What Are First and Second Mortgages?

REtipster does not provide tax, investment, or financial advice. Always seek the help of a licensed financial professional before taking action.

Shortcuts

- First mortgages are primary loans used to buy or refinance real estate, while second mortgages are subordinate extra loans.

- A first mortgage gets first dibs on repayment ahead of the second mortgage.

- The second mortgage position has a higher risk than the first mortgage, but provides an affordable equity-tapping option.

- Like first mortgages, second mortgage qualification involves assessing credit scores, income ratios, and equity levels.

- Foreclosure rates are historically low on first mortgages, limiting the actual risk for second mortgage holders.

An Overview of First and Second Mortgages

A first mortgage is a primary loan used to purchase or refinance real estate, taking the first lien position on the property. This means if the borrower defaults, the first mortgage lender is first in line to foreclose and get paid back.

Meanwhile, a second mortgage is a secondary loan with a second lien position, meaning the lender is second in line behind the first mortgage to get repaid if the borrower defaults.

What Is a First Mortgage?

A first mortgage loan is the main financing used to purchase or refinance a home or other real estate. Also called a senior mortgage, it takes the first position as a lien against the property, meaning the lender is first in line to foreclose if the borrower stops making payments.

First mortgages typically have lower interest rates, longer repayment terms, and stricter underwriting standards than second mortgages. This is because they carry less risk for lenders, with the first lien position safeguarding their investment.

RELATED: The Last Loan Calculator You’ll Ever Need! ➕➖✖️➗

Common Types of First Mortgages

There are a few types of first mortgages that you might be familiar with:

- Conventional loans from banks and mortgage lenders, requiring down payments of at least 3% to 20% of the purchase price[1].

- FHA loans insured by the Federal Housing Administration, allowing down payments as low as 3.5%.

- VA loans from the Department of Veterans Affairs for eligible military members with no down payment required.

- USDA loans from the U.S. Department of Agriculture for low-income borrowers in rural areas.

- Jumbo loans or nonconforming loans above the loan limit set by Fannie Mae and Freddie Mac.

While having very low or no down payment options, government-backed loans like FHA, VA, and USDA mortgages require mortgage insurance premiums added to the monthly payment. Since government-sponsored enterprises cannot purchase or guarantee jumbo loans, their rates are frequently higher[2].

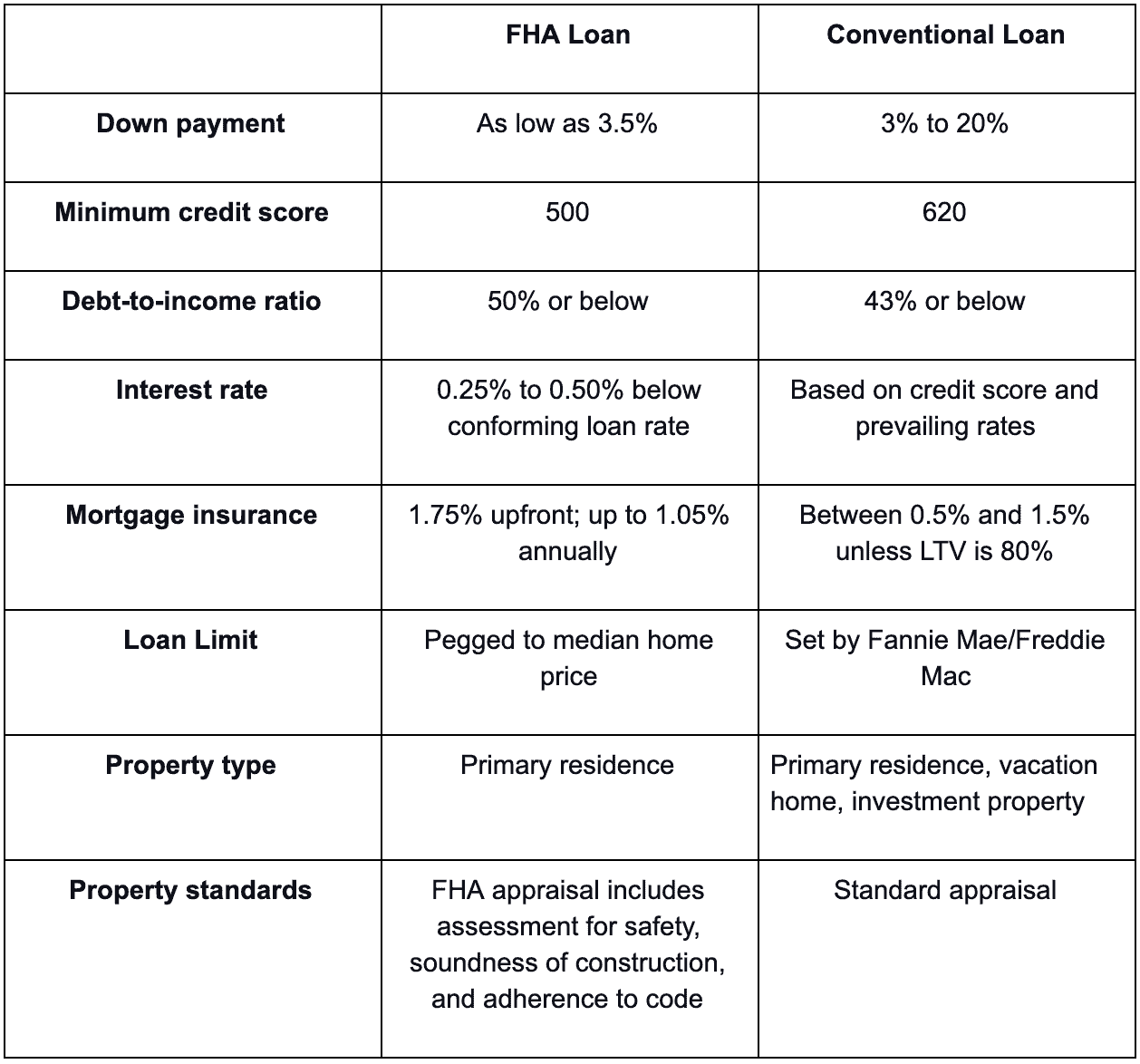

Here’s a short summary of how conventional loans stack up against a typical FHA loan:

What Is a Second Mortgage?

A second mortgage is a secondary loan subordinate to an existing first mortgage. Also called a junior mortgage, the second mortgage loan takes second position behind the primary mortgage in terms of lien priority against the property.

If the borrower defaults on their loans, the first mortgage lender can foreclose on the home and get paid back first out of the sale proceeds. Any remaining sale funds would then go toward repaying the second mortgage. This makes second mortgages riskier for lenders compared to firsts.

Why Do You Need a Second Mortgage?

Some common reasons[3] for obtaining a second mortgage include needing cash for a major expense, consolidating high-interest debt, financing home renovations, or tapping equity for business needs.

Second mortgages can also assist first-time homebuyers through down payment assistance programs[4] or help bridge financing gaps when refinancing a new first mortgage.

While second mortgages carry more risk and thus cost more, with rates running 0.25% to 2% higher than comparable firsts[5], they remain preferable and more affordable than personal loans or credit cards for significant cash needs. To help mitigate their riskier junior lien status, second mortgage terms run shorter as well, usually 10 to 15 years instead of 30 years, so the loan balance amortizes faster.

However, with historically low foreclosure rates, second mortgages facilitate affordable access to substantial equity without as much risk as their subordinate position may imply.

Lien Positions and Foreclosure Implications

If the borrower defaults on a mortgage, the property may go into foreclosure, giving the lender the legal right to seize and sell the home to recuperate losses from unpaid loan balances.

First mortgage lenders initiate foreclosure proceedings by filing a Notice of Default[6] with the county where the property is located. This starts the foreclosure process.

When a property is sold in foreclosure, funds go toward repaying lender debts in order of lien position:

- First mortgages and property taxes in first lien position get paid back first.

- Second mortgages and other junior liens in second position receive repayment next if any sale proceeds remain.

- Lastly, the borrower receives compensation only if funds are left after all mortgage lenders are paid in full.

This demonstrates the additional risk second mortgage lenders undertake compared to those holding first mortgage liens. However, foreclosure rates on first mortgages have been quite low historically[7], giving second mortgage lenders reasonable odds of also getting repaid without this worst-case scenario.

Source: Statista

How to Obtain a Second Mortgage

Second mortgages function similarly to first mortgages in that you must qualify based on income, credit scores, and equity in the home.

Here are the key steps for getting approved:

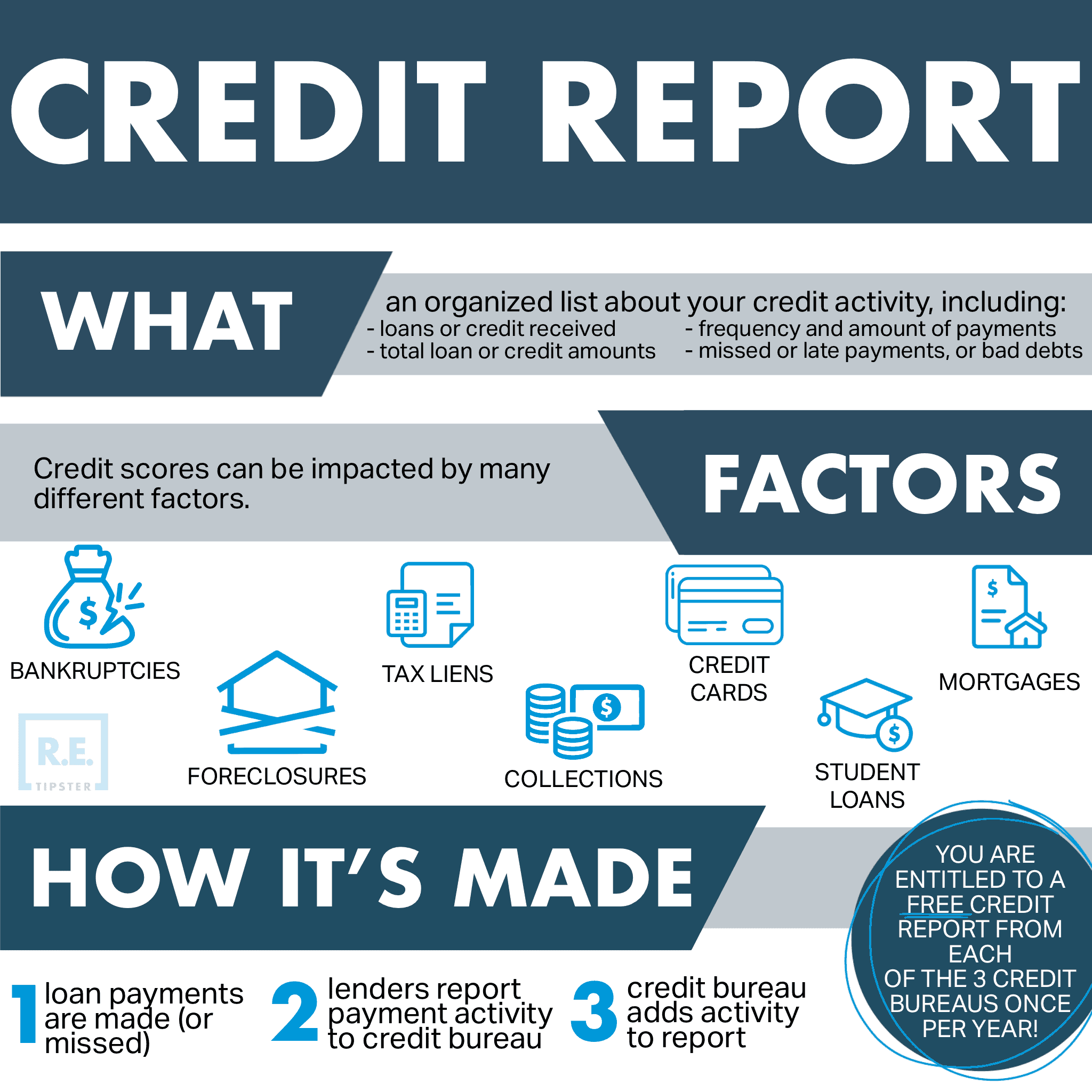

- Review credit reports and scores from the three main bureaus to understand qualification barriers. Scores below 620 may disqualify or require a higher rate.

- Check property values to calculate equity. Most lenders require at least 15% to 20% equity[8] before approving a second mortgage.

- Calculate total monthly debts along with the potential second mortgage payment to confirm affordable ratios below 45% to 50% debt-to-income based on lender type.

- Shop for mortgage lenders specializing in second loans and compare loan estimates after applying to find the best rate and fee combinations customized to your scenario.

- Cooperate fully during underwriting by providing all required financial documentation. This includes recent paystubs, W-2s, tax returns, bank statements, and perhaps a home appraisal.

- Carefully review final closing documents and seek third-party guidance from real estate or legal professionals for optimal terms.

While second mortgages carry more risk and cost than first mortgages, they remain one of the most affordable ways to tap significant cash from your home’s equity under reasonable qualification standards.

Frequently Asked Questions: First and Second Mortgages

How much cash can I get from a second mortgage?

Most lenders allow you to borrow up to 85%[8] of your equity minus what you owe on the first mortgage.

For example, if your home is worth $400k and you owe $200k on your primary loan, you likely qualify for around $170k (($400k x 85%) – $200k first mortgage) in second mortgage proceeds.

What credit score is needed for a second mortgage?

While each lender differs slightly, you typically need at least a 620 FICO score from most second mortgage lenders for a decent rate. Scores below 580 often result in denial or predatory terms. Excellent credit in the mid-700s qualifies for better rates under 1% of prevailing first mortgages.

Will getting a second mortgage affect my ability to refinance my first mortgage later?

Yes, having a second mortgage that gets recorded on your title will show up in refinance underwriting[9]. You meet the same criteria but may pay slightly higher rates. It’s advisable to pay off seconds before a first mortgage refinance when possible.