REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Nowadays, you don’t need millions of dollars to invest in commercial real estate. You don’t even need thousands.

A new generation of real estate crowdfunding platforms makes these investments available to everyone. But not all of them are created equal and work very differently.

So, how does HappyNest stack up to other crowdfunding investments? It offers some real upsides—such as letting non-accredited investors start with as little as $10—but also has significant drawbacks. Make sure you understand both before investing.

HappyNest Rating

-

Overall Rating

Summary

HappyNest is a real estate crowdfunding platform that owns several commercial properties. It’s structured as an equity REIT: you buy shares in a fund that owns the underlying properties, making you a fractional owner.

However, HappyNest is a private REIT (unlike public real estate investment trusts). That means you buy and sell shares directly from the company rather than through public stock exchanges. It also has profound implications for how and when you get your money back.

Pros

- Open to Non-Accredited Investors

- Low Minimum Investment

- Completely Passive

- Automated Investing

- Strong Mobile App

Cons

- Lack of Liquidity

- Opaque Fees

- Small Portfolio

- One Fund Fits All

- Limited Track Record

- No Desktop Platform

What Is HappyNest?

HappyNest is a real estate crowdfunding platform that owns several commercial properties. It’s structured like an equity REIT: you buy shares in a fund that owns the underlying properties, becoming a fractional owner.

However, HappyNest is a private REIT, unlike public real estate investment trusts. That means you buy and sell shares directly from the company rather than through public stock exchanges. It also has profound implications for how and when you get your money back.

Unlike some of the other real estate crowdfunding platforms on the market today, at the time of this writing, HappyNest is a relatively small operation.

The HappyNest fund currently owns three commercial real estate properties:

- A FedEx Ground freight shipping center in Fremont, IN.

- A CVS store and pharmacy in Easthampton, MA.

- An AutoZone auto parts store in Brick Township, NJ.

Buying shares in HappyNest’s REIT means buying shares in all three properties. You can’t pick and choose individual properties.

How HappyNest Works

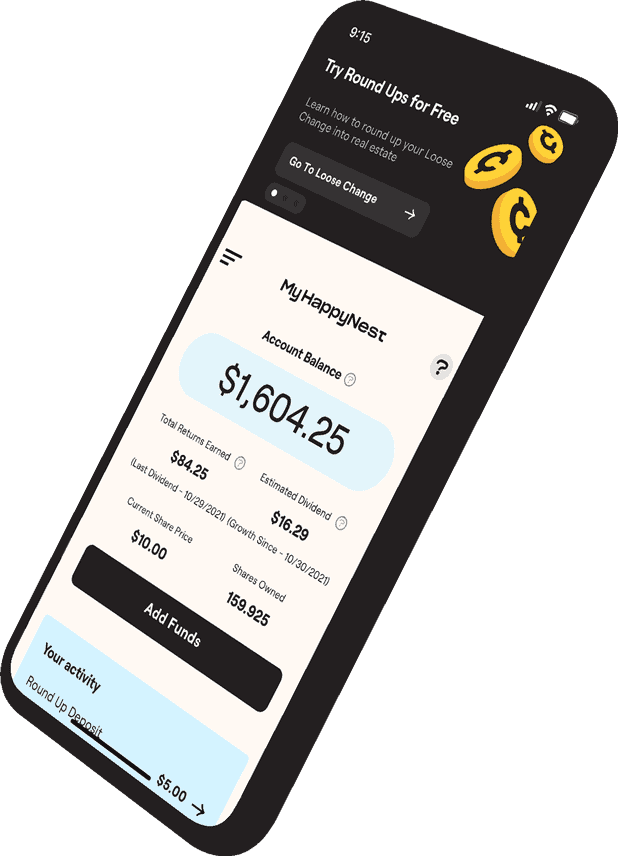

HappyNest built a slick mobile app for investors to control and monitor their money. Everything happens on this mobile app.

You can connect your bank account to transfer funds, like any crowdfunding or brokerage account. You can also set up automated recurring transfers to keep your investments growing over time.

But what sets HappyNest apart is its automated roundup feature. Taking a page out of Acorns’ book, HappyNest lets you round up your credit and debit card purchases to invest your “spare change” without you even noticing.

Inbound money gets invested in their REIT and starts earning you dividends. HappyNest aims for (but by law can’t guarantee) an annual dividend yield of 6%, paid quarterly.

Once invested, it’s not easy to pull your money back out, however. They don’t allow share redemptions within the first six months of investing and impose fees on a step-down basis for the first three years. You can view the early withdrawal penalty schedule here.

HappyNest Pros

HappyNest offers a compelling sales pitch at a time when volatility has rocked stock markets. Beyond a steady dividend, however, consider the following.

Open to Non-Accredited Investors

All too many real estate investments, from crowdfunding to syndications, only allow wealthy accredited investors to participate.

Not HappyNest. They welcome everyday investors and actively court them as their target audience.

Low Minimum Investment

HappyNest lets you start investing with just $10. For the price of a sandwich and a cup of coffee, you can start investing in real estate.

By contrast, even the cheapest residential properties cost tens of thousands of dollars, debt, and other correlated risks.

Completely Passive

It takes a massive amount of skill and effort to buy rental properties. Careful analysis and coordination to do it profitably, find deals, get financing, close the deal, and find tenants.

Which says nothing of the ongoing work to manage properties and tenants.

HappyNest lets you invest in real estate passively, so you don’t have to learn a thing or lift a finger to add real estate to your portfolio.

Automated Investing

You can’t automate the purchase of rental properties, fix-and-flip deals, or commercial property investments. But HappyNest lets you schedule recurring investments and round up your spare change from credit and debit card purchases.

And unlike many similar services, it doesn’t require a special card either. HappyNest connects to your existing checking account or credit card to monitor purchases and automatically charge for spare change.

Strong Mobile App

You must use the mobile app to participate (you can't sign up or log into your account from anything other than a mobile device).

HappyNest Cons

For all those advantages, HappyNest comes with considerable downsides too. Make sure you understand them fully before investing.

Lack of Liquidity

Real estate is an inherently illiquid investment, and most real estate crowdfunding platforms reflect this. HappyNest is no exception.

As noted above, you can’t withdraw your money at all within the first six months, and HappyNest hits you with penalties if you pull out funds within the first three years.

Beyond the fees, there’s no guarantee when or if HappyNest will honor your redemption request. They make that clear in this clause:

“Share repurchases are limited to an annual aggregate repurchase of no more than than 20% of the weighted average number of shares of common stock outstanding during the previous fiscal year and, semi-annually, to not more than 10% of the weighted average number of shares of common stock outstanding during the previous fiscal year.”

Word to the wise: don’t invest any money you might need to see again soon.

Opaque Fees

HappyNest advertises in huge font,

“No broker or platform fees to hinder your savings!”

That’s not as good news as it sounds. Instead of openly disclosing their fees, they hide them in their public offering statement with the SEC. It’s a deceptive practice I can’t stand, and it raises my hackles when I see crowdfunding platforms do it.

In HappyNest’s case, they make money through Sponsor and Advisor fees. They bill up to 3% of all money raised as Sponsor fees, plus 0.0417% for a monthly asset management fee to the Advisor. On top of that, every time they buy or sell a property, they can charge 3% to 6% of the sales price.

Who are the Sponsor and Advisor? It turns out Jesse Prince, founder and CEO of HappyNest is also the Advisor's CEO and the Sponsor's Principal. In other words, these fees are essentially charged by HappyNest; they just don’t want to advertise them so blatantly.

Understand that these fees don’t come directly out of your balance. They simply reduce the returns you can expect over time, much like the expense ratio charged by a mutual fund or index fund.

As a final note, HappyNest’s SEC filing entitles them to charge a $1 monthly administrative fee if your balance exceeds $5,000. It appears HappyNest has suspended this fee indefinitely, however.

Small Portfolio

HappyNest only owns three properties, which are quite modest properties by commercial standards. We’re not talking about a huge apartment building or corporate office park.

A CVS store, an Autozone store, and a FedEx shipping facility make up the entirety of HappyNest’s portfolio. That doesn’t leave much in the way of diversification.

One Fund Fits All

HappyNest offers exactly one investment option: its pooled fund. You can’t adjust or select different investments or pick specific properties—all your money just goes into their REIT.

It makes sense, given their model of simplicity and appealing to passive middle-class investors with no real estate experience. But more advanced investors often prefer more flexibility.

Limited Track Record

As of the end of 2021, HappyNest had raised a total of around $1.3 million. Meanwhile, more established platforms like Fundrise have raised hundreds of millions of dollars over nearly a decade.

That doesn’t mean HappyNest won’t deliver as promised in the years to come… but it also doesn’t demonstrate a long track record of success either.

No Desktop Platform

Not everyone likes managing their investments from their phone.

If you’d rather manage your money on your desktop or laptop computer, HappyNest doesn’t offer it as an option.

How HappyNest Compares

Other real estate crowdfunding platforms offer similar returns but better liquidity. Likewise, other platforms require a long-term investment but pay higher returns.

But HappyNest comes with the worst of both worlds.

If you want a steady dividend at a similar yield, check out Concreit or Stairs by Groundfloor. Both feature funds that own notes secured by real estate, and pay similar dividends. Concreit pays a 5.5% dividend yield, distributed weekly, and you can earn up to 6.5% through referrals and other bonuses. Stairs pays a dividend yield between 4-6%, although there’s a waiting list as it remains a limited test release by Groundfloor.

You can earn 7% to 15% interest through Groundfloor by investing in individual notes. The investments aren’t liquid but short-term, typically ranging from 3 to 12 months.

For longer-term investments, Fundrise and Streitwise both pay better returns than HappyNest.

Seth earned an average 14% annual return over the last five years on his Fundrise investment—check out his personal experience in his Fundrise review. I’ve also invested in Streitwise and have earned a consistent 8.4% annual dividend yield, paid quarterly. Streitwise does require a $5,000 minimum investment, although both allow non-accredited investors.

Fundrise and Streitwise charge penalties if you withdraw money within the first five years of investing, but at least they pay higher returns than HappyNest.

Is HappyNest Worth It?

Only you can decide whether HappyNest’s offering makes sense for you.

Some investors appreciate the steady dividend, low minimum investment, and investing automation features that HappyNest offers. I see a 6% return as unacceptably low for a long-term commitment with weak liquidity and diversification.

Do your homework in evaluating any real estate crowdfunding platform before investing, and pay particular attention to when you can redeem your investments.