You may know a few people who have significantly increased their net worth by investing in real estate. Perhaps you want to try it too, but you’re hesitant for a lot of reasons.

But what if you had a better alternative to build your wealth without getting actively involved in the real estate business?

It’s possible through REIT.

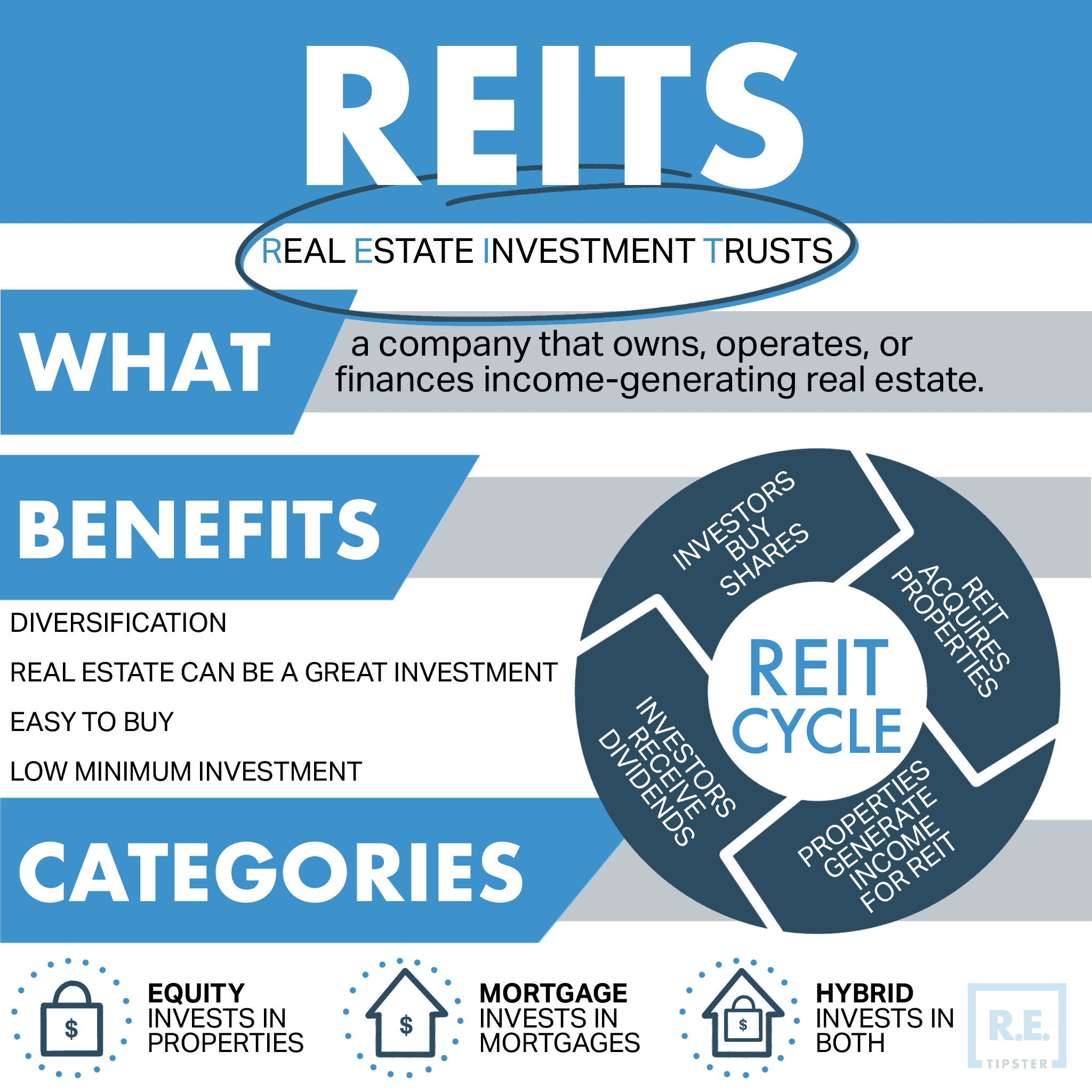

A real estate investment trust (REIT) is one way to get your foot in the door as a real estate investor. Investing in REITs (with the help of a financial advisor) allows you to get into the real estate investing game without purchasing any real property yourself and it can allow you to participate in the marketplace without taking on any direct or active management duties.

So, let's take a closer look at how REITs can help you diversify your investment portfolio and build your wealth.

How Does a REIT Work?

A REIT is a corporation that owns, finances, and sometimes operates income-producing real estate across different real estate markets. Investing in a REIT means you are buying a share of the REIT instead of the real estate equity in that REIT’s portfolio.

Each REIT usually specializes in a specific property type. For example, mortgage REITs provide sector funding, equity REITs purchase income-producing residential or corporate property, and infrastructure REITs acquire land for cell sites or data farms.

One advantage of a REIT over traditional real estate investments is that REITs can be traded publicly, making them highly liquid. REITs also pay at least 90% of their taxable income to shareholders (which is you, if you invest in a REIT).

Because a REIT includes a collection of real estate equity and debt securities, you can receive non-qualified dividends from the revenue that is passively earned by these underlying assets. In other words, you won't be responsible for buying, maintaining, or financing the property like you would if you owned it directly.

How Are REITs Structured?

REITs are structured based on their specialty in the property market. The properties in the portfolio could be diverse or focused on a single type of real estate.

REITs are available in various real estate sections:

- Residential real estate

- Commercial buildings and facilities

- Shopping centers and strip malls

- Healthcare establishments

- Hotels and leisure facilities

- Apartment complexes

- Buildings for offices

According to the National Association of REITs (NAREIT), there are about 200 openly traded REITs listed on U.S. stock exchanges. Similar arrangements exist outside the United States, offering prospects for global diversification.

Why Should You Invest in REITs?

REITs are a crucial part of any investor’s portfolio because they combine income, security, and inflation coverage. While some investors invest in specific real estate stocks, REITs are often a better option.

There are two reasons for this:

- REITs diversify an investment portfolio, as you can choose a REIT that invests in income-producing real estate you prefer.

- Competent fund management at a relatively low cost.

REITs also cater to any type of investment profile: active and passive options, valuation, revenue, and growth objectives. This maximizes your exposure to specific real estate sectors.

Here are other advantages of investing in REITs.

Revenue

REITs generally produce consistent cash flow, which is essential to many investors, especially retirees.

More importantly, REITs, unlike typical corporations, are not taxed on their profits. REITs are obligated to pay out 90% of their tax liability to investors in exchange for this beneficial tax structure, most typically in non-qualified dividends. As a result, REIT dividend returns are sometimes more significant than the typical stock dividend payout.

Equity REITs may also incorporate the capital growth of their underlying assets due to real estate appreciation. Real estate investors may use the additional revenue to manage life goals, such as consolidating credit card bills, paying off medical expenses, contributing to retirement savings, or saving for a vacation.

REIT dividend yields are appealing alternatives to stashing funds in a savings account or buying bonds in a low-interest market. Many equity REITs offer investors an added 300+ basis points over a bank deposit account, although you should beware of the increased volatility that comes with that higher earning potential.

That said, REIT shares do not allow investors to delay capital gains tax, unlike traditional real estate investments (which can postpone capital gains tax indefinitely through a 1031 exchange). Also, REIT profitability can suffer if inflation rises faster than interest rates, especially if financial growth is slow.

Liquidity

Because REITs can be openly purchased and sold with the same ease as any other openly traded stock, REITs are highly liquid. This is much unlike physical real estate, where the owner cannot obtain significant liquidity without engaging in a complex and time-consuming way to sell it.

However, its liquidity itself comes at a cost—the increased fluctuation with the valuation of the underlying assets. As a result, REITs might trade at a discount or premium to the evaluated fair market value of the underlying properties.

Diversification

Usually, financial experts advise customers to build a diversified portfolio. A portfolio is said to be diversified when it includes equities, bonds, and nontraditional investments (such as real estate).

As an independent asset class, real estate (and REITs, by association) has a minimal link to interest rates and the stock market. As a result, it can help balance out a portfolio, particularly against bonds. You can diversify your real estate assets further by investing in other property types or in other locations.

However, equity REITs have a stronger correlation to the broader equities market. You should look at the bigger picture to see whether you’re satisfied with its instability relative to the broader market.

Transparency

Independent professionals and the financial and business media monitor the long-term outlook (and therefore, profitability) of listed REITs. This monitoring provides investors with some security and multiple indicators of a REIT's financial health.

Passive Participation

REITs afford their investors many of the advantages of real estate investing without the time-consuming responsibilities of property ownership. While REIT investors do not have complete control over the portfolio of assets, these can be advantageous to some who want a low-risk, passive option.

Which REIT Do You Choose?

Not all REITs are created equal. Here are several factors when evaluating a REIT if it fits your investment profile:

Choice of REITs

Only put your money into REITs with excellent buildings and tenants. Many REITs are marketed on the stock exchange. You receive the diversification of real estate even without a long-term commitment. The more liquid, the better.

REIT Fund Management

REITs offer significant dividend yields, but not all REITs offer modest, long-term capital growth as well. Find a company that has done both in the past.

Look for organizations that have been established for a while or at the very least have an experienced management team. This way, you can leave the researching and purchase to your team.

Use the Right Figures to Discern Profitability

Depreciation tends to exaggerate the value loss of investment. Instead of looking at a REIT's payout ratio, check its funds from operations figures (FFO), or sometimes as price to funds from operations (P/FFO).

The FFO is calculated as net income plus depreciation, amortization, and other losses minus sales in a particular year. Use the resulting figure to divide the dividend per share to get the FFO ratio (FFO per share) of the REIT. The greater the return, the better.

Real Estate Without the Hassle

For many investors, real estate has long been the cornerstone of wealth. While real estate investments can enable an investor to meet income and diversification objectives, purchasing and maintaining properties can be difficult.

But REITs are a different animal. With a REIT, you can own a piece of the pie without having to dirty your hands yourself. Plus, it automatically diversifies your portfolio, providing a buffer even against the fluctuations in the market.

That’s why investing in REITs makes sense. It empowers the investor to engage capital outside of traditional property purchases without hampering the flow of profit (or making your headache).

Given the vast array of benefits that REITs provide, why don’t you incorporate REITs as a substantial component of your investment portfolio?

Author’s Bio: Lyle Solomon has considerable litigation experience as well as substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California, and now serves as a principal attorney for the Oak View Law Group in California. He has contributed to publications such as Entrepreneur, All Business, US Chamber, Finance Magnates, Next Avenue, and many more.