REtipster features products and services we find useful. If you buy something through the links below, we may receive a referral fee, which helps support our work. Learn more.

Can you really invest in U.S. real estate without setting foot in the country?

In a word, yes.

It's a dream for many people worldwide, but it can come with some unique challenges.

When you're trying to buy, sell, manage, or own property in the U.S. from abroad, you might face obstacles like:

- Setting up a bank account

- Figuring out the logistics of property management

- Dealing with currency exchange rates

- Doing your due diligence on a property from far away

- Navigating taxes and legal issues

- Overcoming language barriers

- Understanding cultural differences

- Working from another time zone

Some hurdles are easy, while others could be more complicated. But don't worry!

No matter where you're located, I'll guide you through the most common challenges of investing in U.S. real estate as a foreigner.

RELATED: From Ireland to America – Ciaran Sheil's 5,000-Mile Land Investing Hustle

Understanding U.S. Geography

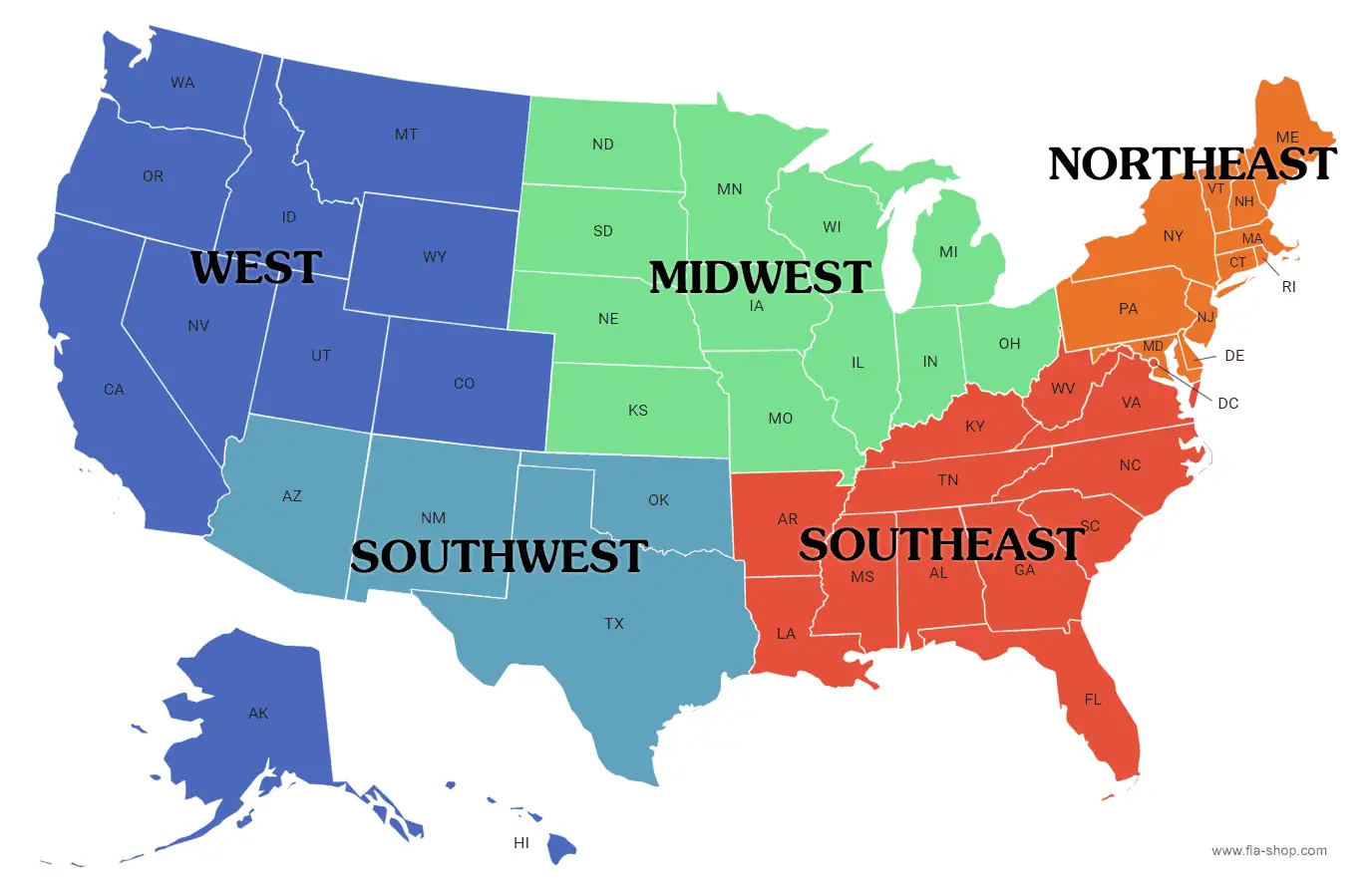

If you're new to investing in the U.S., one of the first things you'll want to familiarize yourself with is the country's general layout.

Which states are where? What are the different regions of the country? Which cities are the most notable metropolitan and economic centers of the country?

There are many different ways that the country can be segmented, but this map below shows one of the most common ways people refer to various regions of the U.S.

Source: fla-shop.com

Beyond knowing where things are, it's important to know which markets are thriving and dying economically. It can also be useful to know which states are controlled by which political parties at any given time, sometimes referred to as red and blue states.

Knowing the economic and political situation will help you identify which markets you may (or may not) want to buy properties in or which markets you can expect to buy at a discount vs. a premium.

It will also give you some clues as to which markets will be most costly in paying income taxes, property taxes, and other ways local governments will claim your revenue as their own.

RELATED: Finding the Best Markets for Land Investing

Real Estate Terminology

Another frustrating aspect of the real estate business is all the different words and terminology used among industry professionals.

Even if English is your first language, plenty of industry jargon is still used in the U.S. real estate market.

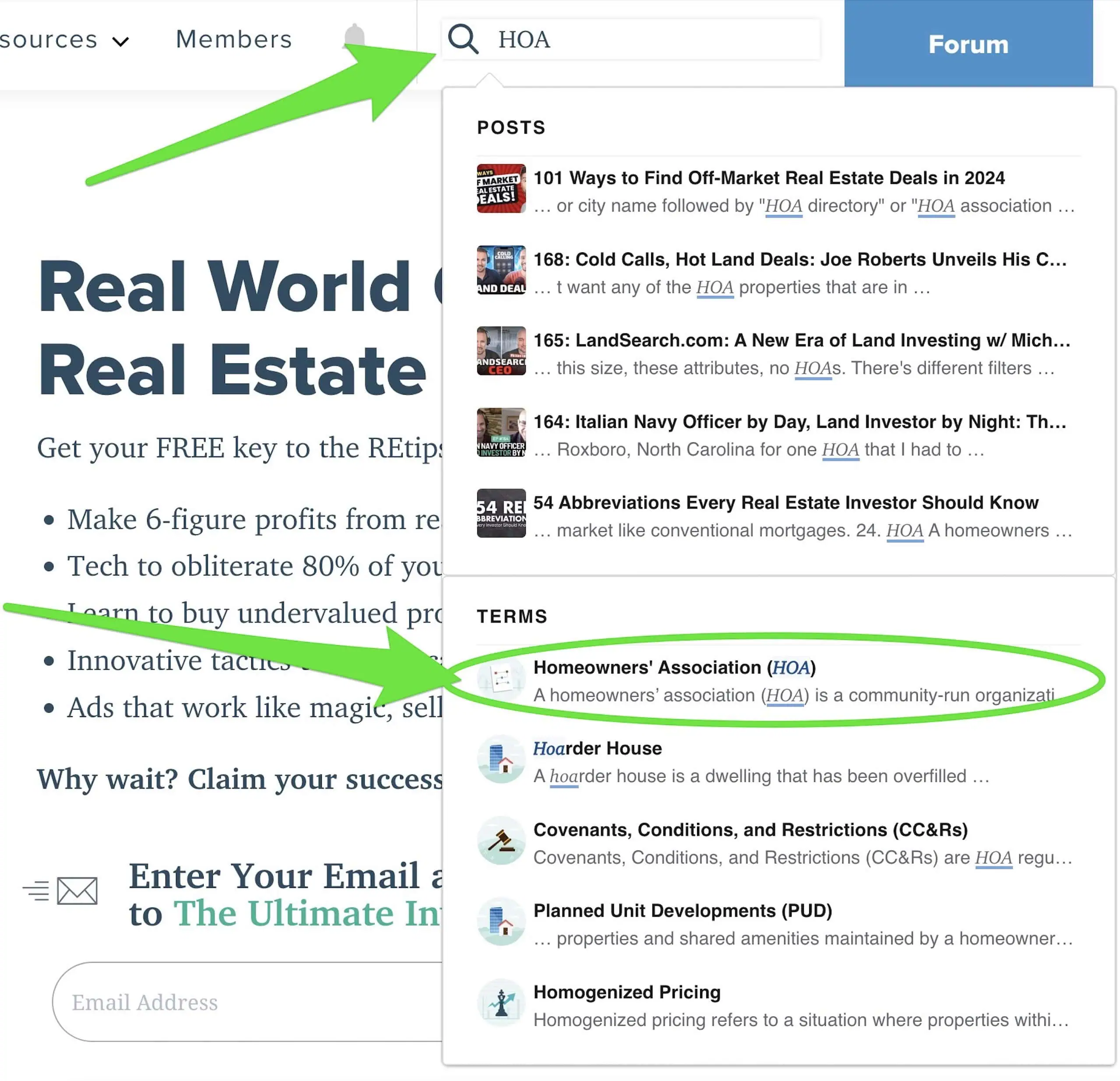

This is why we created the REtipster Terms Library! If you ever encounter unfamiliar words, acronyms, or ‘lingo' in emails, texts, or meetings, type them into our search bar!

We've worked hard at trying to explain every word you'll encounter out there!

Bank Accounts and Transferring Funds

When buying or selling a property, you'll need a painless way to send and receive US funds to and from your title company.

In the US, the vast majority of real estate transactions are closed by title companies or closing attorneys.

These title companies are specialists known as ‘closing agents' who act as a trusted third party. They do several things to close each transaction, which include:

- Researching the property's title history ensures the buyer receives a clear title.

- Preparing all the necessary paperwork and getting signatures from both the buyer and seller.

- Collecting the buyer's funds and holding them until the seller completes their paperwork.

- Sending all documents to the county for recording to complete the transaction.

The title company can help you sign the right documents and/or receive your funds if you're located outside the US.

However, you still need US funds in a US bank account to send (or receive) this money for each deal you close.

If you don't have a bank account, Relay is a platform that makes it easy for people outside the U.S. to set one up.

You don't need to visit a branch or have a social security number to get started. However, you must have a business entity registered in the U.S.

Check out this video of me setting up my account with Relay, and you'll see how easy it is!

As long as you have a registered US business entity and your EIN, you can get through the process relatively easily. If you haven't set up for business entity yet, I'll show you how to do it in this blog post.

RELATED: Why Everyone Is Switching to Relay – Uncover the Hidden Benefits

Signing Documents

However, there are still some situations when you must sign original copies of the documentation (e.g., Deed, Certificate of Trust, Death Certificate, Power of Attorney, etc.).

If you're working with a title company to close a deal, they should be able to help facilitate this process, but you will still have to get some of these documents even notarized in some cases.

What is a Notary? In the United States, a notary public is an official who verifies the identity of signers, ensures they are signing willingly, and witnesses the signing of important documents to prevent fraud. Notary signatures add legal credibility to documents like deeds and wills by confirming the correct person properly executed them. This reduces the risk of forgery and ensures the documents are legally valid and trusted in court.

Depending on your country, there are a few options for getting documents signed and notarized.

- U.S. Embassy or Consulate: The best option is to visit the nearest U.S. Embassy or Consulate. They offer notarial services recognized in the U.S. equivalent to those performed by a U.S. notary public. You can find the U.S. Embassy or Consulate closest to you by visiting your country's U.S. Embassy's website.

- Local Notary with Apostille: If it's not convenient to visit the U.S. Embassy or Consulate, you may be able to find a local notary. However, to ensure the document is accepted in the U.S., you must authenticate the notary's seal with an Apostille. Many countries are members of the Hague Apostille Convention, which allows foreign notarizations to be recognized in other member countries like the U.S.

- Remote Online Notarization: Another option is to use a Remote Online Notary service based in the U.S. Some U.S. states allow notarizations online, even if the signer is abroad, provided the notary is located within the U.S. when performing the service.

Another option is to find someone in the U.S. and give them a Power of Attorney (to handle all your affairs) or a Special Power of Attorney (to handle one specific action). This will allow them to sign documents on your behalf, so you don't need to sign at all, as long as you've given them the proper authority to sign specific things for you.

You could also work with someone like Tony Durante, who offers this as a service and many other useful services for international investors in the U.S.

Get a U.S. Mailing Address

Several remote mail services (e.g., Traveling Mailbox or LegalZoom Virtual Mail) can send and receive your mail from a U.S. address. They will scan all the items you receive so you can view them from your phone or computer and decide whether to trash them.

They'll even mail the original items to your location if needed. If you need an original copy of a deed or cashier's check (for example), they can forward it to you!

This effectively removes one of the most obvious clues that you're not working from within the United States.

RELATED: Traveling Mailbox Review: Here's Why I Switched

Use a U.S. Phone Number

Whether you're using a paid service like OpenPhone or a free one like Google Voice, every virtual phone service allows you to establish a phone number with an area code based in the United States.

RELATED: How to Set Up Your Phone System

Even if you're working from within the U.S. and you want to appear as though you're calling from the market in which you're working, you can still use a phone number based on the area code of your choice.

Due Diligence

The good news is that due diligence is easier to do in the U.S. than in any other place on Earth. Thanks to the Freedom of Information Act (FOIA), citizens, foreign nationals, and other legal entities have the right to access public or government agency records.

This includes the names and addresses of every property owner in the country, along with many other details about each property.

With free tools like Google Earth and paid software like PropStream, DataTree, The Land Portal, and many other data services, I never leave my house anymore. With how easy it is to see everything I need to know on the internet, I could just as well be running my entire business from anywhere in the world!

RELATED: 10 Google Earth Hacks Every Real Estate Professional Should Know

Language Barriers

Depending on your native language (even if it's English), there are two potential language barriers you may have to deal with.

1. Speaking

If you speak English as a first language, you already have a built-in asset when working in the United States.

If you live in Canada, the UK, Australia, or New Zealand and have an accent, it probably won't work against you.

If you speak English as a second language and have a heavy foreign accent, this isn't necessarily a problem, but it could be an issue Americans find difficult to understand.

It helps to know how to write a good email or send a good text message. Good written communication can overcome many issues if you aren't confident on the phone (more on that below).

You can also manage your phone time by asking people to communicate with you via email or text or by using a service like PATLive to be a friendly American voice that receives your initial calls and collects information.

RELATED: PATLive Review: How Helpful is a Virtual Receptionist for Busy Entrepreneurs?

2. Writing

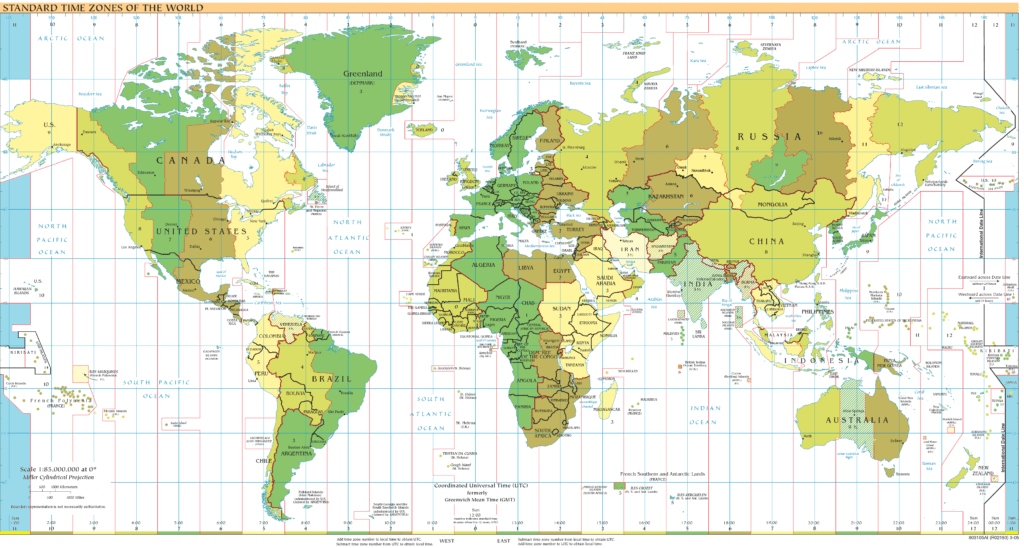

Time Zones

This is probably the least pressing issue, but if you're located in a place like Australia, Japan, South Korea, or New Zealand, this difference in time zones can add some challenges to real-time communication.

If you're running a business like mine, you'll find that most of the ongoing communication with your clients and customers is NOT terribly time-sensitive. Much of the back-and-forth correspondence can be done through emails, voicemails, and even Loom videos.

That being said, if you NEED to have a live phone conversation with someone in the States, be sure to schedule your day so that you can contact them near the beginning (8:00 a.m.) or end (8:00 p.m.) of the day in the North American time zone.

Use this time zone calculator to determine what time you'll have to get on the phone to reach your contact in the States.

Tax and Legal

Tax and legal matters involve a lot of variables. Many details will vary depending on the type of business you're running and the specific tax laws in the state(s) where you're operating. However, there are some key points to remember if you plan to invest in U.S. real estate from a foreign country.

No matter what type of real estate you plan to own in the U.S., you’ll need to pay property taxes to the city or township where your property is located.

In most states, you'll also have to pay state and federal income taxes (although some states do not require state income tax, they usually make up for it by charging higher property taxes).

You'll also be required to file a U.S. tax return and pay federal and (in most cases) state taxes on that income.

If you need help figuring out your tax and accounting situation, a great place to start is with Doola.

This service was built specifically to help international business owners manage their tax and accounting situations without physically being located in the U.S.

Owning U.S. Real Estate as a Foreign National

If you are a “Foreign National” (i.e., you are not a U.S. Citizen and do not have Legal Permanent Resident status in the United States), you should know a few things.

- You DO NOT have to be a U.S. Citizen or have a Green Card (LPR status) to own U.S. real estate in your personal name.

- You DO NOT have to be a U.S. Citizen or have a Green Card (LPR status) to own a U.S. business entity.

- You CAN own U.S. real estate in the name of a foreign business entity.

While you don't need to be a U.S. Citizen or have a Green Card to own U.S. real estate, you must obtain an Individual Tax Identification Number (ITIN). The IRS issues ITINs to foreign nationals who must file federal tax reports and do not qualify for a Social Security Number (SSN).

However, suppose you decide to hold a title in your U.S. real estate. In that case, each scenario will have different tax advantages and disadvantages. As usual, if you want to understand the FULL tax and legal implications involved with owning real estate from your respective country (with or without the involvement of a U.S. business entity), you'll have to talk directly with your legal and/or tax professional.

Starting a U.S. Business Entity

If you want to form a Corporation or LLC in the United States (note: you do not have to be a U.S. Citizen to own a U.S. business entity, but you will need an ITIN, more on that in this video), one of the easiest ways to do so is with Northwest Registered Agent.

If you sign up with Northwest Registered Agent, one of the extra services they can handle is acting as your Registered Agent. This can help shield your privacy in some states and give you a physical mailing address in the United States so that you can receive mail within U.S. borders, eliminating one more hassle of doing business internationally.

If you're ready to create your business entity, this blog post will give you a quick walkthrough.

Document Templates

Whenever I'm working in a new state, and I'm not sure what specific language should be included in the contracts and documents I'm working with, I go to Rocket Lawyer. It is one of the most user-friendly platforms I've ever found for creating legal documents in the real estate business.

Other Issues

If all the issues above aren't enough to deal with, you may find that certain websites will be blocked altogether in some parts of the world.

Some websites will block traffic from certain countries due to legal restrictions, content licensing, security concerns, local law compliance, or to avoid taxes and fees. These “geo-blocks” help websites control where their content or services are available, protect against cyber threats, and focus on specific markets.

If you encounter a website in the US blocking traffic from your country, a VPN service like Nord VPN allows users to bypass these blocks by masking their real location.

Additional Resources

Investing in U.S. real estate from abroad can seem daunting at first, but with the right tools and knowledge, it’s absolutely achievable.

Whether you’re dealing with bank accounts, signing documents, understanding the market, or navigating legal and tax hurdles, there are resources to help you overcome these challenges.

As you begin or continue your journey, remember to join the REtipster forum, where you can connect with, learn from, and share with other real estate investors worldwide.