Lien Position Definition

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

Shortcuts

- Lien position refers to the priority order that determines which lien holders get repaid first in the event a property owner defaults on their debts.

- The lien filed first, typically the primary mortgage, stands in first position with top priority for full repayment if the owner defaults.

- Liens in junior positions have a lower chance of being fully repaid if proceeds from selling the property fall short of satisfying all debts.

- Factors like refinancing agreements, delinquent property taxes, and bankruptcy can impact the original priority order of liens on real estate.

- Checking public land records allows property owners and prospective buyers to identify all existing liens and confirm their positions in the repayment hierarchy.

Understanding Lien Priority

Liens are legal claims against a property that must be resolved, usually through payment, before the property can be sold or refinanced freely.

When a property has multiple liens filed against it, the liens are prioritized by the date and time that they were filed with the appropriate records office[1]. The lien filed first, or the “senior lien,” has the highest priority and must be fully repaid before junior liens receive any funds.

Lien position priority typically follows this order[2]:

- Property tax liens.

- Mortgage liens and home equity loans.

- Mechanic’s liens for home improvements.

- Judgment liens and any other encumbrances.

If a borrower defaults, the lienholders will be repaid in order of lien position until funds run out or all liens are satisfied.

In other words, lien position determines who gets paid first, who must wait in line, and who is most at risk of not being fully repaid in the event of a loan default or foreclosure.

First Lien Position

The first or senior lien position is the highest priority spot. The lender or tax authority in first lien position stands to recover the highest percentage of what they are owed. First lien holders have the right to foreclose and force a sale of the property to satisfy the debt[3].

In the case of a mortgage, the primary mortgage lender is almost always in first position[4]. This means they will be paid back first if the borrower defaults on the loan. Home equity loans or lines of credit, even those from the first mortgage lender, are subordinate and stand behind the primary mortgage.

Second Lien Position

Second lien position stands behind the first mortgage lender but ahead of any non-mortgage liens[5]. Home equity loans and lines of credit typically fall into second lien position. If the borrower defaults, the first mortgage lender is paid in full before the second lien holder can recover any money.

The risk of loss is higher in the second lien position because their right to recover money depends on sufficient equity remaining in the property after repaying the first. Second lien holders generally charge higher interest rates to offset this added risk[6].

Worse Lien Positions

Liens fall into worse positions the later they are filed and the lower on the priority ladder they stand. Mechanic’s liens, tax liens, judgment liens, and any other non-mortgage encumbrances usually fall below even the second mortgage position[7]. Their recovery in the event of a default relies on the property maintaining enough equity value or sale proceeds to satisfy all debts ahead of them.

Factors Impacting Lien Position

Several factors can impact lien position, such as refinancing agreements, lapses in tax payments, and even bankruptcy.

Refinancing Loans

A property owner refinancing into a new primary mortgage loan may negotiate with junior lien holders to have them voluntarily subordinate their position[8]. This effectively pushes them lower in priority. Lien holders may agree to this in order to maintain their stake in the property.

Delinquent Property Taxes

If a borrower fails to pay their property tax bill, a tax lien will be filed against the property[9]. This tax lien jumps to first priority and must be satisfied before any mortgage lien. The original mortgage is effectively pushed into a worse lien position until overdue taxes are paid.

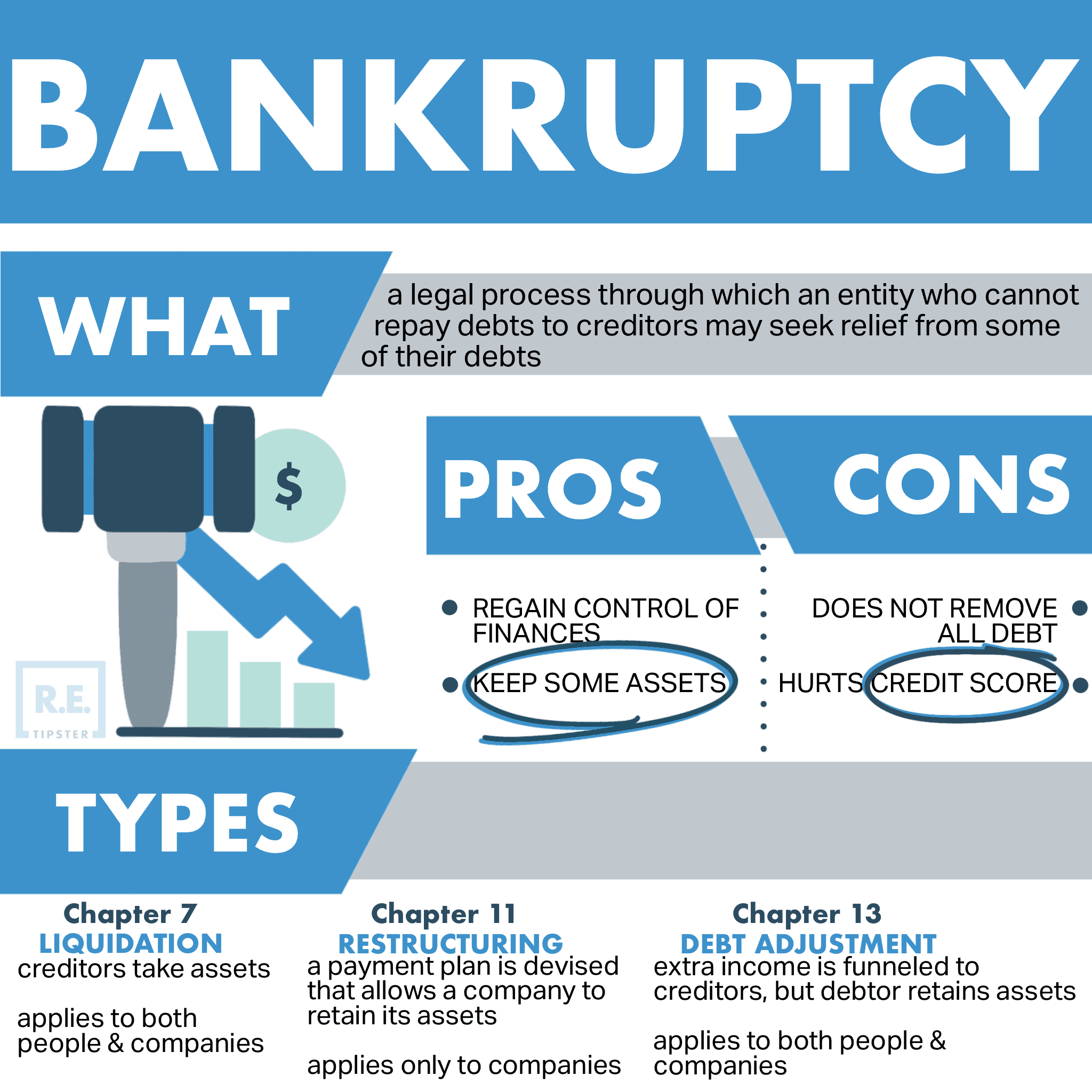

Bankruptcy Filings

Declaring Chapter 7 or Chapter 13 bankruptcy triggers an “automatic stay”[10] where enforcement actions are frozen until the proceedings are complete. No creditors, even senior lien holders, can foreclose or take action to enforce their lien rights throughout the bankruptcy process. Their priority positions remain unchanged.

Importance of Lien Position for Property Owners and Buyers

For property owners, lien position influences options for refinancing or tapping home equity. First position allows the greatest flexibility for loans requiring clear title, like cash-out refinances. Properties with several high-priority liens offer less equity available for the owner to access[11].

On the other hand, identifying all lien positions influences the purchase offer amount and helps home buyers recognize whether unavoidable liens may pose financial risks. Understanding lien priority also assists during negotiations if subordinate lien holders must cooperate to facilitate a sale.

In any case, consulting a real estate attorney is helpful for evaluating how existing liens could impact property ownership rights.

Frequently Asked Questions: Lien Position

How do I check for liens against a property I want to buy?

To check for liens on a property, you can review the public land records which list all debts and encumbrances filed against the real estate. The county clerk’s office or recorder of deeds provides access (often online)[12] to these lien records.

You can also ask the seller to provide documentation from their lender identifying existing mortgage loans and any other creditor judgements or tax debts secured by liens against the property.

RELATED: How to Find Out If There Is a Lien On a Property

Which lien is the hardest to remove from a property?

Property tax liens are usually the most challenging type of lien to remove from real estate[13]. Overdue taxes result in automatic lien filing which jumps ahead of most or all existing mortgages in priority. Tax liens must be paid in full, including any interest and penalties, before subordinate lien holders get any proceeds.

What happens if a property sells but sale proceeds don’t satisfy all liens?

If net sale proceeds don’t fully repay all lien holders, senior liens are paid first, and junior lien holders may receive partial payment or none at all. These lien holders can settle for less than they were owed or file a court judgment against the former property owner for amounts still due.