds, Investments, and Transactions. Investopedia. Retrieved from https://www.investopedia.com/terms/p/principal.asp

- Avoiding overdraft fees. (n.d.) Washington State Department of Financial Institutions. Retrieved from https://dfi.wa.gov/financial-education/information/overdraft-fees

- Robertson, C. (2021, August 8.) Why Are Mortgage Payments Mostly Interest? The Truth About Mortgage. Retrieved from https://www.thetruthaboutmortgage.com/why-are-mortgage-payments-mostly-interest/

- How to calculate home equity and loan-to-value (LTV). (n.d.) Bank of America. Retrieved from https://www.bankofamerica.com/mortgage/learn/how-to-calculate-home-equity/

- Martin, E. (2023, November 22.) Mortgage refinance: What is it and how does it work?. Bankrate. Retrieved from https://www.bankrate.com/mortgages/how-does-refinancing-a-mortgage-work/

- Allec, L. (2022, June 29.) Are Principal Payments Tax Deductible? Or Just the Interest? Money Done Right. Retrieved from https://moneydoneright.com/taxes/personal-taxes/are-principal-payments-tax-deductible/

- Tax Credits and Deductions for First-Time Homebuyers. (n.d.) Equifax. Retrieved from https://www.equifax.com/personal/education/personal-finance/articles/-/learn/tax-credits-for-first-time-buyers/

- Tax Strategies for Minimizing Capital Gains with Cost Basis Planning. (n.d.) Members Trust Company. Retrieved from https://memberstrust.com/tax-strategies-for-minimizing-capital-gains-with-cost-basis-planning/

- Crane, R. (n.d.) Why Do Stock Price Fluctuates? What Explains Up & Down Variation? PatternsWizard. Retrieved from https://patternswizard.com/why-do-stock-prices-fluctuate/