What Is Depreciation Recapture?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts: Depreciation Recapture

- Depreciation recapture is a tax on the gain from selling a depreciated asset.

- For most business assets, recapture is taxed as regular income (up to 37%).

- For real estate, recapture is capped at 25% under Section 1250.

- Real estate investors can use strategies like 1031 exchanges to defer recapture taxes.

- Good tax planning is important to handle depreciation recapture in all types of assets.

Understanding Depreciation Recapture

Depreciation recapture occurs when you sell a depreciated asset for more than its adjusted cost basis.

The IRS uses this mechanism to “recapture” some of the tax benefits you received from prior depreciation deductions by treating a portion of your gain as ordinary income rather than capital gains.

Understanding depreciation recapture matters for businesses and investors, especially those dealing with expensive equipment or real estate. It affects how much tax you’ll pay when the time finally comes to sell them.

Suppose a business buys something like a machine or a building. They can subtract a portion of its cost from their taxes each year. This is all well and good if you don’t plan to sell them later on, but what if you do? Are the proceeds from that sale going to be taxed?

The answer is yes. If you sell it for more than its depreciated value, the IRS wants some of those tax breaks back. This is depreciation recapture.

For example, a company bought a machine for $100,000. Over five years, they claimed $60,000 in depreciation on their taxes. Now they’re selling the machine for $80,000. The IRS will look at this sale in a special way.

From the IRS perspective, $40,000 of the sale price ($80,000 – $40,000 depreciated value) is a gain. This gain is subject to depreciation recapture rules, which often mean higher taxes than if it were just treated as a regular sale.

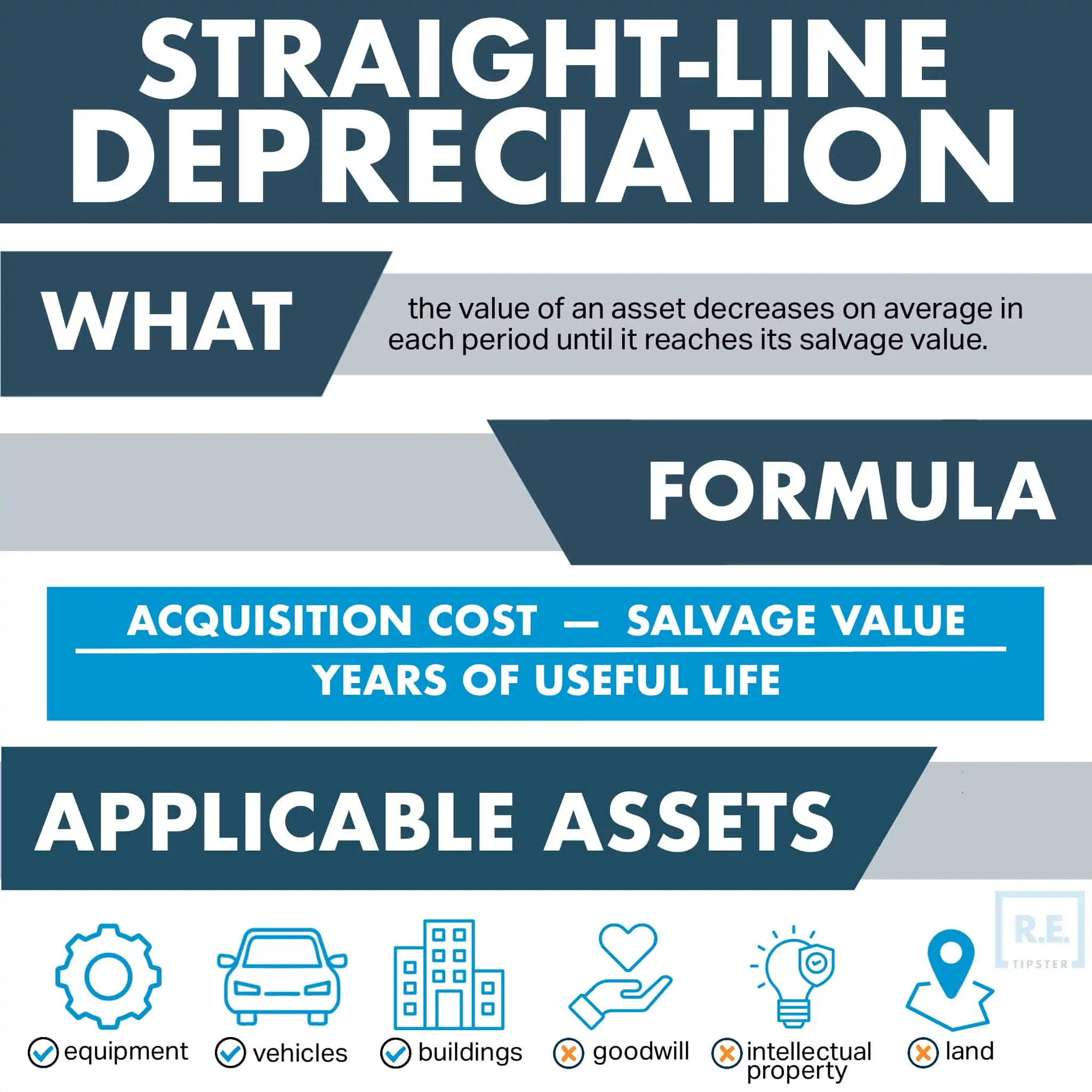

Note that the IRS has several ways to calculate depreciation, but the most common is straight-line depreciation.

Types of Depreciation Recapture

There are two main types of depreciation recapture: Section 1245 recapture and Section 1250 recapture.

Section 145 recapture applies to most business assets, like equipment and vehicles. The recapture amount is taxed as regular income, which usually means higher tax rates.

On the other hand, Section 1250 recapture applies to real estate. The tax calculation is more complex and can involve a mix of income tax and capital gains tax rates.

What You Need to Know About Depreciation Recapture

Taxed as regular income (with some exceptions)

For most business assets, the recaptured amount is taxed as regular income. This often means higher taxes than if it were treated as a capital gain. For real estate, there’s a maximum tax rate of 25% on the recaptured amount.

Applies to the gain, not the whole sale price

Recapture only applies to the gain you make on the sale, not the entire amount you receive. The gain is the difference between what you sell it for and its depreciated value.

Different rules for different assets

Equipment and real estate have different recapture rules. For example, when you sell a piece of equipment, all the depreciation you claimed might be recaptured. For a building, the rules are different and sometimes more favorable.

Affects businesses and individual investors

While businesses deal with this more often, it can also affect individuals who sell depreciated assets they used for business or investment.

Can be postponed in some cases

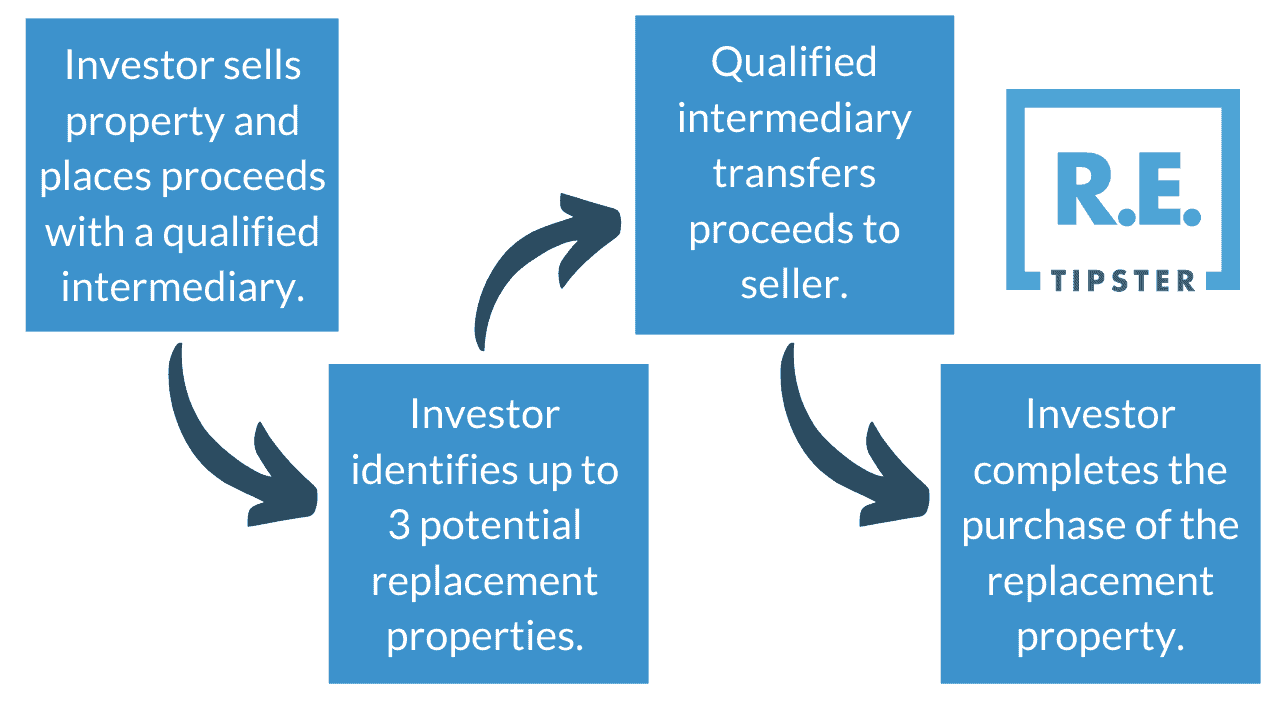

In some situations, especially with real estate, you can postpone paying these taxes through strategies like 1031 exchanges. The interview below illustrates how it works in the context of land investing.

Calculating Depreciation Recapture

Here’s how you calculate depreciation recapture:

- Find out how much the asset cost originally.

- Add up all the depreciation you claimed on your taxes.

- Subtract the total depreciation from the original cost to get the adjusted basis.

- Calculate your gain by subtracting the adjusted basis from the sale price.

- The recapture amount is the smaller of your gain or the total depreciation you claimed.

Here’s an example: You bought a delivery truck for $50,000 and claimed $30,000 in depreciation over the years. The truck’s adjusted basis is now $20,000 ($50,000 – $30,000).

Later, you sell the truck for $45,000, which means your gain is $25,000 ($45,000 – $20,000). This puts the recapture amount at $25,000 (less than the total depreciation of $30,000).

In this case, you’d pay taxes on $25,000 as if it were regular income.

Here’s a handy calculator to give you a starting point for calculating depreciation for real estate:

Depreciation Recapture in Real Estate

Real estate has some special rules regarding depreciation recapture. For starters, it’s considered Section 1250 property, which includes buildings and their structural components.

In addition, unlike other business assets, the recapture rate for real estate is capped at 25%. This can be a big advantage for real estate investors in high tax brackets.

Residential vs. Commercial Property

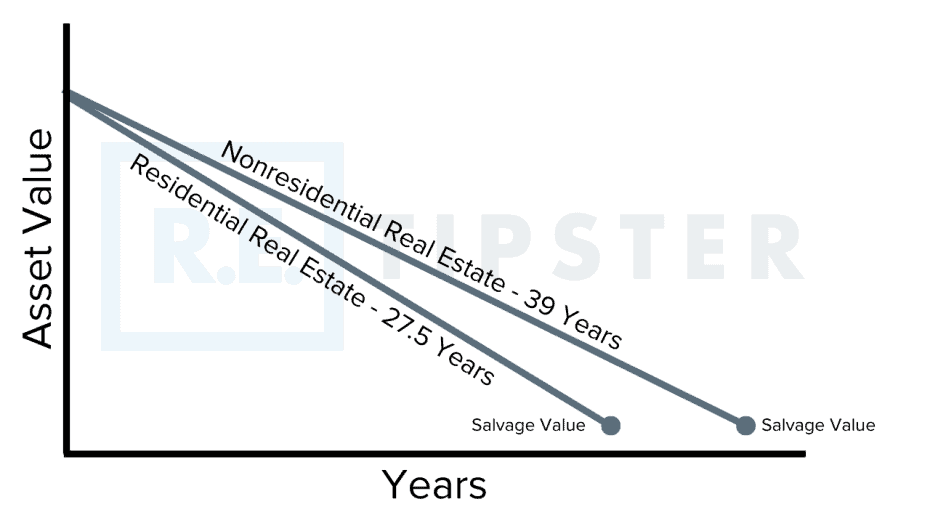

The depreciation period is different for residential and commercial properties.

This affects how much depreciation you can claim each year and, eventually, the recapture amount.

Land Value

Land doesn’t depreciate in the regular sense (at least, in terms of accounting). When you buy a property, you need to separate the value of the land from the building. Only the building part can be depreciated.

Let’s say you bought a rental property for $300,000 (building value: $250,000, land value: $50,000). After 10 years of depreciation, you sell it for $400,000.

- Annual depreciation: $250,000 / 27.5 years = $9,090.91

- Total depreciation after 10 years: $9,090.91 * 10 = $90,909.10

- Adjusted basis: $300,000 – $90,909.10 = $209,090.90

- Gain on sale: $400,000 – $209,090.90 = $190,909.10

- Recapture amount: $90,909.10 (total depreciation taken)

The $90,909.10 would be taxed at a maximum rate of 25%. The remaining gain ($100,000) would be taxed at capital gains rates.

For a more in-depth explanation of calculating land values vs. depreciation, consult our guide on How to Calculate Land Value for Taxes and Depreciation.

Special Considerations for Real Estate Investors

Here are some additional points real estate investors should keep in mind:

- Primary residence exclusion: If you convert a rental property to your primary residence, you might be able to use the Section 121 exclusion to avoid some capital gains tax, but you’ll still owe recapture tax on the depreciation you claimed while it was a rental.

- Pass-through entities: If you own rental properties through an LLC or S-Corporation, the recapture rules still apply, but the tax is typically paid on your personal return.

- State taxes: Some states have their own rules for depreciation recapture or peculiarities with income tax. Some states have no income tax at all!

- Passive activity rules: Rental real estate is usually considered a passive activity. Losses from passive activities can only offset passive income, but these rules can interact with depreciation recapture in complex ways.

- Cost basis adjustments: Keep good records of any improvements you make to the property. These increase your cost basis and can reduce your gain when you sell.

Strategies to Reduce Depreciation Recapture

While you can’t avoid depreciation recapture completely, there are ways to reduce its impact:

- 1031 exchanges: For real estate, a 1031 exchange lets you postpone paying recapture taxes by reinvesting in a similar property. You must identify the new property within 45 days and complete the exchange within 180 days. The graphic below shows the common flow of a 1031 exchange.

- Installment sales: These involve spreading the sale over several years, which can help manage the tax burden. This method is especially useful for seller-financed real estate deals. We talk about this and other advanced seller financing strategies in our Seller Financing Masterclass.

- Timing of sales: Sometimes, selling an asset in a different tax year can be helpful, depending on your overall tax situation. For example, delaying the sale could reduce your tax rate if you expect lower income next year.

- Cost segregation studies: For real estate, these studies can help identify parts of a building that can be depreciated faster. This can increase your depreciation deductions now, but be aware it may also increase future recapture.

- Charitable donations: In some cases, donating a depreciated asset to charity can be more tax-efficient than selling it. This can be especially valuable for highly appreciated real estate.

- Opportunity Zone investments: Reinvesting capital gains into Qualified Opportunity Zones can defer and potentially reduce tax liability, including depreciation recapture.

These strategies can be complicated, so it’s a good idea to talk to a tax professional before using them.

FAQs: Depreciation Recapture

Does depreciation recapture apply to my home?

No, depreciation recapture does not usually apply to personal homes. Depreciation recapture mostly applies to assets used for business or investment.

There are some exemptions. For example, if you’ve taken a home office deduction, that portion might be subject to recapture. Alternatively, if you’ve rented out part of your home, the depreciation on that portion would be subject to recapture as well.

Some owners may also convert a rental property to their primary residence. In this case, they may face recapture of the previously claimed depreciation when they sell.

Can depreciation recapture cause me to lose money on a sale?

Depreciation recapture itself won’t cause a loss; it only applies when you have a gain.

However, you might still have an overall loss on the sale even if some depreciation is recaptured. In other words, if the sale price is not significantly higher than the adjusted basis, the tax on recaptured depreciation can eat into your profits.

Psychologically, it may also feel like a “loss” even if the numbers show otherwise. Since the tax on recaptured depreciation can be substantial, you may feel like the overall financial is a loss even if the sale price exceeds the adjusted basis.

How does depreciation recapture affect my tax bracket?

When you sell a depreciated asset, the amount of depreciation recapture is added to your Adjusted Gross Income (AGI) for that tax year. This increase in AGI can potentially push you into a higher federal income tax bracket. In turn, this may affect the overall rate at which your income is taxed, including any long-term capital gains from the sale.

The recaptured depreciation is taxed at ordinary income rates, which can be as high as 37% for high-income earners. For real estate, the 25% cap can help limit this effect.

References

- Bloomberg Tax, “Depreciation Recapture — Sections 1245 and 1250 (Portfolio 563).” https://pro.bloombergtax.com/portfolios/depreciation-recapture-sections-1245-and-1250-portfolio-563/

- EisnerAmper, “A Guide to Depreciation Recapture for Real Estate.” https://www.eisneramper.com/insights/real-estate/depreciation-recapture-real-estate-0124/

- 1031 Crowdfunding, “Depreciation Recapture When Selling a Property.” https://www.1031crowdfunding.com/depreciation-recapture-when-selling-property/

- FGG 1031, “How to Calculate Adjusted Basis.” https://blog.fgg1031.com/blog/how-to-calculate-adjusted-basis

- Rocket Mortgage, “What Is Rental Property Depreciation And How Does It Work?” https://www.rocketmortgage.com/learn/rental-property-depreciation

- AccountingTools, “Why land is not depreciated.” https://www.accountingtools.com/articles/why-do-we-not-depreciate-land.html

- SmartAsset, “What Is a Section 121 Exclusion? Definition, Example and Basics.” https://smartasset.com/taxes/section-121-exclusion

- Avail, “Should You Create an LLC For Your Rental Property?” https://www.avail.co/education/articles/should-you-create-an-llc-for-your-rental-property

- Investopedia, “What Is a 1031 Exchange? Know the Rules.” https://www.investopedia.com/financial-edge/0110/10-things-to-know-about-1031-exchanges.aspx

- Fidelity Charitable, “3 ways to offset a high-income year with charitable giving.” https://www.fidelitycharitable.org/articles/3-ways-to-offset-taxes-with-charitable-giving.html

- Internal Revenue Service, “Publication 551: Basis of Assets.” https://www.irs.gov/pub/irs-pdf/p551.pdf